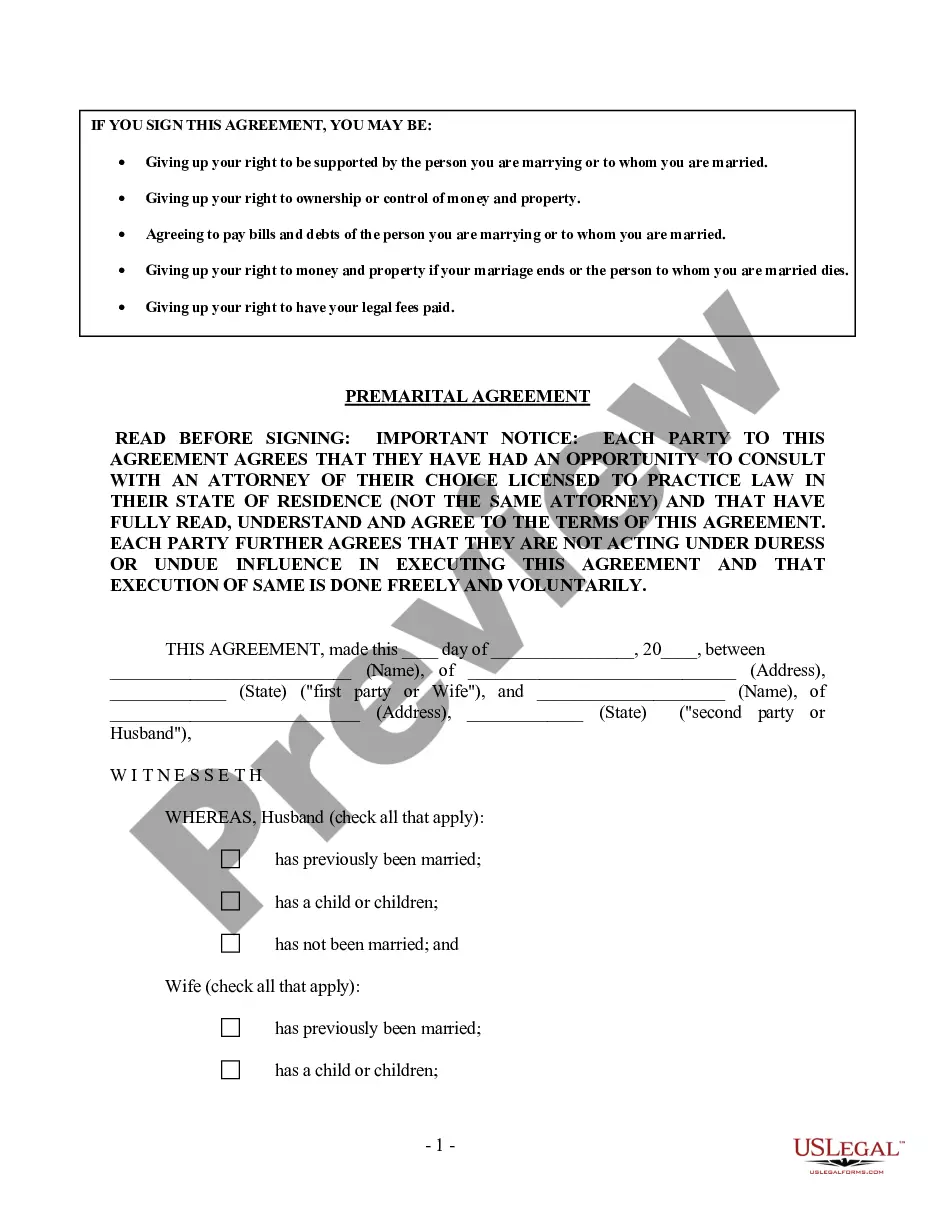

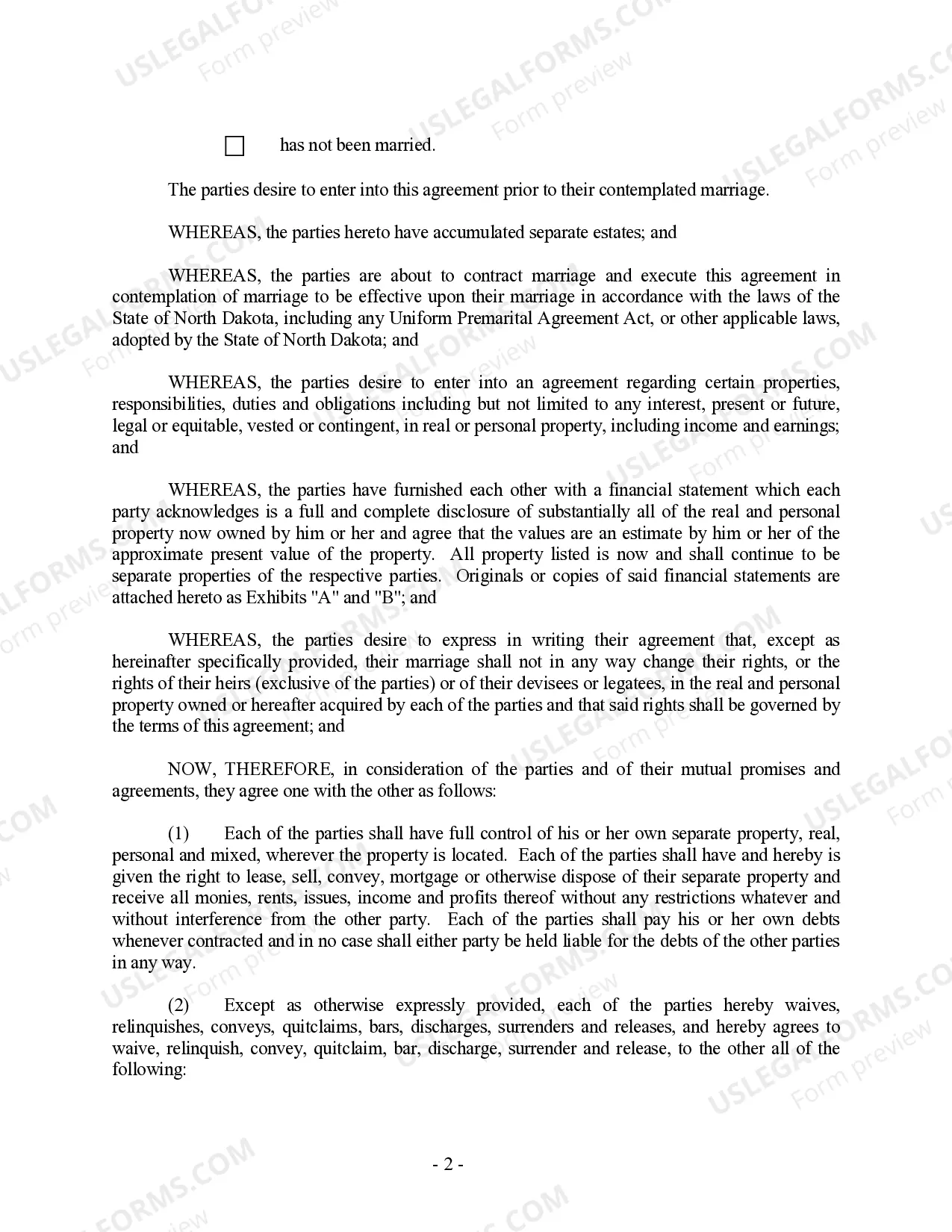

This Prenuptial Premarital Agreement with Financial Statements form package contains a premarital agreement and financial statements for your state. The agreement can be used by persons who have been previously married, or by persons who have never been married. It includes provisions regarding the contemplated marriage, assets and debts disclosure and property rights after the marriage. The agreement describes the rights, duties and obligations of prospective parties during and upon termination of marriage through death or divorce. These contracts are often used by individuals who want to ensure the proper and organized disposition of their assets in the event of death or divorce. Among the benefits that prenuptial agreements provide are avoidance of costly litigation, protection of family and/or business assets, protection against creditors and assurance that the marital property will be disposed of properly.

North Dakota Prenuptial Premarital Agreement with Financial Statements

Description

How to fill out North Dakota Prenuptial Premarital Agreement With Financial Statements?

Avoid expensive attorneys and find the North Dakota Prenuptial Premarital Agreement with Financial Statements you need at a affordable price on the US Legal Forms site. Use our simple groups functionality to find and obtain legal and tax files. Read their descriptions and preview them just before downloading. Moreover, US Legal Forms provides customers with step-by-step tips on how to download and complete every single template.

US Legal Forms clients merely need to log in and get the particular form they need to their My Forms tab. Those, who have not obtained a subscription yet need to follow the tips below:

- Ensure the North Dakota Prenuptial Premarital Agreement with Financial Statements is eligible for use where you live.

- If available, look through the description and use the Preview option just before downloading the sample.

- If you are sure the document fits your needs, click Buy Now.

- If the form is wrong, use the search engine to get the right one.

- Next, create your account and select a subscription plan.

- Pay by credit card or PayPal.

- Select download the document in PDF or DOCX.

- Just click Download and find your form in the My Forms tab. Feel free to save the template to your device or print it out.

