North Carolina Physical Therapist Agreement - Self-Employed Independent Contractor

Description

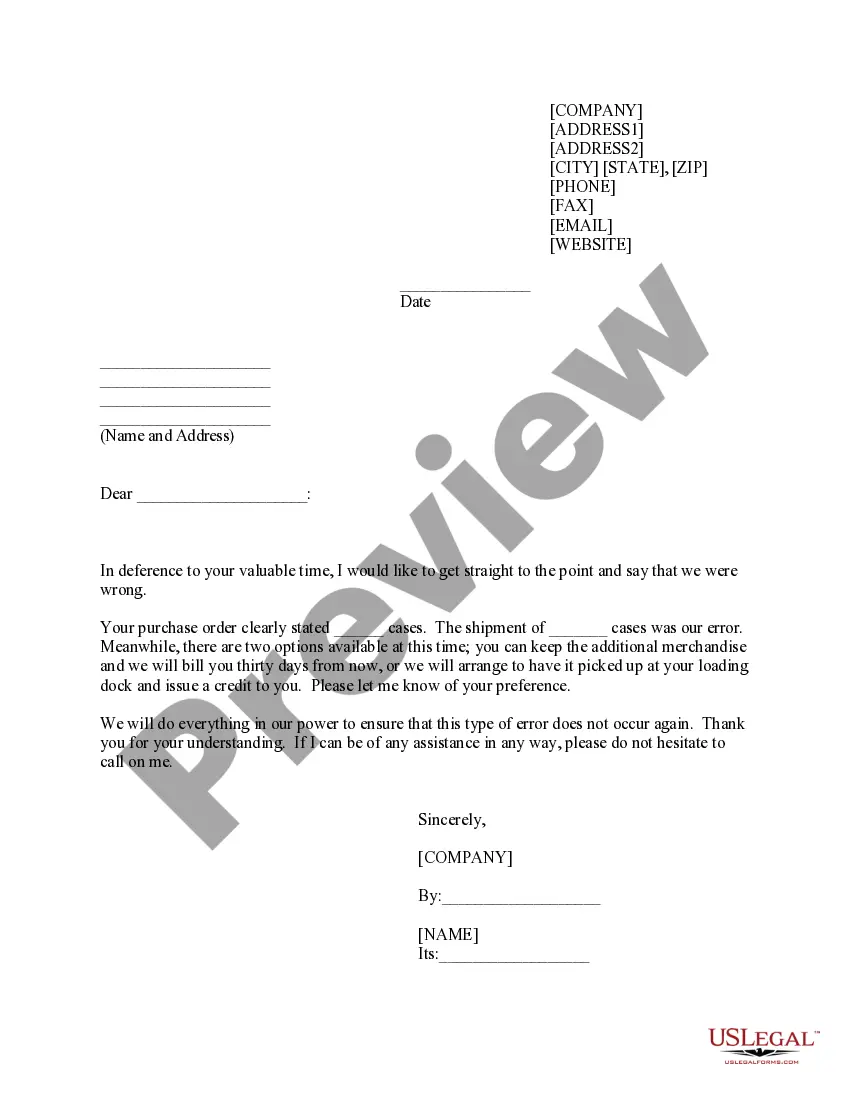

How to fill out North Carolina Physical Therapist Agreement - Self-Employed Independent Contractor?

If you have to full, obtain, or print legal record templates, use US Legal Forms, the greatest variety of legal forms, which can be found on-line. Make use of the site`s easy and hassle-free lookup to get the paperwork you need. A variety of templates for enterprise and personal uses are categorized by classes and states, or keywords. Use US Legal Forms to get the North Carolina Physical Therapist Agreement - Self-Employed Independent Contractor in a number of click throughs.

If you are presently a US Legal Forms client, log in to the accounts and then click the Acquire option to find the North Carolina Physical Therapist Agreement - Self-Employed Independent Contractor. You can also entry forms you formerly delivered electronically within the My Forms tab of the accounts.

If you use US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the shape to the proper metropolis/nation.

- Step 2. Use the Preview method to look over the form`s information. Never forget to read the information.

- Step 3. If you are unhappy with the form, utilize the Research industry towards the top of the display screen to discover other types in the legal form web template.

- Step 4. When you have located the shape you need, go through the Purchase now option. Pick the costs prepare you favor and add your credentials to register to have an accounts.

- Step 5. Procedure the purchase. You should use your charge card or PayPal accounts to accomplish the purchase.

- Step 6. Select the format in the legal form and obtain it on your own system.

- Step 7. Total, revise and print or sign the North Carolina Physical Therapist Agreement - Self-Employed Independent Contractor.

Every single legal record web template you acquire is the one you have permanently. You might have acces to each and every form you delivered electronically in your acccount. Go through the My Forms area and pick a form to print or obtain once again.

Compete and obtain, and print the North Carolina Physical Therapist Agreement - Self-Employed Independent Contractor with US Legal Forms. There are thousands of professional and status-particular forms you may use for your personal enterprise or personal demands.

Form popularity

FAQ

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

You'll usually report this income on Form 1040, Line 21, as Other income. This is taxable income not subject to self-employment tax. When the income reported on Form 1099-MISC Box 3 is from your trade or business, report it with your business income.

There are three easy steps to take when beginning an independent contractor business:Pick a name for your business. The name of your business should shed a little light on what it is you do and who your target clients may be.Get yourself a contracting license.Make sure you figure out your recordkeeping and taxes.

An independent contractor agreement is a contract between a freelancer and a company or client outlining the specifics of their work together. This legal contract usually includes information regarding the scope of the work, payment, and deadlines.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

If you have a 1099-NEC that is not self-employment income subject to self-employment taxes, you need to enter the income in Box 3 of a 1099-MISC instead of Box 1 of the 1099-NEC. If your income is not self-employment income, you do not need to use Schedule C to report business income.

If you have a written contract to complete a specific task or project for a predetermined sum of money, you are probably a 1099 worker. However, if your employment is open-ended, without a contract and subject to a job description, you will typically be considered an employee.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Subcontractor vs Independent contractor is a difference in an employment relationship with a laborer. Independent contractors are employed and paid directly by the employer while subcontractors are employed by an independent contractor and are paid by them.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.