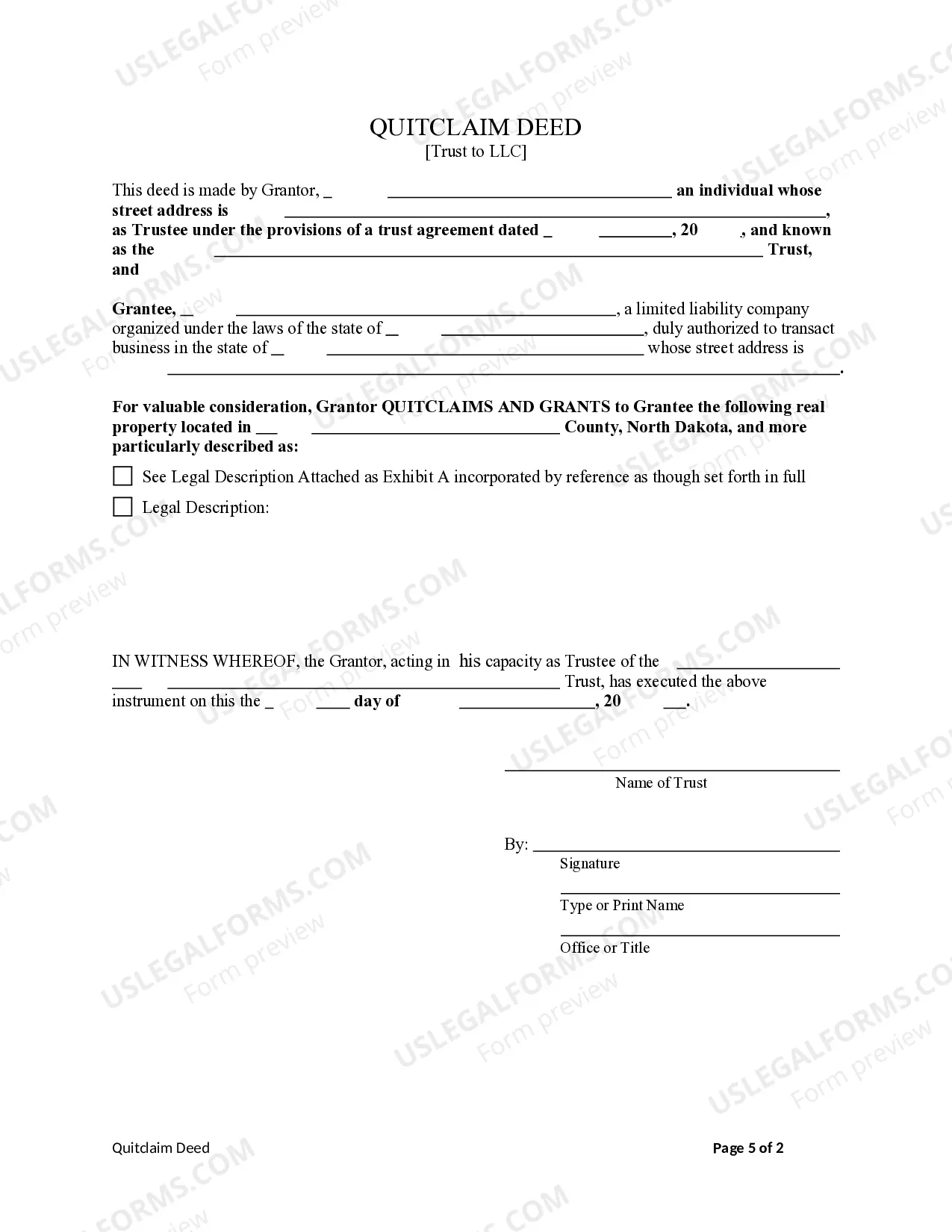

This form is a Quitclaim Deed where the Grantor is a trust and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

North Dakota Quitclaim Deed from Trust to Limited Liability Company.

Description

How to fill out North Dakota Quitclaim Deed From Trust To Limited Liability Company.?

Avoid expensive attorneys and find the North Dakota Quitclaim Deed from Trust to Limited Liability Company. you want at a affordable price on the US Legal Forms website. Use our simple categories functionality to find and obtain legal and tax files. Read their descriptions and preview them well before downloading. Additionally, US Legal Forms provides customers with step-by-step tips on how to obtain and complete each form.

US Legal Forms subscribers basically need to log in and obtain the particular form they need to their My Forms tab. Those, who have not got a subscription yet should follow the tips listed below:

- Ensure the North Dakota Quitclaim Deed from Trust to Limited Liability Company. is eligible for use in your state.

- If available, read the description and make use of the Preview option prior to downloading the sample.

- If you’re confident the document fits your needs, click on Buy Now.

- In case the form is wrong, use the search engine to find the right one.

- Next, create your account and choose a subscription plan.

- Pay out by card or PayPal.

- Choose to download the document in PDF or DOCX.

- Simply click Download and find your form in the My Forms tab. Feel free to save the form to your gadget or print it out.

After downloading, you are able to fill out the North Dakota Quitclaim Deed from Trust to Limited Liability Company. by hand or by using an editing software. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

It is a legal document, hence should be short and precise. The letter must be addressed to the concerned authority. The letter must contain all the required details. You must mention your contact details for any queries or doubts.

When you're ready to transfer trust real estate to the beneficiary who is named in the trust document to receive it, you'll need to prepare, sign, and record a deed. That's the document that transfers title to the property from you, the trustee, to the new owner.

How to Quitclaim Deed to LLC. A quitclaim deed to LLC is actually a very simple process. You will need a deed form and a copy of the existing deed to make sure you identify titles properly and get the legal description of the property.

A quitclaim deed can be used to transfer property from a trust, but a Special Warranty Deed seems to be a more common way to do this.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

However, there are substantial downsides associated with transferring your primary home into an LLC.If you are using your personal residence for estate planning purposes, a qualified personal residence trust (QPRT) may be more effective than transferring your property to a limited liability company.

Yes, a quit claim deed supercedes the trust. The only thing that can be done is to file a suit in court challenging the deed as the product of fraud and undue influence. A court action like that will cost thousands of dollars, but might be worth it if the house was owned free and clear.