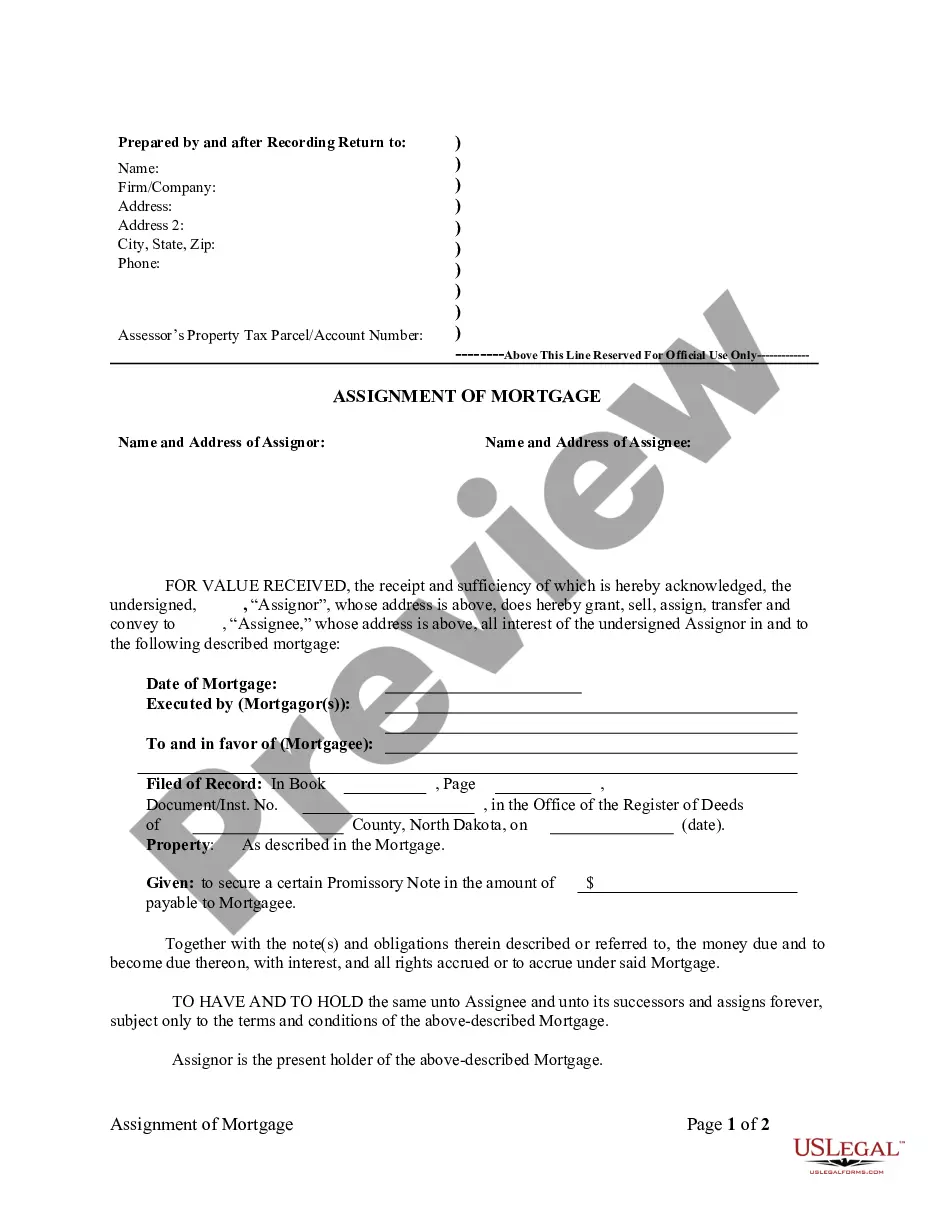

Assignment of Mortgage by Individual Mortgage Holder

Assignment and Satisfaction

of Mortgages

Assignments Generally:

Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust

to other lenders, or third parties. When this is done the assignee

(person who received the assignment) steps into the place of the original

lender or assignor. To effectuate an assignment, the general rule

is that the assignment must be in proper written format and recorded to

provide notice of the assignment.

