North Carolina Specialty Services Contact - Self-Employed

Description

How to fill out North Carolina Specialty Services Contact - Self-Employed?

Choosing the right authorized document format might be a struggle. Needless to say, there are tons of templates available on the Internet, but how will you obtain the authorized form you want? Utilize the US Legal Forms internet site. The support delivers 1000s of templates, like the North Carolina Specialty Services Contact - Self-Employed, that can be used for enterprise and personal requires. Each of the forms are checked out by experts and fulfill federal and state needs.

When you are presently signed up, log in for your account and click on the Download button to obtain the North Carolina Specialty Services Contact - Self-Employed. Make use of your account to appear with the authorized forms you might have purchased in the past. Go to the My Forms tab of your account and get another version of your document you want.

When you are a new user of US Legal Forms, listed here are straightforward instructions that you should adhere to:

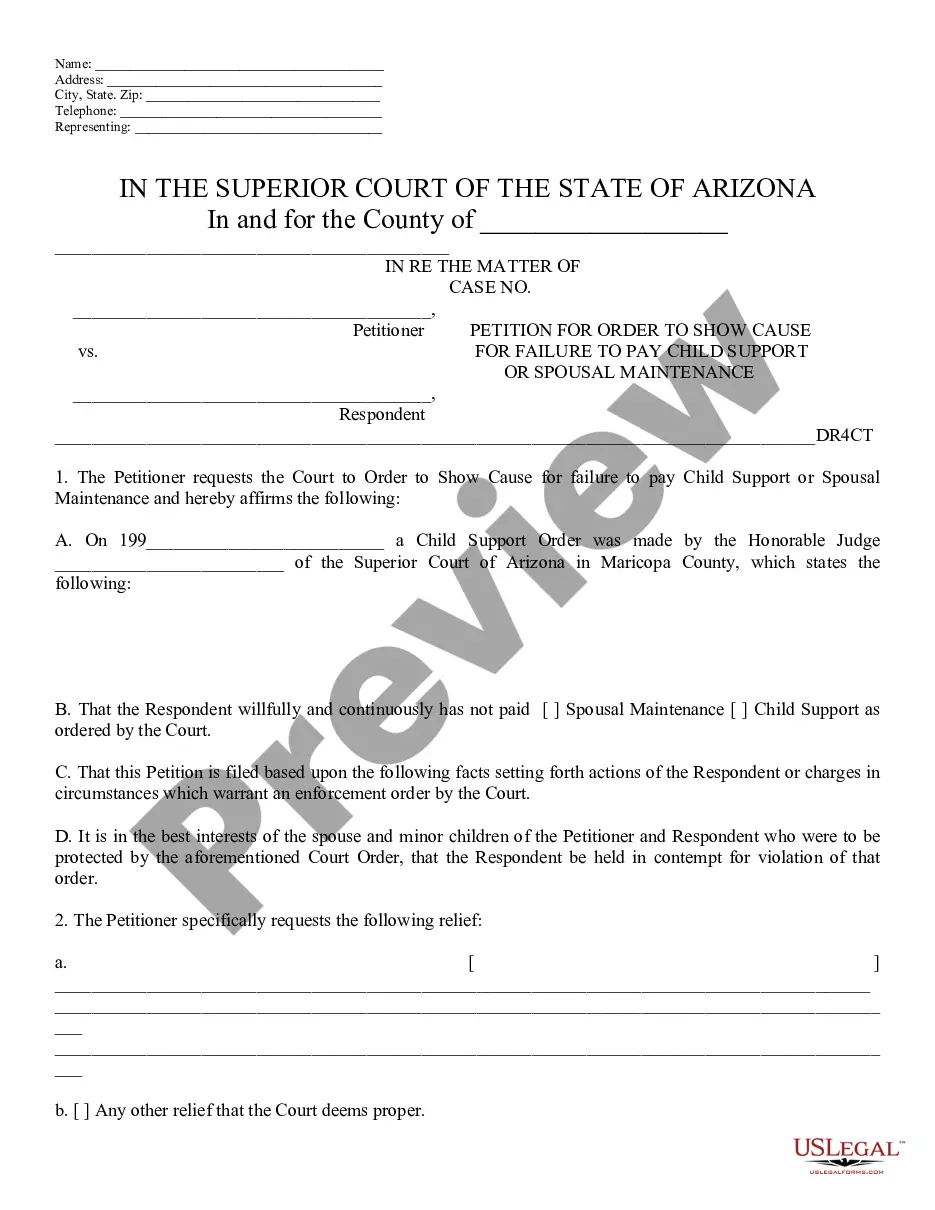

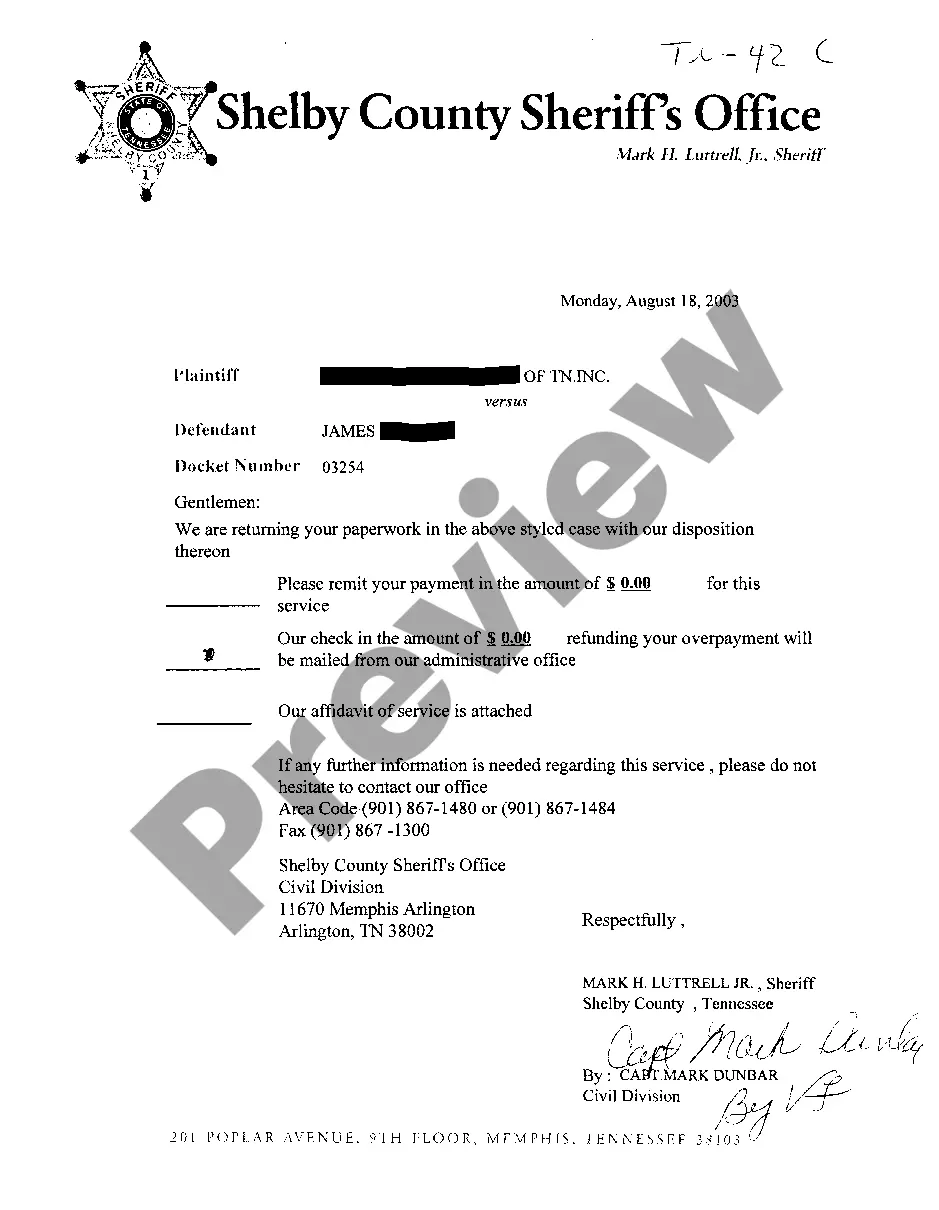

- Very first, ensure you have selected the appropriate form to your area/county. It is possible to check out the form utilizing the Review button and browse the form outline to make sure this is basically the best for you.

- In the event the form does not fulfill your preferences, take advantage of the Seach industry to find the correct form.

- When you are positive that the form would work, select the Get now button to obtain the form.

- Select the prices strategy you would like and enter in the needed information and facts. Make your account and pay money for the order using your PayPal account or credit card.

- Pick the file file format and acquire the authorized document format for your system.

- Full, modify and print out and indicator the received North Carolina Specialty Services Contact - Self-Employed.

US Legal Forms is the biggest collection of authorized forms where you can find various document templates. Utilize the company to acquire professionally-produced documents that adhere to state needs.

Form popularity

FAQ

