The North Carolina Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., and several banks and financial institutions is a legal document that outlines the terms and conditions of a credit agreement between the parties involved. This credit agreement serves as an amendment and restatement of the original agreement, incorporating any changes, updates, or additions necessary to reflect the current financial arrangement. It is specific to the state of North Carolina and provides a comprehensive framework for the credit relationship between SBA Communications, Corp., and SBA Telecommunications, Inc., as borrowers, and the participating banks and financial institutions as lenders. The North Carolina Second Amended and Restated Credit Agreement safeguards the interests of all the parties involved, laying out obligations, rights, and responsibilities regarding the borrowing and lending arrangements. It typically covers various aspects, including loan facilities, interest rates, repayment terms, covenants, representations, warranties, events of default, and administrative procedures. In some cases, there may be different types or versions of the North Carolina Second Amended and Restated Credit Agreement, depending on the purpose or specific provisions agreed upon by the parties involved. These types may include: 1. Term Loan Agreement: This type of credit agreement establishes a fixed-term loan with a set repayment schedule and interest rate. It is commonly used for financing long-term projects or capital expenditures. 2. Revolving Credit Agreement: Unlike a term loan, a revolving credit agreement allows borrowers to access funds repeatedly up to a specific credit limit. It provides flexibility, as borrowers can withdraw and repay the funds as needed, subject to certain conditions. 3. Syndicated Credit Agreement: In situations where the borrowing requirements exceed the lending capacity of a single financial institution, a syndicated credit agreement is utilized. This type of agreement involves multiple banks or financial institutions, known as syndicate members, who jointly provide the credit facility. 4. Secured Credit Agreement: A secured credit agreement involves collateral provided by the borrower to secure the loan. This collateral could include assets like real estate, equipment, or financial securities. In case of default, the lender has the right to seize and sell the collateral to recover the outstanding amount. These are just a few examples of the different types of North Carolina Second Amended and Restated Credit Agreements that may exist among SBA Communications, Corp., SBA Telecommunications, Inc., and several banks and financial institutions. The specific terms and categorization may vary depending on the nature of the credit facility and the agreements reached between the parties.

North Carolina Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions

Description

How to fill out North Carolina Second Amended And Restated Credit Agreement Among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks And Financial Institutions?

If you want to total, down load, or produce lawful file themes, use US Legal Forms, the largest assortment of lawful varieties, that can be found online. Take advantage of the site`s simple and convenient search to get the documents you will need. Various themes for enterprise and individual uses are sorted by types and states, or search phrases. Use US Legal Forms to get the North Carolina Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions within a few mouse clicks.

Should you be currently a US Legal Forms client, log in in your profile and then click the Obtain option to find the North Carolina Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions. You can even access varieties you previously delivered electronically in the My Forms tab of your own profile.

If you work with US Legal Forms the first time, follow the instructions under:

- Step 1. Be sure you have chosen the form for your right area/land.