Satisfactions Generally:

Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy

the mortgage or deed of trust of record to show that the mortgage or deed

of trust is no longer a lien on the property. The general rule is that

the satisfaction must be in proper written format and recorded to provide

notice of the satisfaction. If the lender fails to record a satisfaction

within set time limits, the lender may be responsible for damages set by

statute for failure to timely cancel the lien. Depending on your state,

a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance.

Some states still recognize marginal satisfaction but this is slowly being

phased out. A marginal satisfaction is where the holder of the mortgage

physically goes to the recording office and enters a satisfaction on the

face of the the recorded mortgage, which is attested by the clerk.

North Dakota Law

Execution of Assignment or Satisfaction:

Must be signed by the owner of the mortgage.

Assignment:

An assignment must be in writing and recorded.

Demand to Satisfy:

Within sixty days after any mortgage is satisfied, or within thirty days of receipt of a

written demand of the owner of the property, whichever is shorter, the

owners of the mortgage or other lien shall execute a certificate of discharge

duly acknowledged, and cause a satisfaction of record to be entered. Any

mortgagee or owner of a mortgage or lien who fails to execute or deliver

a discharge or to enter a satisfaction as provided under this section is

liable to the owner of the property for all damages sustained as a result

of the refusal and exemplary damages of one hundred dollars.

Recording Satisfaction:

A recorded mortgage must be discharged upon the record by the recorder having custody of the

mortgage on the presentation of a certificate of discharge signed by the

mortgagee and properly acknowledged.

Penalty:

Any mortgagee or owner of a mortgage or lien who fails to execute or deliver a discharge or to enter a satisfaction

(see above, Demand to Satisfy) is liable to the owner of the property

for all damages sustained as a result of the refusal and exemplary damages

of one hundred dollars.

