North Carolina Translator And Interpreter Agreement - Self-Employed Independent Contractor

Description

How to fill out North Carolina Translator And Interpreter Agreement - Self-Employed Independent Contractor?

If you want to complete, down load, or produce legitimate document layouts, use US Legal Forms, the greatest assortment of legitimate forms, which can be found on the web. Take advantage of the site`s easy and hassle-free search to find the documents you require. Various layouts for business and personal functions are sorted by classes and states, or keywords. Use US Legal Forms to find the North Carolina Translator And Interpreter Agreement - Self-Employed Independent Contractor in just a handful of click throughs.

If you are presently a US Legal Forms buyer, log in in your account and click the Acquire key to get the North Carolina Translator And Interpreter Agreement - Self-Employed Independent Contractor. You can even gain access to forms you previously delivered electronically from the My Forms tab of the account.

If you use US Legal Forms initially, follow the instructions below:

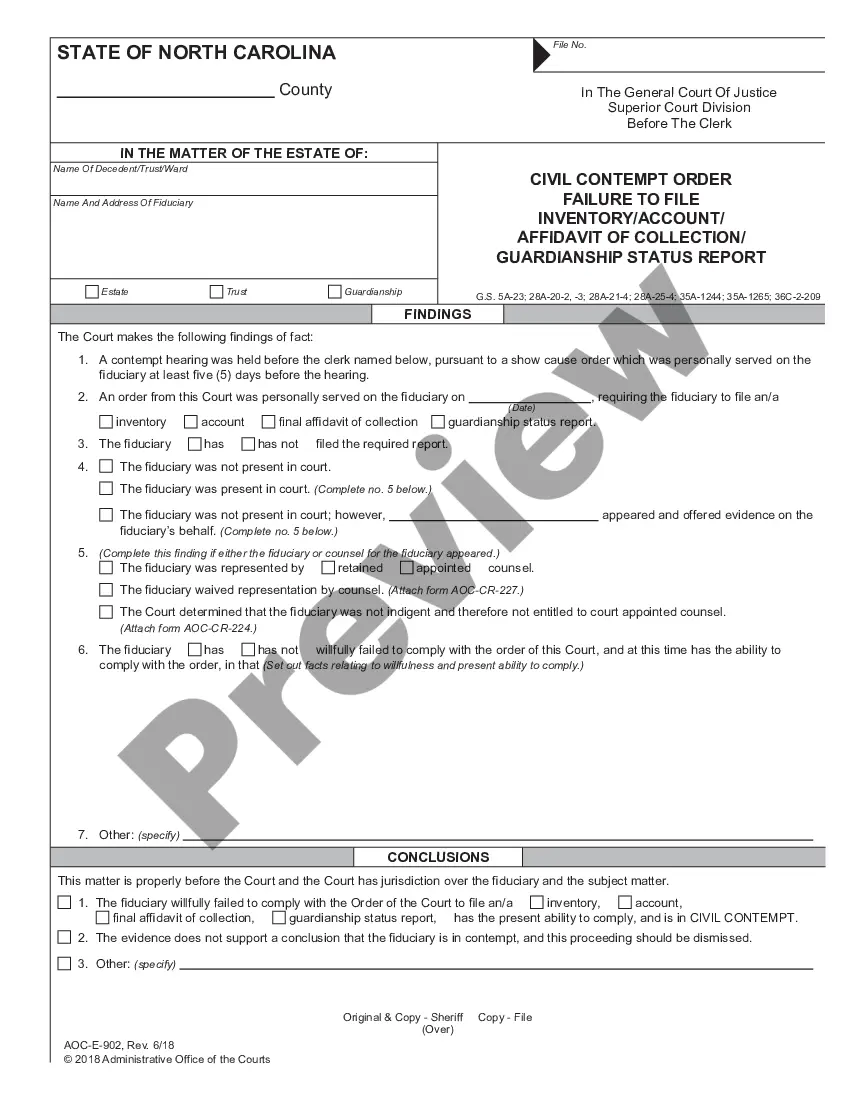

- Step 1. Be sure you have selected the shape for that proper metropolis/country.

- Step 2. Utilize the Preview option to look through the form`s content. Don`t overlook to learn the outline.

- Step 3. If you are unhappy together with the type, use the Research industry near the top of the display screen to locate other variations from the legitimate type design.

