North Carolina Clauses Relating to Venture Interests refer to specific provisions and regulations within the legal framework of North Carolina that govern venture capital investments and interests. These clauses are designed to protect the rights and interests of venture capitalists and investors involved in entrepreneurial endeavors within the state. Here are the key types of North Carolina Clauses Relating to Venture Interests: 1. Management and Control Clauses: These clauses outline the rights and responsibilities of venture capitalists in managing and controlling the invested venture. They cover aspects such as board representation, decision-making authority, and veto powers held by venture capitalists. These clauses ensure that the investors have a say in the strategic direction and operations of the venture. 2. Capital Contribution Clauses: These clauses define the obligations of venture capitalists to contribute capital to the venture and the conditions under which these contributions must be made. They outline the amount, timing, and manner in which the investments will be made, ensuring that the capital is available to support the venture's growth. 3. Transfer and Liquidation Clauses: These clauses determine the conditions under which venture capitalists may transfer or liquidate their interests in the venture. They outline the restrictions, procedures, and legal requirements involved in transferring ownership or disposing of shares, protecting the interests of the investors and ensuring smooth transitions. 4. Dilution Protection Clauses: Dilution protection clauses safeguard venture capitalists from the potential loss of ownership percentage due to subsequent rounds of funding or the issuance of new shares by the venture. These clauses may include preemptive rights that allow investors to maintain their proportional ownership by investing in future financing rounds. 5. Exit Strategy Clauses: Exit strategy clauses address the means by which venture capitalists can realize a return on their investments. They typically outline options such as initial public offerings (IPOs), mergers and acquisitions (M&A), or other liquidity events. These clauses protect the investors' interests by providing a clear roadmap for the eventual monetization of their investments. 6. Anti-Discrimination Clauses: North Carolina may also include anti-discrimination clauses relating to venture interests, aiming to protect investors from discriminatory practices based on factors such as race, gender, or religion. These clauses promote fair and equal treatment within the venture capital ecosystem. It is important to consult legal professionals and refer to the specific statutes and regulations in North Carolina to fully understand the intricate details and requirements of the clauses relating to venture interests. Compliance with these clauses is crucial for both venture capitalists and entrepreneurs seeking investments in North Carolina.

North Carolina Clauses Relating to Venture Interests

Description

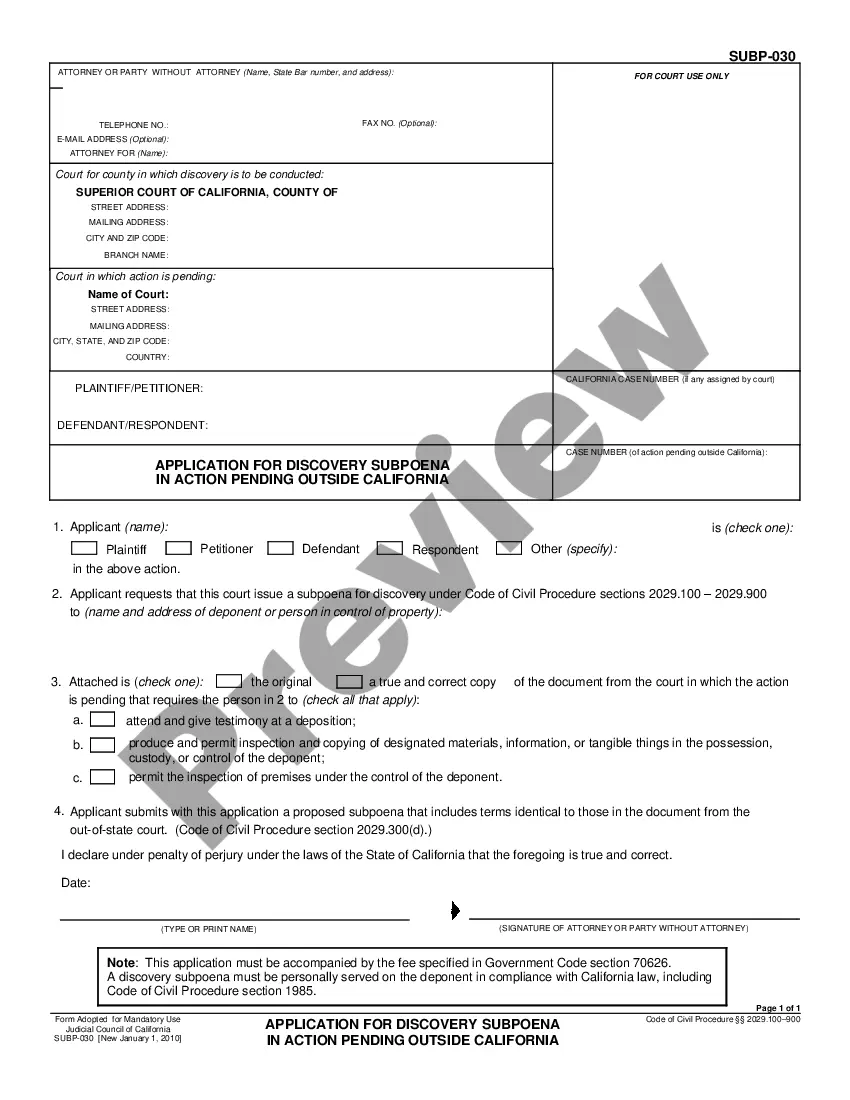

How to fill out North Carolina Clauses Relating To Venture Interests?

US Legal Forms - one of several largest libraries of legal kinds in the USA - gives a variety of legal papers web templates you may down load or produce. Utilizing the website, you will get thousands of kinds for enterprise and personal functions, sorted by categories, suggests, or keywords.You will discover the most up-to-date variations of kinds much like the North Carolina Clauses Relating to Venture Interests in seconds.

If you have a membership, log in and down load North Carolina Clauses Relating to Venture Interests from the US Legal Forms collection. The Obtain switch can look on each type you view. You get access to all in the past acquired kinds from the My Forms tab of your respective profile.

If you wish to use US Legal Forms for the first time, here are simple recommendations to help you get began:

- Be sure to have picked the correct type for the area/county. Go through the Review switch to check the form`s content material. Read the type description to ensure that you have selected the appropriate type.

- If the type does not satisfy your requirements, use the Look for field at the top of the screen to discover the one which does.

- Should you be happy with the shape, validate your selection by simply clicking the Acquire now switch. Then, pick the rates program you like and supply your credentials to sign up to have an profile.

- Procedure the deal. Use your bank card or PayPal profile to perform the deal.

- Find the structure and down load the shape on your product.

- Make modifications. Load, change and produce and indication the acquired North Carolina Clauses Relating to Venture Interests.

Each and every format you added to your bank account lacks an expiry date and is also the one you have for a long time. So, in order to down load or produce an additional backup, just go to the My Forms segment and then click about the type you need.

Obtain access to the North Carolina Clauses Relating to Venture Interests with US Legal Forms, probably the most considerable collection of legal papers web templates. Use thousands of skilled and state-particular web templates that meet your business or personal demands and requirements.