North Carolina Estate Planning Questionnaire and Worksheets

Description

How to fill out North Carolina Estate Planning Questionnaire And Worksheets?

Avoid pricey lawyers and find the North Carolina Estate Planning Questionnaire and Worksheets you want at a affordable price on the US Legal Forms site. Use our simple groups function to search for and obtain legal and tax files. Read their descriptions and preview them prior to downloading. In addition, US Legal Forms provides users with step-by-step instructions on how to obtain and complete each and every template.

US Legal Forms clients basically must log in and get the specific document they need to their My Forms tab. Those, who haven’t obtained a subscription yet should stick to the guidelines listed below:

- Make sure the North Carolina Estate Planning Questionnaire and Worksheets is eligible for use where you live.

- If available, read the description and use the Preview option just before downloading the sample.

- If you’re sure the document suits you, click on Buy Now.

- If the template is incorrect, use the search engine to get the right one.

- Next, create your account and select a subscription plan.

- Pay by card or PayPal.

- Choose to download the form in PDF or DOCX.

- Just click Download and find your form in the My Forms tab. Feel free to save the form to the gadget or print it out.

Right after downloading, you are able to complete the North Carolina Estate Planning Questionnaire and Worksheets by hand or an editing software. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

A Last Will and Testament. When it comes to estate planning, having a last will and testament is likely the first thing that will come to mind. A Document Granting Power of Attorney. An Advance Medical Directive. Revocable Living Trust.

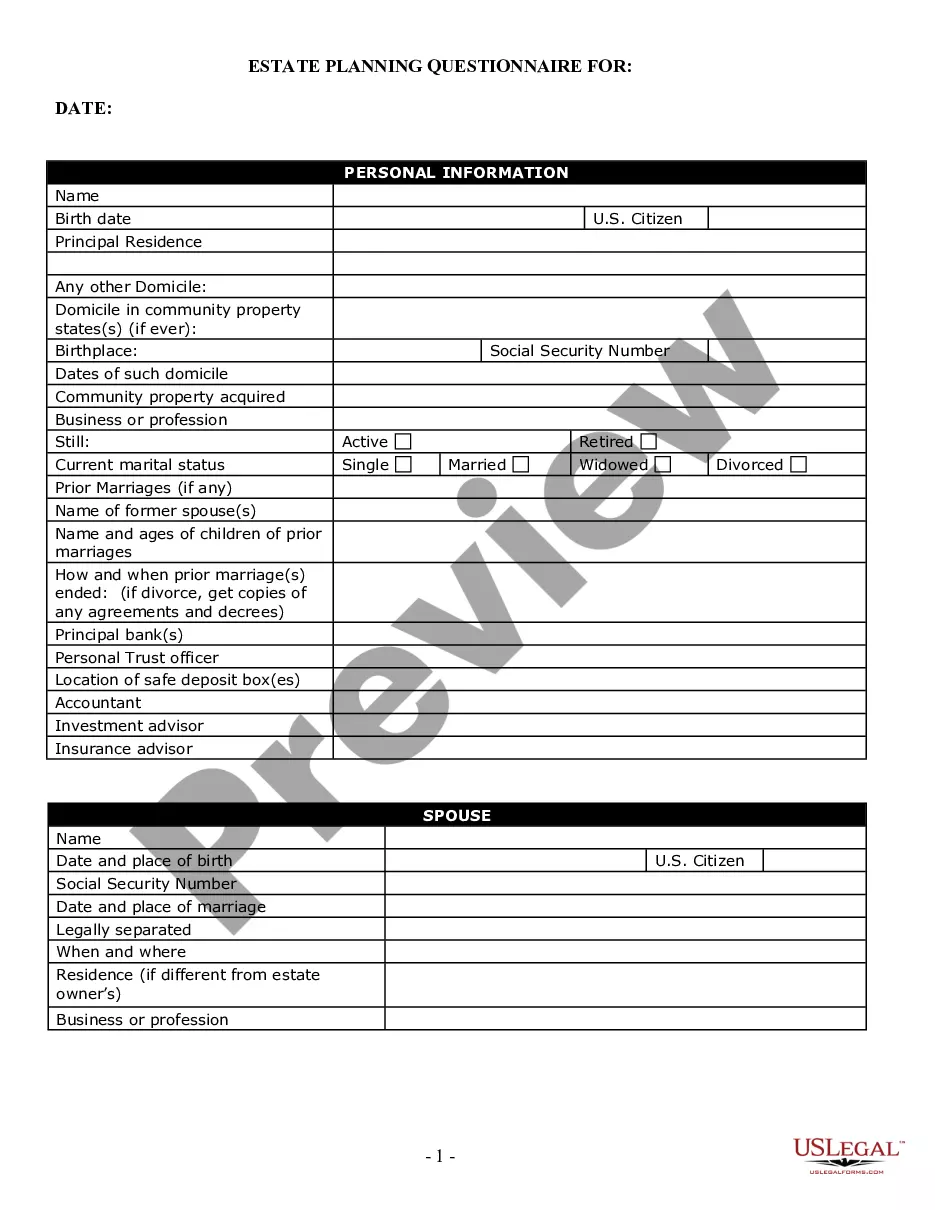

The attached Estate Planning Questionnaire is designed to help you organize your personal and financial information, to help us effectively assess your goals and circumstances, and to enable us to recommend an estate plan that will work for you and your family.

Creating an estate plan is a lot like getting into better shape. Step 1: Sign a will. Step 2: Name beneficiaries. Step 3: Dodge estate taxes. Step 4: Leave a letter. Step 5: Draw up a durable power of attorney. Step 6: Create an advance health care directive.

A Last Will and Testament. When it comes to estate planning, having a last will and testament is likely the first thing that will come to mind. A Document Granting Power of Attorney. An Advance Medical Directive. Revocable Living Trust.

The attached Estate Planning Questionnaire is designed to help you organize your personal and financial information, to help us effectively assess your goals and circumstances, and to enable us to recommend an estate plan that will work for you and your family.

More Than a Last Will. Itemize Your Inventory. Follow with Non-Physical Assets. Assemble a List of Debts. Make a Memberships List. Make Copies of Your Lists. Review Your Retirement Account. Update Your Insurance.

Bank accounts. Brokerage or investment accounts. Retirement accounts and pension plans. A life insurance policy.