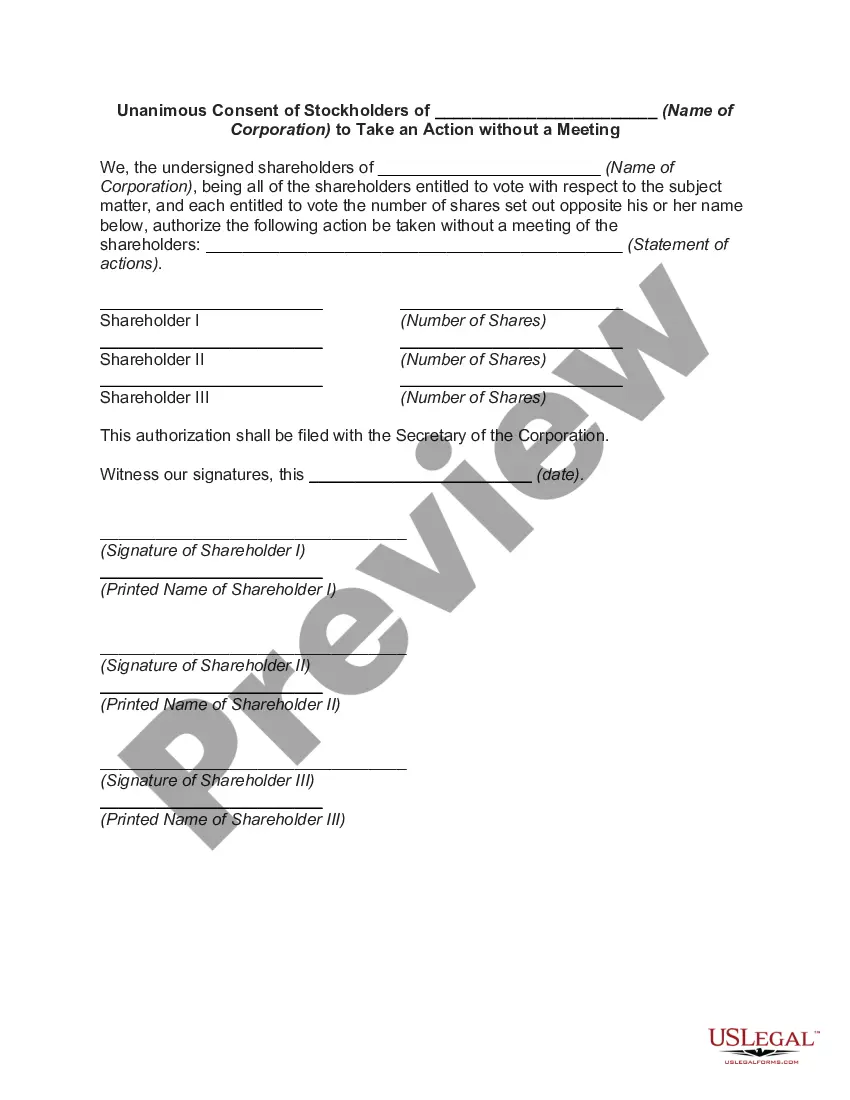

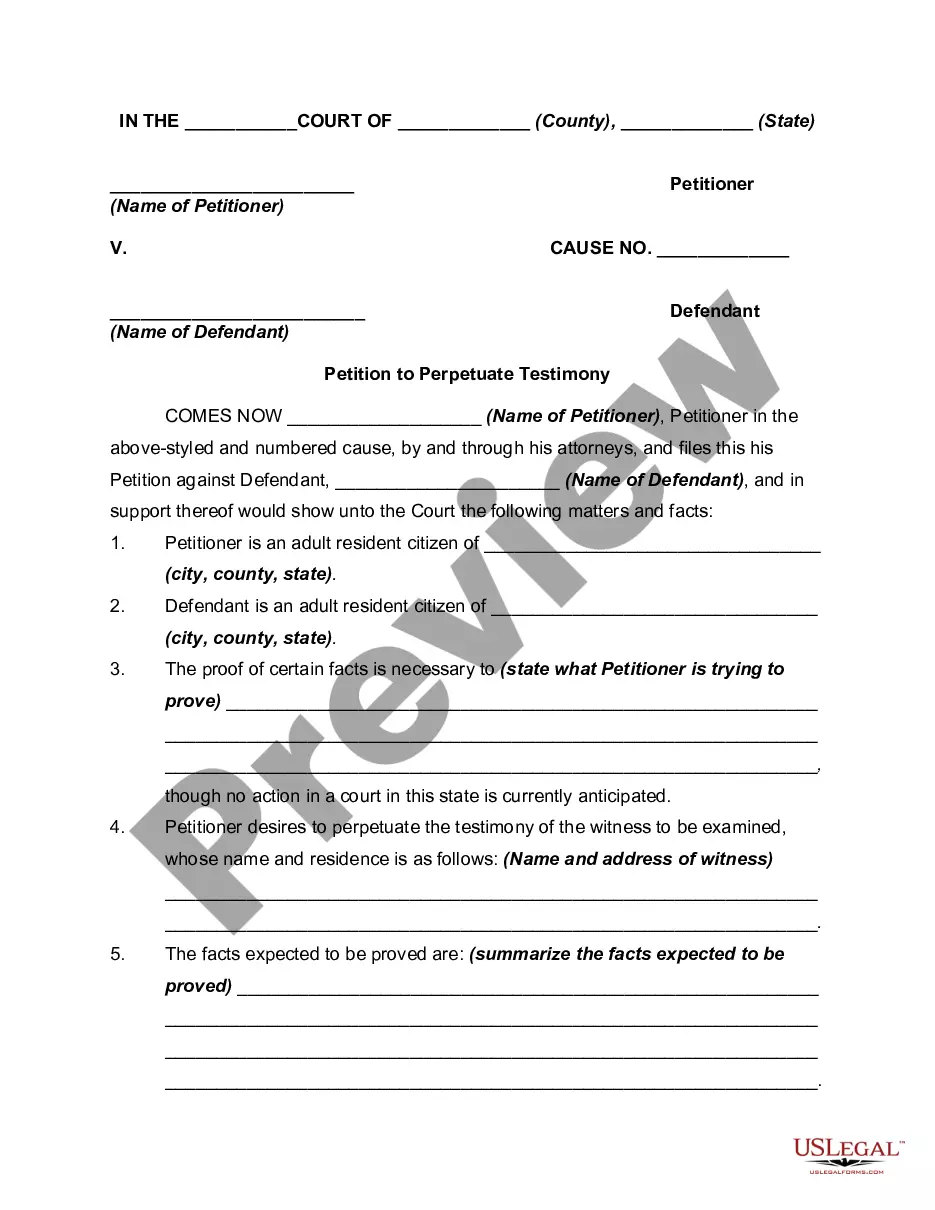

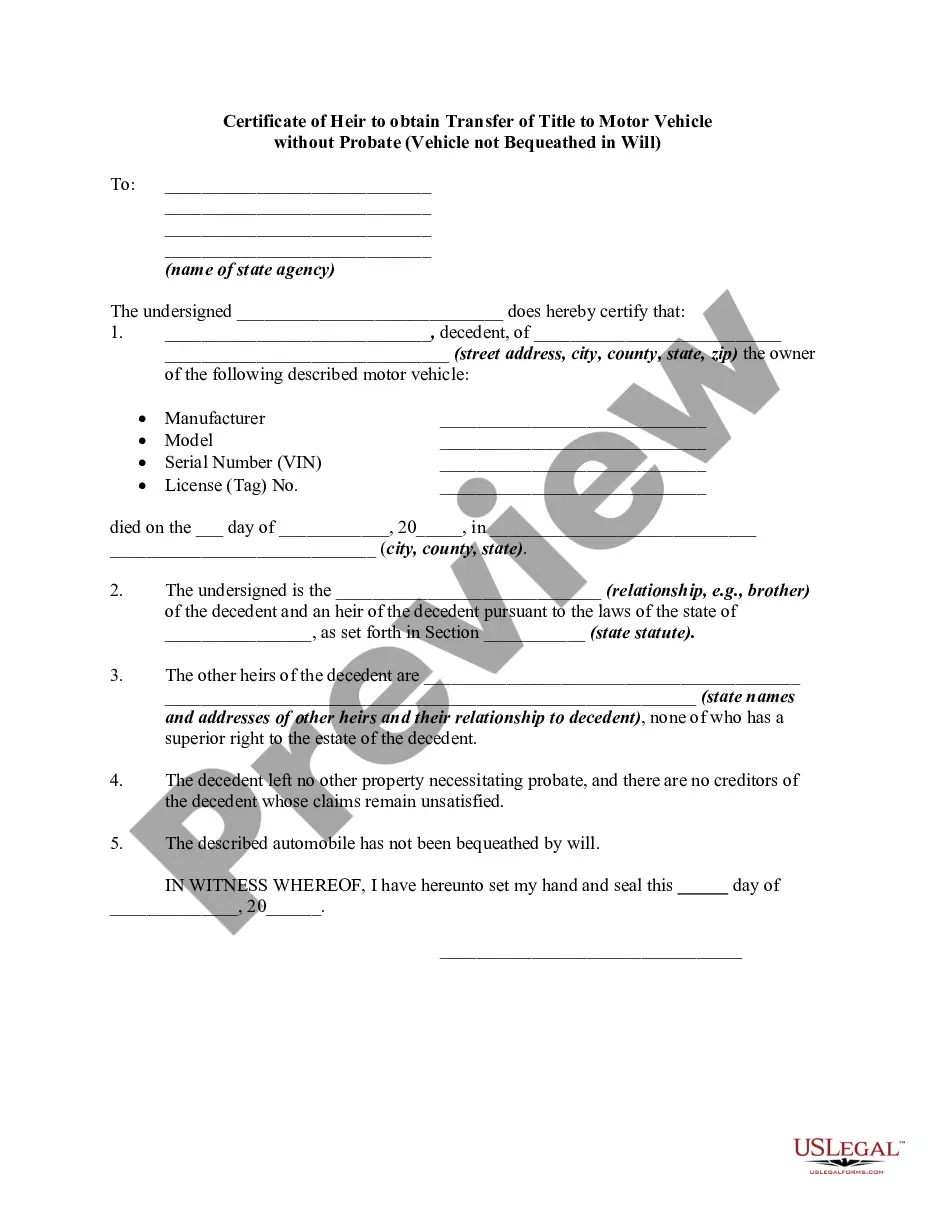

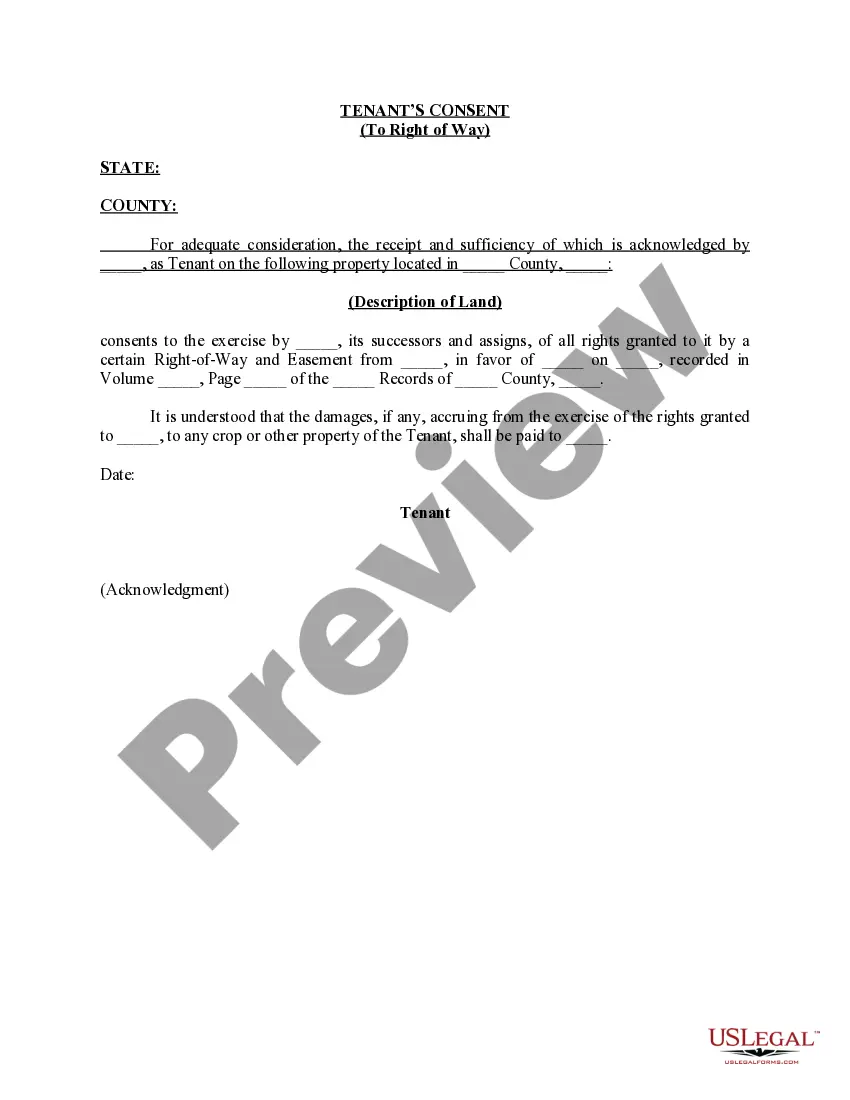

This employee stock option plan grants the optionee (the employee) a non-qualified stock option under the company's stock option plan. The option allows the employee to purchase shares of the company's common stock up to the number of shares listed in the agreement.

North Carolina Employee Stock Option Agreement

Description

How to fill out Employee Stock Option Agreement?

Choosing the right lawful record design can be a have difficulties. Naturally, there are a lot of layouts available online, but how do you get the lawful kind you need? Make use of the US Legal Forms web site. The service gives thousands of layouts, for example the North Carolina Employee Stock Option Agreement, which can be used for enterprise and private requirements. Each of the types are checked out by pros and meet up with federal and state needs.

