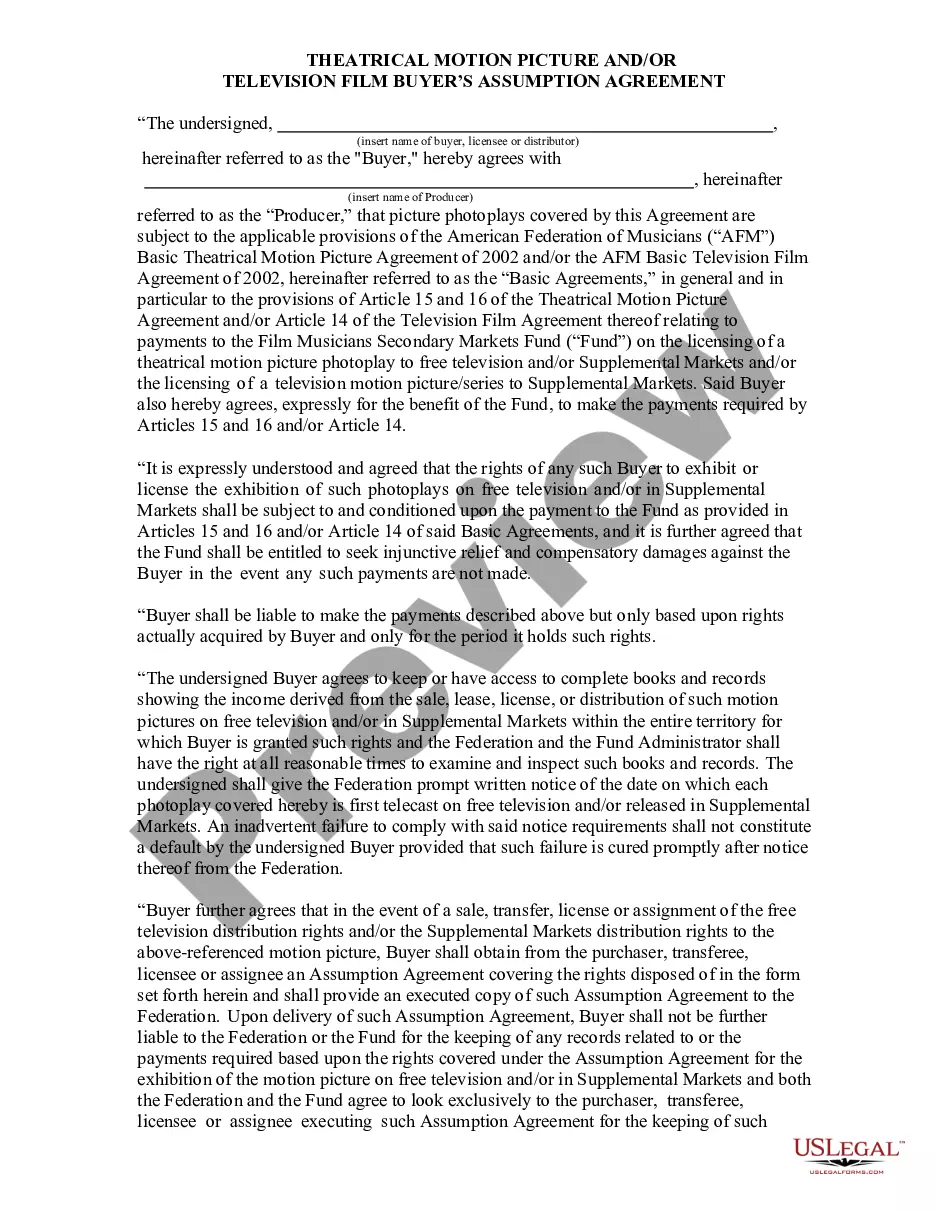

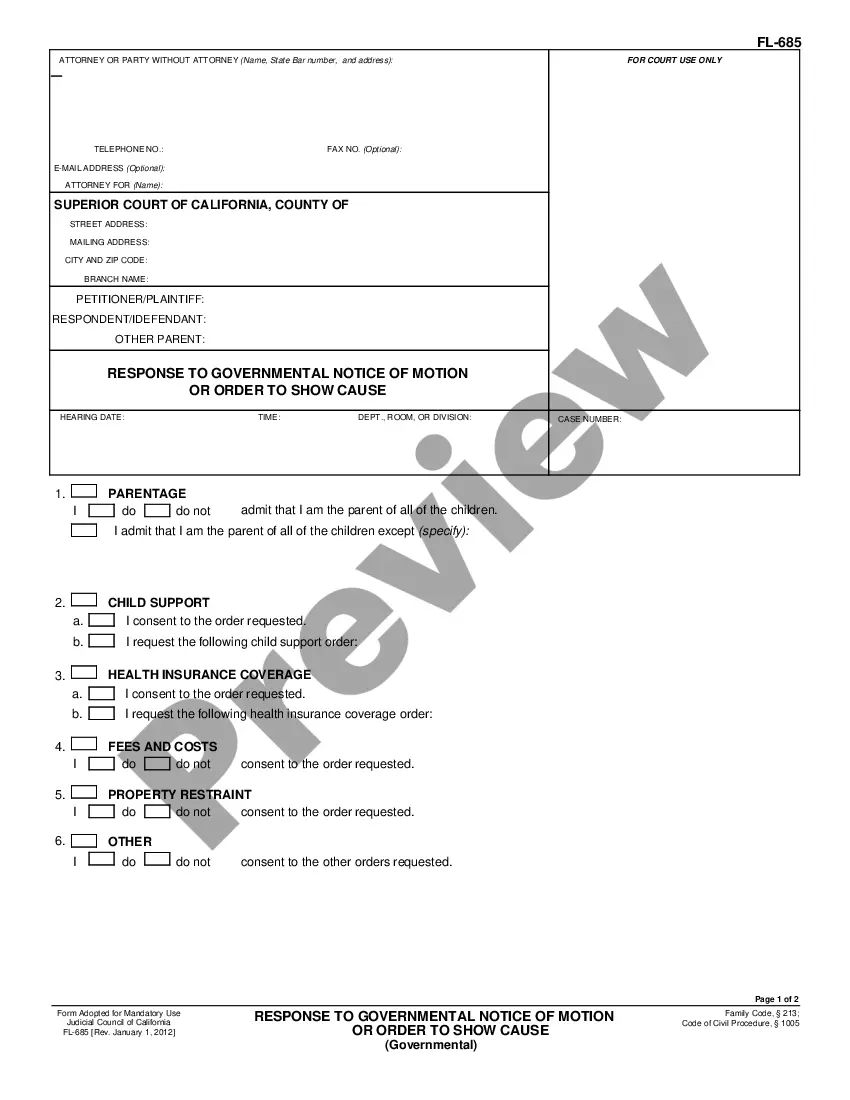

Title: Exploring the Different Types of North Carolina Investment Agreement: A Comprehensive Overview Introduction: North Carolina Investment Agreement is a legal contract that outlines the terms and conditions between an investor and an investment recipient in the state of North Carolina. It serves as a foundation for establishing a relationship and determining the rights and obligations of both parties involved in an investment transaction. This article elaborates on the different types of North Carolina Investment Agreements and highlights their key elements. 1. Venture Capital Investment Agreement: The Venture Capital Investment Agreement is a specific type of North Carolina Investment Agreement primarily used when venture capitalists provide funding to start-ups or emerging businesses. This agreement details the fund allocation, purpose of investment, preferred equity stake, management involvement, exit strategy, and potential returns on investment. 2. Public-Private Partnership (PPP) Agreement: PPP agreements facilitate collaboration between public entities such as government agencies and private investors for the development of infrastructure projects in North Carolina. These agreements outline the specific roles, responsibilities, and financial obligations of both parties, along with revenue sharing, risk allocation, and dispute resolution mechanisms. 3. Real Estate Investment Agreement: This type of North Carolina Investment Agreement is entered into between investors and real estate developers for the purpose of financing and developing properties. It covers aspects like the nature of investment, profit-sharing arrangements, project milestones, ownership structure, renovation or construction terms, and legal obligations related to permits, zoning, and building codes. 4. Joint Venture Agreement: A Joint Venture Agreement is a collaborative effort between two or more parties to combine resources and expertise to achieve a specific business objective in North Carolina. These agreements outline the contributions, roles, and responsibilities of each party, profit distribution, decision-making processes, dispute resolution, and the duration of the joint venture. 5. Acquisition Agreement: An Acquisition Agreement is pertinent when an investor seeks to acquire an existing business or its assets in North Carolina. This agreement encompasses crucial details such as purchase price, payment terms, transfer of ownership, employee retention or termination, due diligence, warranties, indemnification provisions, and post-acquisition obligations. 6. Franchise Agreement: Franchise agreements come into play when an investor purchases the rights to operate a franchise business in North Carolina. The agreement covers various aspects including the franchise fee, territory rights, product or service standards, marketing support, training requirements, royalties, advertising contributions, and renewal or termination clauses. Conclusion: North Carolina Investment Agreements are essential legal documents designed to facilitate secure and mutually beneficial investment transactions in various sectors. Understanding the nuances of each type of investment agreement is crucial for investors, entrepreneurs, and business professionals to successfully navigate the North Carolina investment landscape.

