North Carolina Limited Liability Company - LLC - Formation Questionnaire

Description

This questionnaire may also be used by an attorney as an important information gathering and issue identification tool when forming an attorney-client relationship with a new client. This form helps ensure thorough case preparation and effective evaluation of a new client's needs. It may be used by an attorney or new client to save on attorney fees related to initial interviews.

How to fill out Limited Liability Company - LLC - Formation Questionnaire?

Finding the right legitimate file web template might be a struggle. Of course, there are a lot of layouts available online, but how will you obtain the legitimate type you require? Utilize the US Legal Forms site. The support delivers a large number of layouts, including the North Carolina Limited Liability Company - LLC - Formation Questionnaire, which can be used for business and private needs. All of the varieties are checked out by experts and meet federal and state specifications.

If you are currently signed up, log in for your profile and click on the Acquire switch to get the North Carolina Limited Liability Company - LLC - Formation Questionnaire. Make use of profile to search throughout the legitimate varieties you have acquired in the past. Check out the My Forms tab of your respective profile and get one more version from the file you require.

If you are a whole new customer of US Legal Forms, allow me to share easy directions for you to adhere to:

- Initial, make certain you have chosen the right type to your town/county. You are able to look over the shape making use of the Review switch and study the shape outline to ensure it is the best for you.

- In case the type is not going to meet your expectations, make use of the Seach area to get the right type.

- Once you are sure that the shape would work, click on the Buy now switch to get the type.

- Select the rates plan you want and type in the necessary information and facts. Create your profile and pay money for the order using your PayPal profile or bank card.

- Select the file file format and obtain the legitimate file web template for your gadget.

- Total, revise and print and sign the attained North Carolina Limited Liability Company - LLC - Formation Questionnaire.

US Legal Forms is the biggest local library of legitimate varieties in which you can see a variety of file layouts. Utilize the company to obtain skillfully-made paperwork that adhere to status specifications.

Form popularity

FAQ

You can get an LLC in North Carolina in 2-5 business days if you file online (or 2-3 weeks if you file by mail). If you need your North Carolina LLC faster, you can pay for expedited processing.

10 Frequently Asked Questions About LLCs What is an LLC? ... What are the tax benefits of LLCs? ... In what state should you form your LLC? ... What is the easiest way to form an LLC? ... What are the costs of forming an LLC? ... What are the key documents involved in forming an LLC? ... What can I name my LLC? ... How are LLCs owned and managed?

Because an LLC is a separate entity, the owners of the company have limited liability. This is one of the most important benefits to operating as a limited liability company. Limited liability means that the individual assets of LLC members cannot be used to satisfy the LLC's debts and obligations.

LLCs can have an unlimited number of members; S corps can have no more than 100 shareholders (owners). Non-U.S. citizens/residents can be members of LLCs; S corps may not have non-U.S. citizens/residents as shareholders.

