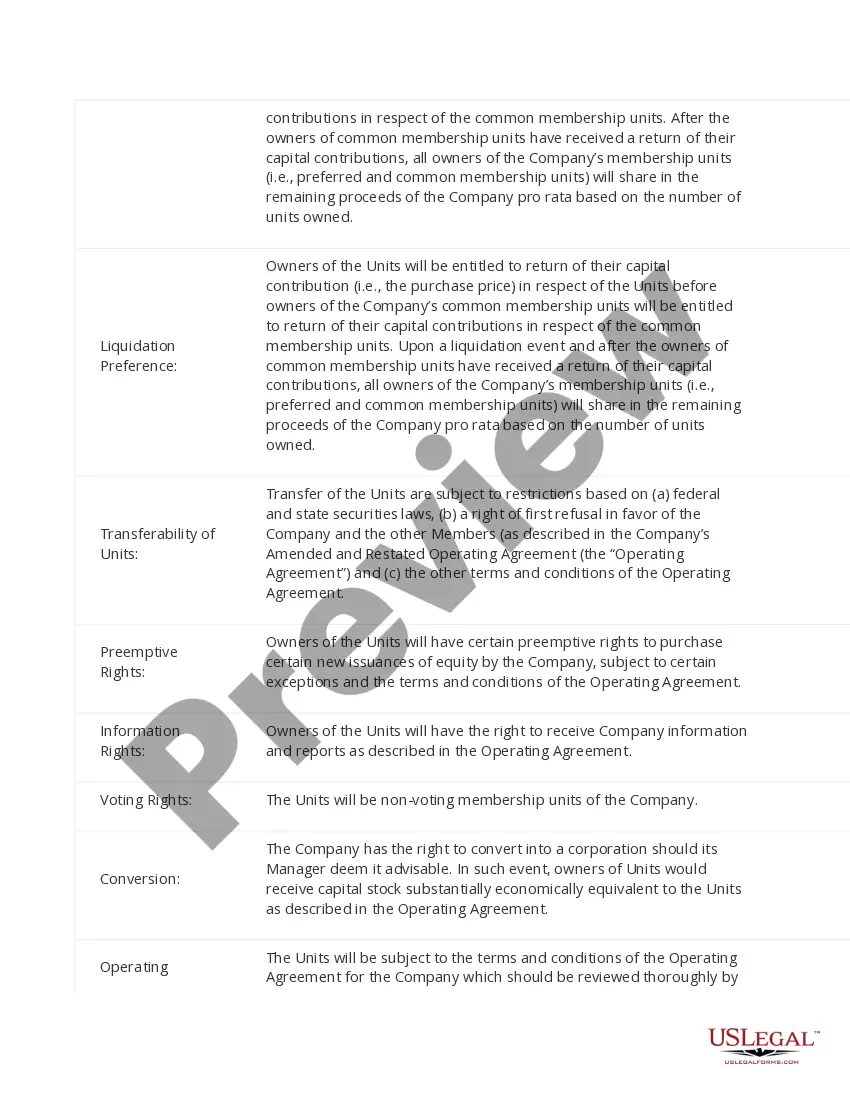

North Carolina Summary of Terms of Proposed Private Placement Offering: A Comprehensive Guide Introduction: In the realm of financial markets, private placement offerings play a crucial role in raising capital for both established companies and emerging startups. Within the regulatory framework in North Carolina, private placement offerings are subject to certain terms and conditions. This article provides a detailed description of what constitutes a North Carolina Summary of Terms of Proposed Private Placement Offering, shedding light on its purpose, legal implications, and types. Key Terms and Definitions: 1. Private Placement Offering: A private placement offering refers to the sale of securities to a specific group of qualified investors, as opposed to a public offering available to the public. This method allows companies to raise capital without the extensive regulatory requirements associated with public offerings. 2. Summary of Terms: The summary of terms encompasses all the vital aspects of the private placement offering, presenting it in a concise and comprehensive manner. It includes information related to the issuer, offering size, type of security being offered, terms of the investment, and any other relevant details. 3. Proposed Private Placement Offering: The proposed private placement offering refers to a potential or upcoming offering that is under consideration by a company. It outlines the terms and conditions that will be offered to investors if the offering moves forward. Components of a North Carolina Summary of Terms of Proposed Private Placement Offering: 1. Issuer Information: This section details pertinent information about the company or entity seeking to raise capital through the private placement offering. It includes the legal name, location, industry sector, history, financial statements, and any other relevant background information. 2. Offering Size: The offering size denotes the total amount of capital the issuer aims to raise through the private placement. It outlines the minimum and maximum subscription amounts, giving potential investors an idea of the investment scale. 3. Type of Security: This segment specifies the class of securities being offered, such as common stock, preferred stock, debt instruments, or convertible securities. It describes the rights, privileges, and potential risks associated with each security type. 4. Terms of Investment: The terms of investment provide details regarding the offering's structure, such as the duration of the investment, interest rates, maturity dates, conversion terms (if applicable), redemption rights, and any other conditions investors need to consider. 5. Regulatory Compliance: This section outlines the relevant legal and regulatory requirements imposed by the North Carolina Securities Division or other authorities. It highlights compliance with securities laws, disclosure obligations, investor qualifications, and any specific regulations unique to North Carolina. Types of North Carolina Summary of Terms of Proposed Private Placement Offering: While the core components of a summary of terms remains constant, the types of private placement offerings in North Carolina can vary based on the securities being offered and the companies involved. Common types may include: 1. Equity Offerings: These offerings involve the sale of ownership shares in a company, typically in the form of common or preferred stock. Investors receive equity and potential voting rights in return for their investment. 