Keywords: North Carolina, Writ of Execution, types Title: Understanding the North Carolina Writ of Execution: Types and Detailed Overview Introduction: The North Carolina Writ of Execution is a legal document utilized in the enforcement of court judgments. It empowers creditors to collect the awarded funds from debtors by authorizing various forms of asset seizure and sale. In North Carolina, there are several types of Writs of Execution, each serving a specific purpose. This article aims to provide a comprehensive understanding of the North Carolina Writ of Execution and its different types. 1. Types of North Carolina Writs of Execution: a. General Writ of Execution: This type of writ is commonly used to enforce monetary judgments. It allows creditors to seize and sell non-exempt property owned by the debtor to satisfy the judgment amount. However, North Carolina law protects certain assets from seizure, such as primary residences, necessary personal items, and specific tools of trade. b. Writ of Execution Against Earnings: Also known as a Writ of Garnishment, this type allows creditors to collect a judgment by garnishing the debtor's wages. The court issues an order to the debtor's employer, directing them to withhold a portion of the debtor's earnings and remit them to the creditor until the debt is satisfied. c. Writ of Execution on Real Property: This writ is applicable when the judgment debtor owns real estate. It grants the creditor the authority to have the property levied, advertised, and sold at a public auction. The generated funds are then used to satisfy the judgment. d. Writ of Execution on Personal Property: In cases where the debtor possesses valuable personal property, such as vehicles, jewelry, or artwork, this type of writ is employed. The creditor can seize and sell these items to generate funds to fulfill the judgment debt. e. Writ of Execution on Bank Accounts: When the judgment debtor maintains funds in a bank account, a Writ of Execution can be issued to seize those funds. The bank is then directed to transfer the funds to the creditor, who can use them towards satisfying the judgment. 2. Process of Obtaining a North Carolina Writ of Execution: — To initiate the enforcement process, the judgment creditor must file a request for a Writ of Execution with the court that handled the case. — The court reviews the request and, if approved, issues the appropriate type of writ based on the debtor's assets. — Once the writ is obtained, the creditor must serve it upon the debtor or relevant third parties, such as employers or banks, for further action. Conclusion: The North Carolina Writ of Execution serves as a crucial tool for enforcing court judgments and ensuring creditors receive the awarded funds. By understanding the different types of Writs of Execution and their respective processes, creditors can take appropriate legal steps to collect outstanding debts. However, it is important to consult with legal professionals to navigate the complexities and ensure compliance with North Carolina laws.

North Carolina Writ of Execution

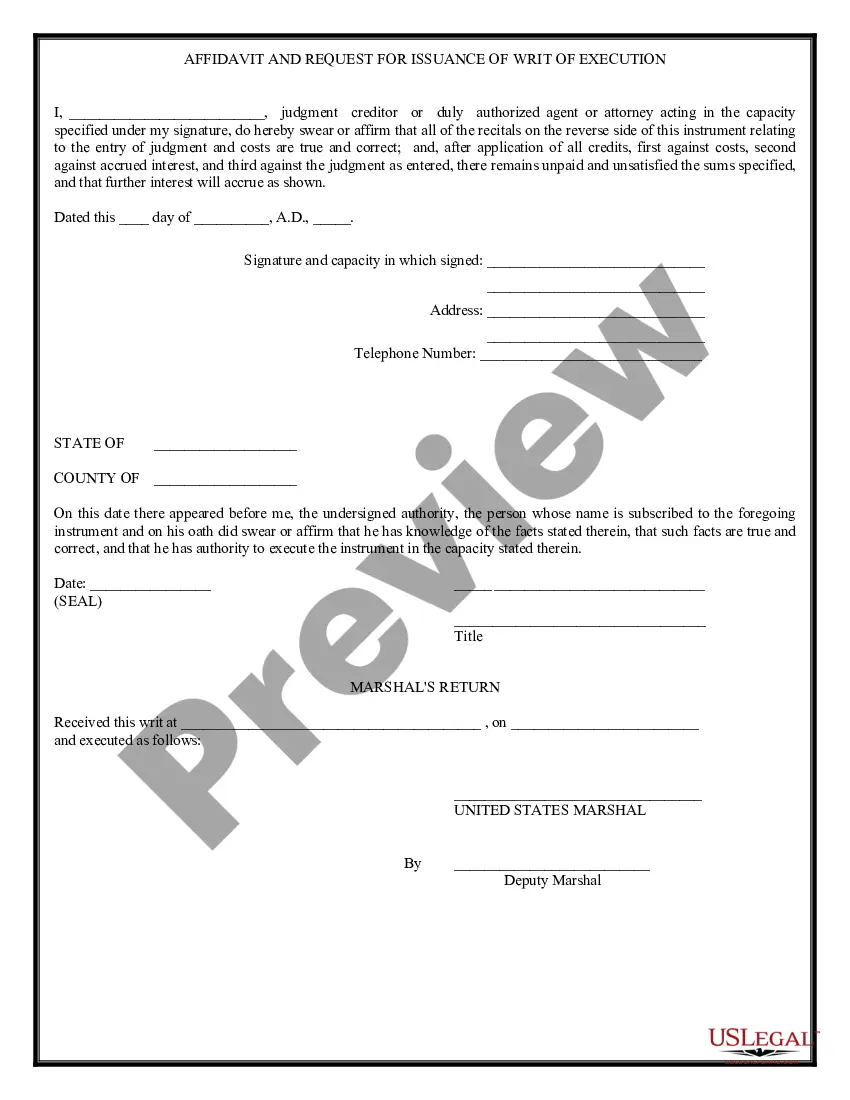

Description

How to fill out North Carolina Writ Of Execution?

You may invest time online looking for the legal document design that meets the federal and state specifications you want. US Legal Forms offers a large number of legal forms which can be analyzed by specialists. You can easily download or printing the North Carolina Writ of Execution from our support.

If you already possess a US Legal Forms profile, you are able to log in and click the Acquire switch. Next, you are able to total, modify, printing, or indication the North Carolina Writ of Execution. Every legal document design you purchase is yours for a long time. To get another copy for any obtained develop, proceed to the My Forms tab and click the related switch.

If you are using the US Legal Forms web site for the first time, adhere to the simple directions beneath:

- First, ensure that you have chosen the proper document design for your area/city of your choosing. See the develop outline to ensure you have picked out the right develop. If available, utilize the Preview switch to look from the document design as well.

- In order to get another edition of the develop, utilize the Look for area to discover the design that suits you and specifications.

- When you have located the design you desire, just click Get now to proceed.

- Choose the rates program you desire, key in your qualifications, and sign up for an account on US Legal Forms.

- Total the deal. You can use your credit card or PayPal profile to pay for the legal develop.

- Choose the format of the document and download it to the device.

- Make adjustments to the document if possible. You may total, modify and indication and printing North Carolina Writ of Execution.

Acquire and printing a large number of document themes using the US Legal Forms website, which provides the biggest collection of legal forms. Use skilled and state-specific themes to handle your small business or individual requirements.