North Carolina Appliance Refinish Services Contract - Self-Employed

Description

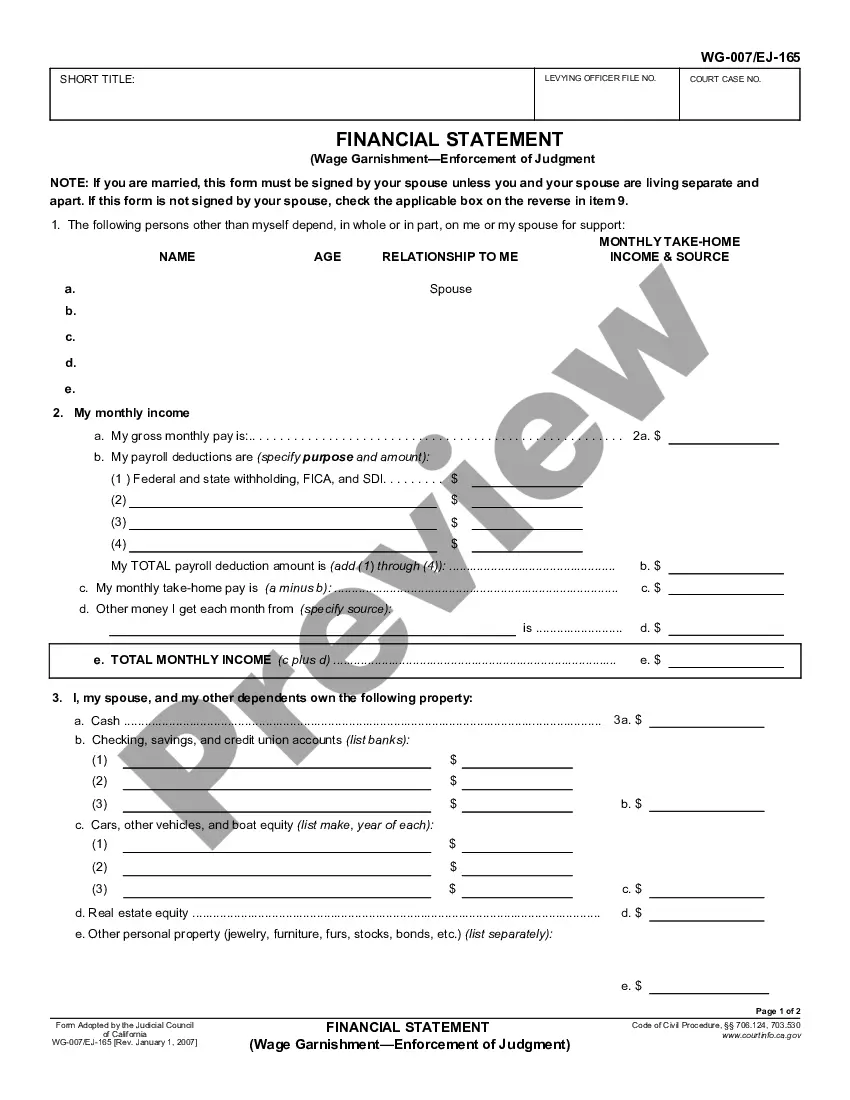

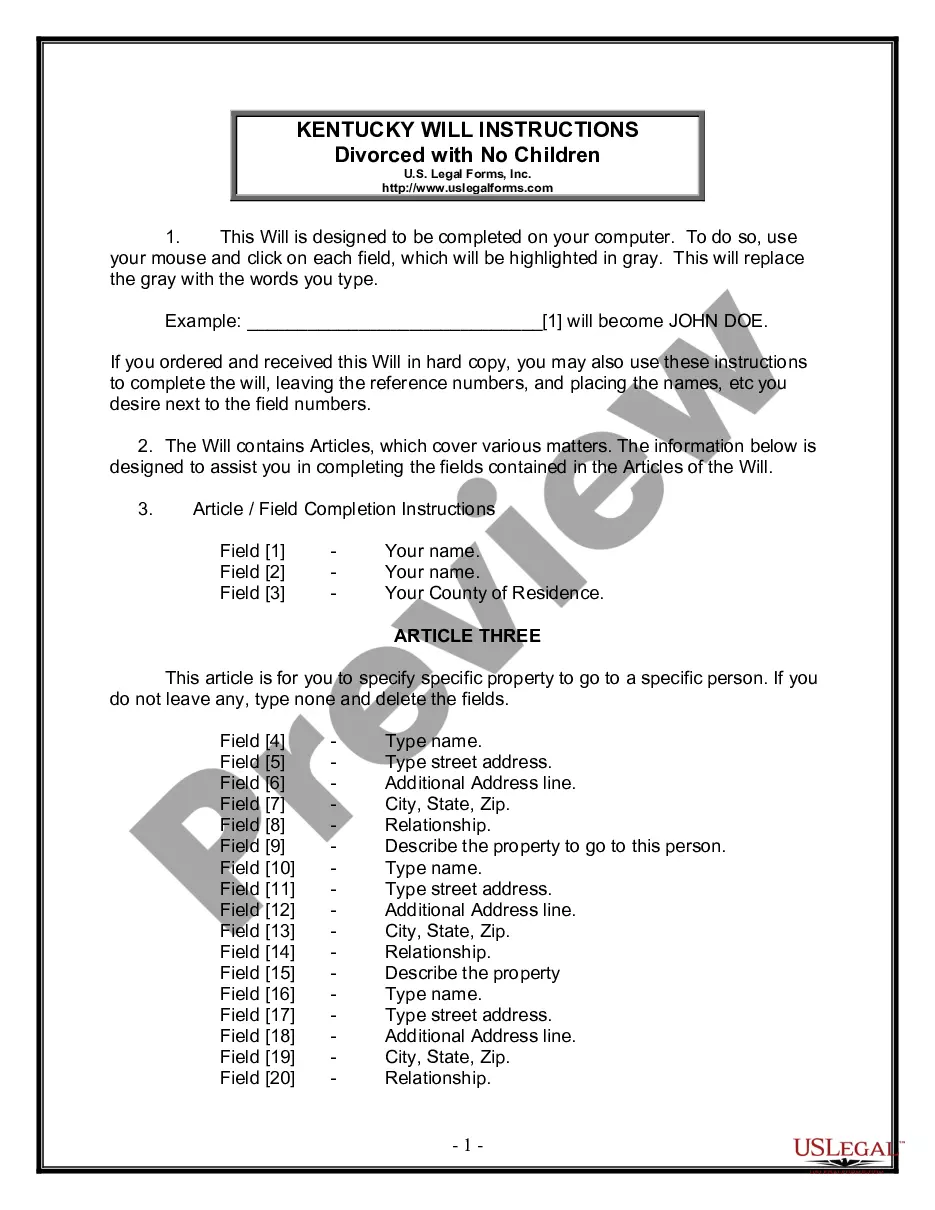

How to fill out North Carolina Appliance Refinish Services Contract - Self-Employed?

It is possible to invest hours on the web attempting to find the legitimate papers format which fits the federal and state needs you need. US Legal Forms supplies a huge number of legitimate varieties that are examined by specialists. It is simple to acquire or print the North Carolina Appliance Refinish Services Contract - Self-Employed from my services.

If you have a US Legal Forms account, you may log in and then click the Download button. Following that, you may total, revise, print, or sign the North Carolina Appliance Refinish Services Contract - Self-Employed. Each and every legitimate papers format you buy is your own for a long time. To acquire another backup of the acquired type, go to the My Forms tab and then click the related button.

If you work with the US Legal Forms web site initially, follow the straightforward recommendations below:

- First, make sure that you have selected the right papers format for your county/town of your liking. See the type outline to make sure you have picked out the proper type. If accessible, make use of the Review button to look with the papers format as well.

- In order to discover another version of the type, make use of the Lookup industry to get the format that meets your needs and needs.

- After you have found the format you desire, click on Get now to continue.

- Choose the prices plan you desire, type your references, and sign up for a free account on US Legal Forms.

- Total the purchase. You can utilize your charge card or PayPal account to fund the legitimate type.

- Choose the structure of the papers and acquire it to the product.

- Make alterations to the papers if required. It is possible to total, revise and sign and print North Carolina Appliance Refinish Services Contract - Self-Employed.

