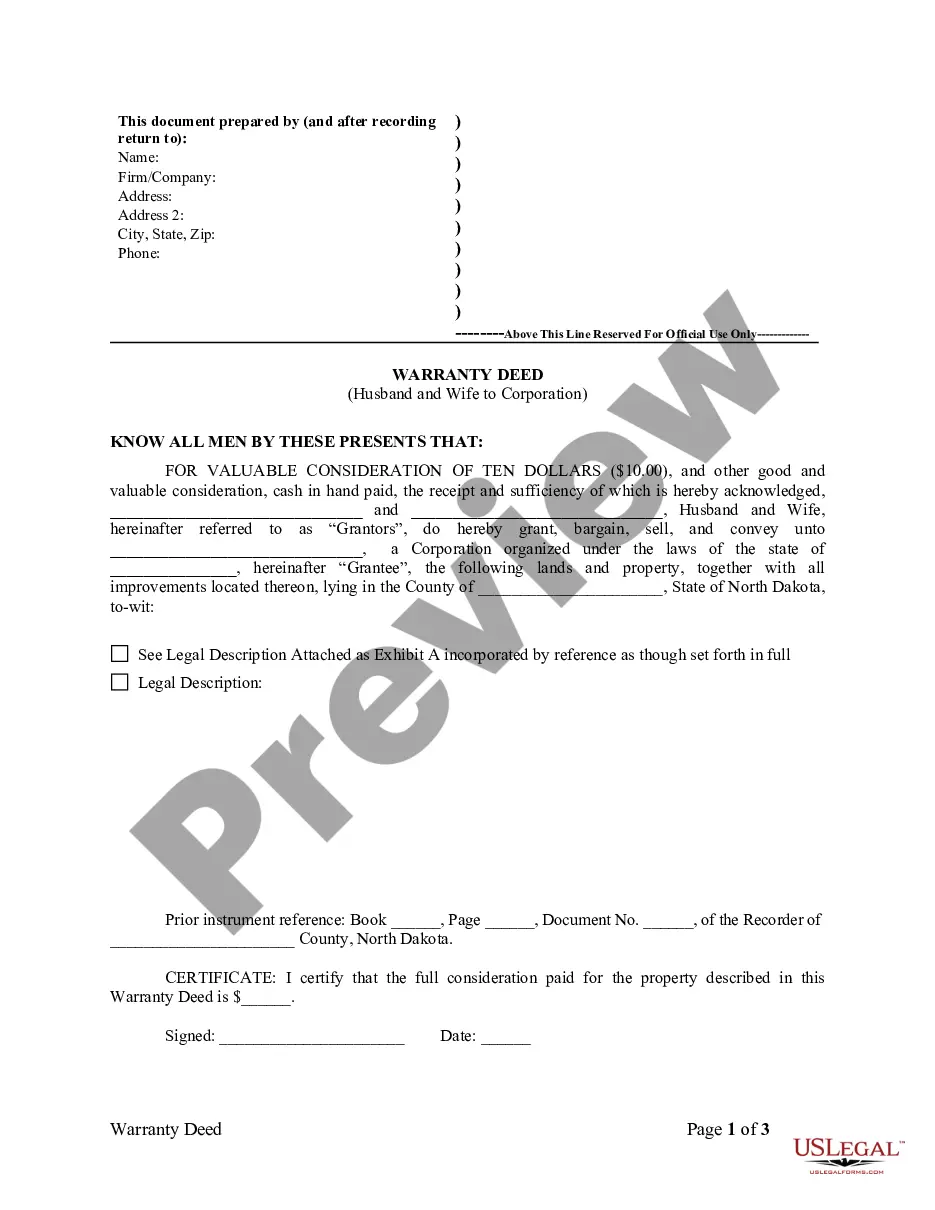

This Warranty Deed from Husband and Wife to Corporation form is a Warranty Deed where the grantors are husband and wife and the grantee is a corporation. Grantors warrant and convey the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

North Dakota Warranty Deed from Husband and Wife to Corporation

Description

How to fill out North Dakota Warranty Deed From Husband And Wife To Corporation?

Avoid pricey lawyers and find the North Dakota Warranty Deed from Husband and Wife to Corporation you want at a reasonable price on the US Legal Forms website. Use our simple categories function to look for and download legal and tax files. Go through their descriptions and preview them before downloading. Moreover, US Legal Forms enables customers with step-by-step instructions on how to download and complete every single form.

