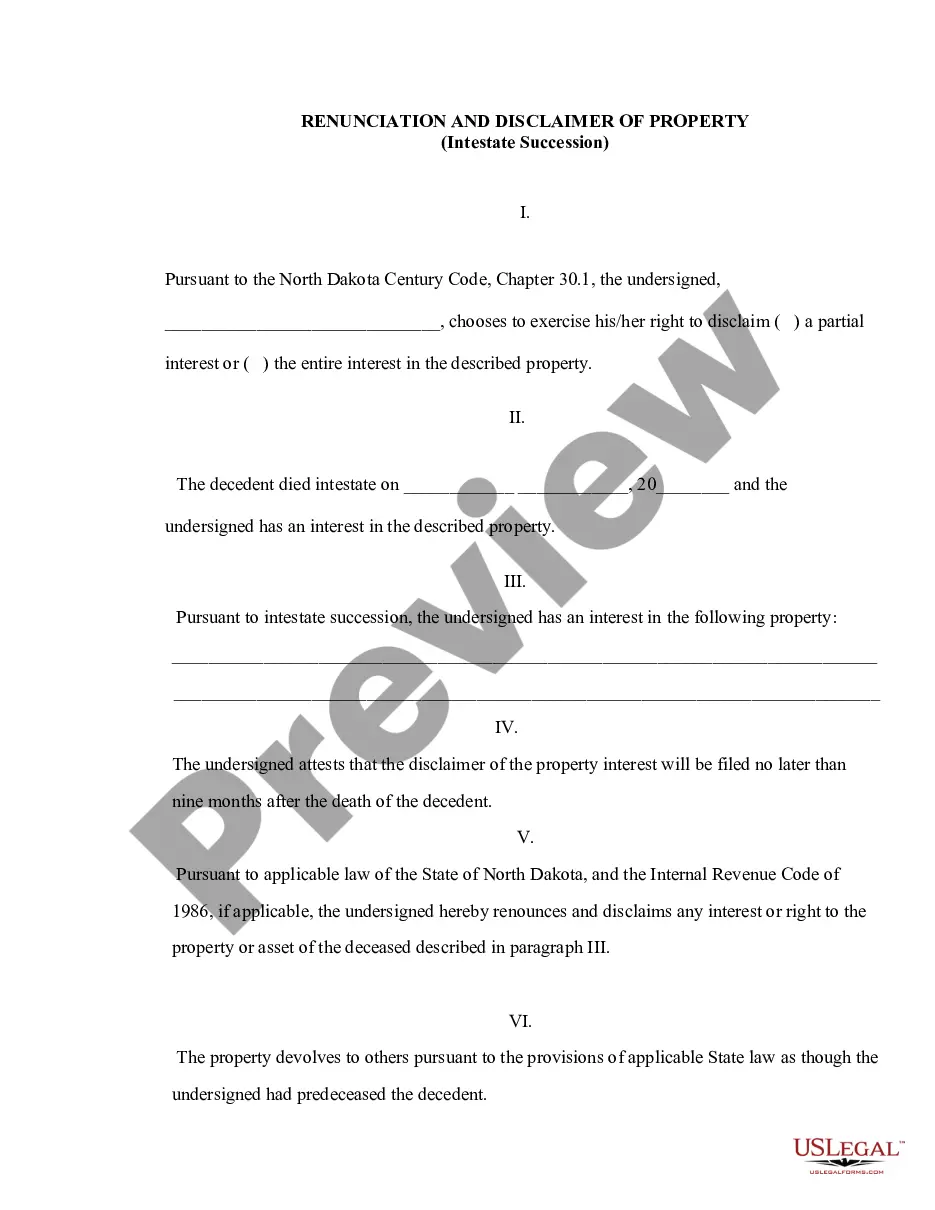

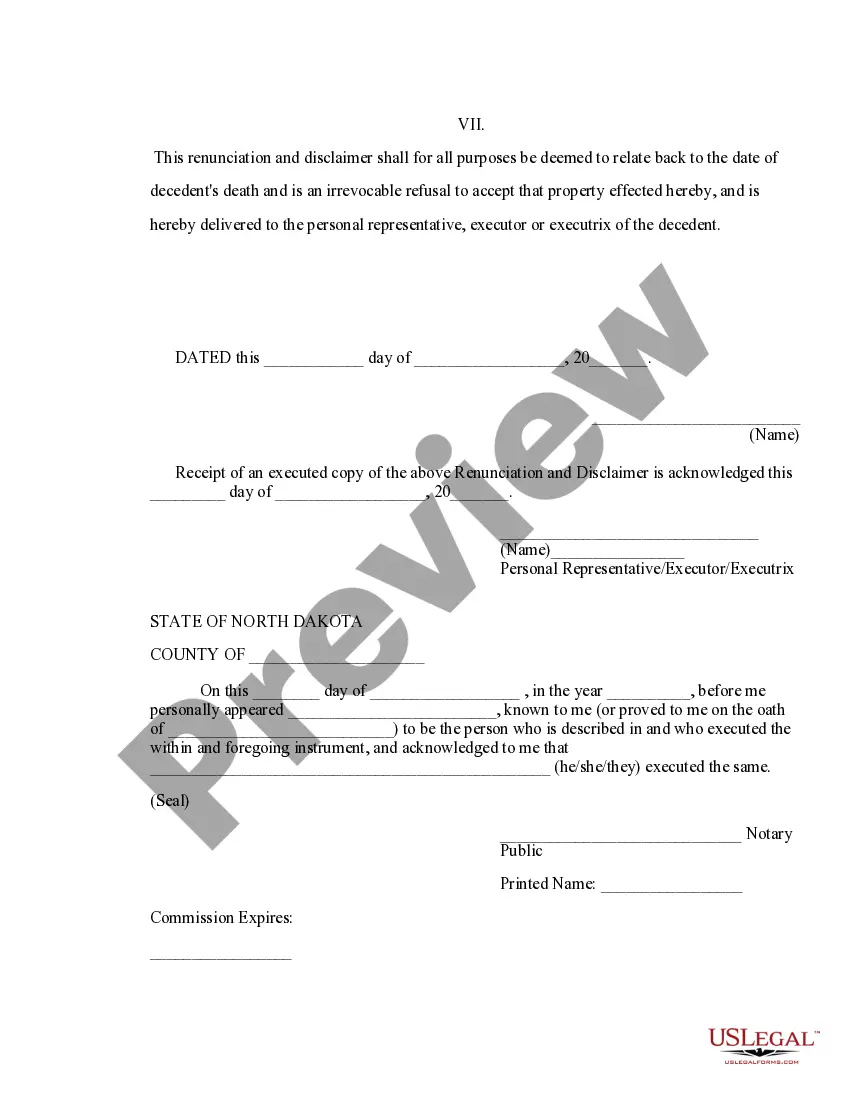

This form is a Renunciation and Disclaimer of Property acquired by Intestate Succession where the decedent died intestate and the beneficiary gained an interest in the property upon the death of the decedent, but, wishes to disclaim a portion of or the entire interest in the property pursuant to the North Dakota Century Code, Chapter 30.1. Therefore, the property will devolve to others as though the beneficiary predeceased the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery of the document.

North Dakota Renunciation And Disclaimer of Property received by Intestate Succession

Description Nd Disclaimer Document

How to fill out Nd Property Intestate?

Avoid pricey lawyers and find the North Dakota Renunciation And Disclaimer of Property received by Intestate Succession you need at a affordable price on the US Legal Forms website. Use our simple categories functionality to search for and download legal and tax documents. Read their descriptions and preview them well before downloading. In addition, US Legal Forms provides users with step-by-step tips on how to download and fill out each template.

US Legal Forms clients simply have to log in and download the particular document they need to their My Forms tab. Those, who haven’t obtained a subscription yet should stick to the tips listed below:

- Ensure the North Dakota Renunciation And Disclaimer of Property received by Intestate Succession is eligible for use where you live.

- If available, look through the description and use the Preview option prior to downloading the sample.

- If you’re confident the template suits you, click Buy Now.

- In case the template is wrong, use the search field to find the right one.

- Next, create your account and choose a subscription plan.

- Pay by card or PayPal.

- Choose to obtain the document in PDF or DOCX.

- Click Download and find your form in the My Forms tab. Feel free to save the template to your device or print it out.

