This office lease provision states that the landlord and the tenant mutually acknowledge a good faith estimate, but that only the real estate brokerage fee has actually been determined. Thereafter, the agreed upon sum will be adjusted, increased or decreased, accordingly to reflect the actual sum once determined.

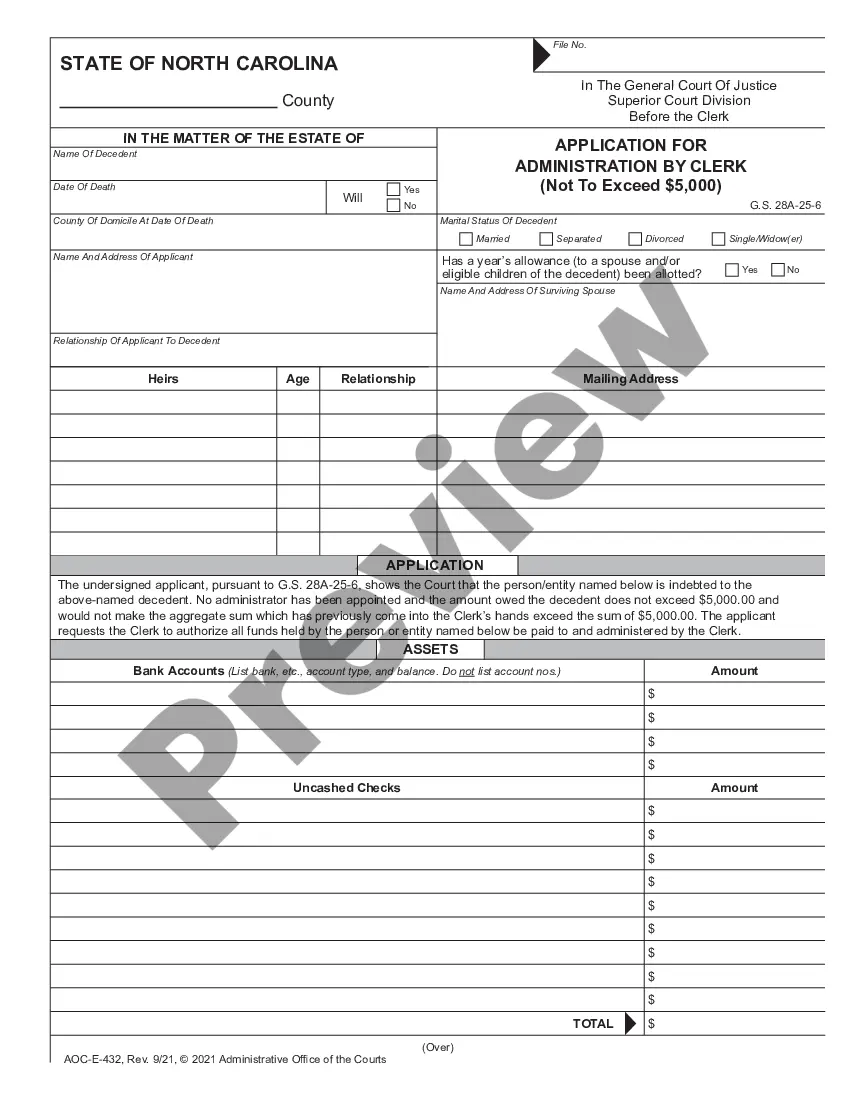

North Carolina Provision to Include Final Billing

Description

How to fill out Provision To Include Final Billing?

Choosing the best authorized record design can be a have a problem. Needless to say, there are a lot of themes available online, but how would you obtain the authorized develop you need? Use the US Legal Forms web site. The services provides a large number of themes, including the North Carolina Provision to Include Final Billing, that can be used for organization and personal demands. Each of the varieties are checked by professionals and fulfill state and federal specifications.

In case you are previously authorized, log in in your bank account and click on the Down load button to find the North Carolina Provision to Include Final Billing. Make use of your bank account to appear from the authorized varieties you have ordered previously. Check out the My Forms tab of your bank account and obtain yet another version in the record you need.

