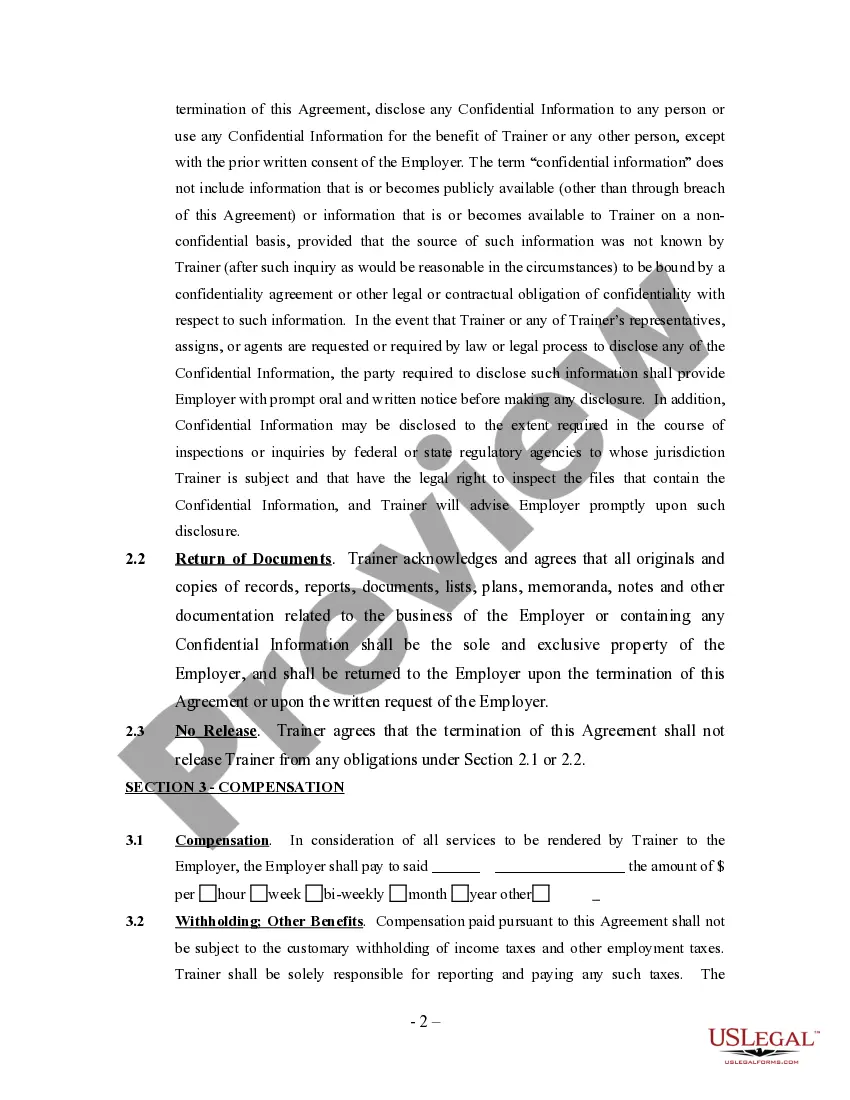

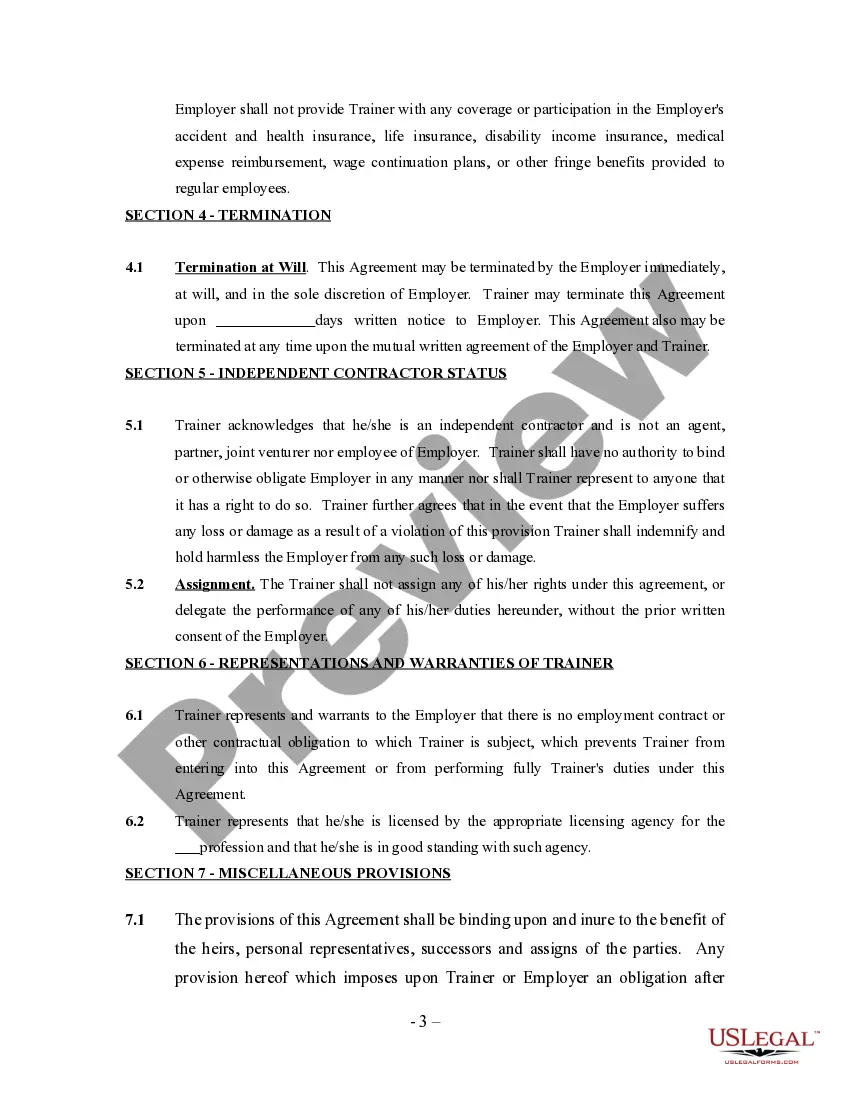

North Carolina Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor

Description

How to fill out North Carolina Athletic Person Training Or Trainer Agreement - Self-Employed Independent Contractor?

Choosing the right lawful document format could be a have a problem. Obviously, there are a lot of templates available on the Internet, but how will you get the lawful type you require? Make use of the US Legal Forms internet site. The service offers a huge number of templates, such as the North Carolina Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor, which can be used for organization and private needs. All of the forms are checked by experts and meet up with federal and state needs.

In case you are previously listed, log in for your accounts and click the Obtain button to obtain the North Carolina Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor. Make use of accounts to look with the lawful forms you possess acquired earlier. Go to the My Forms tab of your accounts and acquire yet another backup of the document you require.

In case you are a new consumer of US Legal Forms, here are easy recommendations that you can comply with:

- Initially, ensure you have selected the right type for your personal city/state. It is possible to examine the shape utilizing the Review button and look at the shape information to make sure it will be the right one for you.

- In case the type does not meet up with your preferences, make use of the Seach area to discover the appropriate type.

- Once you are sure that the shape is proper, click on the Get now button to obtain the type.

- Select the prices program you would like and enter the needed details. Build your accounts and pay for the transaction utilizing your PayPal accounts or charge card.

- Pick the submit structure and down load the lawful document format for your device.

- Total, change and printing and sign the attained North Carolina Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor.

US Legal Forms will be the greatest collection of lawful forms in which you can see a variety of document templates. Make use of the service to down load skillfully-created documents that comply with express needs.

