This form provides boilerplate contract clauses that outline means of securing the funds for payment of any indemnity, including use of an escrow fund or set-offs.

North Carolina Indemnity Provisions - Means of Securing the Payment of the Indemnity

Description

How to fill out Indemnity Provisions - Means Of Securing The Payment Of The Indemnity?

Are you currently in a situation that you require papers for both enterprise or person purposes nearly every day? There are tons of lawful file web templates available on the Internet, but finding kinds you can trust is not easy. US Legal Forms delivers thousands of develop web templates, much like the North Carolina Indemnity Provisions - Means of Securing the Payment of the Indemnity, which can be created in order to meet state and federal requirements.

Should you be already acquainted with US Legal Forms web site and get a free account, merely log in. Afterward, you can acquire the North Carolina Indemnity Provisions - Means of Securing the Payment of the Indemnity template.

Unless you come with an accounts and would like to begin to use US Legal Forms, follow these steps:

- Get the develop you will need and ensure it is for your proper city/region.

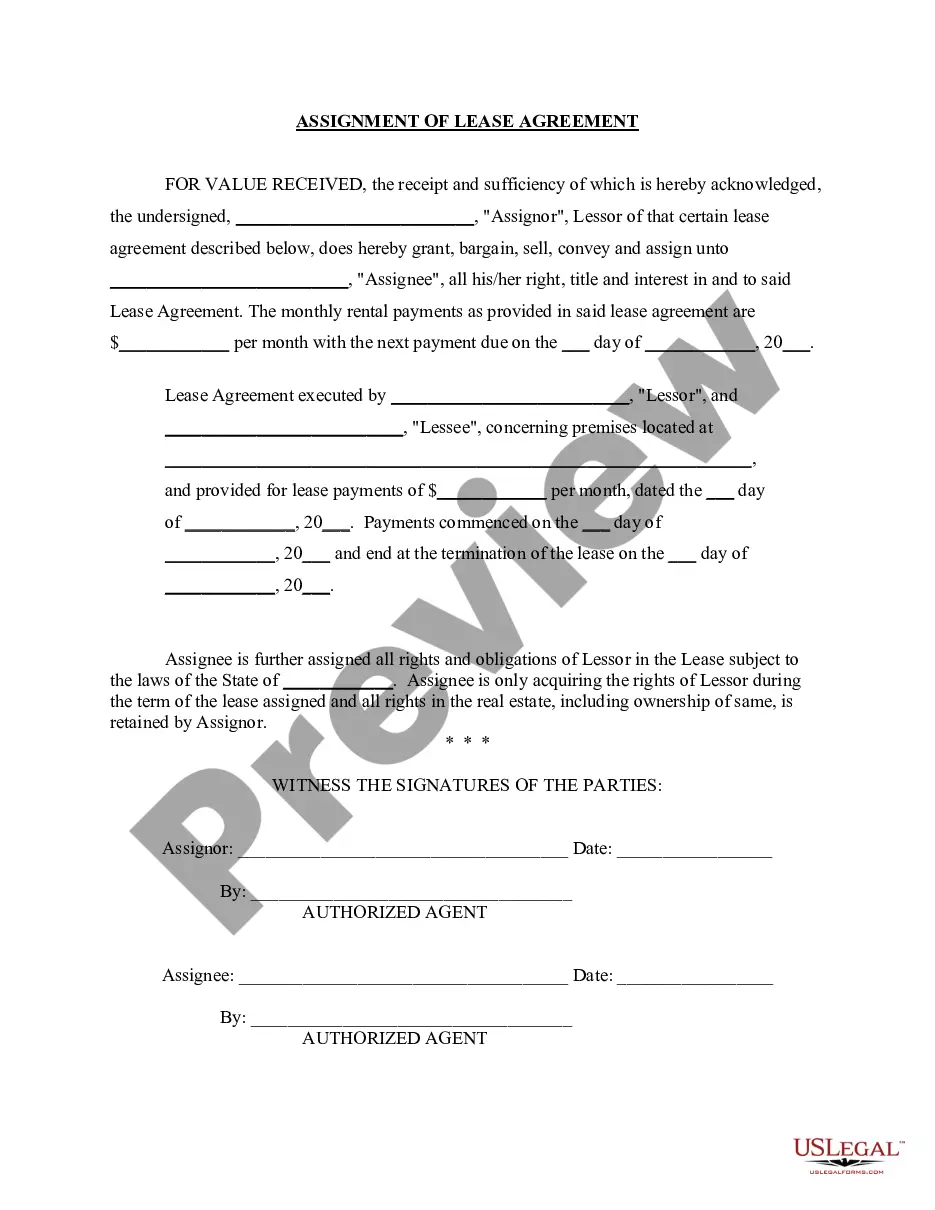

- Use the Review key to analyze the form.

- Read the explanation to actually have chosen the appropriate develop.

- In case the develop is not what you are seeking, take advantage of the Research area to find the develop that suits you and requirements.

- If you obtain the proper develop, just click Buy now.

- Choose the pricing prepare you need, submit the required information to create your bank account, and purchase the transaction using your PayPal or credit card.

- Decide on a hassle-free paper structure and acquire your version.

Discover all of the file web templates you may have bought in the My Forms menu. You can obtain a further version of North Carolina Indemnity Provisions - Means of Securing the Payment of the Indemnity any time, if possible. Just go through the essential develop to acquire or printing the file template.

Use US Legal Forms, one of the most substantial variety of lawful types, to save some time and prevent errors. The support delivers expertly made lawful file web templates that you can use for a selection of purposes. Make a free account on US Legal Forms and commence making your lifestyle a little easier.

Form popularity

FAQ

Indemnifications, or ?hold harmless? provisions, shift risks or potential costs from one party to another. One party to the contract promises to defend and pay costs and expenses of the other if specific circumstances arise (often a claim or dispute with a third party to the contract).

Example 1: A service provider asking their customer to indemnify them to protect against misuse of their work product. Example 2: A rental car company, as the rightful owner of the car, having their customer indemnify them from any damage caused by the customer during the course of the retnal.

How to Write an Indemnity Agreement Consider the Indemnity Laws in Your Area. ... Draft the Indemnification Clause. ... Outline the Indemnification Period and Scope of Coverage. ... State the Indemnification Exceptions. ... Specify How the Indemnitee Notifies the Indemnitor About Claims. ... Write the Settlement and Consent Clause.

Letters of indemnity should include the names and addresses of both parties involved, plus the name and affiliation of the third party. Detailed descriptions of the items and intentions are also required, as are the signatures of the parties and the date of the contract's execution.

Example of Indemnity in Business If the building sustains significant structural damages from fire, then the insurance company will indemnify the owner for the costs to repair by way of reimbursing the owner or by reconstructing the damaged areas using its own authorized contractors.

Upon the occurrence of any Event for which you may become entitled to indemnity in ance with the above, the Company shall make available to you, from time to time, the amounts of money required to cover the various expenses and other payments involved in the handling of any legal proceedings against you in ...

An indemnification clause should clearly define the following elements: who are the indemnifying party and the indemnified party, what are the covered claims or losses, what are the obligations and duties of each party, and what are the exclusions or limitations of the indemnity.

For example, in the case of home insurance, the homeowner pays insurance premiums to the insurance company in exchange for the assurance that the homeowner will be indemnified if the house sustains damage from fire, natural disasters, or other perils specified in the insurance agreement.