North Carolina Investment Agreement

Description

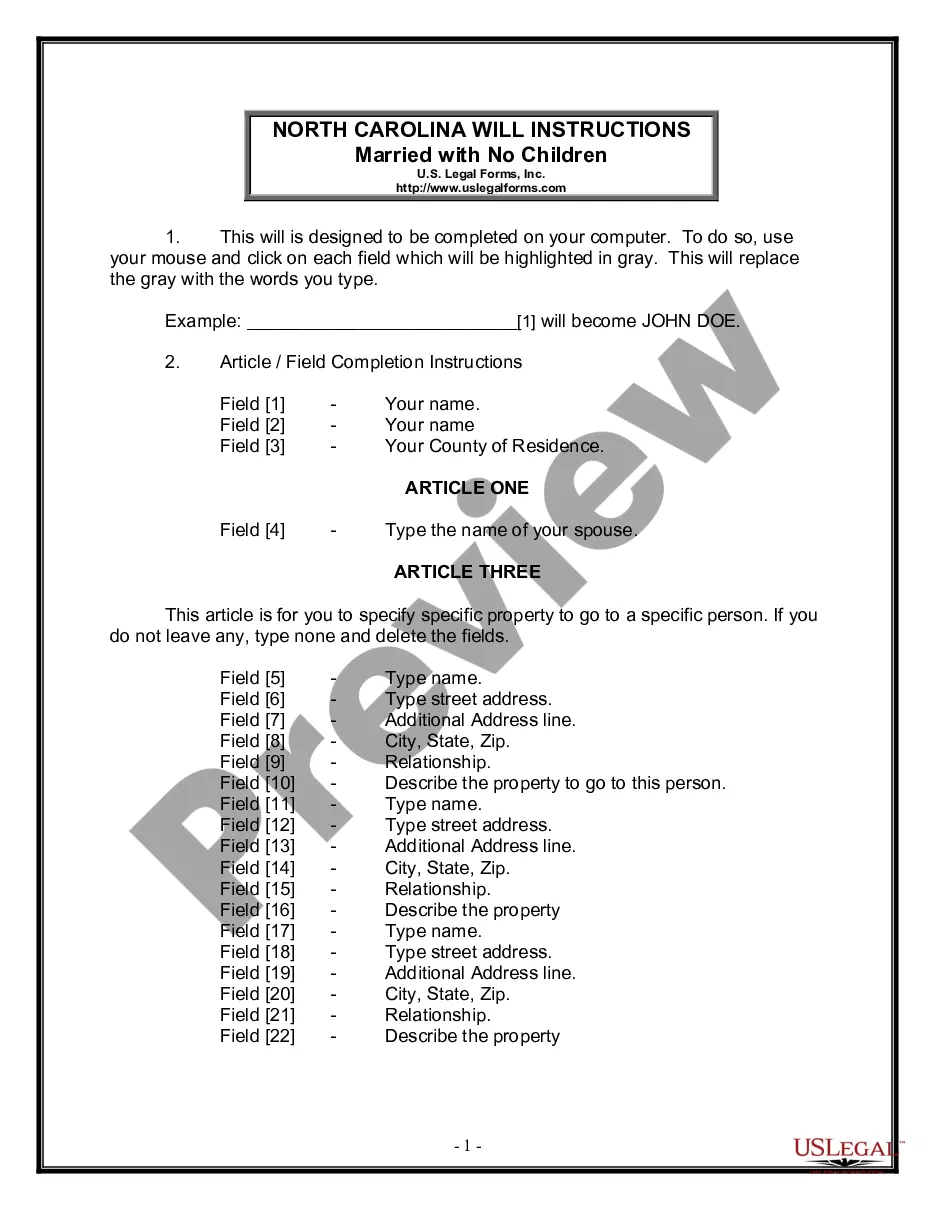

How to fill out North Carolina Investment Agreement?