Right after downloading, you can fill out the North Dakota Prenuptial Premarital Agreement with Financial Statements manually or an editing software. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Form popularity

FAQ

The three most common grounds for nullifying a prenup are unconscionability, failure to disclose, or duress and coercion.Duress and coercion can also invalidate a prenup. If the prenup was signed the day before your wedding, it may appear that the parties didn't have much time to fully review the agreement.

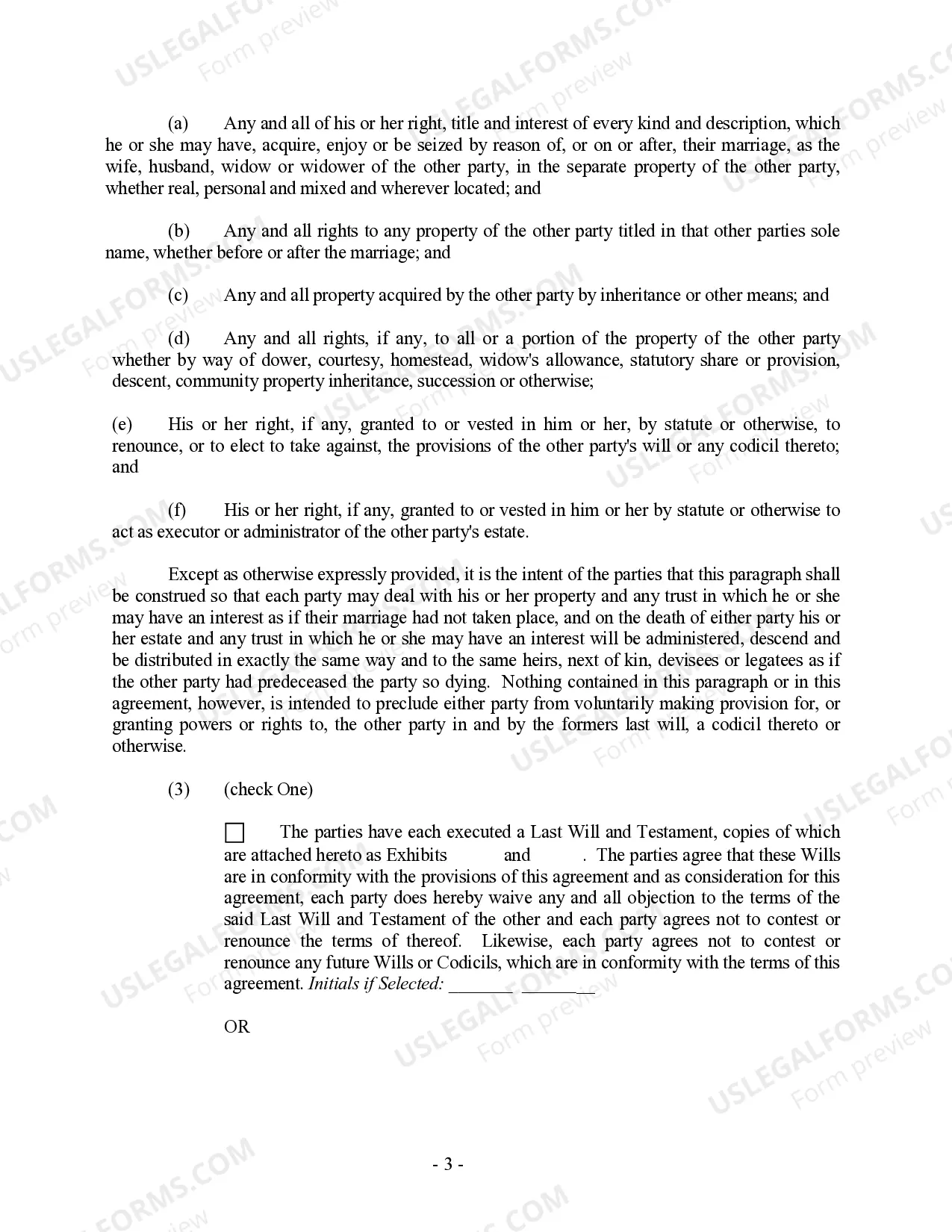

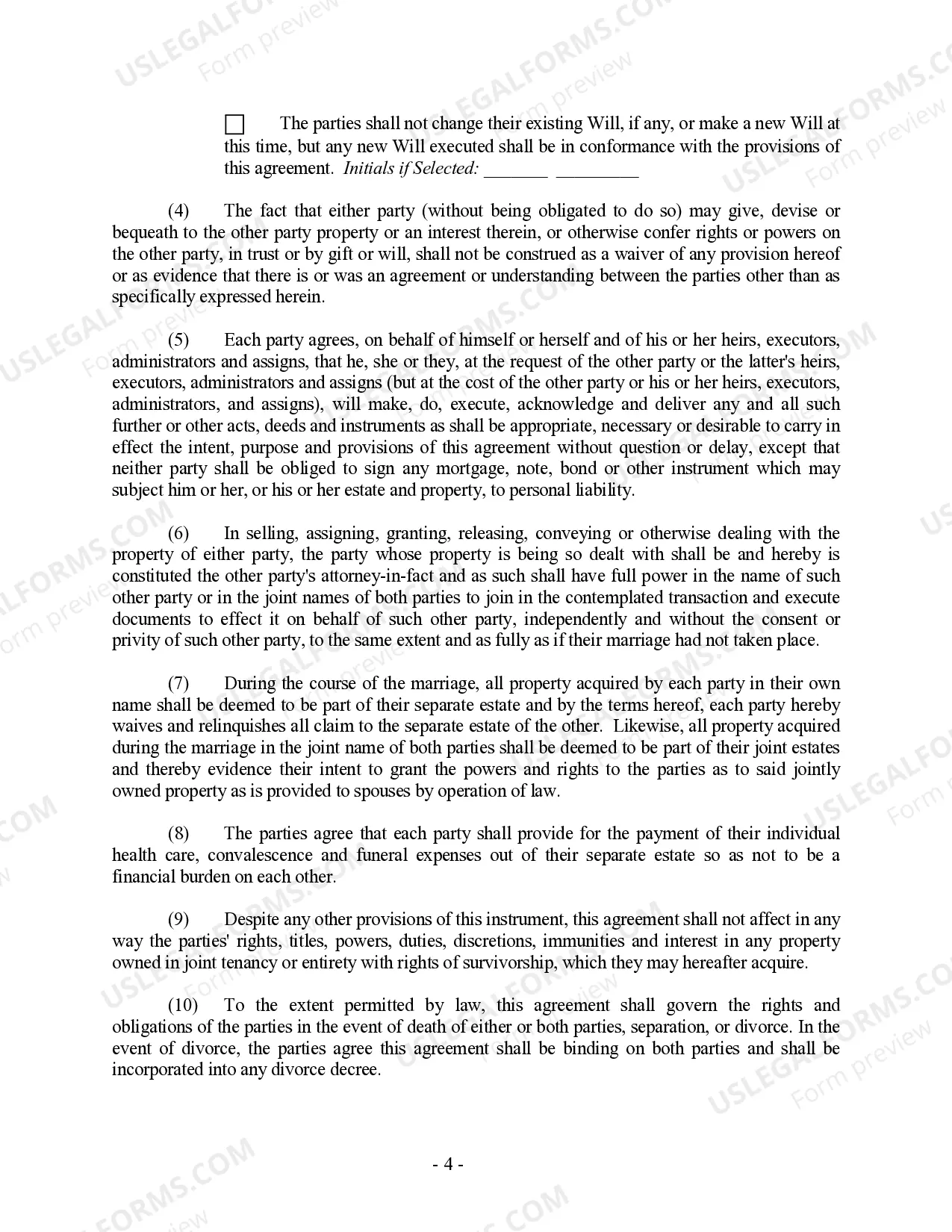

In the event of divorce, a prenup can protect a spouse from being liable for any debt the other spouse brought into the marriage.A prenup can also protect any income or assets you earn during the marriage, as well as unearned income from a bequest or a trust distribution.

One formality that many do not realize the importance of is a full and fair disclosure of assets and debts prior to the prenuptial agreement being signed. In other words, both parties are supposed to disclosure all the assets and debts that they are bringing into the marriage.

In common law states, debt taken on after marriage is usually treated as being separate and belonging only to the spouse that incurred them. The exception is those debts that are in the spouse's name only but benefit both partners.

2. Prenups make you think less of your spouse. And at their root, prenups show a lack of commitment to the marriage and a lack of faith in the partnership.Ironically, the marriage becomes more concerned with money after a prenup than it would have been without the prenup.

Just as a future asset can be protected by a prenup if adequately described, future income can also be treated as belonging to one partner but not both.

Prenuptial agreements:Can reaffirm that premarital debts are separate, establish that debts incurred after the marriage are separate and specify whose income will pay for specific debts.

Prenuptial agreements can also protect each party from being responsible for any debts that existed prior to the marriage. Without an agreement, these debts can become marital property in some states if there's nothing that defines them otherwise.

Typically a prenuptial agreement can cover the following: Each spouse's right to separate and marital property. Each spouse's right to buy, sell, transfer, spend, or manage property and assets during the marriage. Each spouse's entitlement to spousal support.