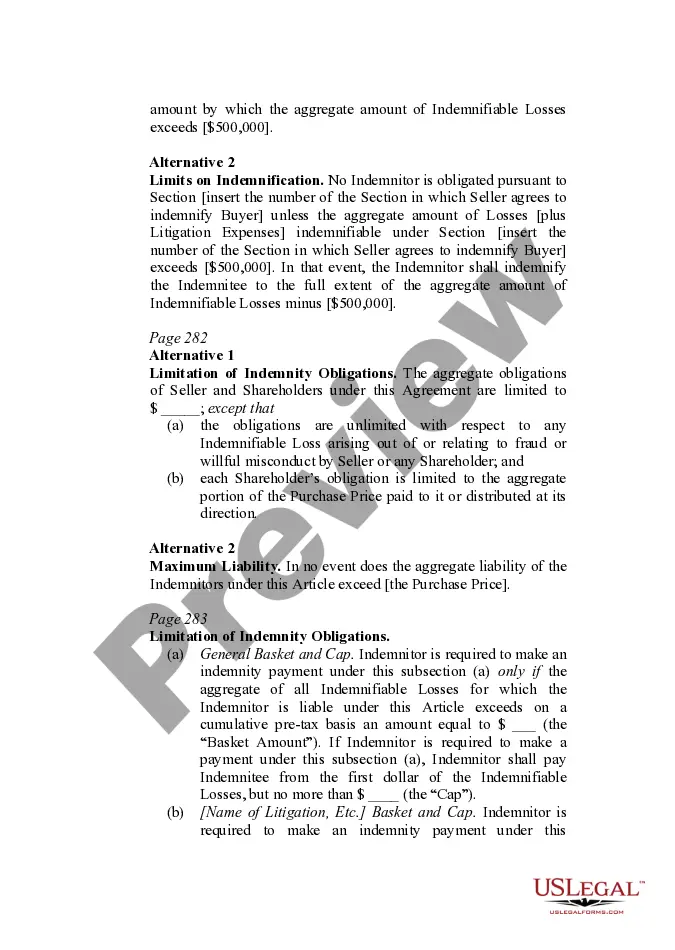

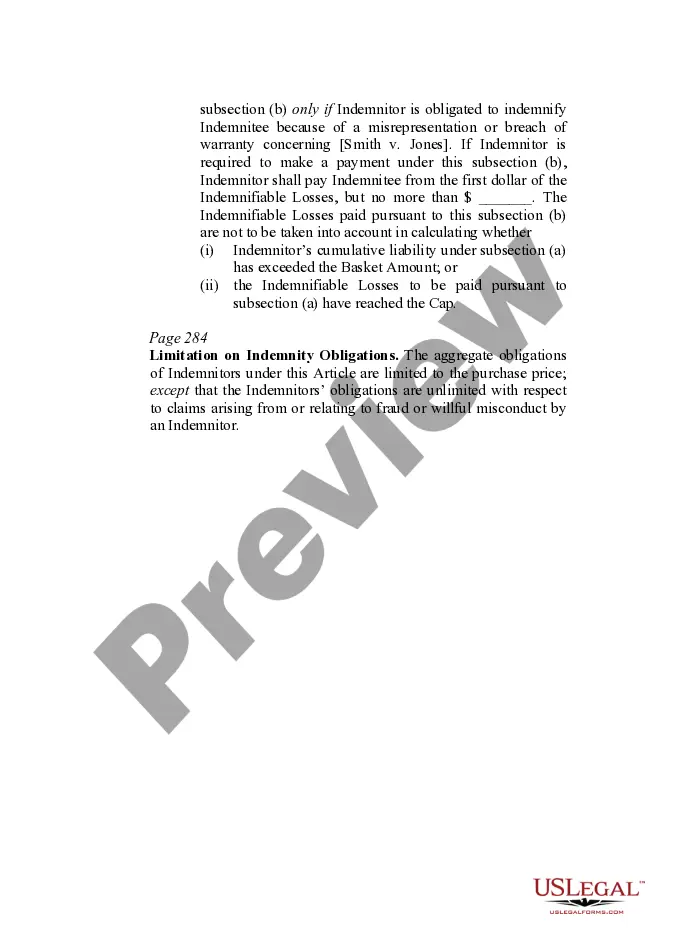

This form provides boilerplate contract clauses that restrict or limit the dollar exposure of any indemnity under the contract agreement. Several different language options are included to suit individual needs and circumstances.