US Legal Forms subscribers basically need to log in and download the particular form they need to their My Forms tab. Those, who have not obtained a subscription yet must stick to the tips below:

- Ensure the North Dakota Warranty Deed from Husband and Wife to Corporation is eligible for use where you live.

- If available, read the description and use the Preview option just before downloading the templates.

- If you’re confident the document suits you, click on Buy Now.

- If the template is incorrect, use the search field to find the right one.

- Next, create your account and select a subscription plan.

- Pay out by card or PayPal.

- Select download the form in PDF or DOCX.

- Just click Download and find your form in the My Forms tab. Feel free to save the template to the device or print it out.

After downloading, you can complete the North Dakota Warranty Deed from Husband and Wife to Corporation by hand or with the help of an editing software. Print it out and reuse the form many times. Do more for less with US Legal Forms!

Form popularity

FAQ

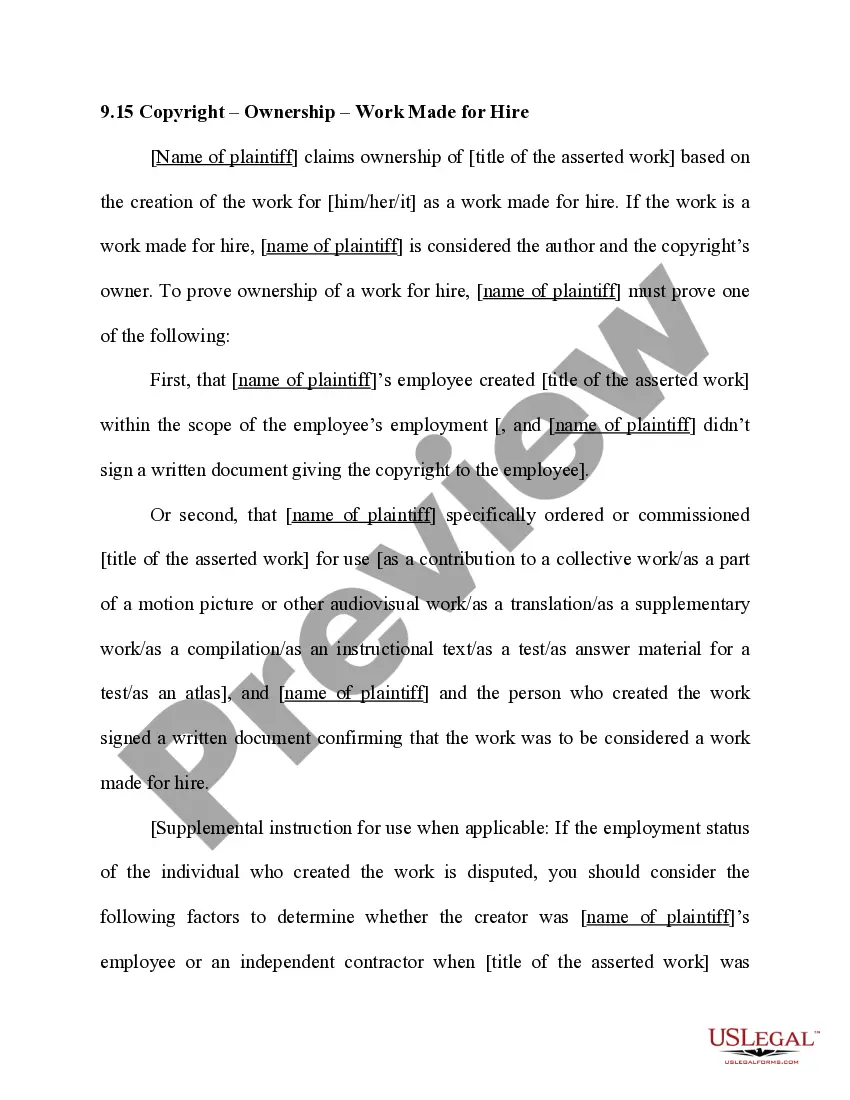

Quitclaim Deeds are used when the transfer of ownership in the property does not occur as the result of a traditional sale.Under a warranty deed, if it turns out that the property is not what the seller promised or there's an uncleared lien or other block to the title, the buyer can sue the seller and recover damages.

