This NOTICE OF HARRASSMENT & VALIDATION OF DEBT is to be used when creditors call you repeatedly and mail you letters too. This form includes a cease and desist and a validation of debt, 2 letters in one.

North Carolina Notice of Harassment and Validation of Debt

Description

How to fill out North Carolina Notice Of Harassment And Validation Of Debt?

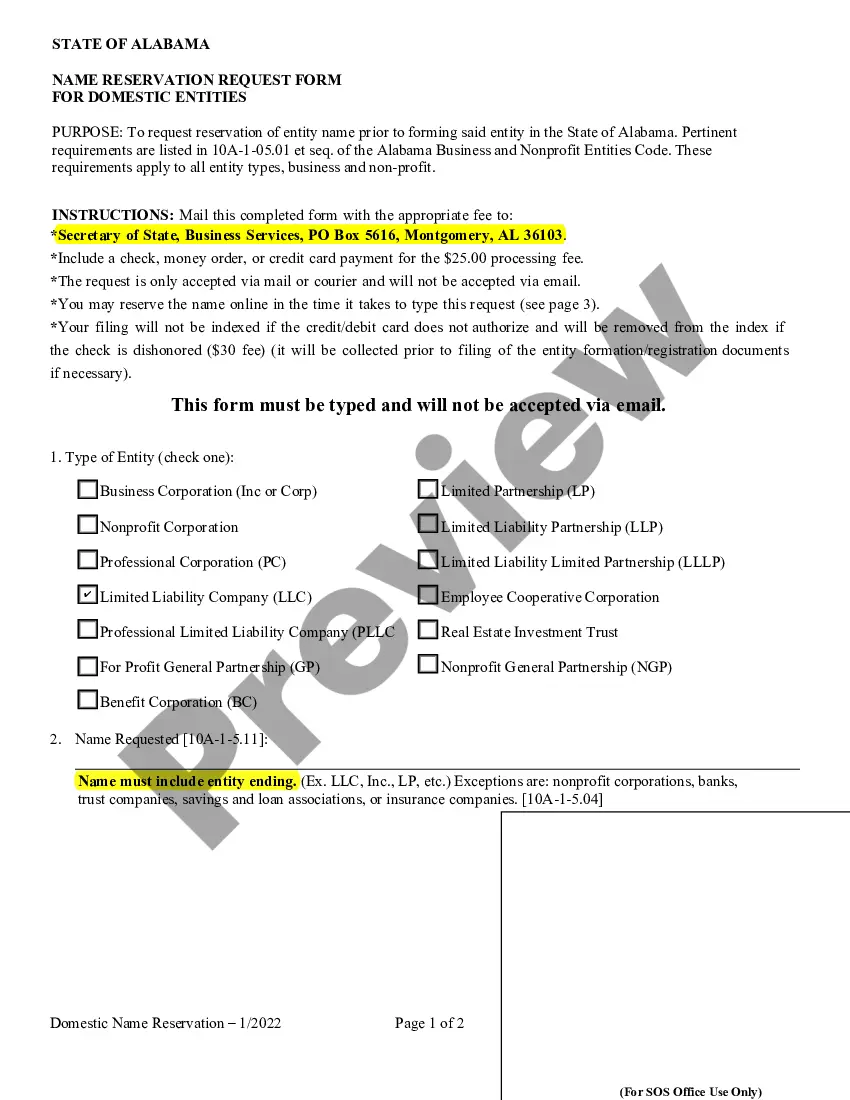

Choosing the best legal papers design can be quite a battle. Needless to say, there are a variety of layouts accessible on the Internet, but how would you find the legal kind you will need? Utilize the US Legal Forms internet site. The assistance provides a huge number of layouts, including the North Carolina Notice of Harassment and Validation of Debt, that you can use for company and personal requires. All of the types are inspected by pros and fulfill state and federal needs.

When you are previously listed, log in to the bank account and then click the Download option to obtain the North Carolina Notice of Harassment and Validation of Debt. Utilize your bank account to look with the legal types you have bought formerly. Go to the My Forms tab of your bank account and obtain yet another copy of the papers you will need.

When you are a fresh user of US Legal Forms, listed below are straightforward instructions that you should comply with:

- First, make certain you have selected the appropriate kind to your city/region. It is possible to look through the form using the Review option and read the form information to make sure this is the best for you.

- In the event the kind does not fulfill your preferences, use the Seach field to get the proper kind.

- When you are sure that the form would work, select the Get now option to obtain the kind.

- Pick the pricing strategy you need and enter the essential information. Design your bank account and pay money for the order utilizing your PayPal bank account or bank card.

- Select the data file formatting and download the legal papers design to the gadget.

- Total, change and produce and sign the obtained North Carolina Notice of Harassment and Validation of Debt.

US Legal Forms is the biggest collection of legal types for which you will find numerous papers layouts. Utilize the company to download appropriately-made paperwork that comply with state needs.

Form popularity

FAQ

Collectors are required by Fair Debt Collection Practices Act to send you a written debt validation notice with information about the debt they're trying to collect. It must be sent within five days of the first contact. The debt validation letter includes: The amount owed.

Debt collectors are legally required to send one within five days of first contact. You have within 30 days from receiving a debt validation letter to send a debt verification letter. Here's the important part: You have just 30 days to respond to a debt validation letter with your debt verification letter.

According to the above FDCPA Section, Debt Validation is defined as the debt collector contacting the original creditor to affirm the debt amount being requested is correct. It is highly doubtful the debt collector ever contacts the original creditor for any debt validation purposes.

While a debt validation letter provides information about the debt the collection agency claims you owe, a verification letter must prove it. In other words, if the collection agency doesn't have enough evidence to prove you owe it, their hands may be tied.

A debt validation letter is what a debt collector sends you to prove that you owe them money. This letter shows you the details of a specific debt, outlines what you owe, who you owe it to, and when they need you to pay.

If a debt collector fails to validate the debt in question and continues trying to collect, you have a right under the FDCPA to countersue for up to $1,000 for each violation, plus attorney fees and court costs, as mentioned previously.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

A debt verification letter doesn't have to say anything fancy. Just state that you're responding to a collection effort, you don't recognize the debt, you are demanding they prove you owe it and, if they can't, to stop contacting you. That's it.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

The definition of debt collection harassment is to intimidate, abuse, coerce, bully or browbeat consumers into paying off debt. This happens most often over the phone, but harassment could come in the form of emails, texts, direct mail or talking to friends or neighbors about your debt.