North Carolina Indemnity Provisions - Dollar Exposure of the Indemnity regarding Baskets, Caps, and Ceilings

Description

How to fill out Indemnity Provisions - Dollar Exposure Of The Indemnity Regarding Baskets, Caps, And Ceilings?

US Legal Forms - one of the biggest libraries of authorized types in the States - gives a variety of authorized record themes you can download or printing. Utilizing the web site, you can find 1000s of types for business and individual reasons, sorted by groups, states, or keywords and phrases.You can get the latest variations of types like the North Carolina Indemnity Provisions - Dollar Exposure of the Indemnity regarding Baskets, Caps, and Ceilings in seconds.

If you already have a monthly subscription, log in and download North Carolina Indemnity Provisions - Dollar Exposure of the Indemnity regarding Baskets, Caps, and Ceilings through the US Legal Forms library. The Obtain key can look on every single develop you view. You gain access to all earlier acquired types in the My Forms tab of the account.

If you wish to use US Legal Forms initially, listed below are easy instructions to help you get started out:

- Be sure you have selected the right develop to your city/region. Click on the Preview key to analyze the form`s content material. See the develop explanation to actually have chosen the right develop.

- In the event the develop doesn`t suit your specifications, use the Research industry at the top of the screen to find the one that does.

- If you are satisfied with the shape, affirm your choice by visiting the Acquire now key. Then, choose the costs program you like and provide your accreditations to register for an account.

- Approach the transaction. Make use of your charge card or PayPal account to perform the transaction.

- Find the formatting and download the shape on the system.

- Make changes. Fill up, change and printing and indication the acquired North Carolina Indemnity Provisions - Dollar Exposure of the Indemnity regarding Baskets, Caps, and Ceilings.

Every single template you put into your money lacks an expiration particular date and it is the one you have for a long time. So, in order to download or printing another backup, just check out the My Forms segment and then click about the develop you require.

Obtain access to the North Carolina Indemnity Provisions - Dollar Exposure of the Indemnity regarding Baskets, Caps, and Ceilings with US Legal Forms, probably the most considerable library of authorized record themes. Use 1000s of professional and condition-distinct themes that fulfill your organization or individual requirements and specifications.

Form popularity

FAQ

The most common example of indemnity in the financial sense is an insurance contract. For instance, in the case of home insurance, homeowners pay insurance to an insurance company in return for the homeowners being indemnified if the worst were to happen.

How to Write an Indemnity Agreement Consider the Indemnity Laws in Your Area. ... Draft the Indemnification Clause. ... Outline the Indemnification Period and Scope of Coverage. ... State the Indemnification Exceptions. ... Specify How the Indemnitee Notifies the Indemnitor About Claims. ... Write the Settlement and Consent Clause.

How Do You Create an Indemnification Agreement? Named Parties and Contractual Relationship. ... Governing Law and Jurisdiction. ... Indemnification Clause. ... Scope of Coverage. ... Exceptions. ... Notice and Defense of a Claim. ... Settlement and Consent Clause. ... Enforcement.

Letters of indemnity should include the names and addresses of both parties involved, plus the name and affiliation of the third party. Detailed descriptions of the items and intentions are also required, as are the signatures of the parties and the date of the contract's execution.

Letters of indemnity should include the names and addresses of both parties involved, plus the name and affiliation of the third party. Detailed descriptions of the items and intentions are also required, as are the signatures of the parties and the date of the contract's execution.

For example, A promises to deliver certain goods to B for Rs. 2,000 every month. C comes in and promises to indemnify B's losses if A fails to so deliver the goods. This is how B and C will enter into contractual obligations of indemnity.

In the context of mergers and acquisitions, or a commercial transaction, a basket is a provision in a purchase and sale agreement that limits an indemnifying party's obligations to indemnify another party for small losses or claims. The basket establishes a monetary threshold.

An indemnification clause should clearly define the following elements: who are the indemnifying party and the indemnified party, what are the covered claims or losses, what are the obligations and duties of each party, and what are the exclusions or limitations of the indemnity.