North Carolina Terms for Private Placement of Series Seed Preferred Stock

Description

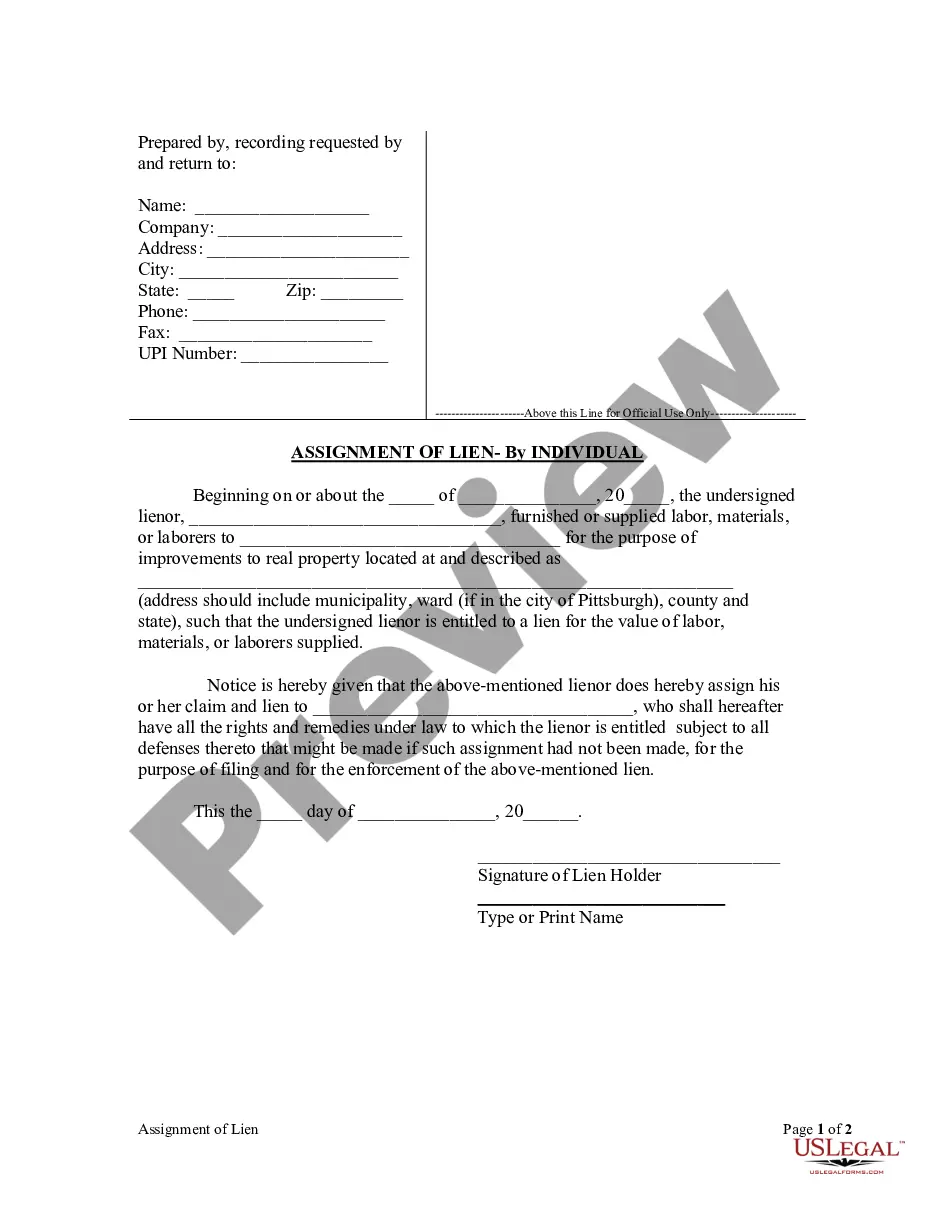

How to fill out Terms For Private Placement Of Series Seed Preferred Stock?

Are you currently in a situation that you will need papers for possibly enterprise or person reasons virtually every day? There are tons of authorized record web templates accessible on the Internet, but getting ones you can depend on is not simple. US Legal Forms delivers a huge number of form web templates, such as the North Carolina Terms for Private Placement of Series Seed Preferred Stock, that are published in order to meet federal and state requirements.

If you are currently knowledgeable about US Legal Forms internet site and have a free account, basically log in. Afterward, you may down load the North Carolina Terms for Private Placement of Series Seed Preferred Stock design.

If you do not have an accounts and need to start using US Legal Forms, follow these steps:

- Obtain the form you need and ensure it is for the proper metropolis/state.

- Make use of the Review option to examine the form.

- See the information to actually have chosen the appropriate form.

- In case the form is not what you are seeking, utilize the Research area to obtain the form that meets your needs and requirements.

- If you discover the proper form, click on Get now.

- Opt for the costs plan you want, fill in the required information and facts to generate your money, and pay money for an order utilizing your PayPal or charge card.

- Choose a handy data file format and down load your duplicate.

Get all of the record web templates you have bought in the My Forms food list. You may get a more duplicate of North Carolina Terms for Private Placement of Series Seed Preferred Stock any time, if possible. Just click on the necessary form to down load or print out the record design.

Use US Legal Forms, the most comprehensive assortment of authorized forms, to save lots of some time and steer clear of faults. The service delivers skillfully produced authorized record web templates that you can use for a range of reasons. Create a free account on US Legal Forms and start generating your way of life a little easier.

Form popularity

FAQ

Series Seed Preferred Stock is a type of preferred stock issued by startups during their early stage of development. Preferred stock is a hybrid security that combines elements of both debt and equity.

A Series AA Round is a round of startup financing using a class of preferred stock called the ?Series AA Preferred Shares.? Series AA is also known as ?Seed? because it comes before Series A. Series AA terms are usually not as onerous as Series A terms, and the valuation is typically lower.

The Series E Preferred Stock (a) shall rank senior to the Junior Stock in respect of the right to receive dividends and the right to receive payments out of the assets of the Company upon voluntary or involuntary liquidation, dissolution or winding up of the Company and (b) shall be of equal rank with Parity Stock as ...

The first round of stock offered during the seed or early stage round by a portfolio company to the venture investor or fund. This stock is convertible into common stock in certain cases such as an IPO or the sale of the company.

The first round of stock made available to the public by a startup is referred to as Series A preferred stock. This type of stock is generally offered for purchase during the seed stage of a new startup and can be converted into common stock in the event of an initial public offering or sale of the company.

In finance, a class A share refers to a share classification of common or preferred stock that typically has enhanced benefits with respect to dividends, asset sales, or voting rights compared to Class B or Class C shares.

There are four types of preferred stock - cumulative (guaranteed), non-cumulative, participating and convertible. Preference shares are ideal for risk-averse investors and they are callable (the issuer can redeem them at any time).

The main difference between preferred and common stock is that preferred stock gives no voting rights to shareholders while common stock does. Preferred shareholders have priority over a company's income, meaning they are paid dividends before common shareholders.