North Carolina Subscription Agreement

Description

How to fill out Subscription Agreement?

If you wish to complete, obtain, or print legitimate document themes, use US Legal Forms, the most important assortment of legitimate forms, that can be found online. Utilize the site`s simple and handy search to get the documents you will need. Various themes for business and individual uses are sorted by classes and claims, or keywords and phrases. Use US Legal Forms to get the North Carolina Subscription Agreement with a few clicks.

Should you be previously a US Legal Forms client, log in to the profile and click on the Acquire button to find the North Carolina Subscription Agreement. You can also gain access to forms you previously downloaded in the My Forms tab of your own profile.

If you use US Legal Forms for the first time, refer to the instructions under:

- Step 1. Ensure you have selected the shape to the right area/country.

- Step 2. Use the Preview choice to examine the form`s articles. Don`t forget to learn the explanation.

- Step 3. Should you be unhappy using the kind, make use of the Search discipline at the top of the monitor to find other variations in the legitimate kind design.

- Step 4. When you have identified the shape you will need, click the Get now button. Choose the prices program you prefer and add your credentials to register to have an profile.

- Step 5. Procedure the purchase. You may use your bank card or PayPal profile to finish the purchase.

- Step 6. Choose the formatting in the legitimate kind and obtain it on your own system.

- Step 7. Full, modify and print or signal the North Carolina Subscription Agreement.

Every legitimate document design you buy is your own permanently. You may have acces to every single kind you downloaded within your acccount. Click the My Forms section and select a kind to print or obtain yet again.

Remain competitive and obtain, and print the North Carolina Subscription Agreement with US Legal Forms. There are millions of skilled and condition-distinct forms you can utilize to your business or individual requirements.

