North Carolina Amended Equity Fund Partnership Agreement for New Fund Hub

Description

How to fill out Amended Equity Fund Partnership Agreement For New Fund Hub?

Have you been within a placement in which you need to have paperwork for both business or person purposes almost every time? There are a lot of authorized file web templates available on the Internet, but finding ones you can depend on isn`t effortless. US Legal Forms provides a huge number of form web templates, like the North Carolina Amended Equity Fund Partnership Agreement for New Fund Hub, that are composed to meet federal and state needs.

In case you are previously familiar with US Legal Forms website and possess an account, basically log in. Following that, you can down load the North Carolina Amended Equity Fund Partnership Agreement for New Fund Hub design.

Unless you provide an bank account and need to start using US Legal Forms, follow these steps:

- Find the form you need and ensure it is to the proper city/state.

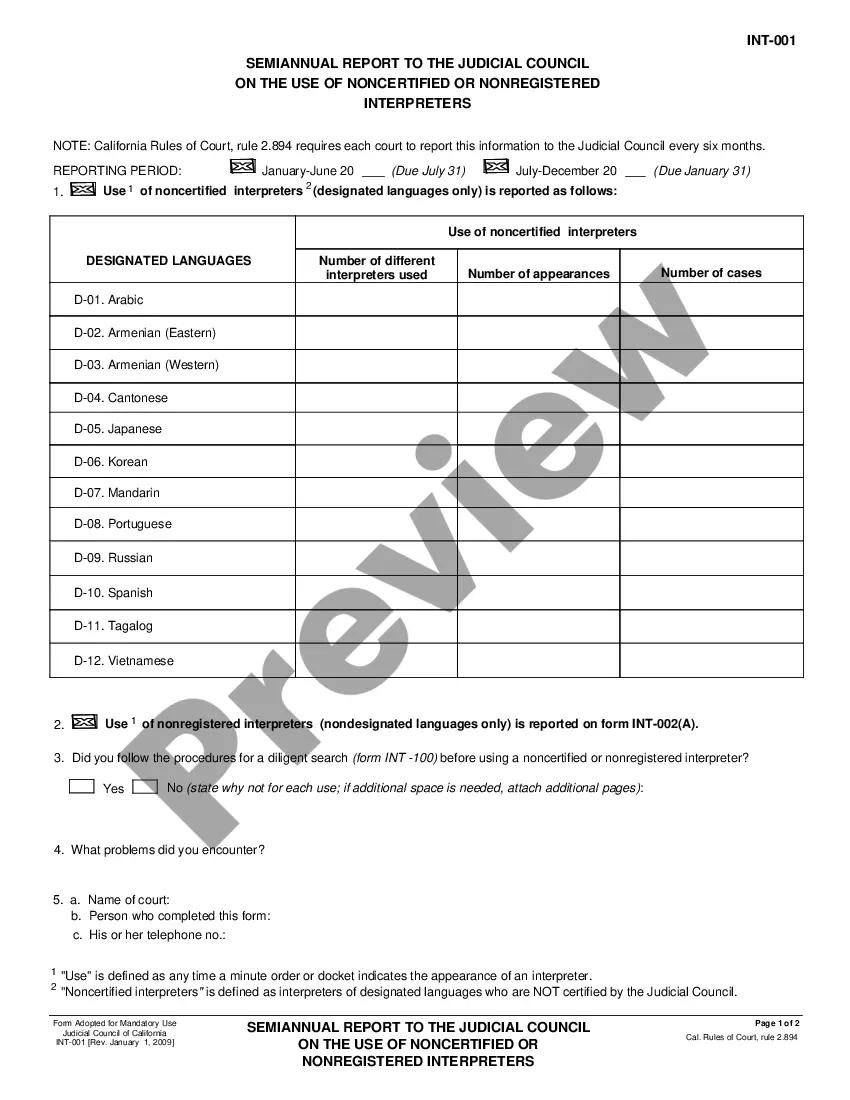

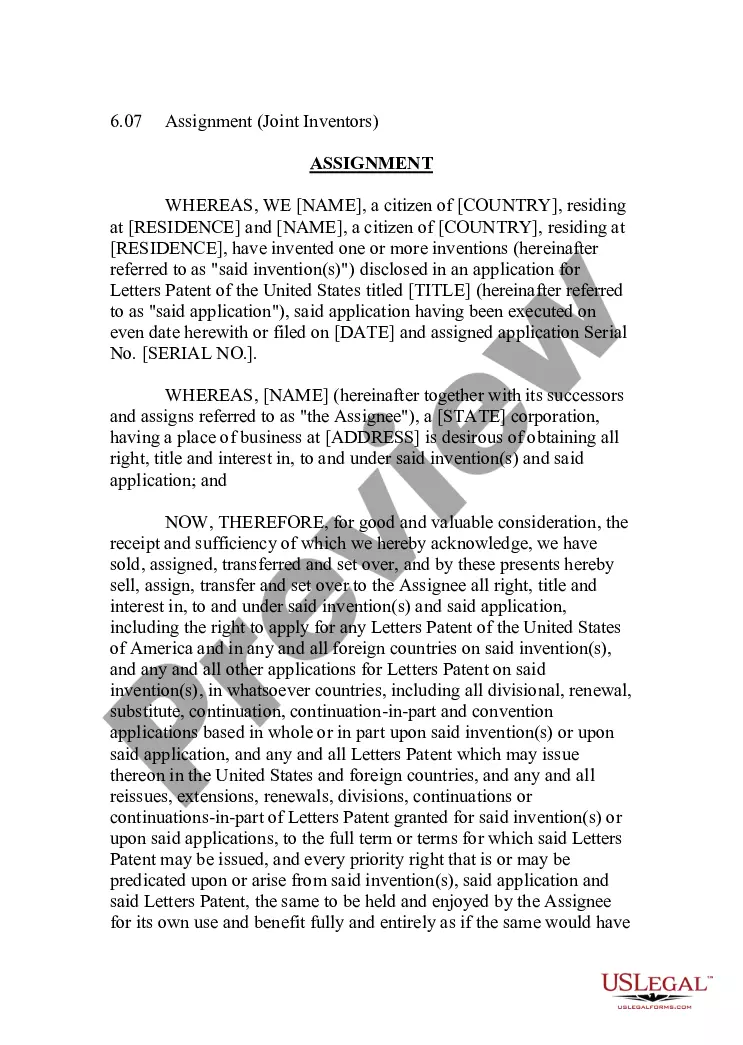

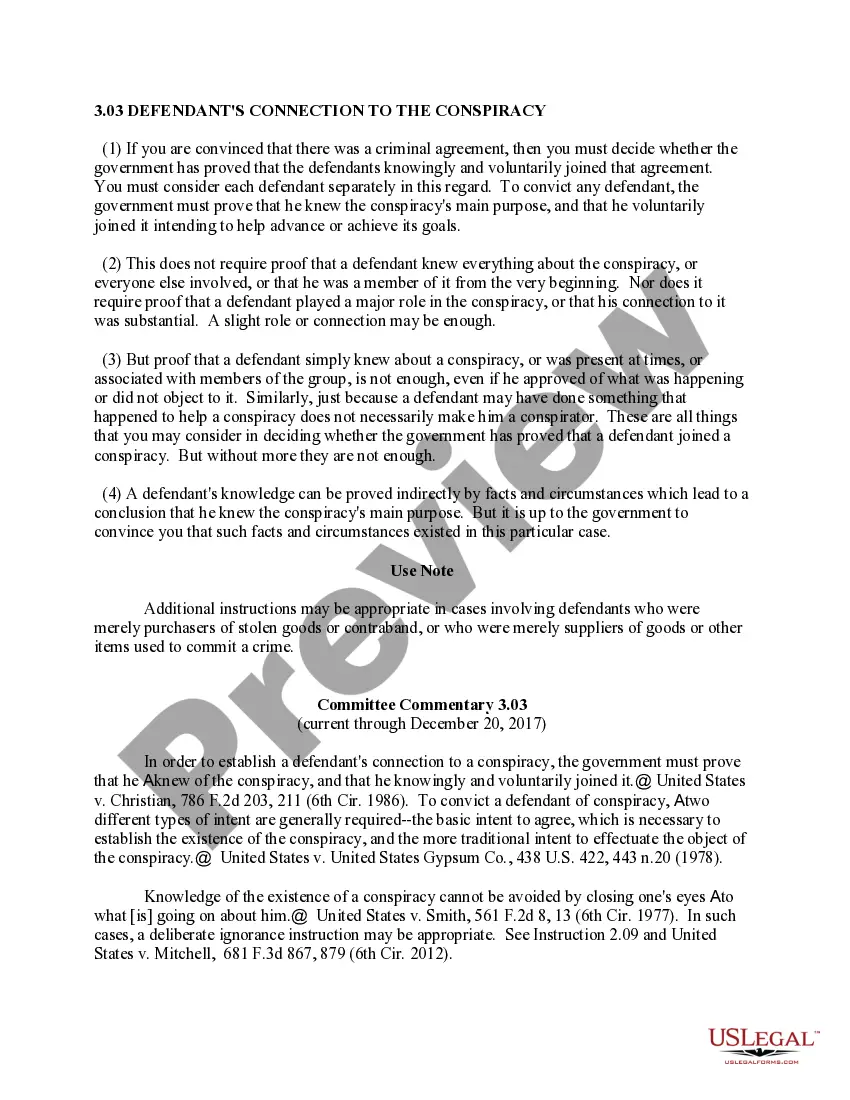

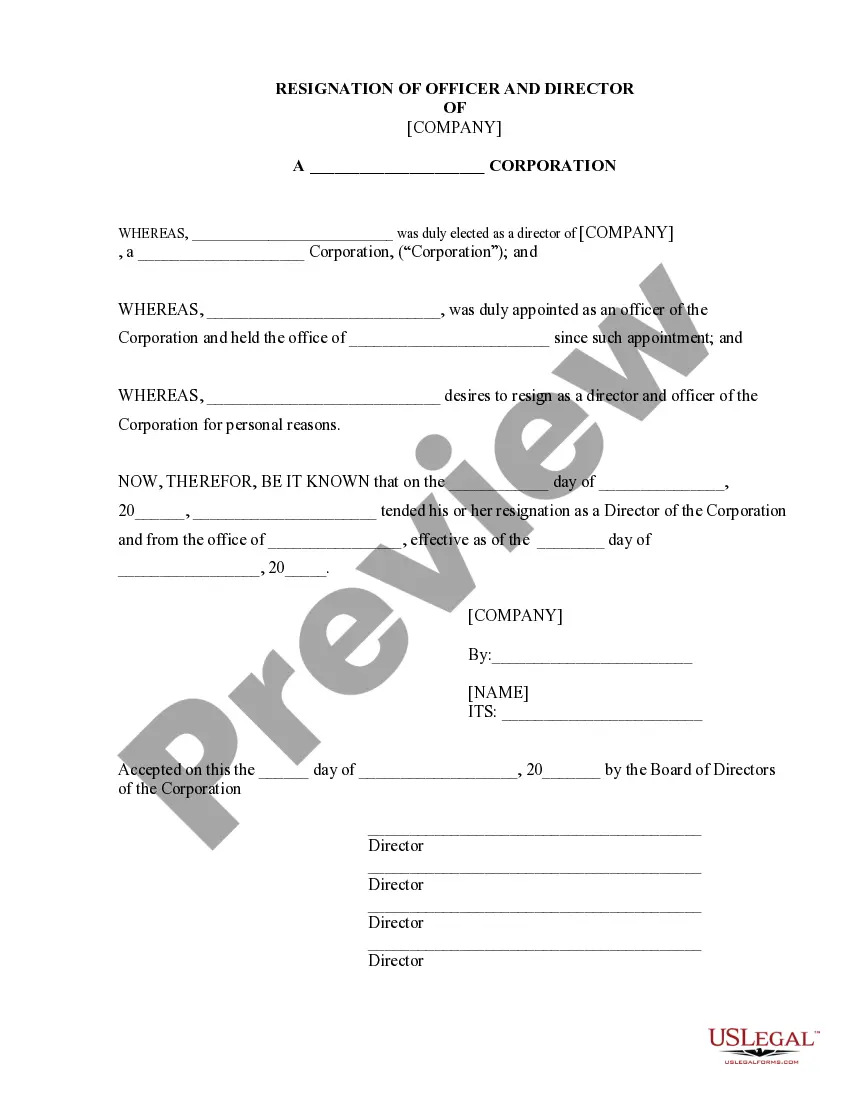

- Utilize the Review option to review the shape.

- Look at the outline to actually have selected the correct form.

- In the event the form isn`t what you`re looking for, take advantage of the Search area to discover the form that suits you and needs.

- Whenever you get the proper form, click Purchase now.