Form popularity

FAQ

With a little bit of planning, you can put your knowledge to use and design the perfect plan for you. Becoming your own personal trainer takes a few hours of time. But the payoff is huge. You'll gain all of the essential skills to get your mind and body in shape and you'll lose weight along the way.

As an independent contractor, you will get a Form 1099-NEC at tax time instead of a Form W-2. The 1099-NEC will list income details as non-employee compensation, and this information is reported to the IRS as well. Double-check your 1099-NEC it should only include your portion of what the trainees paid.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Ways to Make Money as a Personal TrainerSell online courses. People increasingly want to learn and train on their own schedule.Offer small group PT.Organise retreats or fitness holidays.Run courses.Run seminars or workshops.Promote supplements.Create ebooks.Sell home equipment.More items...?

What can kind of tax deductions can personal trainers claim?Business insurance (and other kinds of insurance) Insurance claims are common in the fitness industry.Car expenses and mileage.Equipment and supplies.Home office and utilities.Legal fees.Marketing expenses.Miscellaneous expenses.Travel costs.

As you may already know, marketing and promotional merchandise is fully deductible. So, convert your everyday gym gear into fitness coaching promotional clothing. By adding your company logo to your workout clothes, you can deduct the cost. The cost of adding your personalized logo is also deductible.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

What Is the Business Code for Personal Trainers? A personal fitness trainer falls under the business code of NAICS 812990.

In many cases, yes. Some may instead choose to set themselves up as a limited company, or join a gym as an employee, but personal trainers typically move into self-employment after their initial training.

When it comes to taxes, employees have the simplest process. Your gym will send a Form W-2, which helps you fill out income and withholding information on your tax return. Unfortunately, employees can't deduct unreimbursed work expenses like uniforms and equipment; those out-of-pocket expenses are yours to handle.