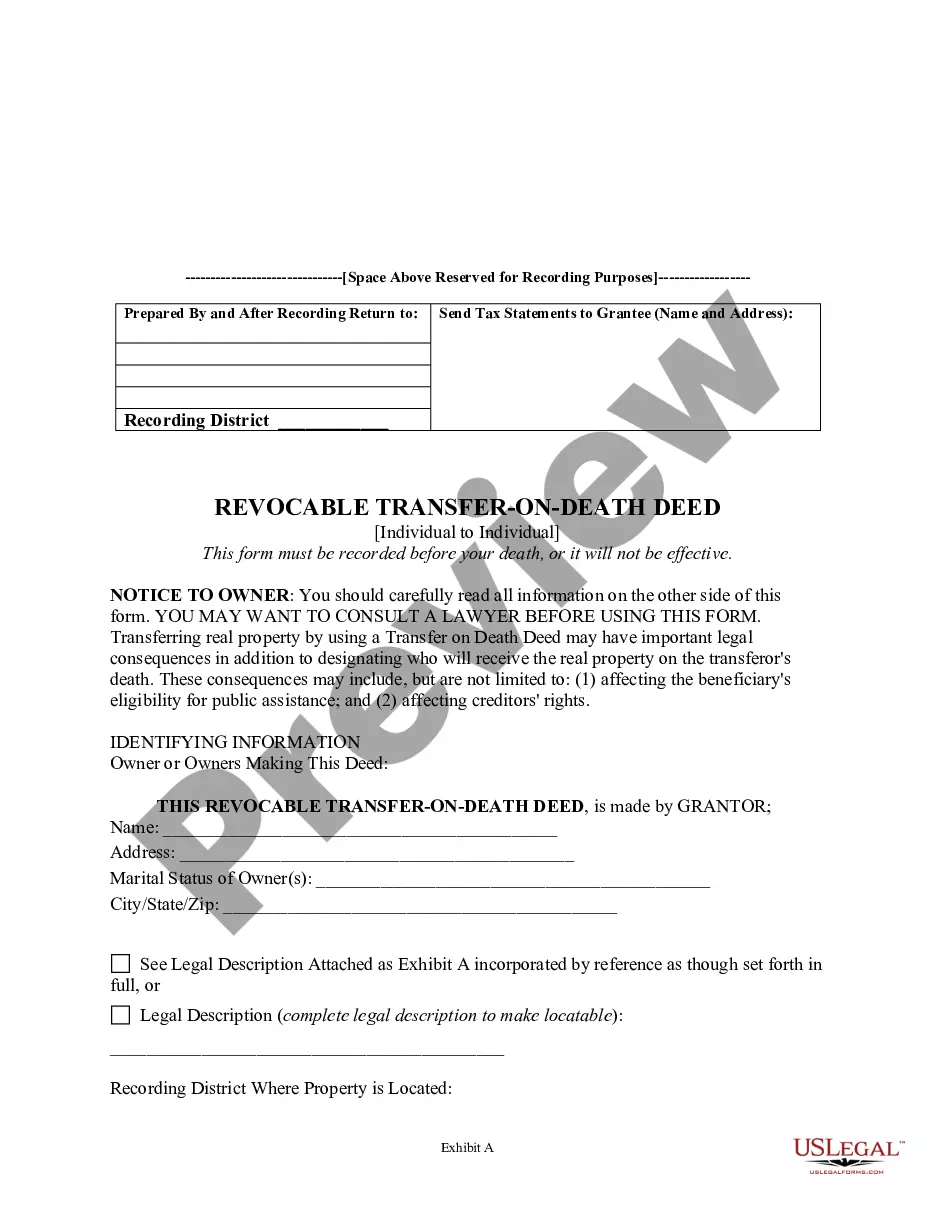

North Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife / Two Individuals to Individual

Description North Dakota Transfer On Death Deed

How to fill out Nd Death Deed?

Avoid expensive attorneys and find the North Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife / Two Individuals to Individual you want at a affordable price on the US Legal Forms site. Use our simple groups function to look for and download legal and tax documents. Go through their descriptions and preview them well before downloading. Moreover, US Legal Forms enables customers with step-by-step tips on how to obtain and complete every form.

US Legal Forms subscribers merely must log in and get the specific document they need to their My Forms tab. Those, who have not obtained a subscription yet must follow the tips below:

- Ensure the North Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife / Two Individuals to Individual is eligible for use in your state.

- If available, read the description and use the Preview option prior to downloading the templates.

- If you’re sure the template is right for you, click Buy Now.

- If the form is wrong, use the search engine to get the right one.

- Next, create your account and select a subscription plan.