Right after downloading, you may fill out the North Dakota Renunciation And Disclaimer of Property received by Intestate Succession by hand or with the help of an editing software. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Nd Succession Blank Form popularity

Renunciation Disclaimer Succession Other Form Names

North Dakota Renunciation FAQ

The laws are different in every state, but if you're married and die without a will, your estate will probably go to your spouse if you both own it.If he passes away without a will, the law says his surviving spouse will inherit the first $50,000 of his personal assets (not any shared assets) plus half the balance.

Children - if there is no surviving married or civil partnerIf there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

Who Gets What: The Basic Rules of Intestate Succession.Generally, only spouses, registered domestic partners, and blood relatives inherit under intestate succession laws; unmarried partners, friends, and charities get nothing. If the deceased person was married, the surviving spouse usually gets the largest share.

Children - if there is no surviving married or civil partner If there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

4. Siblings If the person who died had no living spouse, civil partner, children or parents, then their siblings are their next of kin.

If one dies, the other partner will automatically inherit the whole of the money. Property and money that the surviving partner inherits does not count as part of the estate of the person who has died when it is being valued for the intestacy rules.

In North Dakota, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Who Inherits When There's No Will? Intestate succession laws determine how to distribute assets among them when no will is in place. This varies between states. Generally, a spouse receives most of the assets and property, followed by children, parents, grandparents, and other blood relatives of the deceased.

Many married couples own most of their assets jointly with the right of survivorship. When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will.