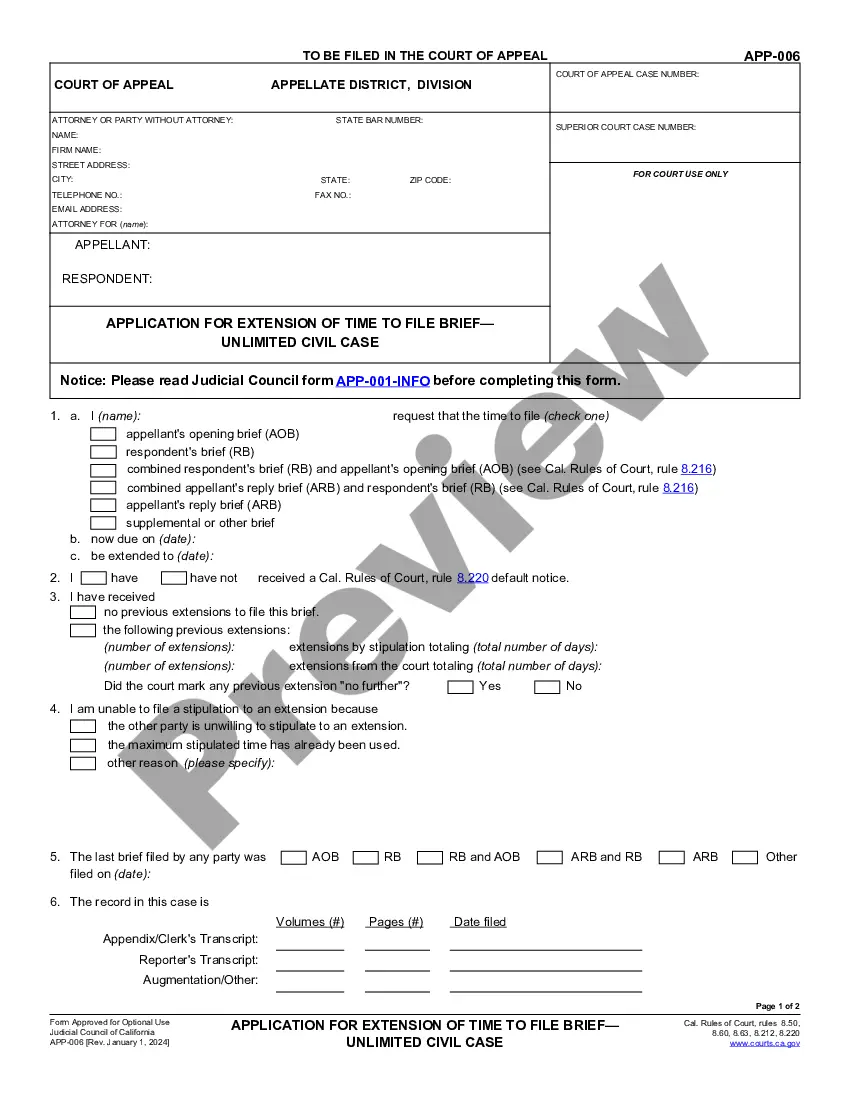

- Step 4. Once you have located the shape you require, click the Get now key. Choose the costs plan you choose and add your accreditations to sign up on an account.

- Step 5. Method the purchase. You should use your bank card or PayPal account to accomplish the purchase.

- Step 6. Pick the structure from the legitimate type and down load it on your own gadget.

- Step 7. Full, modify and produce or sign the North Carolina Translator And Interpreter Agreement - Self-Employed Independent Contractor.

Every legitimate document design you get is the one you have eternally. You possess acces to each and every type you delivered electronically in your acccount. Click on the My Forms segment and choose a type to produce or down load again.

Compete and down load, and produce the North Carolina Translator And Interpreter Agreement - Self-Employed Independent Contractor with US Legal Forms. There are thousands of specialist and express-distinct forms you can utilize for your personal business or personal demands.

Form popularity

FAQ

Freelancers are independent contractors who should receive 1099 from the company using their services and are subject to paying their own taxes, including self-employment tax.