2. Debt Offerings: Debt offerings involve the issuance of fixed-income securities, usually in the form of bonds or promissory notes. Investors lend capital to the issuer in return for periodic interest payments and the return of principal at maturity. 3. Convertible Offerings: In convertible offerings, investors purchase securities that can be converted into another class of securities at a later date, usually common stock. This type allows investors to potentially benefit from future company growth and value appreciation. Conclusion: Understanding the North Carolina Summary of Terms of Proposed Private Placement Offering is crucial for investors, companies, and financial professionals alike. By adhering to the specific terms and regulations, companies can navigate the private placement offering process while providing investors with the necessary information to make informed investment decisions.

North Carolina Summary of Terms of Proposed Private Placement Offering

Description

How to fill out North Carolina Summary Of Terms Of Proposed Private Placement Offering?

Choosing the right legal document format can be quite a struggle. Of course, there are plenty of themes available on the net, but how would you discover the legal kind you require? Utilize the US Legal Forms website. The service offers a huge number of themes, like the North Carolina Summary of Terms of Proposed Private Placement Offering, which you can use for organization and personal needs. All of the forms are examined by experts and meet state and federal specifications.

Should you be presently registered, log in to your bank account and click on the Acquire button to get the North Carolina Summary of Terms of Proposed Private Placement Offering. Make use of your bank account to search from the legal forms you possess ordered previously. Proceed to the My Forms tab of your bank account and have an additional duplicate of the document you require.

Should you be a whole new customer of US Legal Forms, here are simple recommendations so that you can stick to:

- Very first, be sure you have chosen the proper kind for the town/region. You are able to look through the shape using the Review button and read the shape information to make certain this is the right one for you.

- In the event the kind does not meet your expectations, use the Seach discipline to get the correct kind.

- Once you are sure that the shape would work, go through the Purchase now button to get the kind.

- Opt for the pricing prepare you would like and type in the necessary information and facts. Create your bank account and buy the transaction with your PayPal bank account or charge card.

- Opt for the data file formatting and obtain the legal document format to your system.

- Complete, edit and printing and sign the obtained North Carolina Summary of Terms of Proposed Private Placement Offering.

US Legal Forms is definitely the most significant catalogue of legal forms in which you can see different document themes. Utilize the service to obtain expertly-produced files that stick to express specifications.