US Legal Forms - one of several most significant libraries of legitimate varieties in the USA - gives an array of legitimate document web templates it is possible to download or print. While using internet site, you will get thousands of varieties for business and person reasons, sorted by categories, says, or keywords.You will discover the most recent types of varieties such as the North Carolina Investment Agreement in seconds.

If you have a membership, log in and download North Carolina Investment Agreement through the US Legal Forms local library. The Down load key can look on every single develop you view. You have access to all previously delivered electronically varieties from the My Forms tab of your respective accounts.

In order to use US Legal Forms initially, listed below are simple directions to help you get started out:

- Ensure you have selected the correct develop for your personal metropolis/state. Go through the Preview key to analyze the form`s content. Look at the develop explanation to actually have chosen the right develop.

- When the develop doesn`t suit your demands, make use of the Look for industry on top of the display screen to obtain the one who does.

- In case you are pleased with the shape, confirm your option by simply clicking the Acquire now key. Then, opt for the costs program you favor and give your qualifications to register to have an accounts.

- Procedure the purchase. Use your bank card or PayPal accounts to finish the purchase.

- Choose the format and download the shape in your product.

- Make modifications. Complete, revise and print and indication the delivered electronically North Carolina Investment Agreement.

Every web template you included in your bank account does not have an expiration time and is also the one you have eternally. So, if you would like download or print another backup, just visit the My Forms portion and then click about the develop you require.

Obtain access to the North Carolina Investment Agreement with US Legal Forms, the most extensive local library of legitimate document web templates. Use thousands of skilled and express-distinct web templates that satisfy your small business or person requires and demands.

Form popularity

FAQ

Writing an investment contract can be simplified by examining related samples and including all the content listed below: The names and addresses of interested parties. The general investment structure. Purpose of the investment. Effective date agreed upon. Signatures by both/all parties.

What is a letter of agreement? The names of the parties involved. The contact information of each party. A description of the purpose of the agreement. Terms and conditions for the transaction or deal. A timeline if services are to be performed. A payment timeline (if applicable) A termination date (if applicable)

How to write an agreement letter Title your document. ... Provide your personal information and the date. ... Include the recipient's information. ... Address the recipient and write your introductory paragraph. ... Write a detailed body. ... Conclude your letter with a paragraph, closing remarks, and a signature. ... Sign your letter.

A simple contract might include an agreement between two acquaintances to exchange one service for another. For example, if one person is a plumber and the other an electrician, they might agree to complete certain work for each other as a trade exchange.

There are several key elements that should be included in any contract for investments, including: Identification of the parties involved. Objectives of the investment. Investment amount and payment terms. Duration and termination clauses. Confidentiality and non-disclosure provisions. Dispute resolution and governing law.

How to draft a contract between two parties: A step-by-step checklist Check out the parties. ... Come to an agreement on the terms. ... Specify the length of the contract. ... Spell out the consequences. ... Determine how you would resolve any disputes. ... Think about confidentiality. ... Check the contract's legality. ... Open it up to negotiation.

How to draft a contract between two parties: A step-by-step checklist Check out the parties. ... Come to an agreement on the terms. ... Specify the length of the contract. ... Spell out the consequences. ... Determine how you would resolve any disputes. ... Think about confidentiality. ... Check the contract's legality. ... Open it up to negotiation.

Key elements of an investment agreement #1 Introduction and background information. ... #2 Investment terms and conditions. ... #3 Rights and obligations of the parties. ... #4 Investment amount and payment terms. ... #5 Governance and decision-making processes. ... #6 Reporting and accountability requirements. ... #7 Termination and exit provisions.