This office lease form describes the language to be used by a landlord seeking to charge the tenant for operating and maintaining the garage without offsetting the expense with income.

North Carolina Language Charging for Operating and Maintenance of a Garage Without Offsetting the Expense with Income

Description

How to fill out Language Charging For Operating And Maintenance Of A Garage Without Offsetting The Expense With Income?

Are you currently in the place that you will need paperwork for either enterprise or individual uses virtually every time? There are a variety of legitimate papers web templates available on the net, but locating types you can rely isn`t straightforward. US Legal Forms provides 1000s of type web templates, much like the North Carolina Language Charging for Operating and Maintenance of a Garage Without Offsetting the Expense with Income, which are published to fulfill state and federal requirements.

If you are presently knowledgeable about US Legal Forms web site and possess an account, merely log in. After that, it is possible to download the North Carolina Language Charging for Operating and Maintenance of a Garage Without Offsetting the Expense with Income web template.

If you do not offer an profile and want to begin using US Legal Forms, follow these steps:

- Get the type you need and make sure it is to the proper city/state.

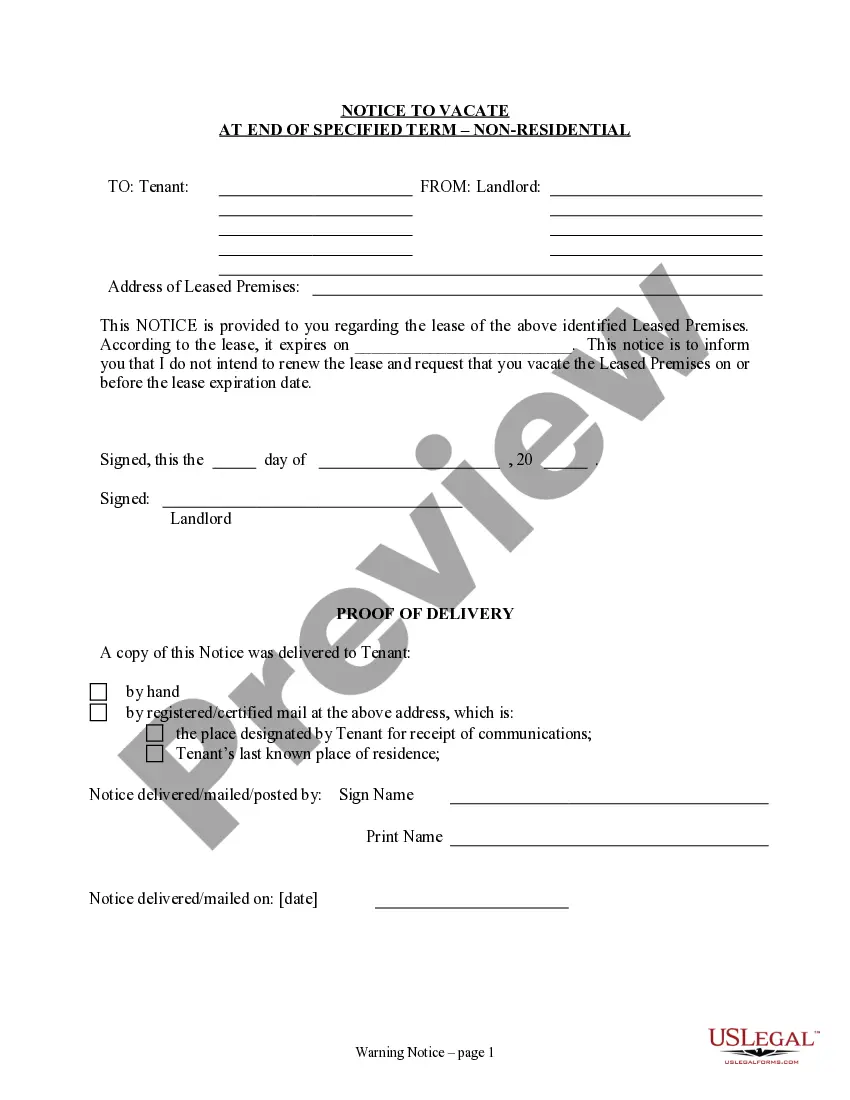

- Take advantage of the Preview button to review the shape.

- Look at the outline to ensure that you have selected the proper type.

- When the type isn`t what you are seeking, use the Look for area to get the type that meets your needs and requirements.

- If you obtain the proper type, click Get now.

- Select the rates plan you desire, fill in the necessary info to make your account, and pay money for the transaction with your PayPal or bank card.

- Choose a hassle-free document formatting and download your backup.

Find every one of the papers web templates you have purchased in the My Forms menu. You can aquire a further backup of North Carolina Language Charging for Operating and Maintenance of a Garage Without Offsetting the Expense with Income whenever, if needed. Just go through the required type to download or print the papers web template.

Use US Legal Forms, probably the most substantial selection of legitimate types, to save lots of time and steer clear of mistakes. The service provides professionally produced legitimate papers web templates which you can use for an array of uses. Generate an account on US Legal Forms and start making your way of life a little easier.