- Choose the pricing plan you need, complete the required information to generate your bank account, and buy your order using your PayPal or charge card.

- Pick a hassle-free file structure and down load your version.

Discover every one of the file web templates you possess purchased in the My Forms food list. You can get a extra version of North Carolina Amended Equity Fund Partnership Agreement for New Fund Hub any time, if required. Just click the needed form to down load or printing the file design.

Use US Legal Forms, probably the most comprehensive variety of authorized forms, in order to save some time and prevent blunders. The assistance provides appropriately manufactured authorized file web templates which can be used for a variety of purposes. Make an account on US Legal Forms and commence creating your daily life easier.

Form popularity

FAQ

Private equity firms usually look for entry-level associates with at least two years of experience within the banking industry. Investment bankers usually follow the PE firm career path as their next job and typically have a bachelor's degree in finance, accounting, economics, and other related fields.

In the U.S. and Europe, most private equity funds are established as Limited Partnerships or Limited Liability Firms, and you'll need competent attorneys to complete all the necessary paperwork and registration documents.

Minimum Investment Requirement Private equity investing is not easily accessible for the average investor. Most private equity firms typically look for investors who are willing to commit as much as $25 million. Although some firms have dropped their minimums to $250,000, this is still out of reach for most people.

Private equity fund structure The fund is managed by a private equity firm that serves as the 'General Partner' of the fund. By contributing capital, investors become 'Limited Partners' of the fund. As such, the fund is structured as a 'Limited Partnership'.

For example, let's say that a large (fictitious) institutional investor called Global Opportunity Corporation (GOC) has agreed to invest with a private equity firm called RockStreet Partners. RockStreet is raising a $1 billion private equity fund, and GOC agrees to commit $100 million to the fund as a limited partner.

The process is as follows: Find an attractive investment consistent with the fund's planned strategy, convince investors to participate in the deal, create an SPV, and close the deal. It's important that the rationale behind those investments is consistent with the fund strategy in order to serve as a track record.

Again, complexity of this depends upon many factors ? significance of investor, other investors' demands etc. but heavily driven by market terms and now ILPA. Typically takes about 3-6 months. Initial investor commitments are made and the fund launches.

Steps for starting a private equity fund Write a business plan. Much of a new fund's business plan should mirror that of any start-up business. ... Work out the legal details. ... Calculate fee structure. ... Find prospective limited partners.