North Carolina Term Sheet - Series Seed Preferred Share for Company

Description

How to fill out Term Sheet - Series Seed Preferred Share For Company?

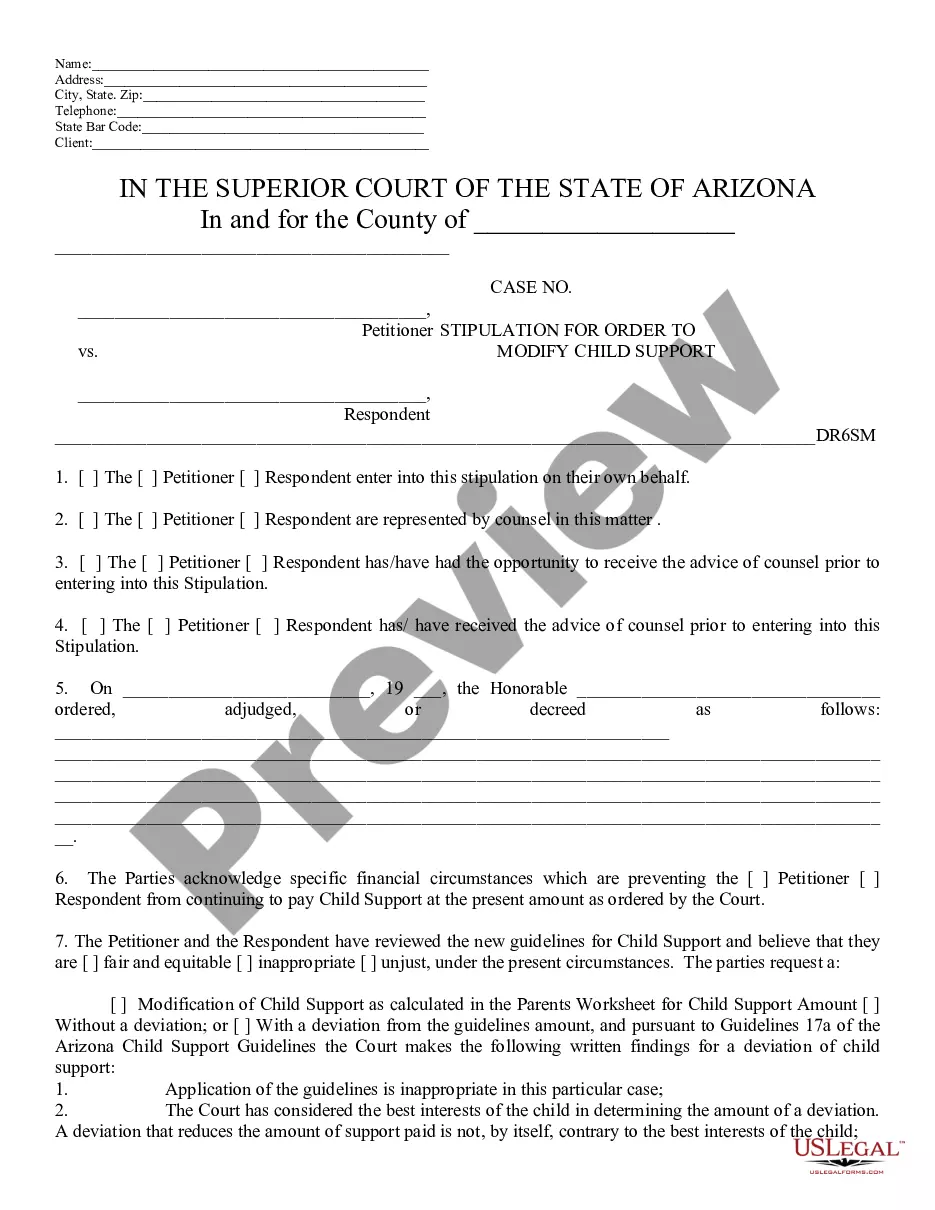

Are you presently in a place that you need files for possibly business or specific uses virtually every working day? There are plenty of authorized document themes available on the Internet, but locating versions you can rely isn`t easy. US Legal Forms provides a huge number of form themes, just like the North Carolina Term Sheet - Series Seed Preferred Share for Company, which can be written to satisfy state and federal specifications.

When you are already familiar with US Legal Forms internet site and possess your account, just log in. Afterward, it is possible to download the North Carolina Term Sheet - Series Seed Preferred Share for Company template.

Should you not come with an account and would like to begin using US Legal Forms, abide by these steps:

- Get the form you will need and ensure it is for your right town/county.

- Make use of the Review button to check the shape.

- Read the outline to ensure that you have chosen the correct form.

- If the form isn`t what you are trying to find, use the Research discipline to obtain the form that meets your requirements and specifications.

- When you discover the right form, click on Buy now.

- Select the prices plan you desire, fill in the specified info to produce your money, and buy the transaction with your PayPal or Visa or Mastercard.

- Select a practical paper structure and download your version.

Find all of the document themes you have bought in the My Forms food selection. You can aquire a more version of North Carolina Term Sheet - Series Seed Preferred Share for Company whenever, if necessary. Just click the necessary form to download or print out the document template.

Use US Legal Forms, probably the most considerable variety of authorized types, in order to save time as well as prevent blunders. The assistance provides expertly created authorized document themes that can be used for a selection of uses. Create your account on US Legal Forms and begin creating your life easier.

Form popularity

FAQ

Second-preferred stock. Preferred stock issue that has less priority in claiming dividends and assets in liquidation than another issue of preferred stock.

Series Seed II Preferred Stock means the Series Seed II Preferred Shares of Waitr with such designations, rights, powers and privileges, and the qualifications, limitations and restrictions thereof as provided in the Waitr Articles of Incorporation. Series Seed II Preferred Stock Definition | Law Insider lawinsider.com ? dictionary ? series-seed-ii-... lawinsider.com ? dictionary ? series-seed-ii-...

Series Seed will generally be issued as preferred stock. This is the order of payments made to various classes of stockholders in the event that the business is liquidated and there is cash available for distribution to the stockholders. Innovation@work: Understanding the Series Seed Term Sheet bernsteinshur.com ? what ? publications ? u... bernsteinshur.com ? what ? publications ? u...

Series Seed Preferred Stock is a type of preferred stock issued by startups during their early stage of development. Preferred stock is a hybrid security that combines elements of both debt and equity.

These fundraising rounds allow investors to invest money into a growing company in exchange for equity/ownership. The initial investment?also known as seed funding?is followed by various rounds, known as Series A, B, and C. A new valuation is done at the time of each funding round.

Series Seed Preferred Stock is a type of preferred stock issued by startups during their early stage of development. Preferred stock is a hybrid security that combines elements of both debt and equity. What Is Series Seed Preferred Stock? | Wojcik Law Firm wojciklawfirm.com ? what-is-series-seed-pre... wojciklawfirm.com ? what-is-series-seed-pre...

A Preference Shares Investment Term Sheet is a record of discussions between the founders of a business and an investor for potential investment by preference shares. A Preference Shares Investment Term Sheet is not legally binding, except for confidentiality and exclusivity obligations (if applicable). Preference Shares Investment Term Sheet - Zegal zegal.com ? preference-shares-investment-term-sh... zegal.com ? preference-shares-investment-term-sh...

The first round of stock offered during the seed or early stage round by a portfolio company to the venture investor or fund. This stock is convertible into common stock in certain cases such as an IPO or the sale of the company.