- Pay out by card or PayPal.

- Select download the document in PDF or DOCX.

- Simply click Download and find your template in the My Forms tab. Feel free to save the form to your device or print it out.

After downloading, you can fill out the North Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife / Two Individuals to Individual manually or an editing software. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Transfer Deed Tod Form popularity

Transfer On Death Deed North Dakota Other Form Names

North Dakota Transfer Death Deed Form FAQ

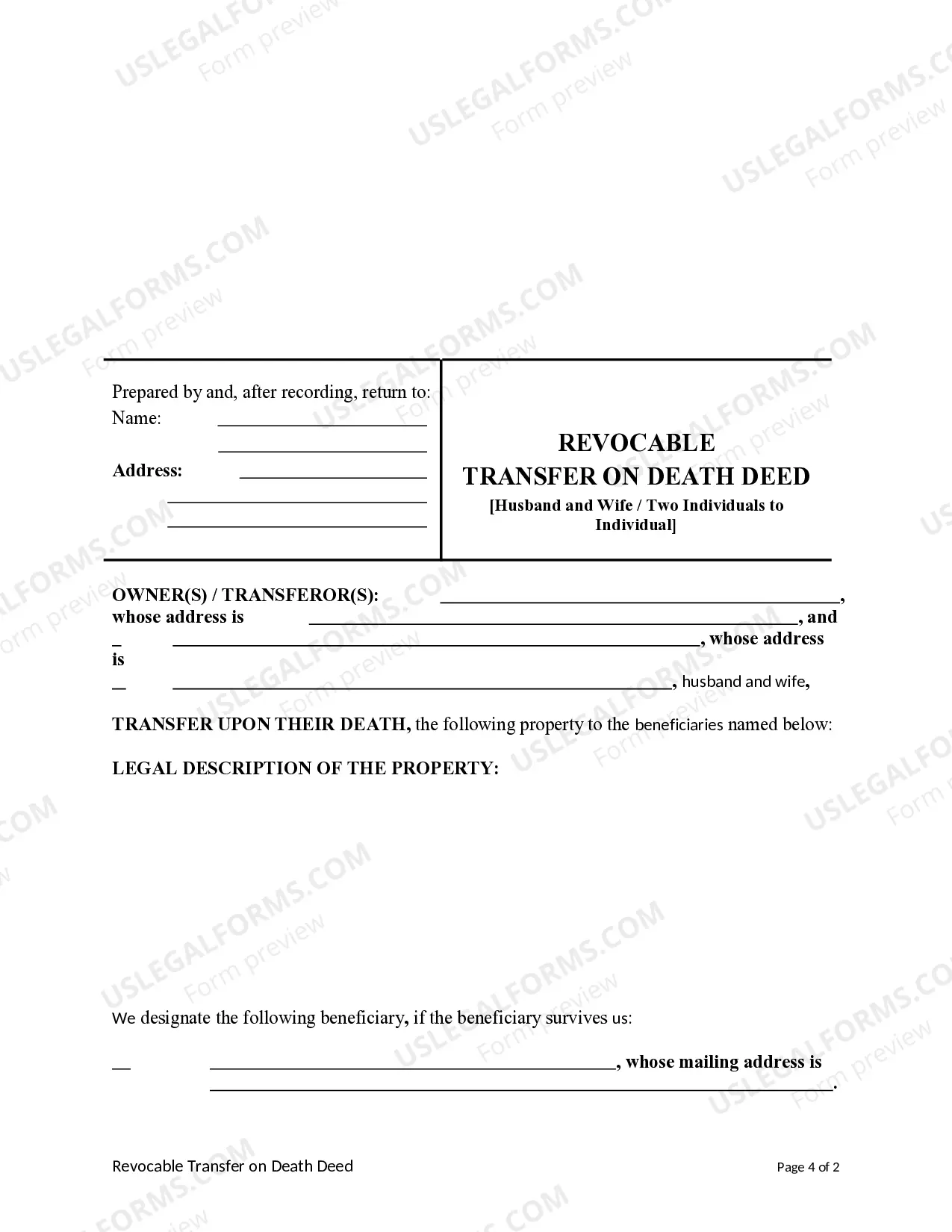

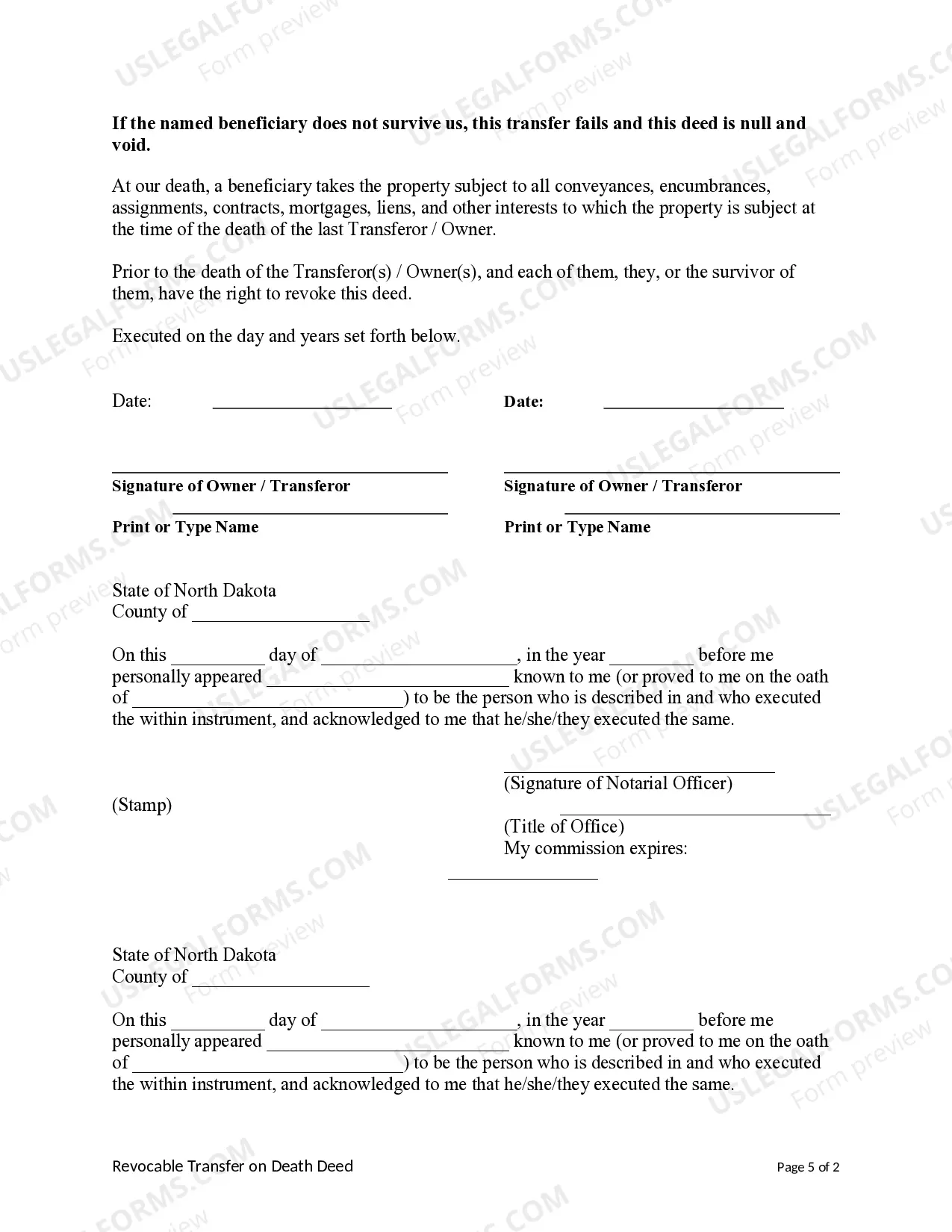

In most cases, the surviving owner or heir obtains the title to the home, the former owner's death certificate, a notarized affidavit of death, and a preliminary change of ownership report form. When all these are gathered, the transfer gets recorded, the fees are paid, and the county issues a new title deed.

In most cases, the surviving owner or heir obtains the title to the home, the former owner's death certificate, a notarized affidavit of death, and a preliminary change of ownership report form. When all these are gathered, the transfer gets recorded, the fees are paid, and the county issues a new title deed.

All you need to do is fill out a simple form, provided by the bank, naming the person you want to inherit the money in the account at your death. As long as you are alive, the person you named to inherit the money in a payable-on-death (POD) account has no rights to it.

Transfer on death applies to certain assets that have a named beneficiary. The beneficiaries (or a spouse) receive the assets without having to go through probate. Beneficiaries of the TOD don't have access to the assets prior to the owner's death.

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.

Get a Deed Form or Prepare Your Own. You can buy a state-specific TOD deed form for your state or type up your own document. Name the Beneficiary. Describe the Property. Sign the Deed. Record the Deed.

To transfer it, you will have to get a succession certificate (for moveable property) and a letter of administration (for Immoveable property). While doing so, get the son and daughter to give no objections in court that they have no objection if all the property is transferred to the widow.

The California TOD deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.