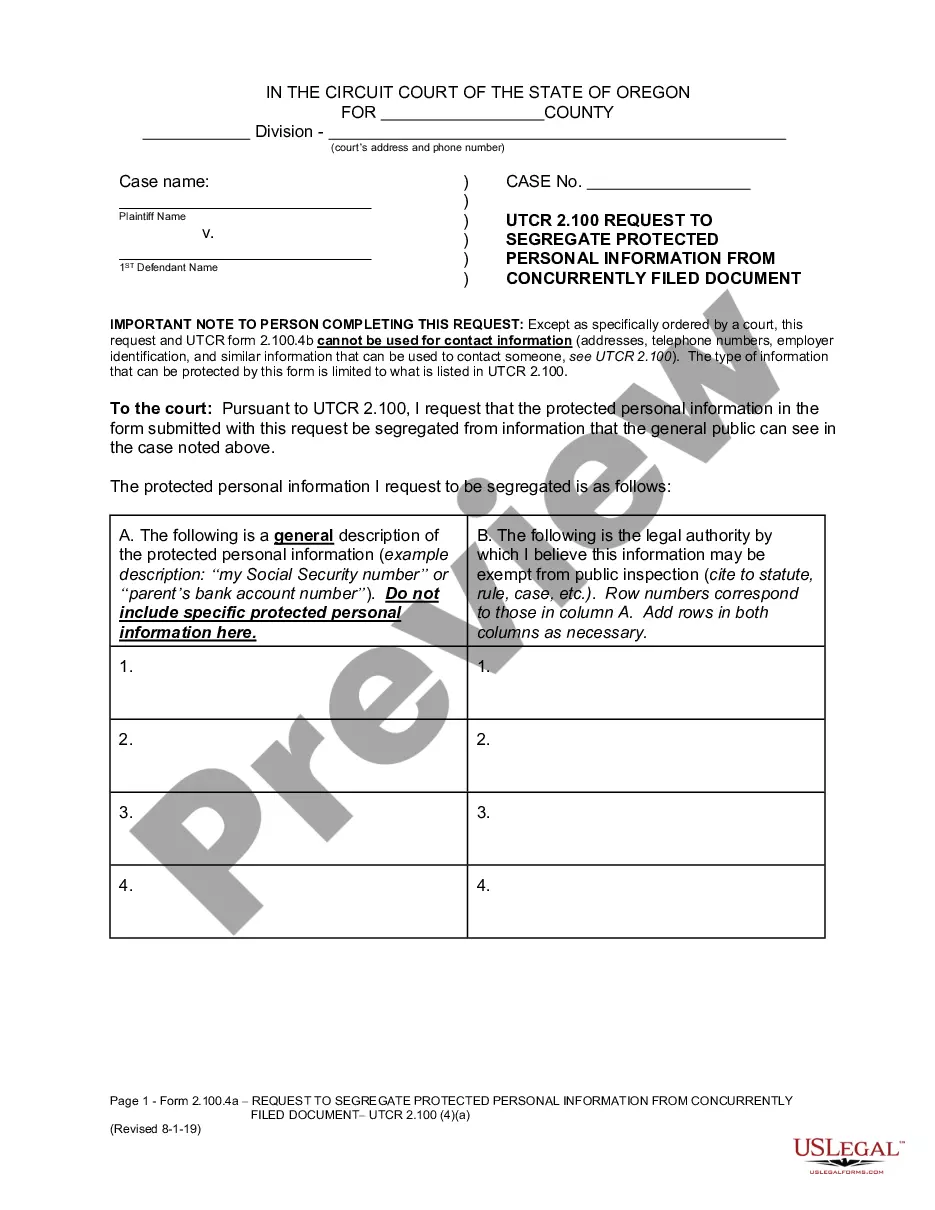

In case you are a whole new customer of US Legal Forms, listed here are straightforward instructions for you to adhere to:

