North Carolina Anual Shareholder Resolution

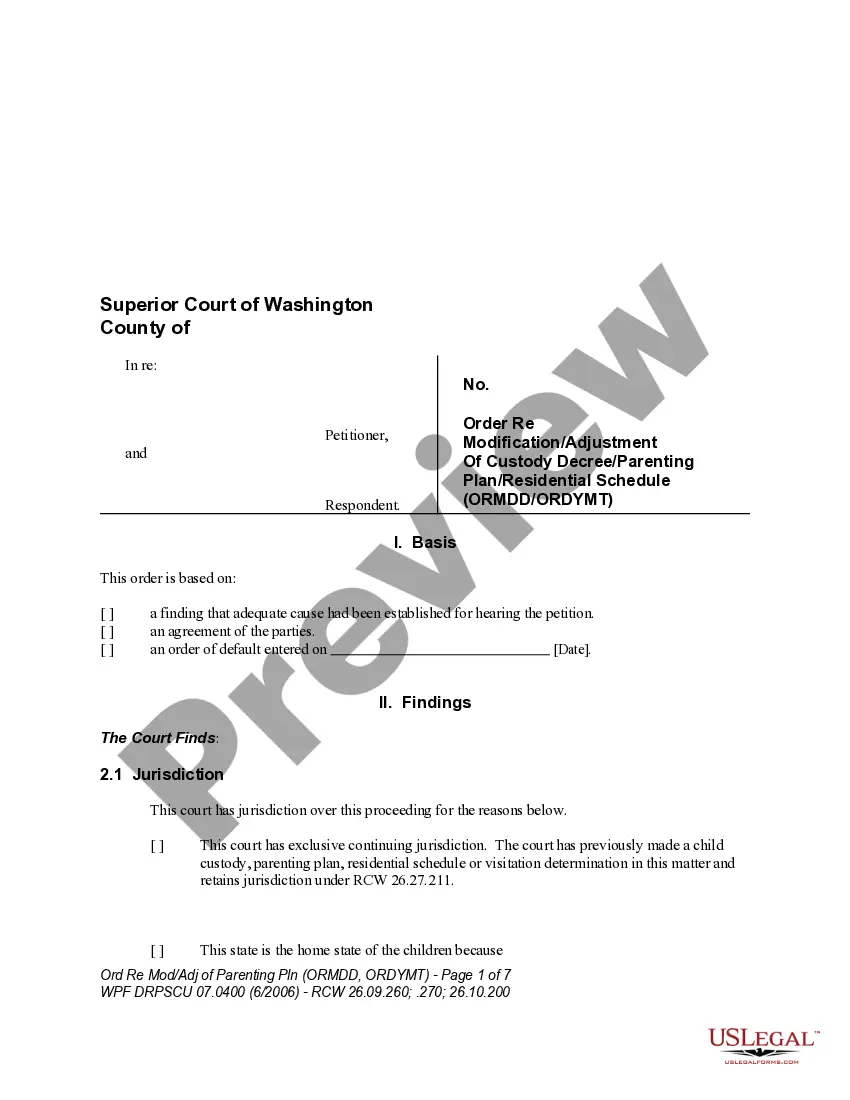

Description

How to fill out Anual Shareholder Resolution?

If you need to full, acquire, or printing authorized record layouts, use US Legal Forms, the greatest assortment of authorized types, which can be found on the web. Make use of the site`s basic and hassle-free research to obtain the paperwork you want. Various layouts for company and individual purposes are categorized by categories and suggests, or keywords. Use US Legal Forms to obtain the North Carolina Anual Shareholder Resolution in a number of click throughs.

If you are previously a US Legal Forms customer, log in to the profile and click on the Download button to have the North Carolina Anual Shareholder Resolution. You can also entry types you previously delivered electronically inside the My Forms tab of your respective profile.

If you are using US Legal Forms for the first time, follow the instructions under:

- Step 1. Be sure you have selected the form to the correct area/country.

- Step 2. Take advantage of the Review method to look over the form`s information. Do not forget about to read the explanation.

- Step 3. If you are unhappy with the develop, make use of the Search field on top of the display screen to get other versions of your authorized develop web template.

- Step 4. When you have identified the form you want, select the Purchase now button. Pick the costs program you favor and add your accreditations to register for an profile.

- Step 5. Approach the deal. You can utilize your charge card or PayPal profile to complete the deal.

- Step 6. Find the structure of your authorized develop and acquire it on your own system.

- Step 7. Full, change and printing or sign the North Carolina Anual Shareholder Resolution.

Every authorized record web template you purchase is yours forever. You might have acces to every develop you delivered electronically inside your acccount. Click on the My Forms area and decide on a develop to printing or acquire yet again.

Be competitive and acquire, and printing the North Carolina Anual Shareholder Resolution with US Legal Forms. There are many professional and status-particular types you can use for your personal company or individual requirements.

Form popularity

FAQ

The primary benefit of an S corp election is that it allows the shareholders to receive profits free of taxation at the corporate level. The profits will only be taxed at the individual level, thereby avoiding the ?double tax? that C corporation shareholders are subject to.

Per the NC S Corporation Instructions: "The franchise tax rate is $200 for the first one million dollars ($1,000,000) of the corporation's tax base and $1.50 per $1,000 of its tax base that exceeds one million dollars ($1,000,000).

Step 1: Name Your North Carolina LLC. ... Step 2: Choose a Registered Agent. ... Step 3: File the North Carolina Articles of Organization. ... Step 4: Create an Operating Agreement. ... Step 5: File Form 2553 to Elect North Carolina S Corp Tax Designation.

Step 1: Name Your North Carolina LLC. ... Step 2: Choose a Registered Agent. ... Step 3: File the North Carolina Articles of Organization. ... Step 4: Create an Operating Agreement. ... Step 5: File Form 2553 to Elect North Carolina S Corp Tax Designation.

Can I set up an S corp myself? While it is possible to file articles of incorporation and go through the S corporation election process alone, S corp requirements are both strict and complex. To ensure you're following the rules, we recommend consulting an attorney or tax professional.

Outlined below is a detailed description of the process to guide you to produce legally binding corporate resolution documents. Step 1: Write the Company's Name. ... Step 2: Include Further Legal Identification. ... Step 3: Include Location, Date and Time. ... Step 4: List the Board Resolutions. ... Step 5: Sign and Date the Document.

NC corporations (foreign and domestic) and partnerships (LLPs and LLLPs) must file an annual report by the 15th day of the 4th month after fiscal year end. The filing fee for corporations is $20 (online) or $25 (paper).

If you do not file an annual report on time, the state of North Carolina will send you a ?Notice of Grounds for Administrative Dissolution.? If you do not file your report within 60 days, your business will be dissolved.