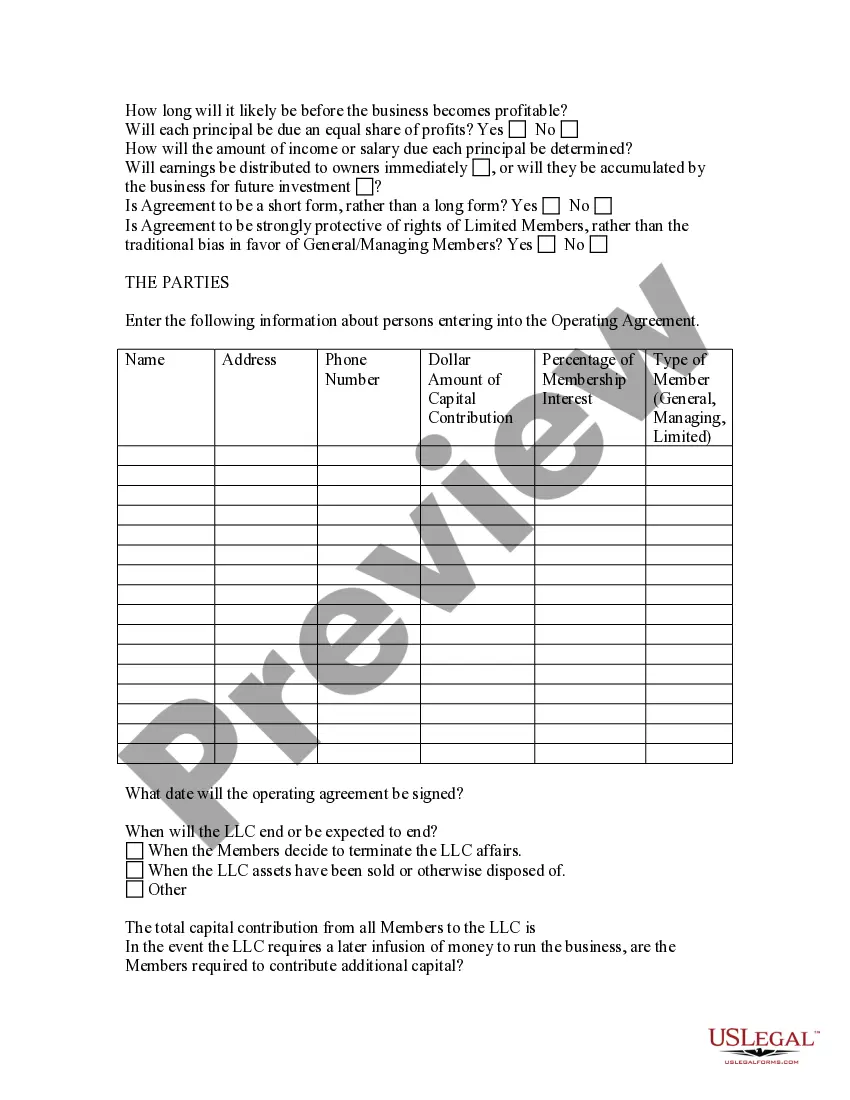

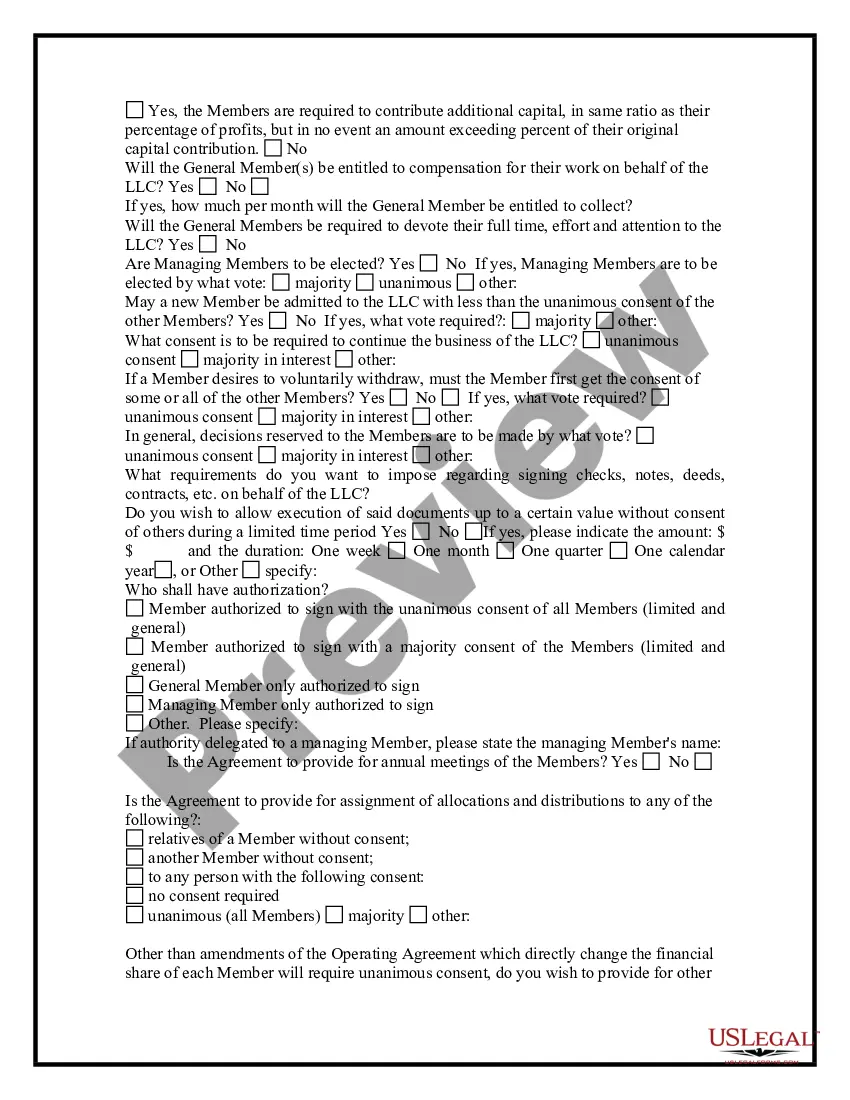

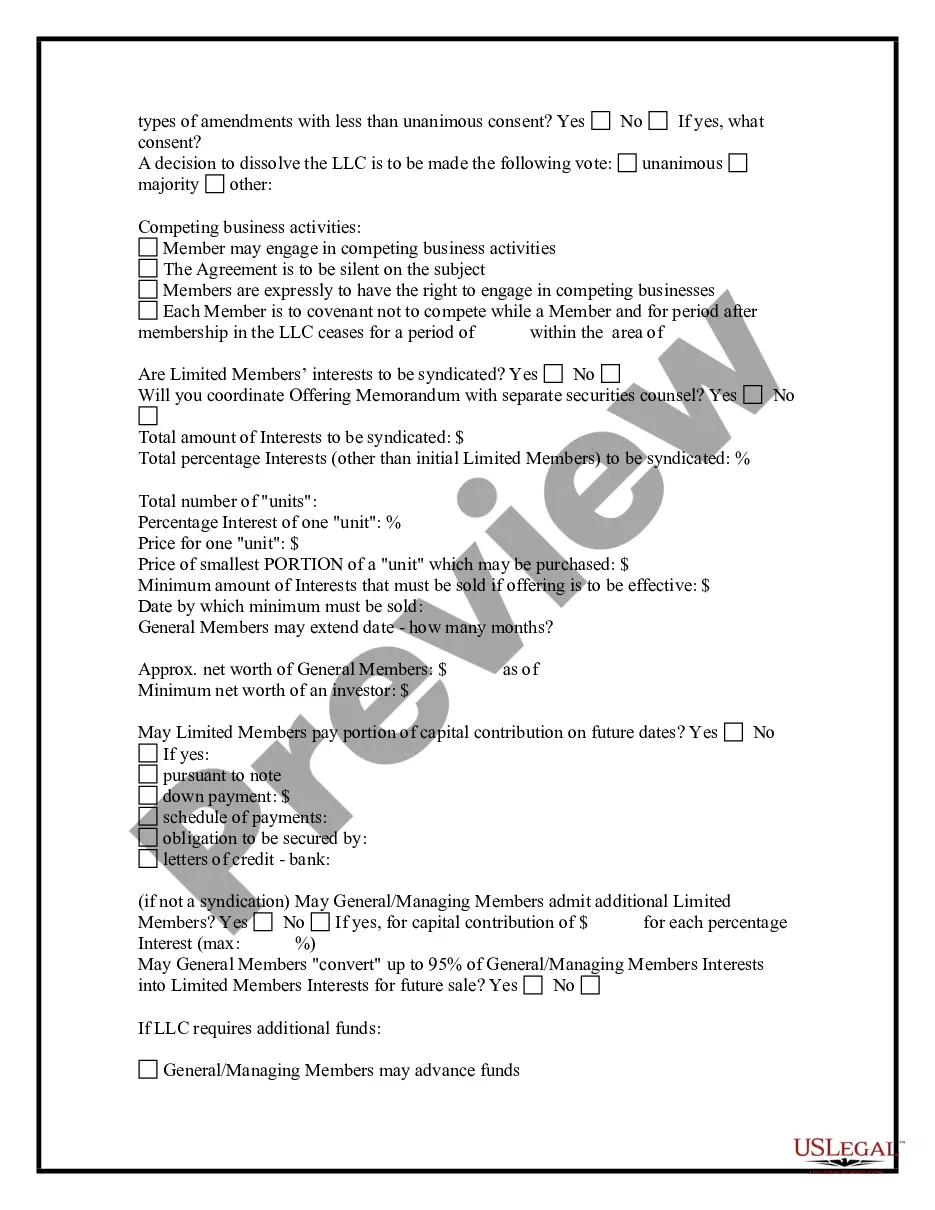

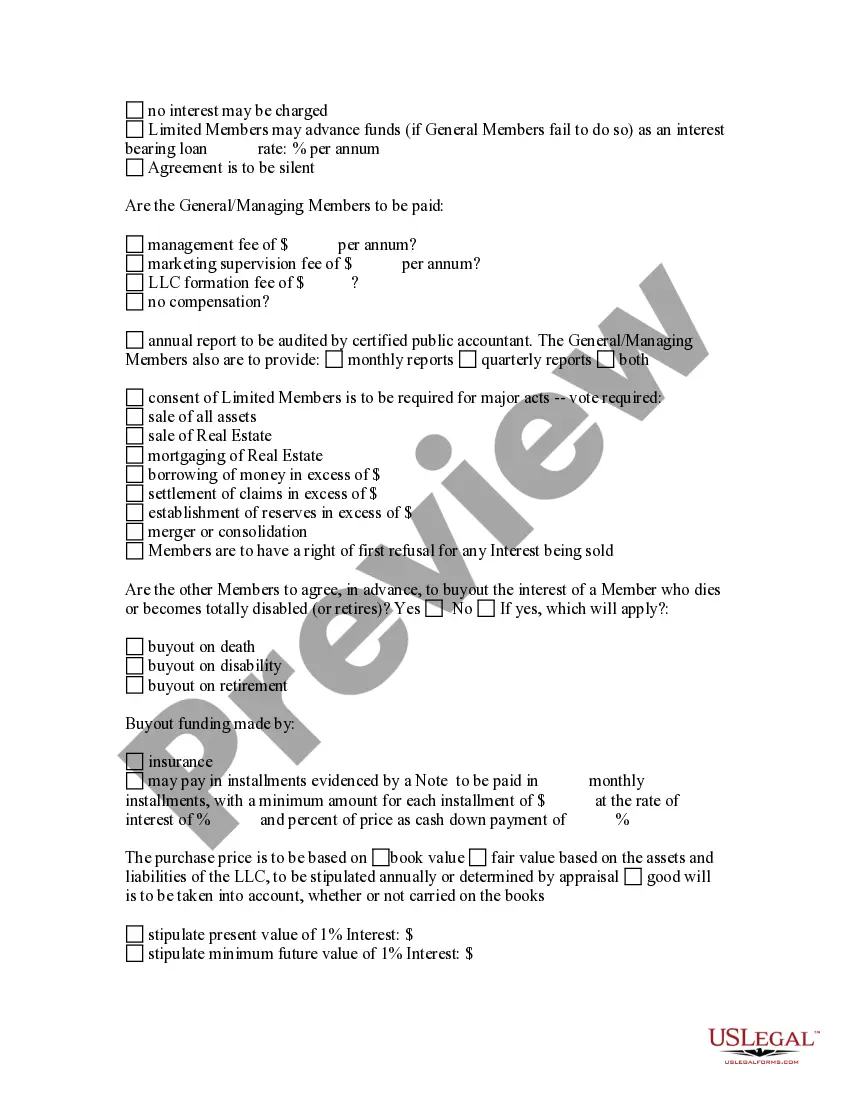

Although North Carolina's laws do not require LLCs to have operating agreements, you are still encouraged to have one to protect the operations of your business. Having an operating agreement is critical to ensure that your business is legally compliant and that all of the proper procedures and policies are followed.

Limited Liability Company Examples The same is true about Johnson and Johnsons, Hertz Rent-a-Car, eBay, and IBM. These businesses could easily adjust their business structure and take advantage of corporate tax laws, but there are still sometimes advantages to remaining an LLC.

To register your LLC in NC, you must North Carolina file articles of organization with the Secretary of State. For a North Carolina LLC, the articles must include: Your LLC name. The name and address of each member signing the articles.

Before you establish a business in the State of California, you should consult with a private attorney or tax advisor for advice about what type of business entity will meet your business needs, and what your legal obligations will be.