North Carolina Reinsurance Agreement, also known as the N.C. Reinsurance Pool, is an agreement between Blue Cross Blue Shield of Missouri (BCBS) and Healthy Alliance Life Insurance Co. (HALF). This agreement aims to provide reinsurance coverage for health insurance plans offered by these two companies in the state of North Carolina. Under the North Carolina Reinsurance Agreement, BCBS and HALF contribute funds to a shared pool. This pool is designed to provide financial protection to the insurers by reimbursing a portion of the eligible high-cost claims incurred by their policyholders. This helps to stabilize the individual health insurance market in North Carolina, making coverage more affordable and accessible for consumers. The N.C. Reinsurance Agreement plays a crucial role in mitigating the financial risk faced by BCBS and HALF. By sharing the risk among multiple insurers, it provides a safety net for unexpected high-cost claims, promoting stability and ensuring the continued availability of affordable health insurance options in the state. Different types of North Carolina Reinsurance Agreement between BCBS and HALF may include variations in the terms, duration, and financial contributions made by each party. These agreements could be specific to particular policy types or cover a broader range of health insurance plans provided by both companies in North Carolina. In summary, the North Carolina Reinsurance Agreement between Blue Cross Blue Shield of Missouri and Healthy Alliance Life Insurance Co. is a collaborative arrangement aimed at mitigating the financial risk associated with high-cost claims and promoting stability in the individual health insurance market in North Carolina. This agreement helps to make health insurance coverage more affordable and accessible to consumers while allowing insurers to manage their risk effectively.

North Carolina Reinsurance Agreement between Blue Cross Blue Shield of Missouri and Healthy Alliance Life Insurance Co.

