North Carolina State of Delaware Limited Partnership Tax Notice

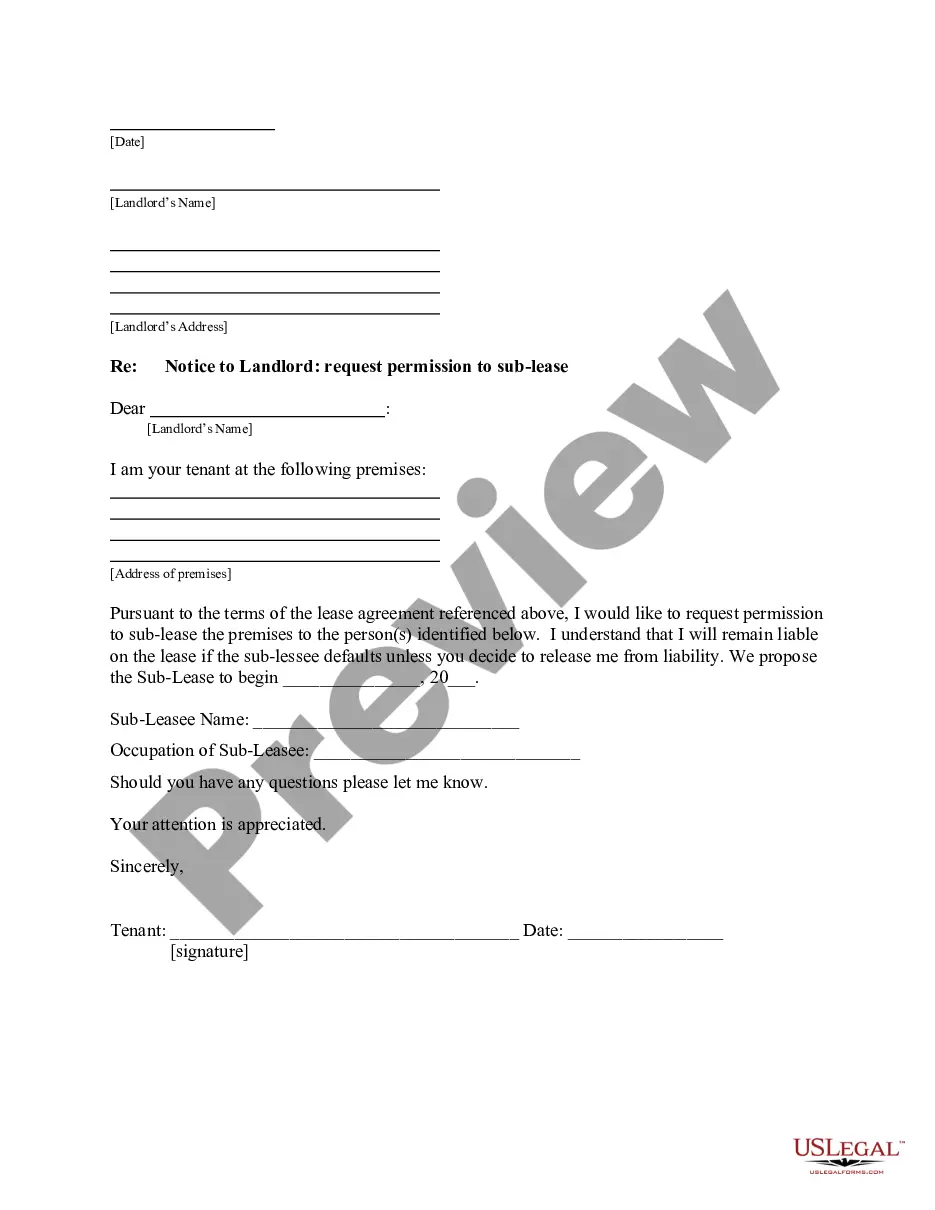

Description

How to fill out State Of Delaware Limited Partnership Tax Notice?

If you wish to comprehensive, down load, or produce lawful document templates, use US Legal Forms, the largest assortment of lawful forms, which can be found on-line. Use the site`s basic and hassle-free search to find the paperwork you want. A variety of templates for enterprise and person purposes are sorted by categories and says, or keywords. Use US Legal Forms to find the North Carolina State of Delaware Limited Partnership Tax Notice with a handful of clicks.

Should you be currently a US Legal Forms client, log in for your accounts and click the Obtain switch to find the North Carolina State of Delaware Limited Partnership Tax Notice. You can even gain access to forms you previously downloaded from the My Forms tab of your respective accounts.

If you work with US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Ensure you have chosen the shape to the proper city/land.

- Step 2. Take advantage of the Review solution to look over the form`s information. Never overlook to read the information.

- Step 3. Should you be unsatisfied with all the form, make use of the Search area near the top of the display screen to get other models of your lawful form format.

- Step 4. When you have discovered the shape you want, click on the Get now switch. Pick the rates program you choose and add your references to sign up on an accounts.

- Step 5. Procedure the transaction. You can use your credit card or PayPal accounts to accomplish the transaction.

- Step 6. Select the format of your lawful form and down load it on your own gadget.

- Step 7. Total, revise and produce or sign the North Carolina State of Delaware Limited Partnership Tax Notice.

Every lawful document format you buy is your own property forever. You possess acces to every form you downloaded inside your acccount. Select the My Forms segment and select a form to produce or down load yet again.

Remain competitive and down load, and produce the North Carolina State of Delaware Limited Partnership Tax Notice with US Legal Forms. There are thousands of skilled and express-particular forms you can utilize for the enterprise or person needs.

Form popularity

FAQ

Note: While most partnerships in Delaware are not subject to income taxes, they are required to file yearly state income tax returns and are required to pay an annual tax to the Secretary of State.

Delaware treats a single-member ?disregarded entity? as a sole proprietorship for tax purposes. This means that the LLC itself does not pay taxes and does not have to file a return with the State of Delaware.

Delaware has a graduated tax rate ranging from 2.2% to 5.55% on income under $60,000. The maximum income tax rate is 6.60% on income of $60,000 or over.

A partnership must file an annual information return to report the income, deductions, gains, losses, etc., from its operations, but it does not pay income tax. Instead, it "passes through" profits or losses to its partners.

A resident partner must file Form PIT-RES (Delaware Resident Income Tax Return, formerly known as 200-01) and must report their share of partnership income or loss. Partnerships must file by the 15th day of the third month following the expiration of the taxable period (March 15 for calendar year taxpayers).

Every partnership doing business in North Carolina must file a partnership income tax return, Form D-403, for the taxable year if a federal partnership return was required to be filed. (Exception: A partnership whose only activity is as an investment partnership is not considered to be doing business in North Carolina.

Tax Treatment for Limited Partners Limited partnerships, like general partnerships, are pass-through or flow-through entities. This means that all partners are responsible for taxes on their share of the partnership income, rather than the partnership itself.

Partnerships are not subject to North Carolina income tax, ( Sec. 59-84.1(b), G.S.) unless the partnership elects to pay the optional pass-through entity tax. ( 105-154.1, G.S.) The partners report their share of the income, losses, and credits from the entity or business on their North Carolina income tax return.