Should you be presently listed, log in to your bank account and click the Obtain button to find the North Carolina Employee Stock Option Agreement. Use your bank account to look with the lawful types you might have purchased formerly. Visit the My Forms tab of your respective bank account and get yet another copy of the record you need.

Should you be a fresh consumer of US Legal Forms, here are basic guidelines that you should comply with:

- Initial, be sure you have chosen the appropriate kind for your town/state. You can check out the form while using Review button and read the form outline to make certain this is basically the best for you.

- If the kind will not meet up with your expectations, use the Seach industry to get the correct kind.

- When you are certain the form is acceptable, click the Acquire now button to find the kind.

- Select the rates prepare you need and enter in the necessary info. Design your bank account and buy an order making use of your PayPal bank account or bank card.

- Opt for the file format and download the lawful record design to your system.

- Total, revise and printing and indication the acquired North Carolina Employee Stock Option Agreement.

US Legal Forms will be the largest collection of lawful types in which you can find a variety of record layouts. Make use of the service to download skillfully-made files that comply with state needs.

Form popularity

FAQ

Weighing your options Ultimately, it's best to remember that stock options are just that: Options. They don't compel anyone to do anything, but they can, in some cases, prove extremely valuable and help significantly increase an employee's wealth. If they're fortunate enough to be at a strong, growing company, that is.

These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price. This offer doesn't last forever, though. You have a set amount of time to exercise your options before they expire.

Employee Stock option plan or Employee Stock Ownership Plan (ESOP) is an employee benefit scheme that enables employees to own shares in the company. These shares are purchased by employees at price below market price, or in other words, a discounted price.

An employee stock purchase plan allows you to buy company stock at a bargain price. Discounts usually range from 5% to 15%. For example, if you work and participate in Hilton's ESPP, you can buy Hilton stock at a 15% discount. If Hilton's stock is trading at $130/share, they'll buy it at $110.50/share for you.

Stock options allow employees to buy a piece of your company at a discount in exchange for their dedication and commitment. As a small business, you can consider offering stock options as a great way to compensate employees and help build a hardworking and innovative staff.

With stock-based compensation, employees in an early-stage business are offered stock options in addition to their salaries. The percentage of a company's shares reserved for stock options will typically vary from 5% to 15% and sometimes go up as high as 20%, depending on the development stage of the company.

Employee Share Option (ESOP) An ESOP plan gives an employee the right to purchase shares in a company (usually the employer or a parent company of the employer) at a specific pre-determined price on or after specific dates under the plan.

An employee stock option (ESO) is a form of financial equity compensation that is offered to employees and executives by their organization. The stock options offered come in the form of regular call options and allow the employee or executive to purchase their organization's stocks at a specified price and time.