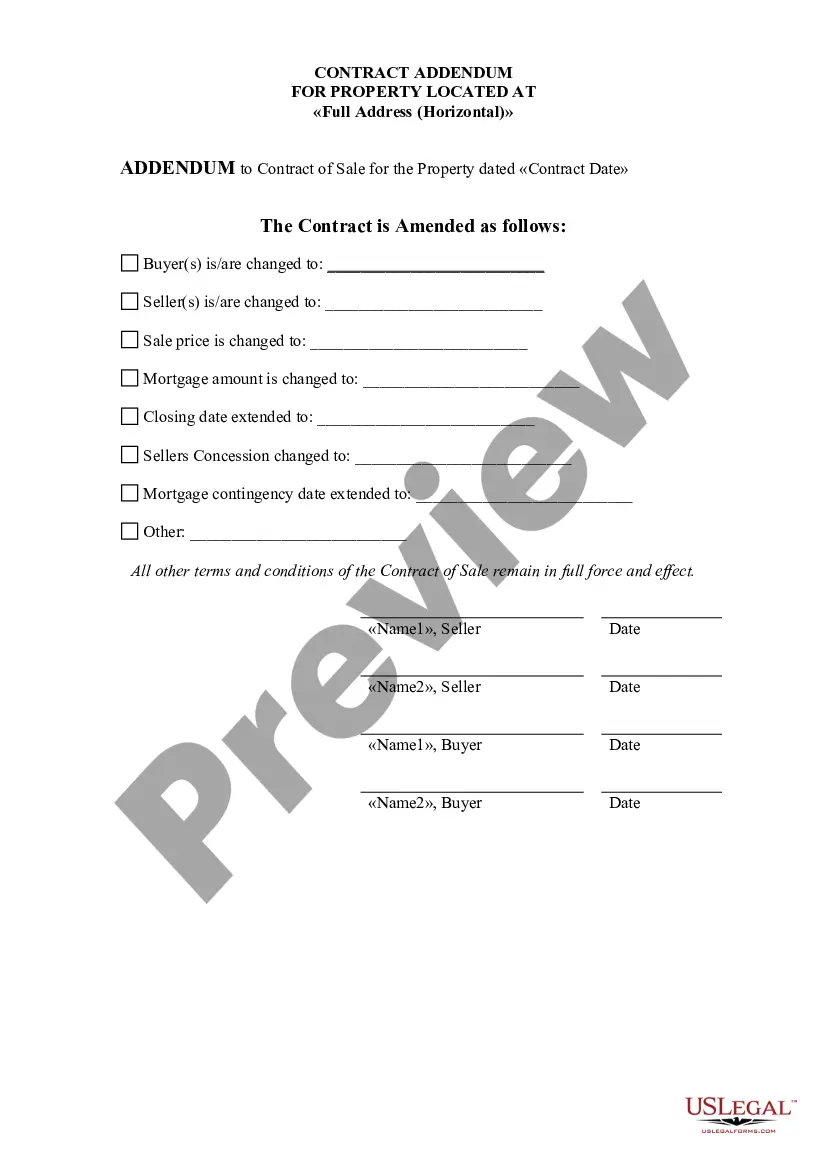

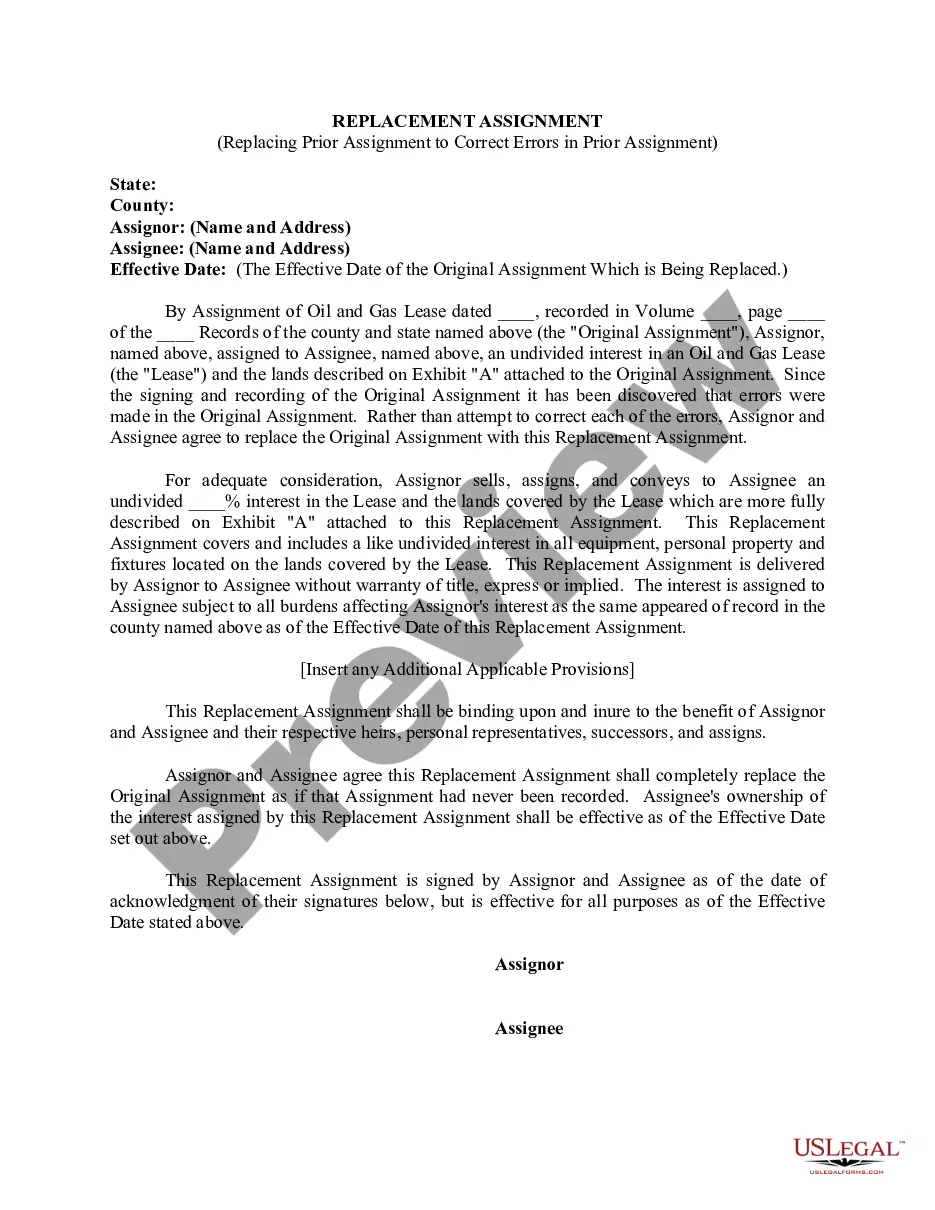

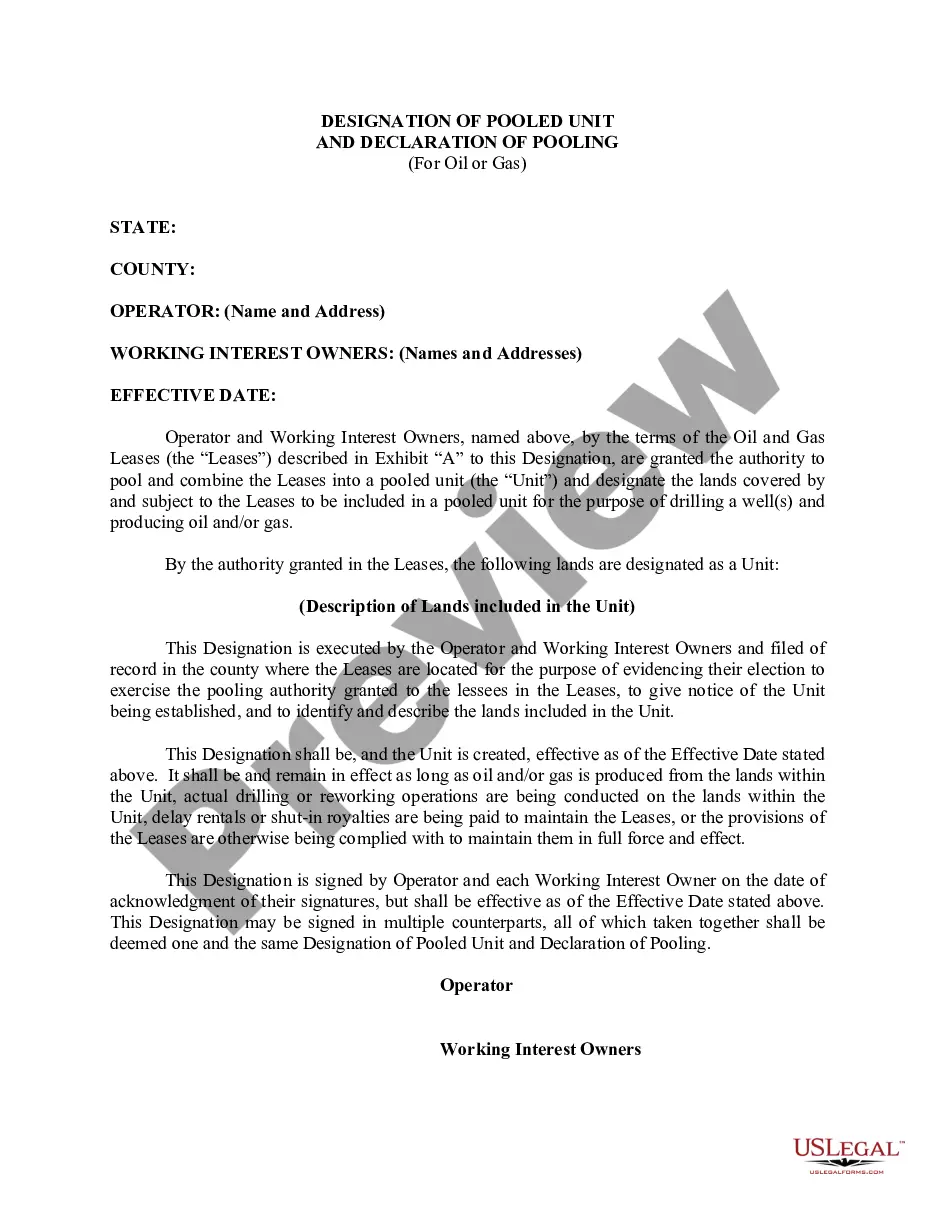

Title: Understanding North Carolina Assignment and Conveyance of Net Profits Interest: A Comprehensive Overview Introduction: The North Carolina Assignment and Conveyance of Net Profits Interest is a legal process that allows individuals or entities to transfer their ownership rights over a portion of the net profits generated from a particular investment, business venture, or project. This concept enables a flexible and efficient system for sharing the financial benefits arising from such activities. This article will delve into the details of this mechanism, outline its essential components, and discuss any variations that exist within North Carolina. 1. Defining Net Profits Interest: Net Profits Interest (NPI) refers to the percentage of profits that an individual or entity is entitled to receive from a specific venture after all expenses, liabilities, and other costs are deducted. NPI is a valuable asset that can be assigned or sold to other parties, providing them with a share of the earnings generated by the project. 2. Key Components of North Carolina Assignment and Conveyance of Net Profits Interest: a. Agreement: Typically, the transfer of NPI requires a legally binding agreement between the assignor (the current owner of NPI) and the assignee (the individual/entity acquiring the NPI). This agreement outlines the terms, conditions, and obligations for both parties involved. b. Consideration: Assignments and conveyances of NPI often involve a financial consideration from the assignee to the assignor. This consideration can be in the form of a lump sum payment, installments, or a percentage of future profits. c. Consent and Recording: In North Carolina, assignments and conveyances of NPI require the consent and approval of all parties involved. Additionally, the transfer must be recorded with the appropriate authorities or agencies for legal validity and transparency. 