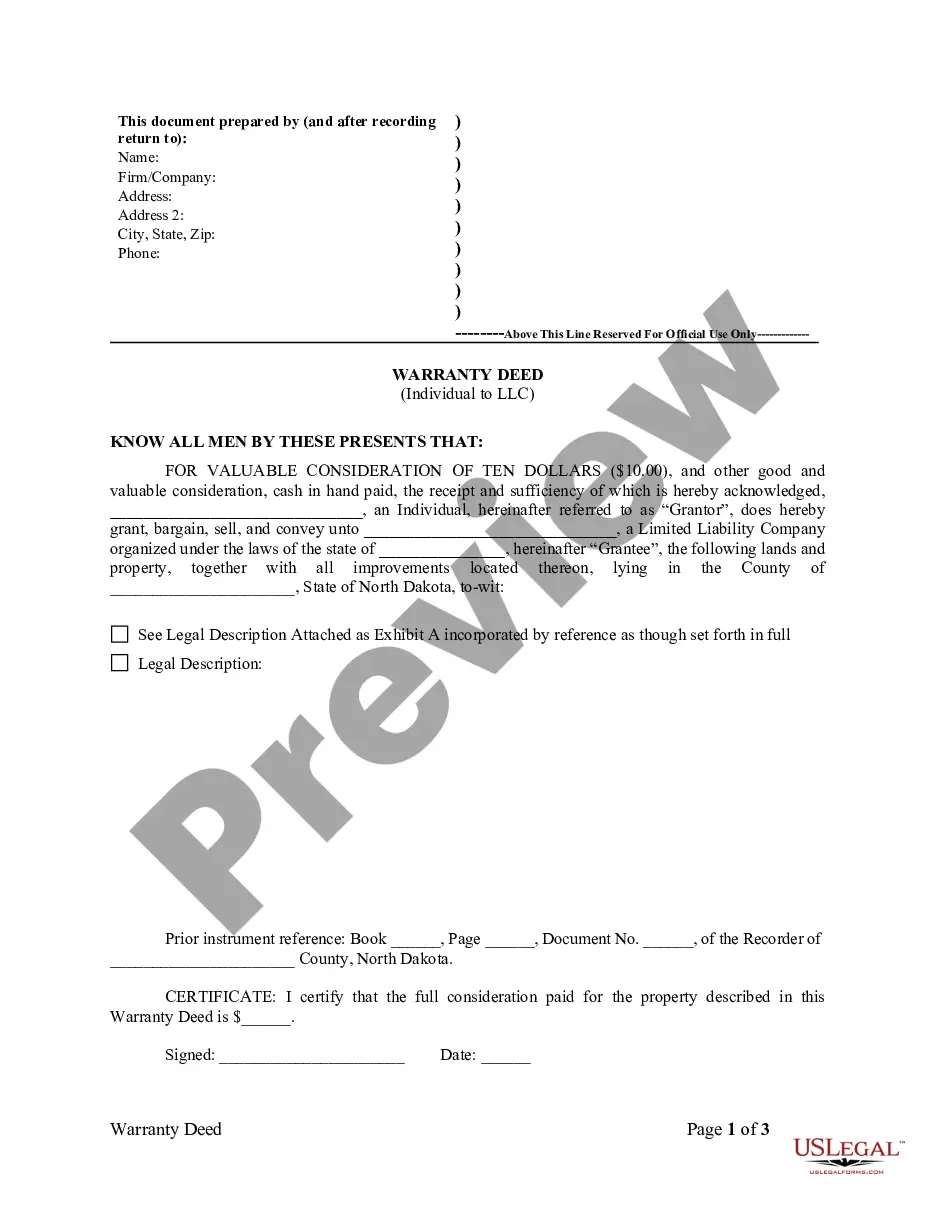

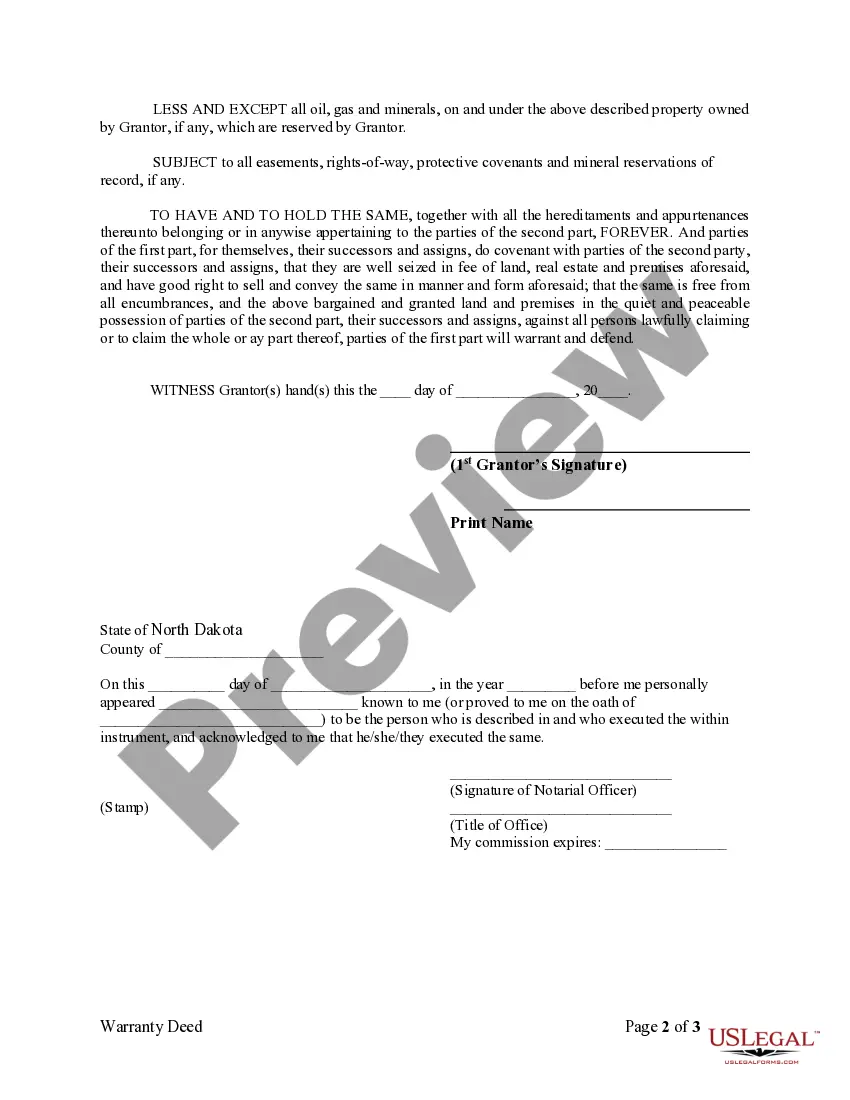

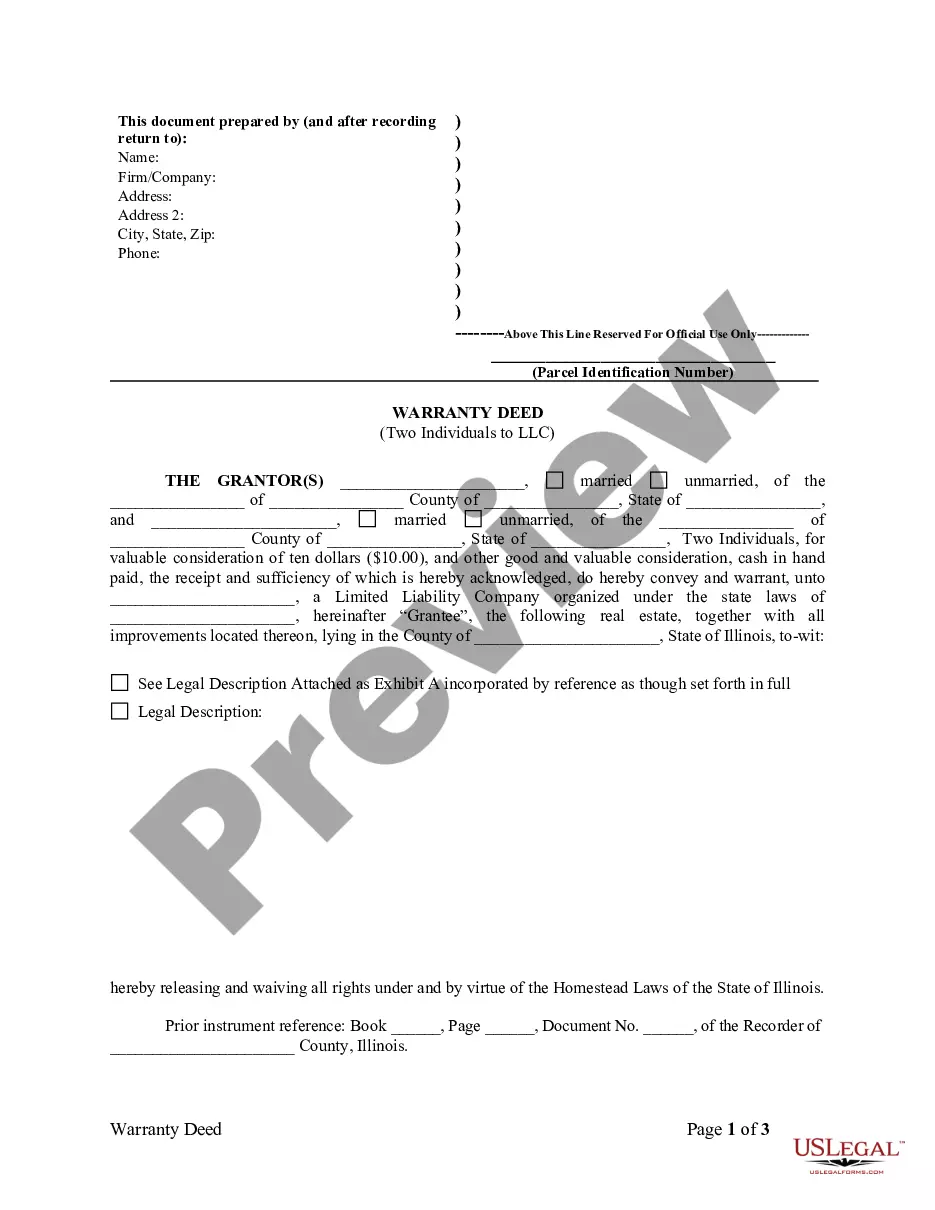

This Warranty Deed from Individual to LLC form is a Warranty Deed where the grantor is an individual and the grantee is a limited liability company. Grantor conveys and warrants the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

North Dakota Warranty Deed from Individual to LLC

Description Llc Limited Liability

How to fill out North Dakota Warranty Deed Form?

Avoid expensive lawyers and find the North Dakota Warranty Deed from Individual to LLC you want at a reasonable price on the US Legal Forms website. Use our simple categories functionality to look for and obtain legal and tax documents. Read their descriptions and preview them well before downloading. In addition, US Legal Forms provides users with step-by-step tips on how to obtain and fill out every single form.

US Legal Forms customers simply need to log in and obtain the particular form they need to their My Forms tab. Those, who haven’t got a subscription yet need to stick to the guidelines listed below:

- Make sure the North Dakota Warranty Deed from Individual to LLC is eligible for use where you live.

- If available, read the description and make use of the Preview option just before downloading the templates.

- If you’re sure the template is right for you, click Buy Now.

- In case the template is wrong, use the search engine to find the right one.