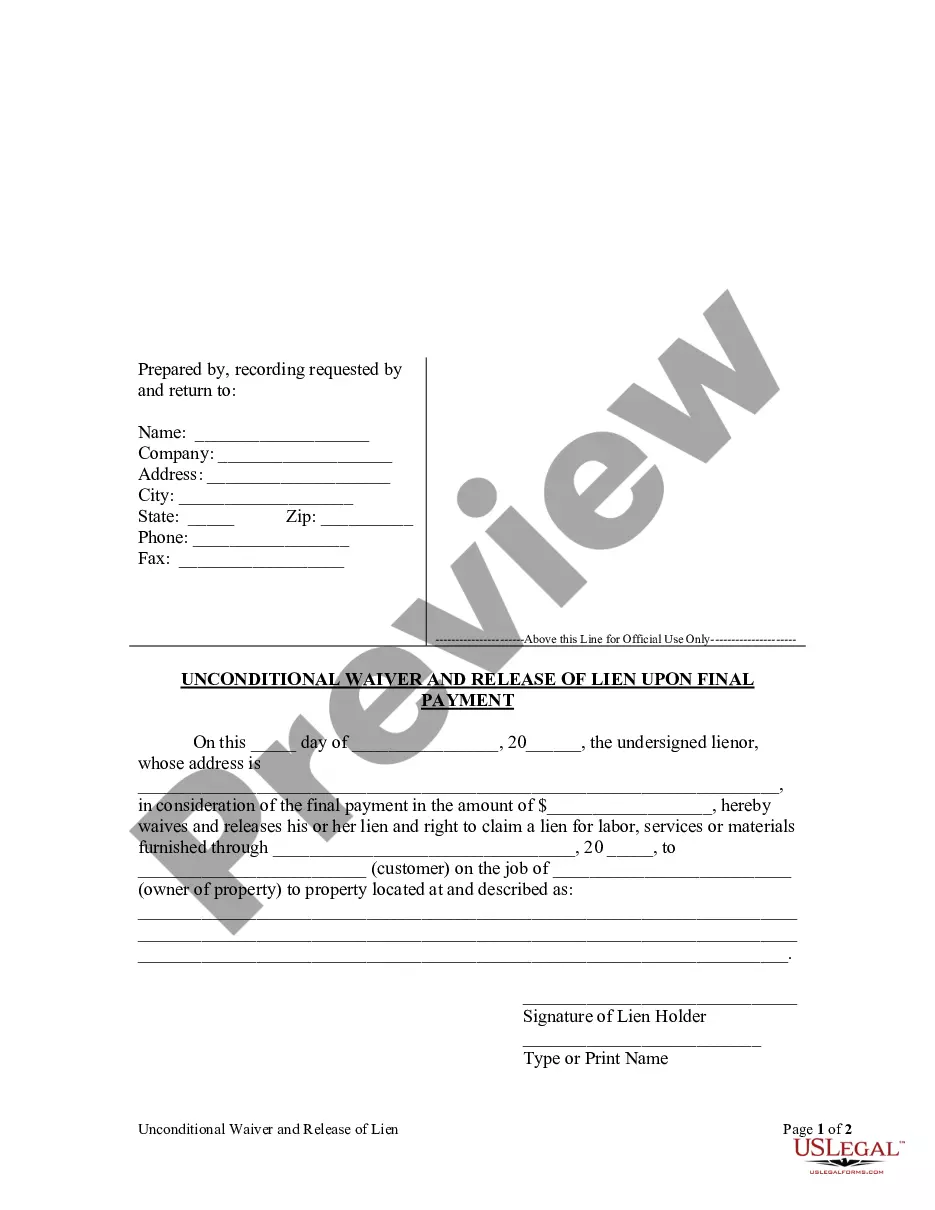

The other contract (Independent contractor) is a Contract for Service, and is usually a contract where the contractor undertakes to perform a specific service or task, and upon completion of the agreed service or task, or upon production of the result agreed upon, the contractor will be paid.

The main pieces of employment legislation, chief among which are the Labour Relations Act 66 of 1995 (LRA) the Basic Conditions of Employment Act 75 of 1997 (BCEA) and the Employment Equity Act 55 of 1998 (EEA), apply to employees and not independent contractors.

Employees in South Africa are entitled to certain minimum employment benefits, while independent contractors are not. Subject to some exclusions, all employees are entitled to a number of statutory minimum entitlements and basic conditions of employment.

The Labour Relations Act applies to all employers, workers, trade unions and employers' organisations.

Fact #1: A large percentage of all interpreters and translators are independent contractors. There are many reasons that language professionals choose to work as independent contractors. Many prefer the flexibility of making their own schedule and being able to choose their assignments.