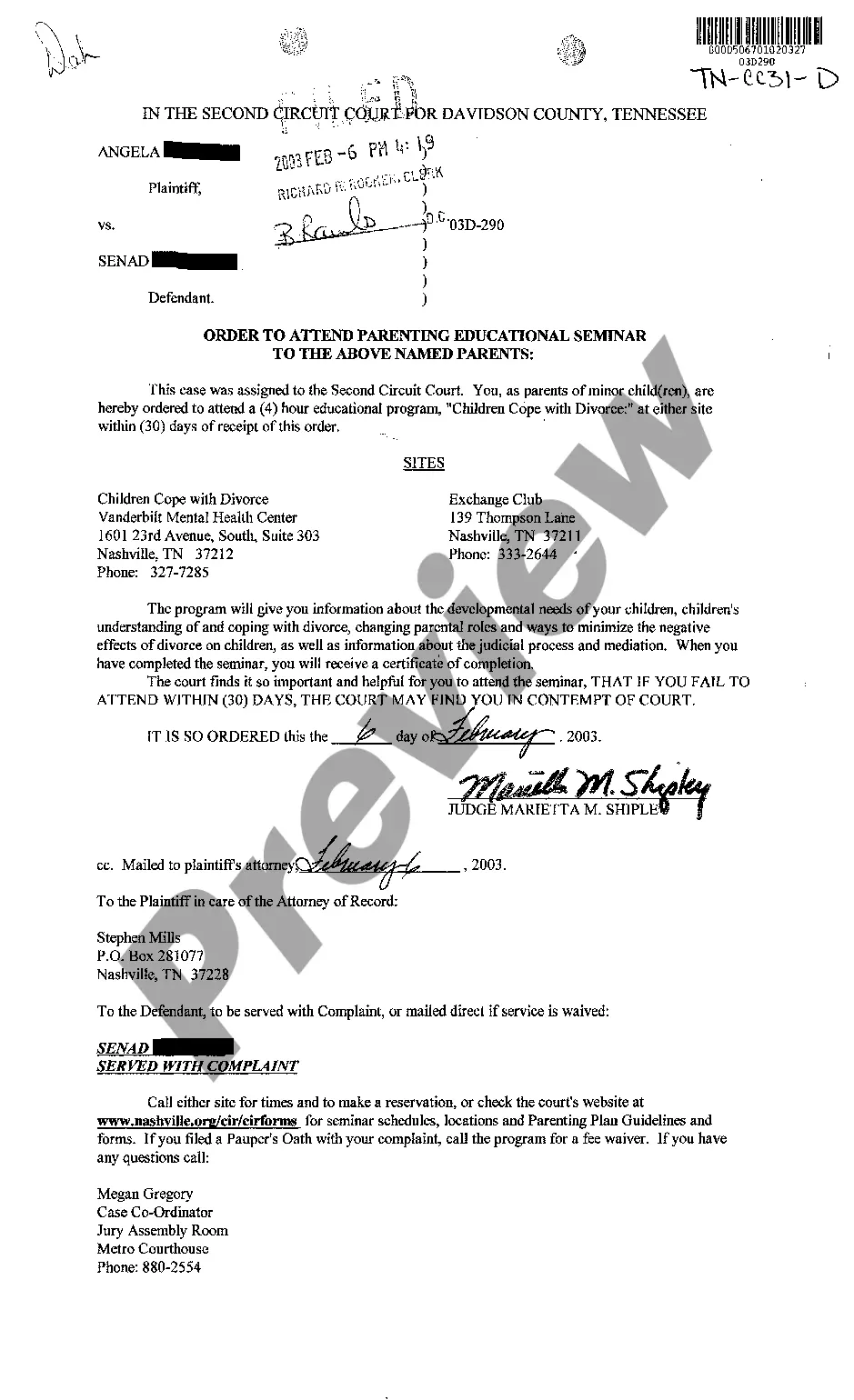

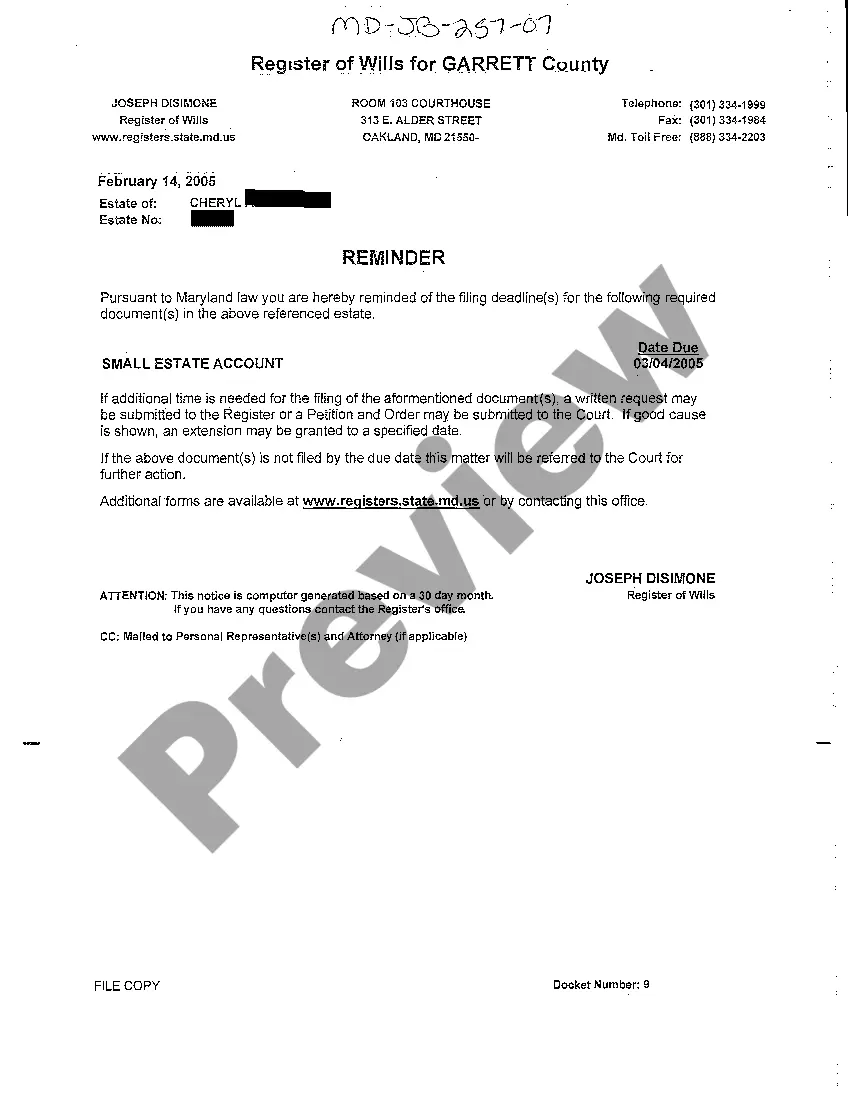

- Step 2. Use the Preview solution to look through the form`s content material. Never overlook to read through the explanation.

- Step 3. Should you be not happy together with the kind, take advantage of the Look for area near the top of the screen to locate other versions in the lawful kind web template.

- Step 4. After you have discovered the form you will need, click on the Purchase now option. Opt for the pricing prepare you prefer and add your qualifications to sign up on an profile.

- Step 5. Method the transaction. You should use your credit card or PayPal profile to accomplish the transaction.

- Step 6. Select the format in the lawful kind and down load it on the gadget.

- Step 7. Full, change and produce or signal the North Carolina Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions.

Each lawful file web template you get is the one you have for a long time. You might have acces to each kind you delivered electronically in your acccount. Click on the My Forms portion and select a kind to produce or down load yet again.

Be competitive and down load, and produce the North Carolina Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions with US Legal Forms. There are many specialist and state-distinct varieties you can use for your enterprise or individual demands.