3. Different Types of North Carolina Assignment and Conveyance of Net Profits Interest: Although the fundamental concept of NPI remains the same, variations in its application exist within North Carolina. Some examples include: a. Oil and Gas Lease Assignments: In the oil and gas industry, individuals or companies may assign their NPI to others, granting them the right to receive a portion of the net profits generated from the extraction and sale of oil or gas reserves within a specific lease area. b. Real Estate Assignment of Net Profits Interest: In real estate development projects, developers may assign a percentage of their NPI to investors, providing them with a share of the project's profits. This helps developers raise capital and share risks. c. Innovation and Technology Assignment of Net Profits Interest: In the realm of startups and technology, inventors or technology creators may assign a portion of their NPI to investors or licensing companies in exchange for financial support or marketing expertise. Conclusion: The North Carolina Assignment and Conveyance of Net Profits Interest process serves as a useful tool for individuals and entities to transfer their rights to receive a portion of the net profits from various ventures. With its fair and flexible nature, this mechanism facilitates beneficial collaborations, financial arrangements, and risk-sharing among parties involved in diverse industries such as oil and gas, real estate, and innovation. Understanding these aspects is crucial for anyone seeking to enter into NPI transfers within North Carolina to ensure legality and maximize opportunities.

Title: Understanding North Carolina Assignment and Conveyance of Net Profits Interest: A Comprehensive Overview Introduction: The North Carolina Assignment and Conveyance of Net Profits Interest is a legal process that allows individuals or entities to transfer their ownership rights over a portion of the net profits generated from a particular investment, business venture, or project. This concept enables a flexible and efficient system for sharing the financial benefits arising from such activities. This article will delve into the details of this mechanism, outline its essential components, and discuss any variations that exist within North Carolina. 1. Defining Net Profits Interest: Net Profits Interest (NPI) refers to the percentage of profits that an individual or entity is entitled to receive from a specific venture after all expenses, liabilities, and other costs are deducted. NPI is a valuable asset that can be assigned or sold to other parties, providing them with a share of the earnings generated by the project. 2. Key Components of North Carolina Assignment and Conveyance of Net Profits Interest: a. Agreement: Typically, the transfer of NPI requires a legally binding agreement between the assignor (the current owner of NPI) and the assignee (the individual/entity acquiring the NPI). This agreement outlines the terms, conditions, and obligations for both parties involved. b. Consideration: Assignments and conveyances of NPI often involve a financial consideration from the assignee to the assignor. This consideration can be in the form of a lump sum payment, installments, or a percentage of future profits. c. Consent and Recording: In North Carolina, assignments and conveyances of NPI require the consent and approval of all parties involved. Additionally, the transfer must be recorded with the appropriate authorities or agencies for legal validity and transparency. 3. Different Types of North Carolina Assignment and Conveyance of Net Profits Interest: Although the fundamental concept of NPI remains the same, variations in its application exist within North Carolina. Some examples include: a. Oil and Gas Lease Assignments: In the oil and gas industry, individuals or companies may assign their NPI to others, granting them the right to receive a portion of the net profits generated from the extraction and sale of oil or gas reserves within a specific lease area. b. Real Estate Assignment of Net Profits Interest: In real estate development projects, developers may assign a percentage of their NPI to investors, providing them with a share of the project's profits. This helps developers raise capital and share risks. c. Innovation and Technology Assignment of Net Profits Interest: In the realm of startups and technology, inventors or technology creators may assign a portion of their NPI to investors or licensing companies in exchange for financial support or marketing expertise. Conclusion: The North Carolina Assignment and Conveyance of Net Profits Interest process serves as a useful tool for individuals and entities to transfer their rights to receive a portion of the net profits from various ventures. With its fair and flexible nature, this mechanism facilitates beneficial collaborations, financial arrangements, and risk-sharing among parties involved in diverse industries such as oil and gas, real estate, and innovation. Understanding these aspects is crucial for anyone seeking to enter into NPI transfers within North Carolina to ensure legality and maximize opportunities.