Typically, though, you can be exempt from withholding tax only if two things are true:You got a refund of all your federal income tax withheld last year because you had no tax liability.You expect the same thing to happen this year.

Prescription Medicine, groceries, and gasoline are all tax-exempt. Some services in North Carolina are subject to sales tax.

Repair, Maintenance, and Installation Services; and Other Repair Information. The sales price of or the gross receipts derived from repair, maintenance, and installation services sold at retail is subject to the general State and applicable local and transit rates of sales and use tax.

Some items are exempt from sales and use tax, including:Sales of certain food products for human consumption (many groceries)Sales to the U.S. Government.Sales of prescription medicine and certain medical devices.Sales of items paid for with food stamps.

When it comes to sales tax, the general rule of thumb has always been products are taxable, while services are non-taxable. Under that scenario, if your business sells coffee mugs, you should charge sales tax for those products.

Repair, Maintenance, and Installation Services; and Other Repair Information. The sales price of or the gross receipts derived from repair, maintenance, and installation services sold at retail is subject to the general State and applicable local and transit rates of sales and use tax.

Services in North Carolina are generally not taxable, with important exceptions. If the service you provide includes creating or manufacturing a product, you may have to deal with the sales tax on products.

Your sales and use tax account ID number is the 9-digit number issued to you by the Department of Revenue at the time of registration. You can find your sales and use tax account ID number on your registration certificate or coupon booklet.

Contact the Taxpayer Assistance and Collection Center at 1-877-252-3052 (toll-free) or fax your request to (919) 715-2999. Include in the request, your name or company name, address, telephone number, and exemption number.

A13. North Carolina law requires income tax to be withheld from all wages; however, the law does allow an exemption from withholding if certain conditions are met. Because your circumstances may change from year to year, an exempt status is good for only one year at a time.