- Next, create your account and select a subscription plan.

- Pay out by credit card or PayPal.

- Select download the form in PDF or DOCX.

- Just click Download and find your template in the My Forms tab. Feel free to save the template to the device or print it out.

After downloading, you may fill out the North Dakota Warranty Deed from Individual to LLC by hand or with the help of an editing software program. Print it out and reuse the form many times. Do more for less with US Legal Forms!

Deed Individual Limited Form popularity

Nd Llc Other Form Names

Limited Liability Company Document FAQ

North Dakota Secretary of State - 1-800-352-0867. The Green Book - North Dakota new business registration forms. Choosing Your Business Name - choosing a business name is an important step in the business planning process.

Choose a Name for Your LLC. Under North Dakota law, an LLC name must contain the words "Limited Liability Company" or one the abbreviations: "L.L.C." or "LLC." Appoint a Registered Agent. File Articles of Organization. Prepare an Operating Agreement. Obtain an EIN. File Annual Reports.

North Dakota Secretary of State - 1-800-352-0867. The Green Book - North Dakota new business registration forms. Choosing Your Business Name - choosing a business name is an important step in the business planning process.

No, you do not need an attorney to form an LLC. You can prepare the legal paperwork and file it yourself, or use a professional business formation service, such as .In all states, only one person is needed to form an LLC.

When you form a corporation or LLC, you need to pay a one-time filing fee to the state's secretary of state office. Arkansas, Colorado, Hawaii, Iowa, Oklahoma and Mississippi all boast the lowest corporation formation fee at $50. It costs $310 to incorporate in Texas.

An LLC's simple and adaptable business structure is perfect for many small businesses. While both corporations and LLCs offer their owners limited personal liability, owners of an LLC can also take advantage of LLC tax benefits, management flexibility and minimal recordkeeping and reporting requirements.

LLCs aren't required to have income or post profits, but if a business owner is claiming tax deductions through an LCC without reporting income, the IRS is likely to conduct an audit to determine if the LLC is an actual for-profit business.

Corporations offer more flexibility when it comes to their excess profits. Whereas all income in an LLC flows through to the members, an S corporation is allowed to pass income and losses to its shareholders, who report taxes on an individual tax return at ordinary levels.

STEP 1: Name your North Dakota LLC. STEP 2: Choose a Registered Agent in North Dakota. STEP 3: File the North Dakota LLC Articles of Organization. STEP 4: Create a North Dakota LLC Operating Agreement. STEP 5: Obtain an EIN.