The North Carolina State of Delaware Limited Partnership Tax Notice is a detailed document that provides important information regarding the taxation regulations and requirements for limited partnerships operating within the state of North Carolina and organized under Delaware law. This notice serves as a guideline for limited partnership entities and outlines the necessary steps they must take to ensure compliance with tax laws in North Carolina. One type of North Carolina State of Delaware Limited Partnership Tax Notice is the Annual Franchise Tax Notice. This notice informs limited partnerships of their obligation to file an annual franchise tax return and pay the required franchise tax to the state of North Carolina. It outlines the due dates, filing instructions, and payment methods for the franchise tax, providing crucial information to limited partnerships to meet their tax obligations. Another type of North Carolina State of Delaware Limited Partnership Tax Notice is the Estimated Tax Notice. This notice serves as a reminder to limited partnerships to make quarterly estimated tax payments based on their projected income for the tax year. It details the deadlines, calculation methods, and payment instructions for these estimated tax payments, enabling limited partnerships to properly plan and fulfill their tax responsibilities throughout the year. Additionally, the North Carolina State of Delaware Limited Partnership Tax Notice may include important updates or changes to tax laws, regulations, or procedures that are relevant to limited partnerships operating in the state. This ensures that limited partnerships are aware of any new requirements or adjustments that may impact their tax obligations, allowing them to stay compliant and avoid any penalties or issues related to tax matters. In summary, the North Carolina State of Delaware Limited Partnership Tax Notice is a crucial document that provides comprehensive information regarding taxation requirements for limited partnerships organized under Delaware law and operating in North Carolina. By carefully reviewing and following the guidelines outlined in this notice, limited partnerships can ensure they meet their tax obligations and maintain a good standing within the state.

North Carolina State of Delaware Limited Partnership Tax Notice

Description

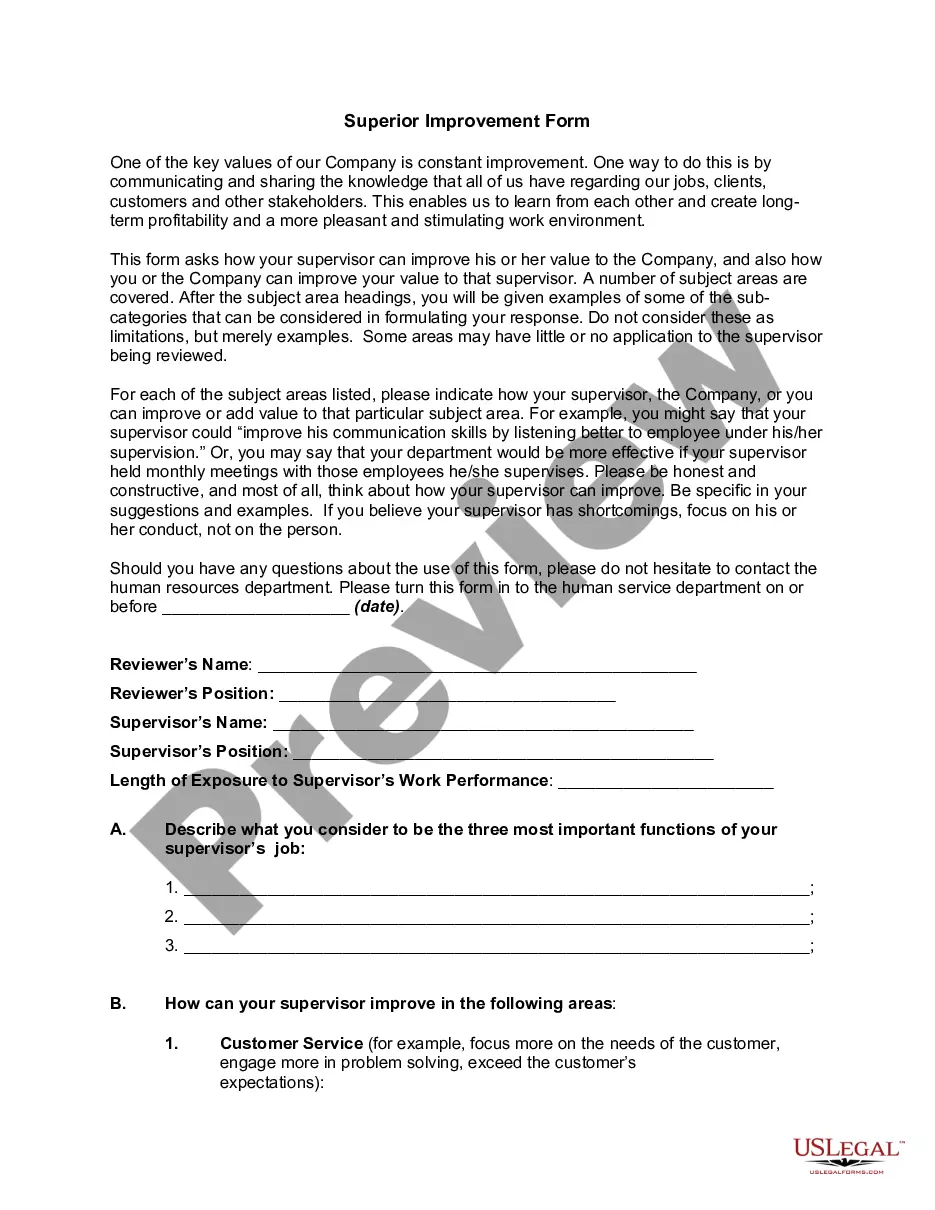

How to fill out North Carolina State Of Delaware Limited Partnership Tax Notice?

If you wish to comprehensive, down load, or produce lawful document templates, use US Legal Forms, the largest assortment of lawful forms, which can be found on-line. Use the site`s basic and hassle-free search to find the paperwork you want. A variety of templates for enterprise and person purposes are sorted by categories and says, or keywords. Use US Legal Forms to find the North Carolina State of Delaware Limited Partnership Tax Notice with a handful of clicks.

Should you be currently a US Legal Forms client, log in for your accounts and click the Obtain switch to find the North Carolina State of Delaware Limited Partnership Tax Notice. You can even gain access to forms you previously downloaded from the My Forms tab of your respective accounts.

If you work with US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Ensure you have chosen the shape to the proper city/land.

- Step 2. Take advantage of the Review solution to look over the form`s information. Never overlook to read the information.

- Step 3. Should you be unsatisfied with all the form, make use of the Search area near the top of the display screen to get other models of your lawful form format.

- Step 4. When you have discovered the shape you want, click on the Get now switch. Pick the rates program you choose and add your references to sign up on an accounts.

- Step 5. Procedure the transaction. You can use your credit card or PayPal accounts to accomplish the transaction.

- Step 6. Select the format of your lawful form and down load it on your own gadget.

- Step 7. Total, revise and produce or sign the North Carolina State of Delaware Limited Partnership Tax Notice.

Every lawful document format you buy is your own property forever. You possess acces to every form you downloaded inside your acccount. Select the My Forms segment and select a form to produce or down load yet again.

Remain competitive and down load, and produce the North Carolina State of Delaware Limited Partnership Tax Notice with US Legal Forms. There are thousands of skilled and express-particular forms you can utilize for the enterprise or person needs.