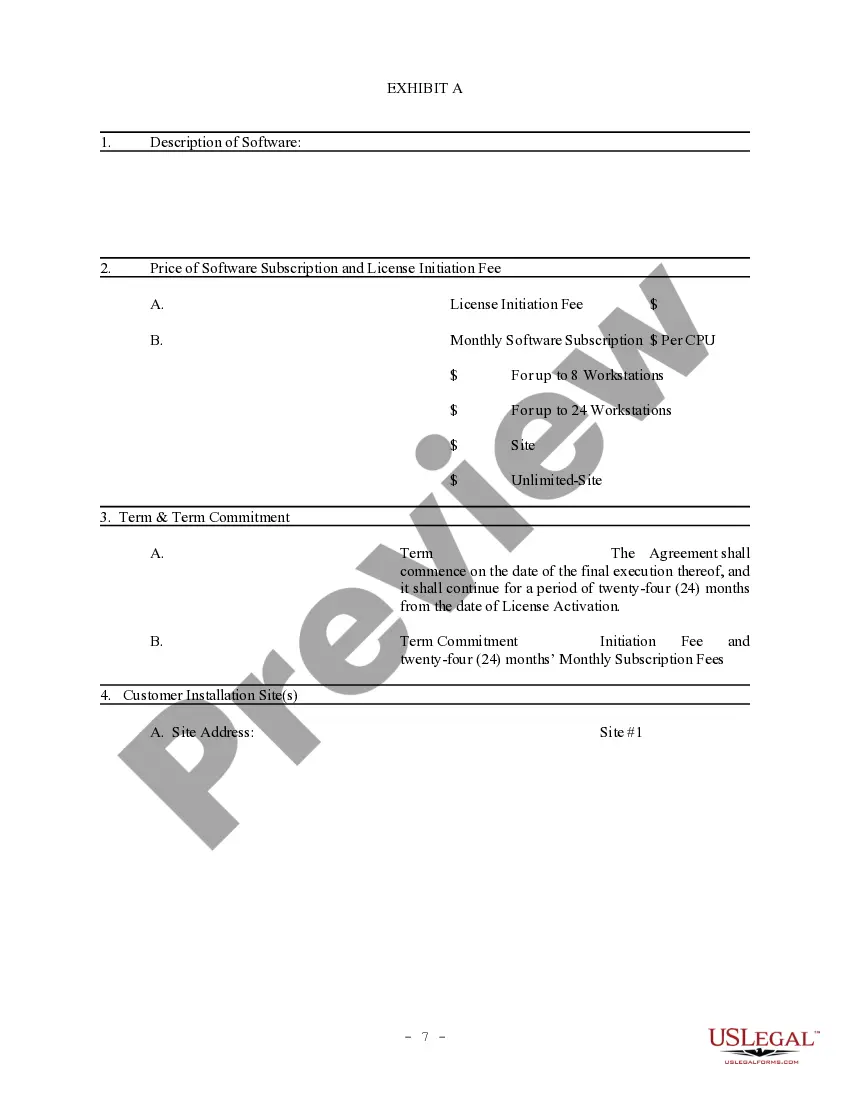

North Carolina Software License Subscription Agreement

Description

How to fill out North Carolina Software License Subscription Agreement?

You can invest time online searching for the authorized document template that fits the state and federal requirements you want. US Legal Forms offers 1000s of authorized types that are evaluated by pros. You can easily obtain or produce the North Carolina Software License Subscription Agreement from our assistance.

If you have a US Legal Forms profile, you may log in and click on the Down load key. Afterward, you may full, edit, produce, or sign the North Carolina Software License Subscription Agreement. Each authorized document template you get is yours eternally. To have another backup of any obtained type, go to the My Forms tab and click on the related key.

If you use the US Legal Forms web site for the first time, adhere to the straightforward guidelines below:

- Initial, make certain you have selected the correct document template for that area/town that you pick. Read the type explanation to make sure you have picked the proper type. If available, use the Review key to check through the document template also.

- If you would like discover another edition from the type, use the Look for area to get the template that meets your needs and requirements.

- Once you have found the template you want, click on Purchase now to continue.

- Pick the rates prepare you want, enter your accreditations, and register for an account on US Legal Forms.

- Full the deal. You should use your credit card or PayPal profile to pay for the authorized type.

- Pick the structure from the document and obtain it to the device.

- Make changes to the document if required. You can full, edit and sign and produce North Carolina Software License Subscription Agreement.

Down load and produce 1000s of document layouts while using US Legal Forms web site, that offers the biggest assortment of authorized types. Use specialist and state-particular layouts to deal with your company or personal requires.

Form popularity

FAQ

The sale of electronic data products such as software, data, digital books (eBooks), mobile applications and digital images is generally not taxable (though if you provide some sort of physical copy or physical storage medium then the sale is taxable.)

Taxation of digital goods under the states' sales tax rulesApproximately 20 of the 45 states currently do not have laws to tax digital goods because they either do not have the ability to tax electronically delivered products or they have specifically identified digital goods as not subject to their sales tax.

Sales of custom software - downloaded are exempt from the sales tax in Louisiana. In the state of Louisiana, any transactions where the customer is required to pay a subscription or access fee to obtain the use, although not the ownership of a website or software are not taxable.

North Carolina Excludes Sales of Certain Digital Goods from Sales and Use Taxes. On June 5, 2020, Governor Cooper signed HB 1079, which will exclude sales of certain digital audio and visual works from the state's sales and use tax, and make other tax changes.

Goods that are subject to sales tax in North Carolina include physical property, like furniture, home appliances, and motor vehicles. Prescription Medicine, groceries, and gasoline are all tax-exempt. Some services in North Carolina are subject to sales tax.

Repair, Maintenance, and Installation Services; and Other Repair Information. The sales price of or the gross receipts derived from repair, maintenance, and installation services sold at retail is subject to the general State and applicable local and transit rates of sales and use tax.

Services in North Carolina are generally not taxable, with important exceptions. If the service you provide includes creating or manufacturing a product, you may have to deal with the sales tax on products.

Prescription Medicine, groceries, and gasoline are all tax-exempt. Some services in North Carolina are subject to sales tax.

The North Carolina Department of Revenue issued a private letter ruling, concluding that subscription fees for a Software as a Service (SaaS) product are non-taxable.

California Photographers Sales Tax If you sell physical prints or deliver digital images to clients on physical media like cds or thumb drives (even loading the images onto a cd or drive your client owns), pretty much everything will be subject to sales tax.