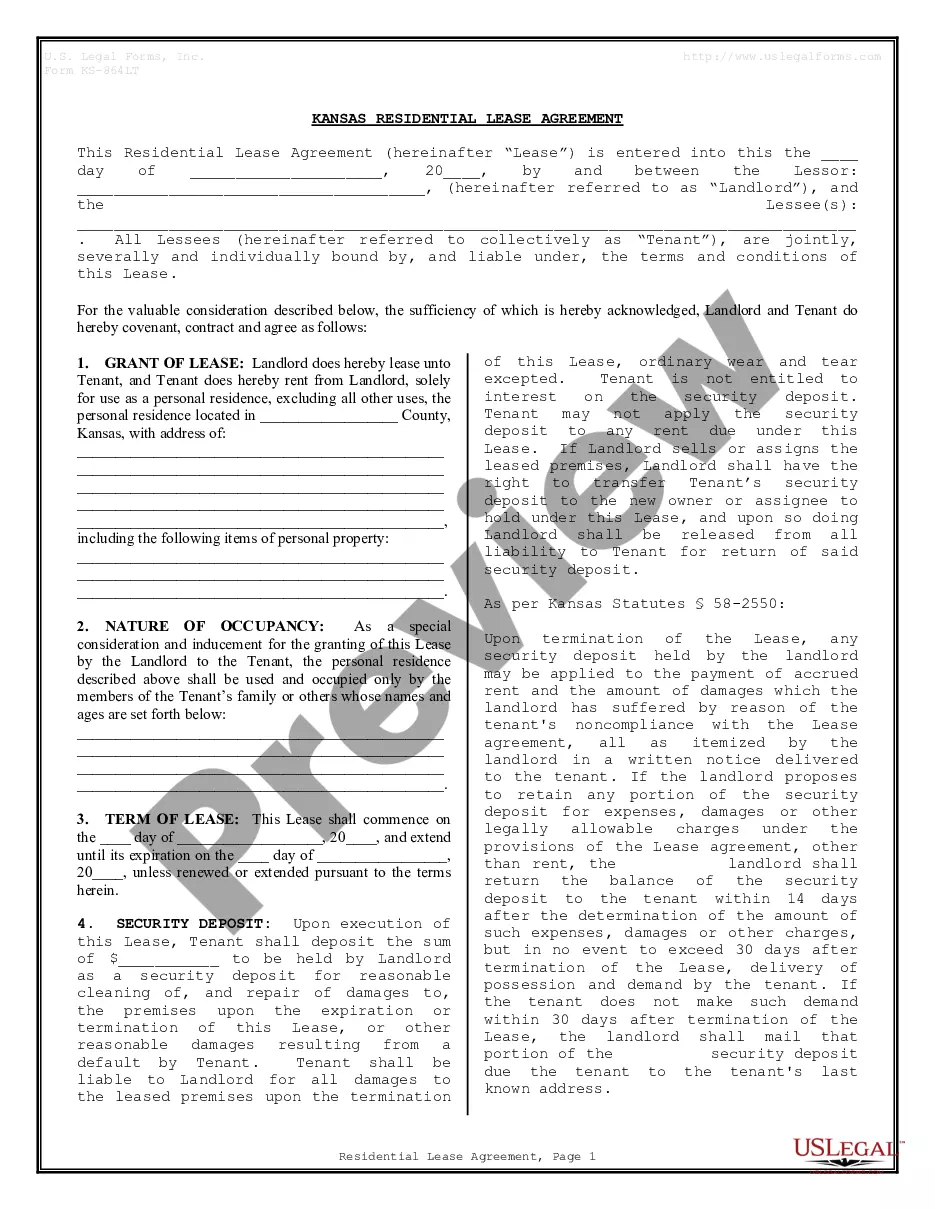

Get the free contract for deed north dakota form A Contract for Deed is used as owner financing for the purchase of real property. The Seller retains title to the property until an agreed amount is paid. After the agreed amount is paid, the Seller conveys the property to Buyer.

A warranty deed contains a guarantee that the grantor has legal title and rights to the real estate. A quitclaim deed offers little to no protection to the grantee.Warranty deeds ensure that the grantor has the right to sell the property, and guarantees that there are no liens or encumbrances against the land.

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

It is also crucial that a spouse know about the loan, even if he or she is not on the mortgage. In general, the spouse must sign a deed of trust, the Truth in Lending and Right to Cancel documents. By signing these documents, they are simply acknowledging the existence of the mortgage.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

A warranty deed, also known as a general warranty deed, is a legal real estate document between the seller (grantor) and the buyer (grantee). The deed protects the buyer by pledging that the seller holds clear title to the property and there are no encumbrances, outstanding liens, or mortgages against it.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

In order to transfer ownership of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim deed, interspousal transfer deed, or a grant deed, in order to convey the title to the property.