Description

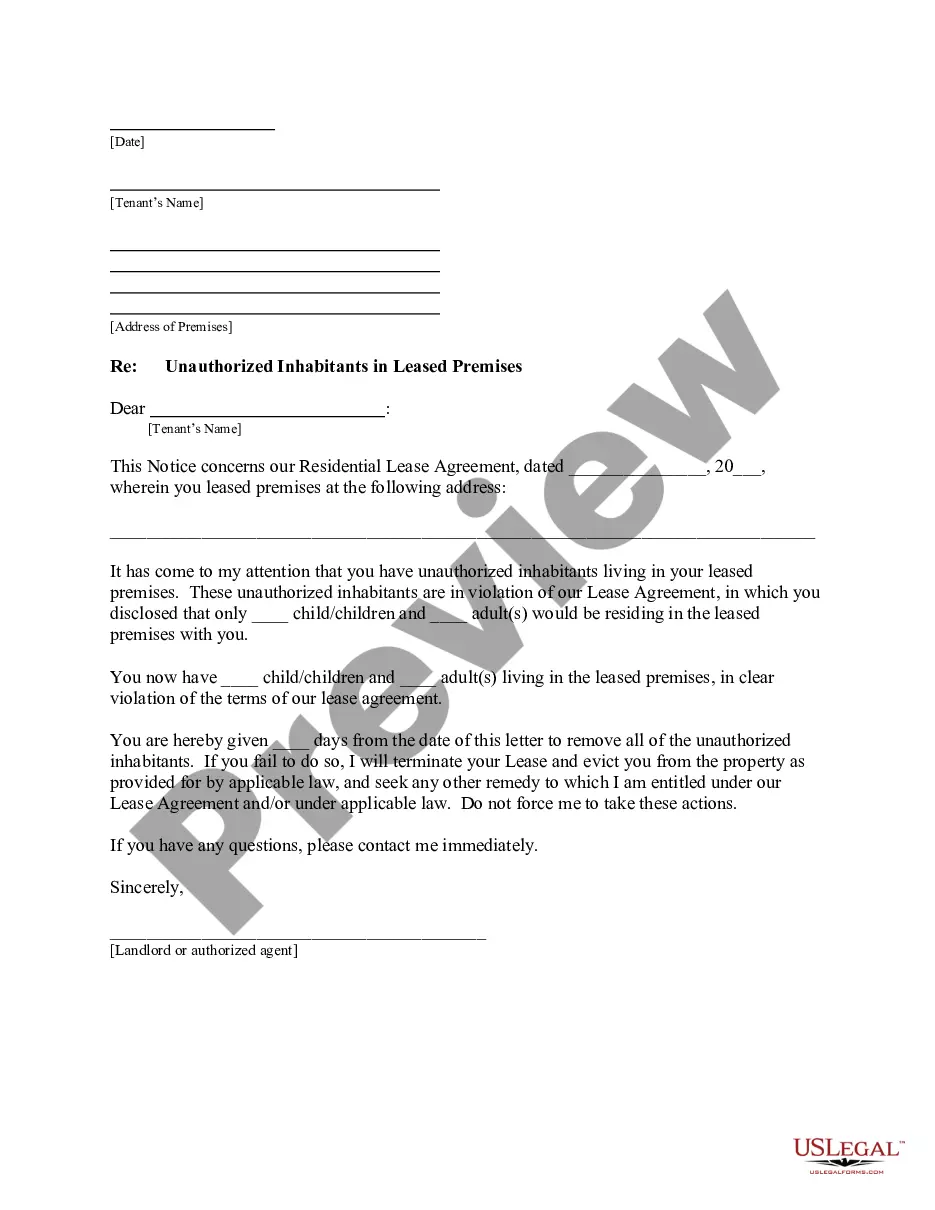

How to fill out Reinsurance Agreement Between Blue Cross Blue Shield Of Missouri And Healthy Alliance Life Insurance Co.?

Are you presently inside a situation the place you require papers for possibly organization or specific functions just about every day? There are tons of legitimate document layouts accessible on the Internet, but getting ones you can depend on isn`t easy. US Legal Forms gives a huge number of kind layouts, such as the North Carolina Reinsurance Agreement between Blue Cross Blue Shield of Missouri and Healthy Alliance Life Insurance Co., which can be published to fulfill state and federal requirements.

Should you be already informed about US Legal Forms internet site and also have a free account, just log in. Next, you can obtain the North Carolina Reinsurance Agreement between Blue Cross Blue Shield of Missouri and Healthy Alliance Life Insurance Co. design.

If you do not offer an profile and wish to begin to use US Legal Forms, abide by these steps:

- Find the kind you need and make sure it is to the proper city/county.

- Use the Preview key to check the shape.

- Read the description to ensure that you have chosen the proper kind.

- When the kind isn`t what you`re trying to find, take advantage of the Research area to discover the kind that meets your needs and requirements.

- Once you discover the proper kind, just click Purchase now.

- Select the costs program you would like, fill out the desired information and facts to make your bank account, and purchase your order making use of your PayPal or Visa or Mastercard.

- Select a handy data file formatting and obtain your backup.

Get each of the document layouts you possess purchased in the My Forms menus. You can get a further backup of North Carolina Reinsurance Agreement between Blue Cross Blue Shield of Missouri and Healthy Alliance Life Insurance Co. any time, if needed. Just click on the required kind to obtain or print out the document design.

Use US Legal Forms, by far the most substantial variety of legitimate kinds, to save time as well as steer clear of faults. The service gives skillfully manufactured legitimate document layouts which you can use for a range of functions. Generate a free account on US Legal Forms and begin making your lifestyle easier.

Form popularity

FAQ

An insurance policy is a contract between the insured and the insurance company. You pay premiums to an insurance company. They then pay some or all of your medical provider's bills when you need treatment.

Most insurance contracts are indemnity contracts. Indemnity contracts apply to insurances where the loss suffered can be measured in terms of money. Principle of Indemnity.

Shopping Assistance Individuals & Family Plans (under age 65): 1-844-290-7588. Medicare Supplement and Medicare Advantage Plans: 7 days a week 8 a.m. to 8 p.m. ... Medicare Part D Plans: 7 days a week 8 a.m. to 8 p.m. ... Employers Plans: Contact your broker or consultant to learn more about Anthem plans.

An insurance agreement is a legal contract between an insurance company and an insured party. This contract allows the risk of a significant financial loss or burden to be transferred from the insured to the insurer. In exchange, the insured promises to pay a small, guaranteed payment called a premium.

Endorsement - A written agreement attached to a policy expanding or limiting the benefits otherwise payable under the policy. Also called a "rider." ERISA plan - Health plans created under the Employee Retirement and Income Security Act (ERISA) of 1974.

Policy - The written contract between an individual or group policyholder and an insurance company.