Often Independent Contractors are completely unaware that they are not Employees as defined in South African labour legislation and therefore unprotected by labour legislation.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

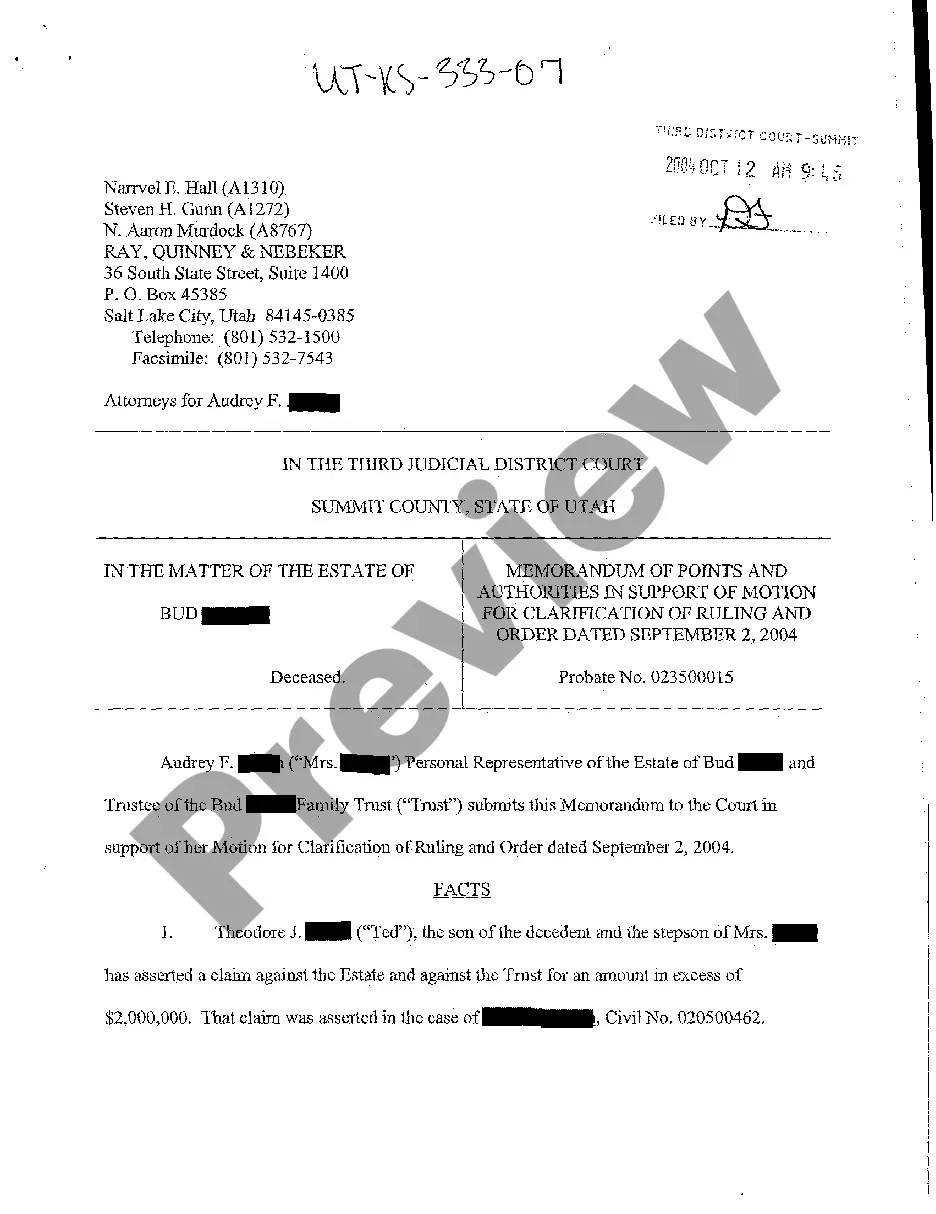

Freelance interpreters or translators work on a self-employed basis converting written texts from one language to another or providing verbal translations in live situations, such as conferences, performances, or meetings.

Highly skilled and experienced interpreters who travel to interpret at conferences are often contractors, working directly for the conference or through an LSP. They typically have a contract to provide services at a specific conference (i.e., a short-term commitment with a clearly-stated end date).