North Carolina Bookkeeping Agreement - Self-Employed Independent Contractor

Description

How to fill out North Carolina Bookkeeping Agreement - Self-Employed Independent Contractor?

It is possible to invest time on-line attempting to find the authorized document format that suits the state and federal specifications you require. US Legal Forms gives 1000s of authorized kinds which are examined by specialists. It is possible to down load or print the North Carolina Bookkeeping Agreement - Self-Employed Independent Contractor from your service.

If you have a US Legal Forms profile, it is possible to log in and then click the Download button. Next, it is possible to comprehensive, modify, print, or signal the North Carolina Bookkeeping Agreement - Self-Employed Independent Contractor. Each authorized document format you purchase is your own property eternally. To have yet another backup of the acquired form, proceed to the My Forms tab and then click the corresponding button.

If you work with the US Legal Forms website the first time, follow the easy directions under:

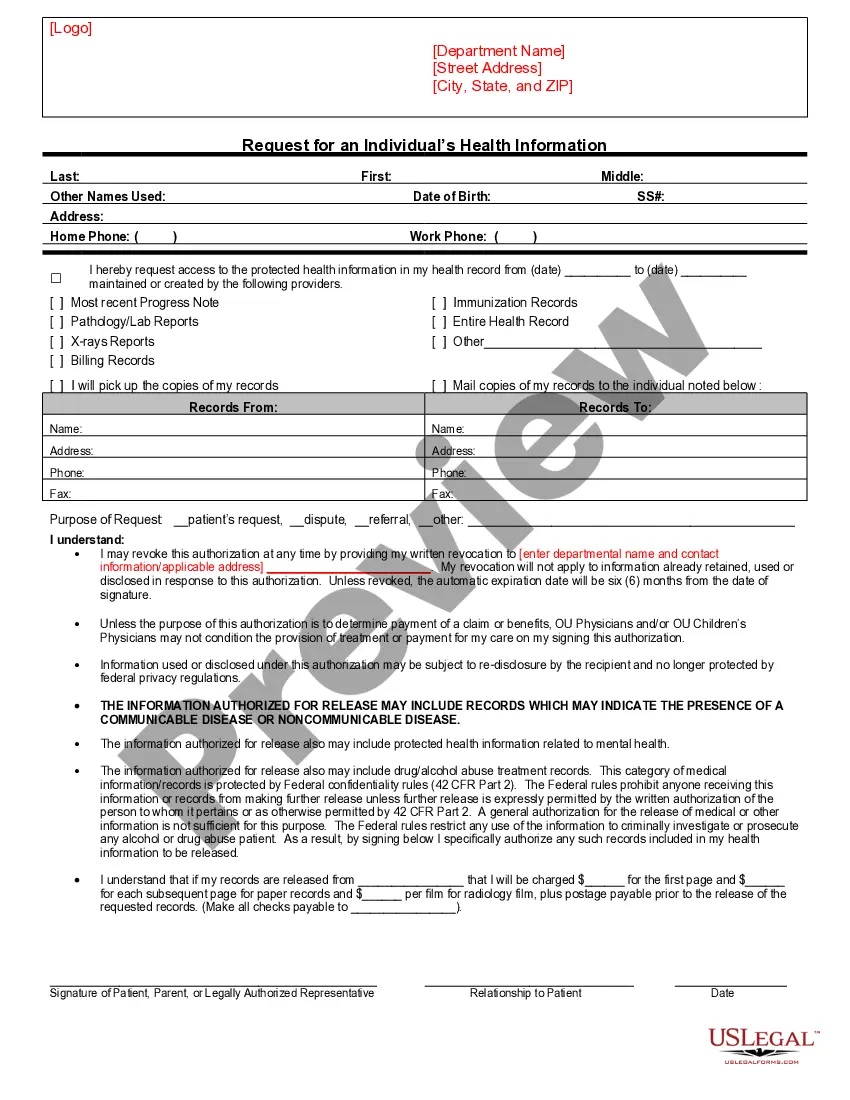

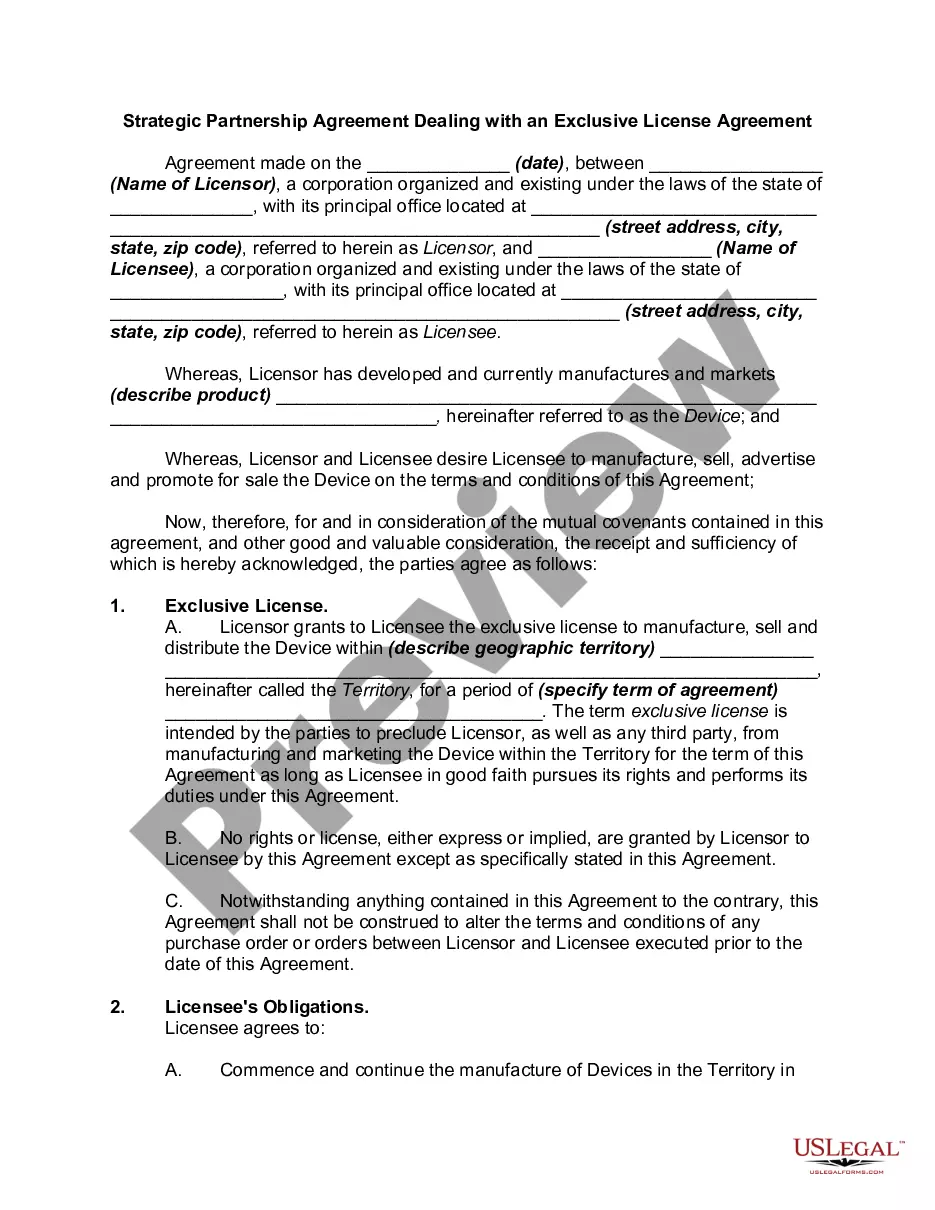

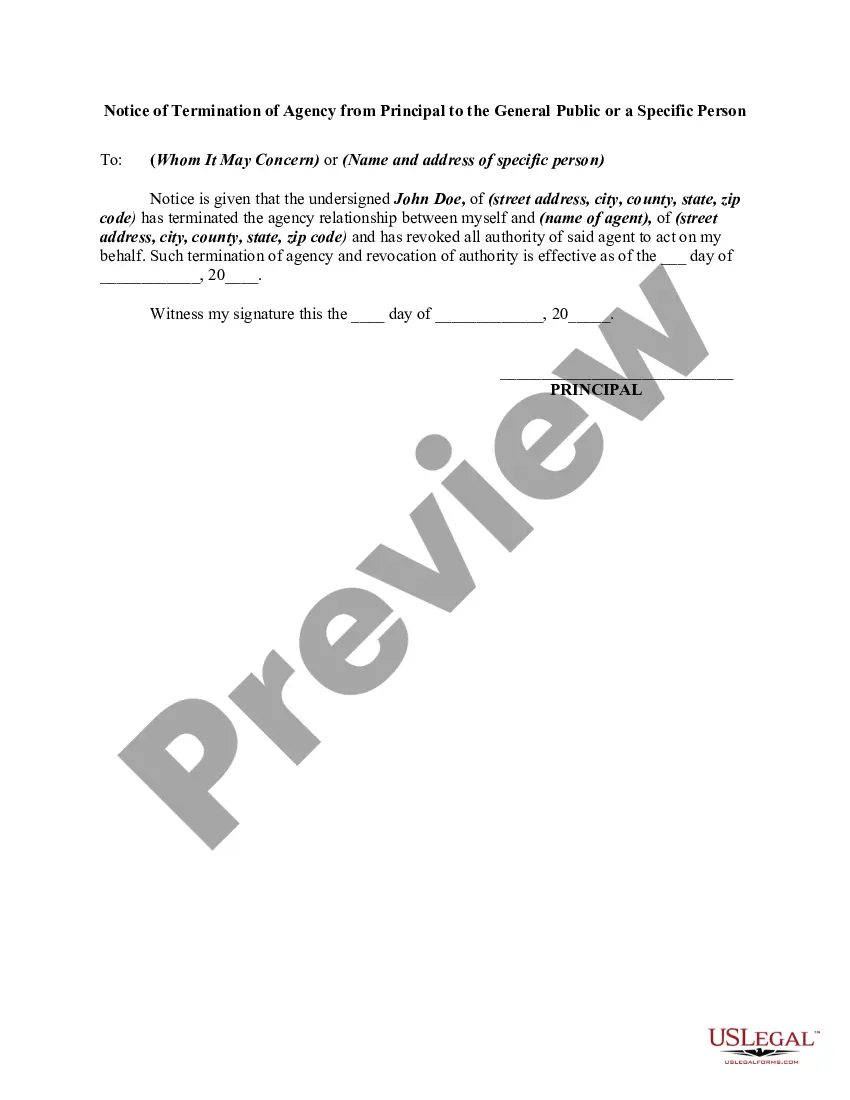

- First, be sure that you have chosen the correct document format to the region/metropolis of your choosing. See the form explanation to make sure you have picked out the appropriate form. If accessible, use the Review button to search through the document format also.

