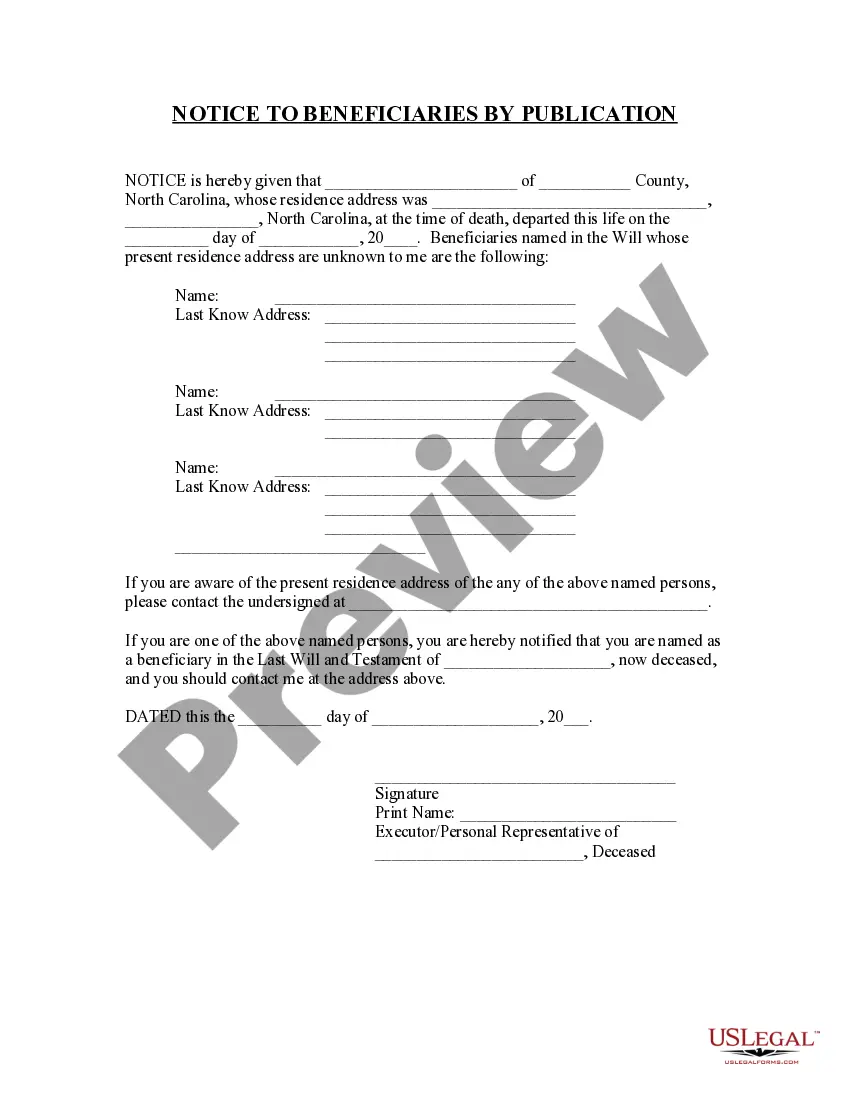

North Carolina Notice to Beneficiaries of being Named in Will

Description Beneficiaries Named Will

How to fill out Notice Being Publication?

Avoid costly attorneys and find the North Carolina Notice to Beneficiaries of being Named in Will you need at a affordable price on the US Legal Forms site. Use our simple categories functionality to search for and download legal and tax documents. Read their descriptions and preview them prior to downloading. In addition, US Legal Forms provides users with step-by-step instructions on how to download and fill out every form.

US Legal Forms clients basically must log in and download the specific form they need to their My Forms tab. Those, who haven’t got a subscription yet need to stick to the tips listed below:

- Ensure the North Carolina Notice to Beneficiaries of being Named in Will is eligible for use in your state.

- If available, read the description and use the Preview option before downloading the sample.

- If you are sure the document suits you, click on Buy Now.

- If the form is wrong, use the search field to find the right one.

- Next, create your account and choose a subscription plan.

- Pay out by credit card or PayPal.

- Select download the form in PDF or DOCX.

- Just click Download and find your form in the My Forms tab. Feel free to save the template to the gadget or print it out.

Right after downloading, you can complete the North Carolina Notice to Beneficiaries of being Named in Will manually or an editing software program. Print it out and reuse the template many times. Do more for less with US Legal Forms!

North Carolina Will Form Form popularity

Nc Will Form Blank Other Form Names

Nc Beneficiaries Will FAQ

What are my rights as a beneficiary?A beneficiary is entitled to be told if they are named in a person's will. They are also entitled to be told what, if any, property/possessions have been left to them, and the full amount of inheritance they will receive.

As Executor, you should notify beneficiaries of the estate within three months after the Will has been filed in Probate Court. For beneficiaries of assets that are not included in the will (and therefore do not pass through Probate) there are no specific notification requirements.

Beneficiaries of a will must be notified after the will is accepted for probate. 3feff Moreover, probated wills are automatically placed in the public record. If the will is structured to avoid probate, there are no specific notification requirements. 4feff This is relatively rare.

The person named as the Executor in the Will (or the Administrator if there is no Will) is responsible for contacting all of the Beneficiaries. This person should promptly notify everyone who has an interest in the Estate, advising what their entitlement is, to avoid any confusion later on in the process.

The person named as the Executor in the Will (or the Administrator if there is no Will) is responsible for contacting all of the Beneficiaries. This person should promptly notify everyone who has an interest in the Estate, advising what their entitlement is, to avoid any confusion later on in the process.

All taxes and liabilities paid from the estate, including medical expenses, attorney fees, burial or cremation expenses, estate sale costs, appraisal expenses, and more. The executor should keep all receipts for any services or transactions needed to liquidate the assets of the deceased.

Call the probate court to obtain the name and phone number of the executor, if you cannot obtain it from family members. Ask the executor of the will whether you are a beneficiary in your relative's will. Ask for a copy of the will so you can verify the information he provided.