North Carolina Qualified Written RESPA Request to Dispute or Validate Debt

Description

How to fill out North Carolina Qualified Written RESPA Request To Dispute Or Validate Debt?

You are able to invest several hours on the web attempting to find the legitimate papers design that meets the federal and state requirements you require. US Legal Forms provides 1000s of legitimate types that are analyzed by specialists. You can actually download or print out the North Carolina Qualified Written RESPA Request to Dispute or Validate Debt from your services.

If you have a US Legal Forms bank account, you can log in and click on the Down load switch. Afterward, you can comprehensive, revise, print out, or sign the North Carolina Qualified Written RESPA Request to Dispute or Validate Debt. Each and every legitimate papers design you acquire is your own for a long time. To acquire another duplicate for any obtained form, check out the My Forms tab and click on the corresponding switch.

Should you use the US Legal Forms site initially, keep to the easy directions below:

- Very first, make certain you have chosen the right papers design to the region/city of your liking. Read the form explanation to ensure you have picked out the appropriate form. If available, take advantage of the Review switch to check with the papers design as well.

- In order to get another model from the form, take advantage of the Research industry to find the design that meets your requirements and requirements.

- Upon having located the design you would like, just click Acquire now to move forward.

- Pick the prices strategy you would like, type your accreditations, and sign up for a merchant account on US Legal Forms.

- Comprehensive the financial transaction. You can use your charge card or PayPal bank account to purchase the legitimate form.

- Pick the file format from the papers and download it to the gadget.

- Make alterations to the papers if needed. You are able to comprehensive, revise and sign and print out North Carolina Qualified Written RESPA Request to Dispute or Validate Debt.

Down load and print out 1000s of papers web templates while using US Legal Forms site, that offers the largest selection of legitimate types. Use expert and condition-certain web templates to deal with your business or personal demands.

Form popularity

FAQ

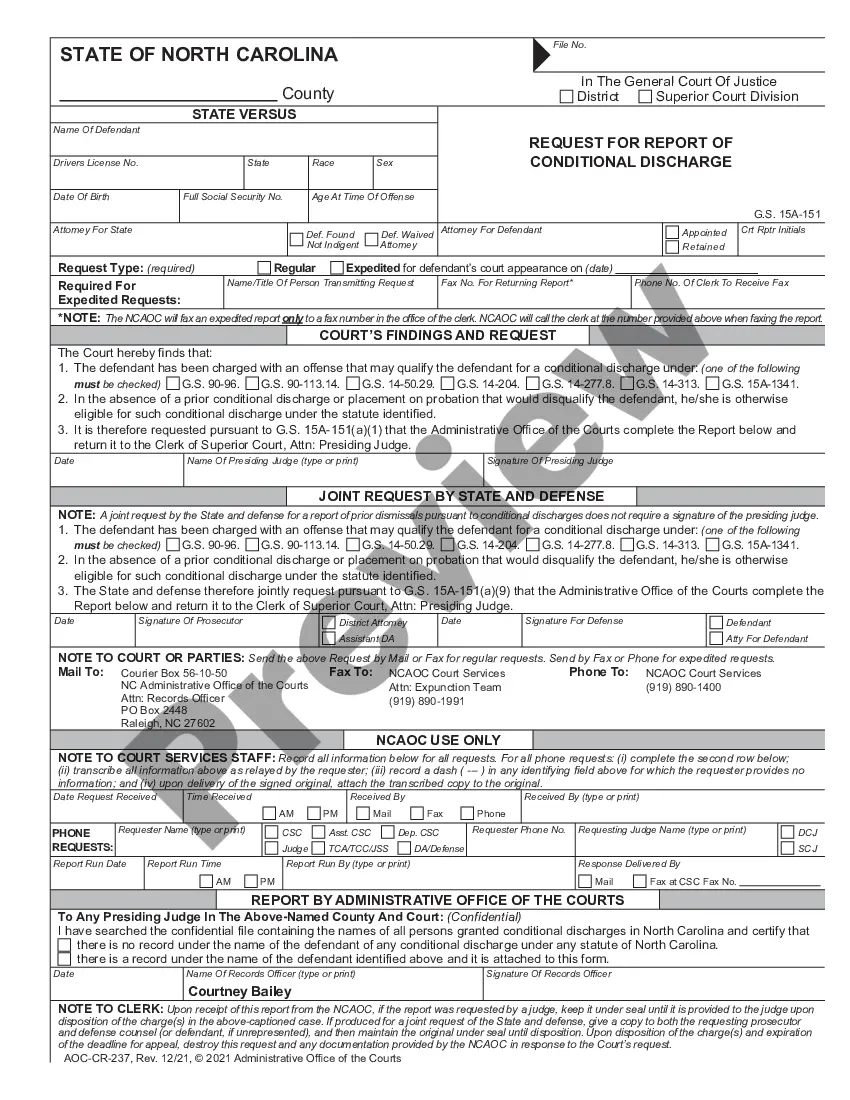

A Qualified Written Request, or QWR, is written correspondence that you or someone acting on your behalf can send to your mortgage servicer. Instead of a QWR, you can also send your servicer a Notice of Error or a Request for Information.

To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.

Failing to respond to a Debt Validation Letter while continuing to collect on the debt is a direct violation of the FDCPA. You can report a debt collector's failure to respond to your state's attorney general, the Consumer Financial Protection Bureau (CFPB), or the FTC.

According to the above FDCPA Section, Debt Validation is defined as the debt collector contacting the original creditor to affirm the debt amount being requested is correct. It is highly doubtful the debt collector ever contacts the original creditor for any debt validation purposes.

How to Write a Debt Verification LetterDetermine the exact amounts you owe.Gather documents that verify your debt.Get information on who you owe.Determine how old the debt is.Place a pause on the collection proceedings.

I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

§ 1006.34 Notice for validation of debts.Deceased consumers.Bankruptcy proofs of claim.In general.Subsequent debt collectors.Last statement date.Last payment date.Transaction date.Assumed receipt of validation information.More items...

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

A debt validation letter is what a debt collector sends you to prove that you owe them money. This letter shows you the details of a specific debt, outlines what you owe, who you owe it to, and when they need you to pay.

To make a qualified written request, you must send a letter to the servicer with the following information:your name and account information (or information that enables the servicer to be able to identify your account)a statement of the reasons why you believe that the account is in error, or.More items...