- If you want to find yet another edition from the form, use the Research area to discover the format that meets your needs and specifications.

- After you have located the format you would like, simply click Buy now to continue.

- Pick the costs strategy you would like, key in your credentials, and register for an account on US Legal Forms.

- Complete the deal. You can use your credit card or PayPal profile to cover the authorized form.

- Pick the file format from the document and down load it to your product.

- Make alterations to your document if required. It is possible to comprehensive, modify and signal and print North Carolina Bookkeeping Agreement - Self-Employed Independent Contractor.

Download and print 1000s of document themes utilizing the US Legal Forms Internet site, that provides the most important selection of authorized kinds. Use professional and express-distinct themes to tackle your business or person demands.

Form popularity

FAQ

Yes, the company should send you a 1099. Its easy to forget to include yourself when you're doing the books! All you need to do is print out a blank form 1099 (from IRS.gov), fill it out, check the "Corrected" box, and mail to the IRS.....and keep your copy of course!

In Australia, you don't technically have to be certified in any way to work as a bookkeeper. That's the reason why small business owners can do their own books and BAS. Administrators with experience in bookkeeping can offer their services without having to get a qualification to formalise their experience.

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

Do you need a license to be a bookkeeper in the UK? To be a bookkeeper you need to have a money laundering license, also known as AML - Anti Money Laundering. If you don't have this you would be breaking the law if you start a bookkeeping business from home.

A bookkeeping business plan is necessary for your career as a self-employed bookkeeper. You must structure your journey so you don't get stuck in the middle. You must know which industry to work in, services to offer, tools to use, and important precautions to take.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

There are no legal requirements for a self-employed bookkeeper to have any formal qualifications. However, if you are planning to start a bookkeeping business, it is essential you have bookkeeping experience.

Bookkeepers and accountants are independent contractors when they: Are hired (temporary or potentially for a long period of time) to accomplish a specific result and are not subject to direction or control over the methods or means to accomplish it.