Form popularity

FAQ

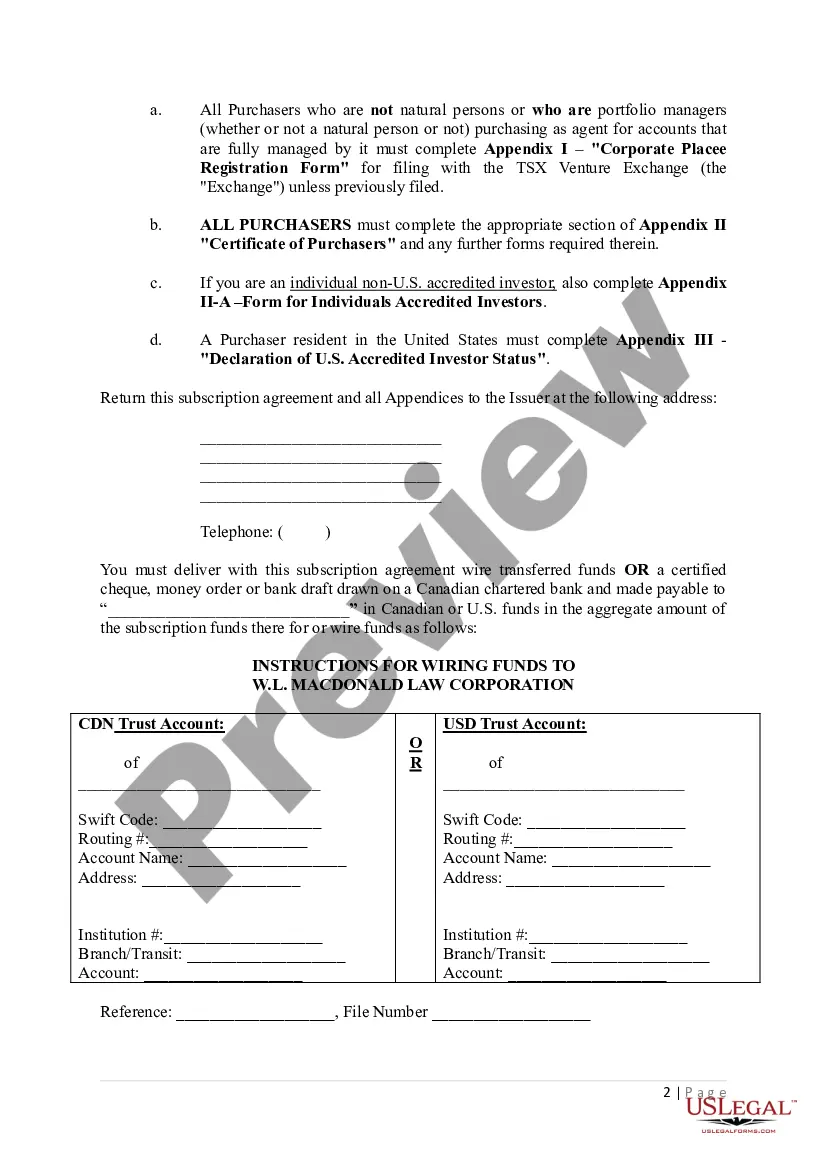

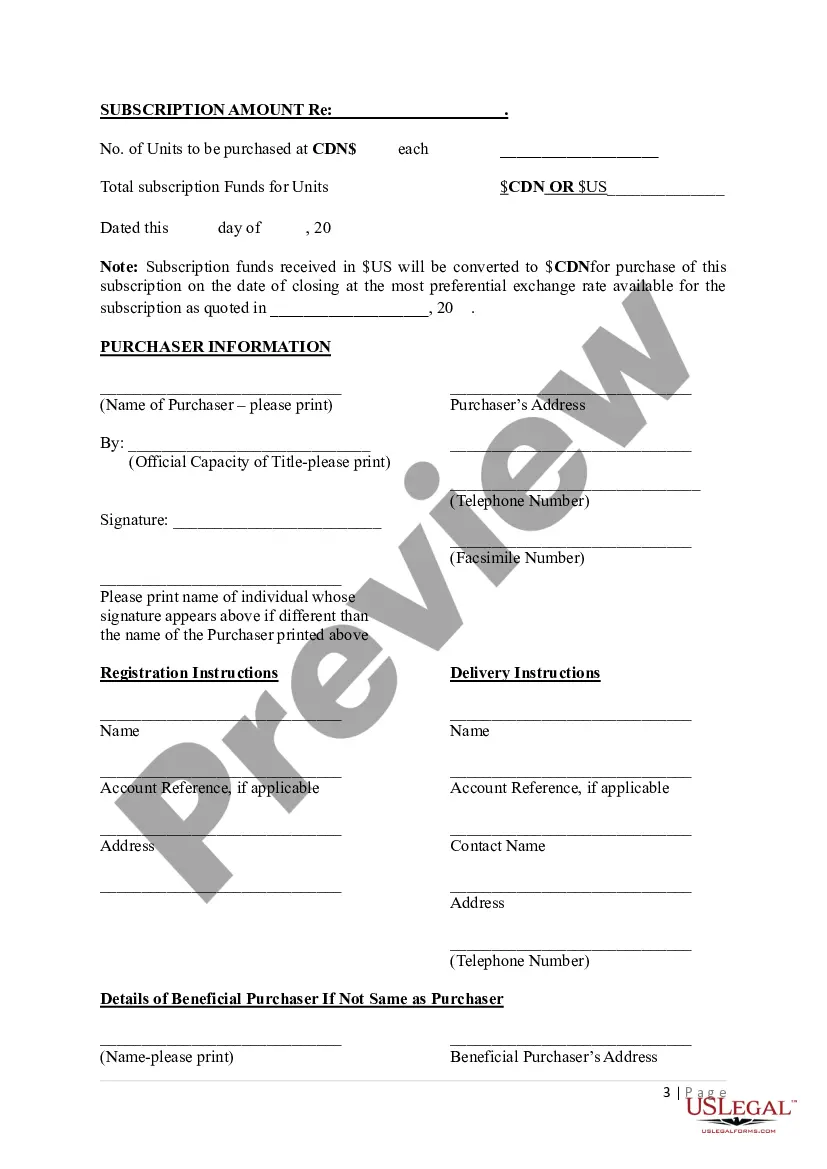

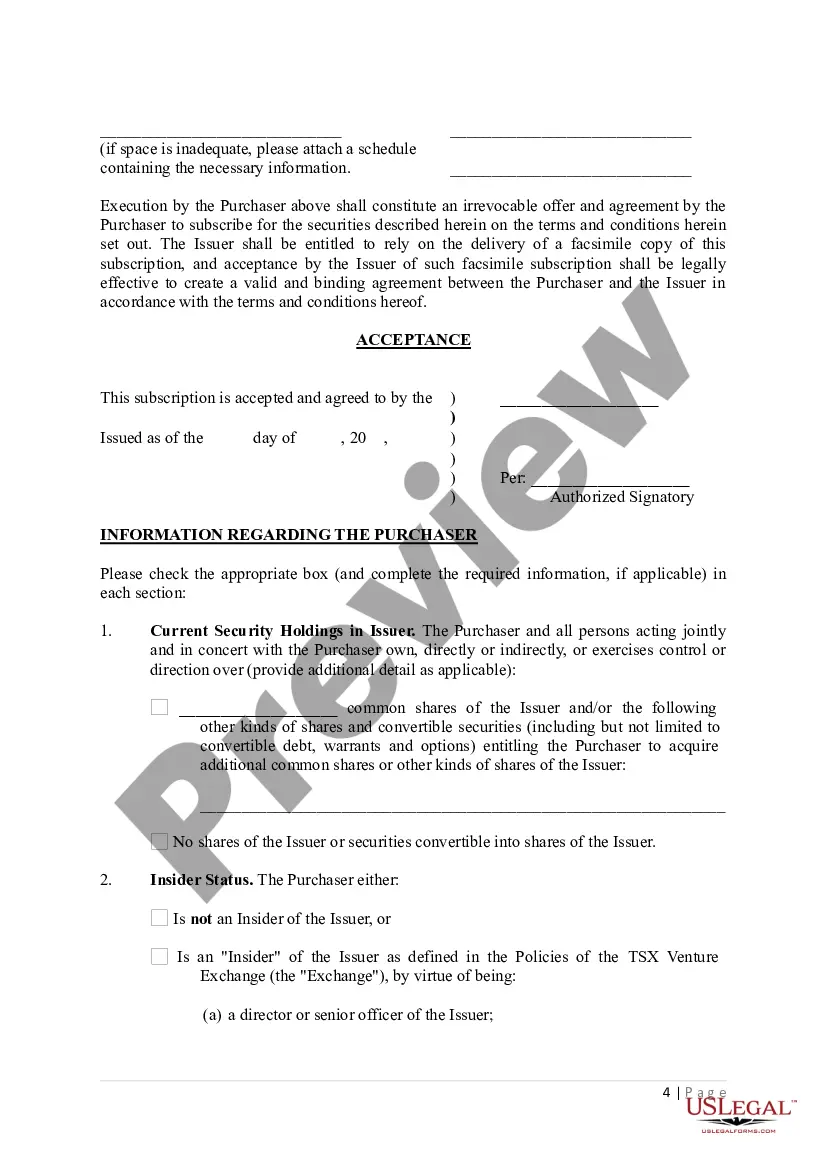

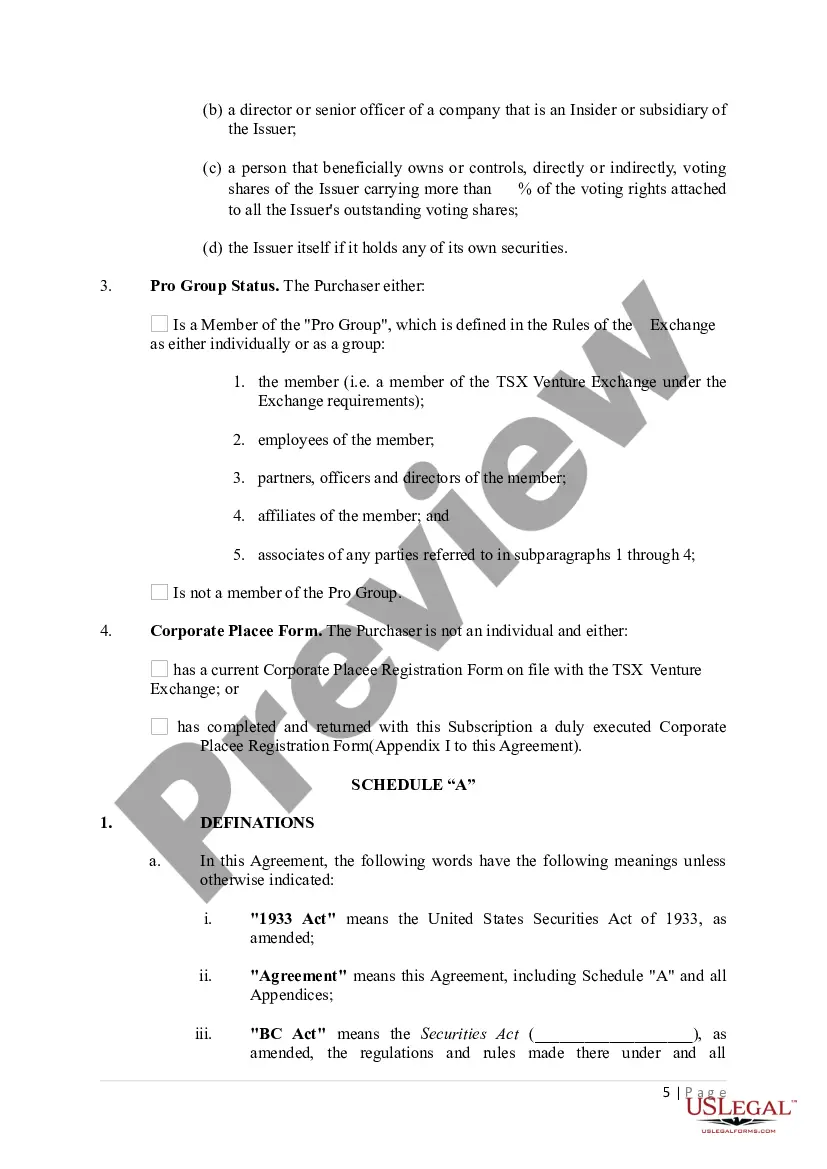

What information is typically included in a subscription agreement? Company information. Expectations of both parties. Agreement to subscribe (this includes the number of shares and price) Rights attached to the subscription. ... Terms for termination before completion. Nomination onto board. Confidentiality provisions.

A Share Subscription Agreement is a legally binding contract between a company and an investor or subscriber. It outlines the terms and conditions under which the investor agrees to purchase newly issued company shares.

There are two key documents that set out the terms and the structure of an LLC, the Operating Agreement and the Subscription Agreement. Note that investors do not buy shares in an LLC ? they buy an interest, which determines their percentage ownership and is documented in the Subscription Agreement.

The subscription agreement is the principal agreement between the issuer and the investor or substitute purchasers in a private placement of debt obligations or equity securities.

Summary. A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

The subscription agreement is the principal agreement between the issuer and the investor or substitute purchasers in a private placement of debt obligations or equity securities.

A subscription license agreement is an agreement between your company and a customer to use the software or product you have the rights to. It allows the customer to use the product in the way you want them to and with any limitations you wish to establish.