Download and print a huge number of papers templates while using US Legal Forms website, which offers the biggest collection of legitimate varieties. Use professional and state-particular templates to handle your company or personal demands.

Form popularity

FAQ

Services in North Carolina are generally not taxable, with important exceptions. If the service you provide includes creating or manufacturing a product, you may have to deal with the sales tax on products.

Are service contract or warranty sales to the end customer subject to sales tax at the time of sale? Yes. Retail sales tax applies to a service contract or warranty sold to a consumer (WAC 458-20-257).

Prescription Medicine, groceries, and gasoline are all tax-exempt. Some services in North Carolina are subject to sales tax.

The sales price of or the gross receipts derived from a service contract sold at retail is subject to the general 4.75% State, applicable local (2.00% or 2.25%), and applicable transit (0.50%) rates of sales and use tax. Service contracts are taxed in accordance with N.C. Gen. Stat. § 105-164.4I.

Traditional Goods or Services Goods that are subject to sales tax in North Carolina include physical property, like furniture, home appliances, and motor vehicles. Prescription Medicine, groceries, and gasoline are all tax-exempt.

Are services subject to sales tax in North Carolina? In the state of North Carolina, services are not generally considered to be taxable.

Beginning on January 1, 2014, NC rolled out a new sales and use tax. The tax applies to warranty agreements, service contracts and maintenance agreements that cover tangible personal property. The amount of the NC Sales and Use tax for these contracts is 4.75%. What is Tangible Personal Property?

Services in North Carolina are generally not taxable, with important exceptions. If the service you provide includes creating or manufacturing a product, you may have to deal with the sales tax on products.