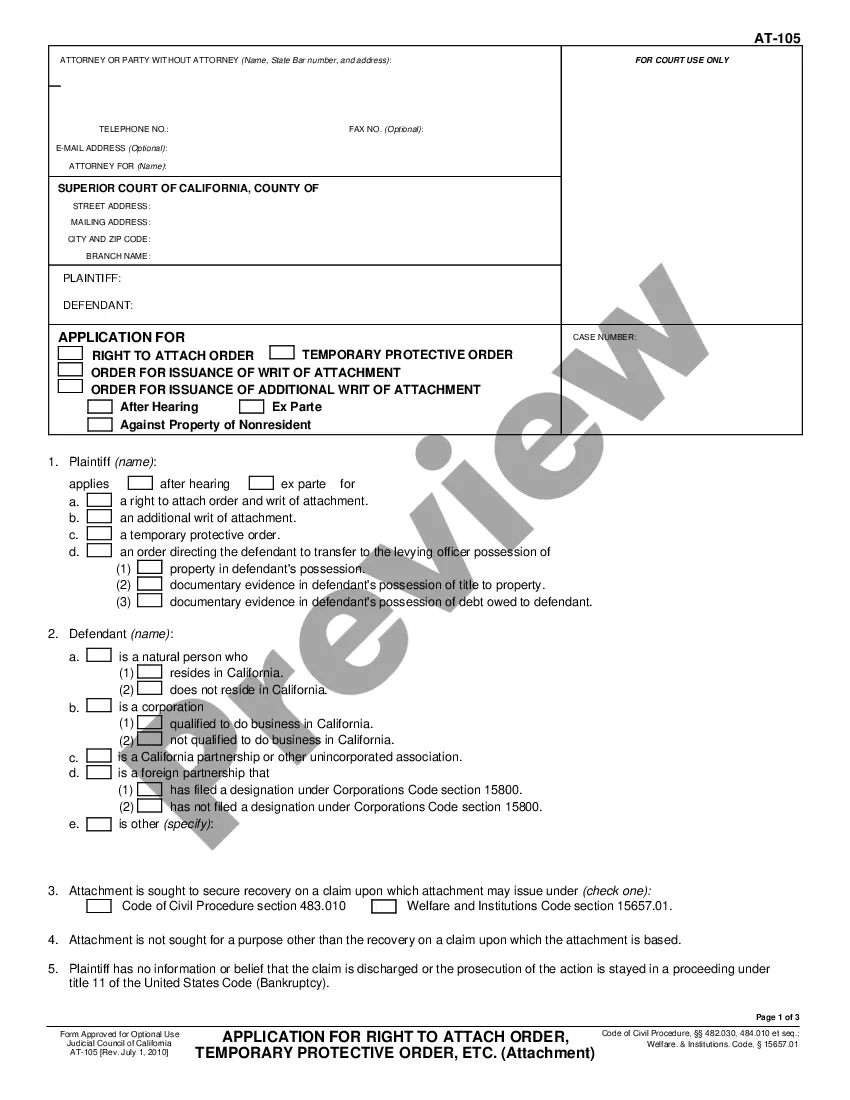

- Very first, be sure you have selected the correct develop for your town/state. You may examine the shape making use of the Preview button and read the shape explanation to make certain this is the best for you.

- In case the develop fails to fulfill your expectations, take advantage of the Seach industry to obtain the appropriate develop.

- Once you are sure that the shape is proper, click on the Acquire now button to find the develop.

- Opt for the prices program you desire and enter the essential information and facts. Make your bank account and pay for the transaction making use of your PayPal bank account or charge card.

- Opt for the document format and down load the authorized record design in your device.

- Total, change and printing and signal the attained North Carolina Provision to Include Final Billing.

US Legal Forms is the largest collection of authorized varieties for which you can see different record themes. Use the service to down load appropriately-manufactured paperwork that adhere to condition specifications.

Form popularity

FAQ

§143-134.1(b3). In the event the general contractor improperly holds excess retainage or fails to promptly pay its subcontractors their retainage, the general contractor must pay 1% per month interest on such retainage. N.C.G.S. §143- 134.1(b1)(3).

§ 22C-2. Performance by a subcontractor in ance with the provisions of its contract shall entitle it to payment from the party with whom it contracts.

Unlike ?sick pay,? the North Carolina Department of Labor takes the position that vacation pay needs to be paid upon termination unless there is a written policy that states that vacation pay will be forfeited. Such unused vacation should be paid to you at your final rate of pay.

In North Carolina, at-will employment means that you or your employer can end your employment at any time. And neither you nor your employer has to have a good reason?or any reason?to terminate your employment relationship.

Employees whose employment is discontinued for any reason shall be paid all wages due on or before the next regular payday either through the regular pay channels or by mail if requested by the employee.

North Carolina requires that final paychecks be paid on the next scheduled payday, regardless of whether the employee quit or was terminated.

For more information about workplace rights, please contact our toll free number at 1-800-NC-LABOR (800-625-2267).

Employees whose employment is discontinued for any reason shall be paid all wages due on or before the next regular payday either through the regular pay channels or by mail if requested by the employee.

Under Labor Code Section 202, when an employee not having a written contact for a definite period quits his or her employment and gives 72 hours prior notice of his or her intention to quit, and quits on the day given in the notice, the employee is entitled to his or her wages at the time of quitting.

An employer must pay an employee at least the minimum wage (currently $7.25 an hour under both North Carolina and federal labor laws) or pay the employee the promised rate of pay, whichever is greater, and pay time and one-half overtime pay based on the employee's regular rate of pay for all hours worked in excess of ...