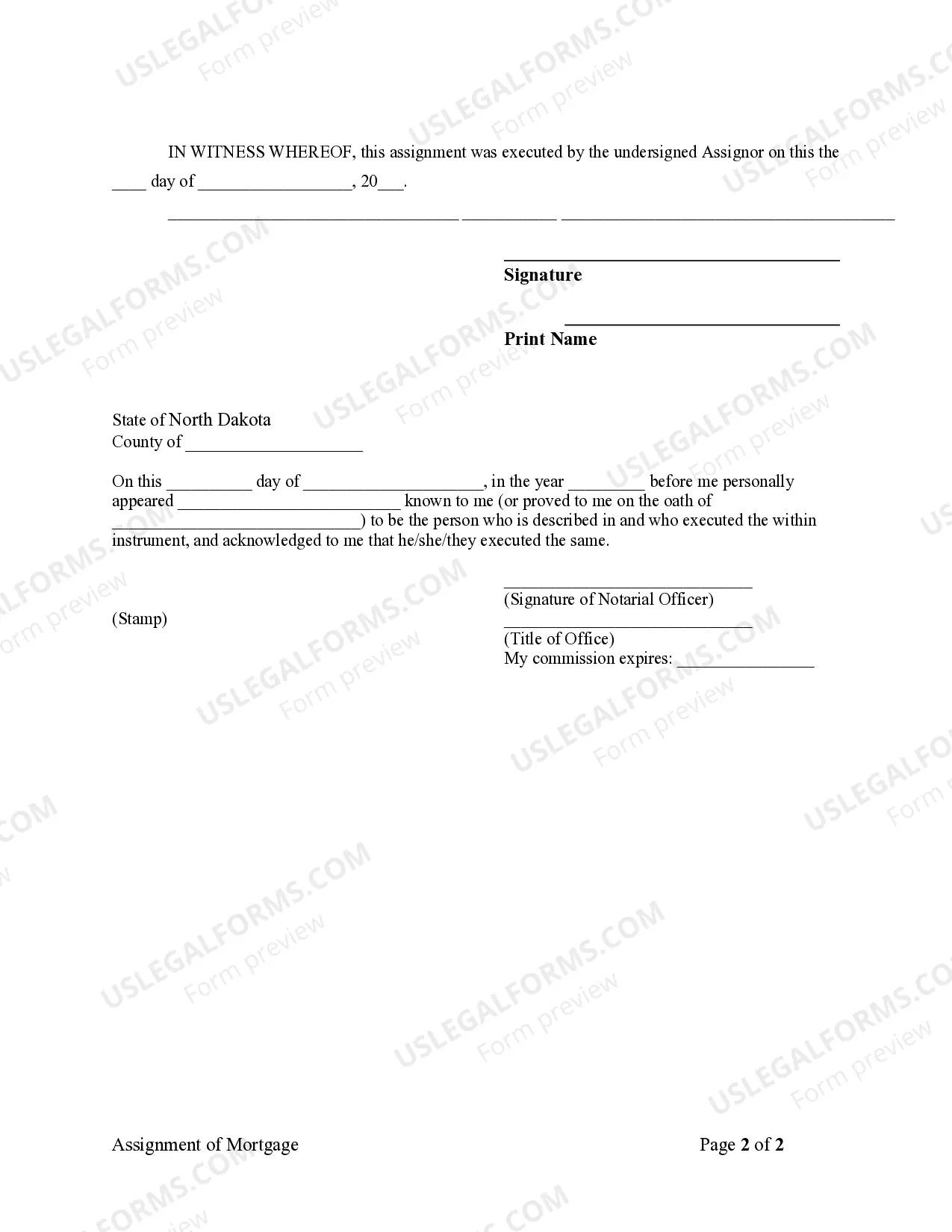

Acknowledgment:

An assignment or satisfaction must contain a proper North Dakota acknowledgment, or other acknowledgment

approved by Statute.

North Dakota Statutes

35-01-27. Discharge of mortgage or lien on real property - Penalty.

Within sixty days after any mortgage or other lien upon real property

is satisfied or within thirty days of receipt of a written demand of the

owner of the property, whichever is shorter, the owners of the mortgage

or other lien shall execute a certificate of discharge duly acknowledged,

and cause a satisfaction of record to be entered. The fee for filing

the satisfaction must be paid by the owner of the property or added to

the debt paid by the owner of the property. Any mortgagee or owner of a

mortgage or lien who fails to execute or deliver a discharge or to enter

a satisfaction as provided under this section is liable to the owner of

the property for all damages sustained as a result of the refusal and exemplary

damages of one hundred dollars.

35-03-11. Certificate of discharge - How recorded.

A certificate of the discharge of a mortgage and proof or acknowledgment of the discharge

must be recorded at length and a reference made in the record to the

book and page or document number where the mortgage is recorded and of

the minute of the discharge, made upon the record of the mortgage, to the

book and page or document number where the discharge is recorded.

35-03-16. Satisfaction of mortgage - Discharge - Form - Power

of attorney.

A recorded mortgage must be discharged upon the record

by the recorder having custody of the mortgage on the presentation of a

certificate of discharge signed by the mortgagee, the mortgagee's executors,

administrators, guardians, trustees, assigns, personal representatives,

or special administrators appointed for that purpose, properly acknowledged

or proved and certified as prescribed by chapter 47-19. The certificate

of discharge must contain a brief description of the mortgage and must

state that the mortgage has been paid in full or otherwise satisfied and

discharged and that the officer is authorized to discharge the mortgage

of record. Any person executing a certificate of discharge as a personal representative

of the mortgagee first shall file and have recorded in the office of the

recorder where the mortgage is recorded, a power of attorney showing the

person's authority to discharge mortgages in behalf of the mortgagee and

in the mortgagee's name. The mortgagee shall present the certificate of

discharge to the recorder for recording in the county in which the property

is located within thirty days after the certificate of discharge is signed.

The mortgagee may add the amount of the recording fee to the balance of

the debt paid by the mortgagor.