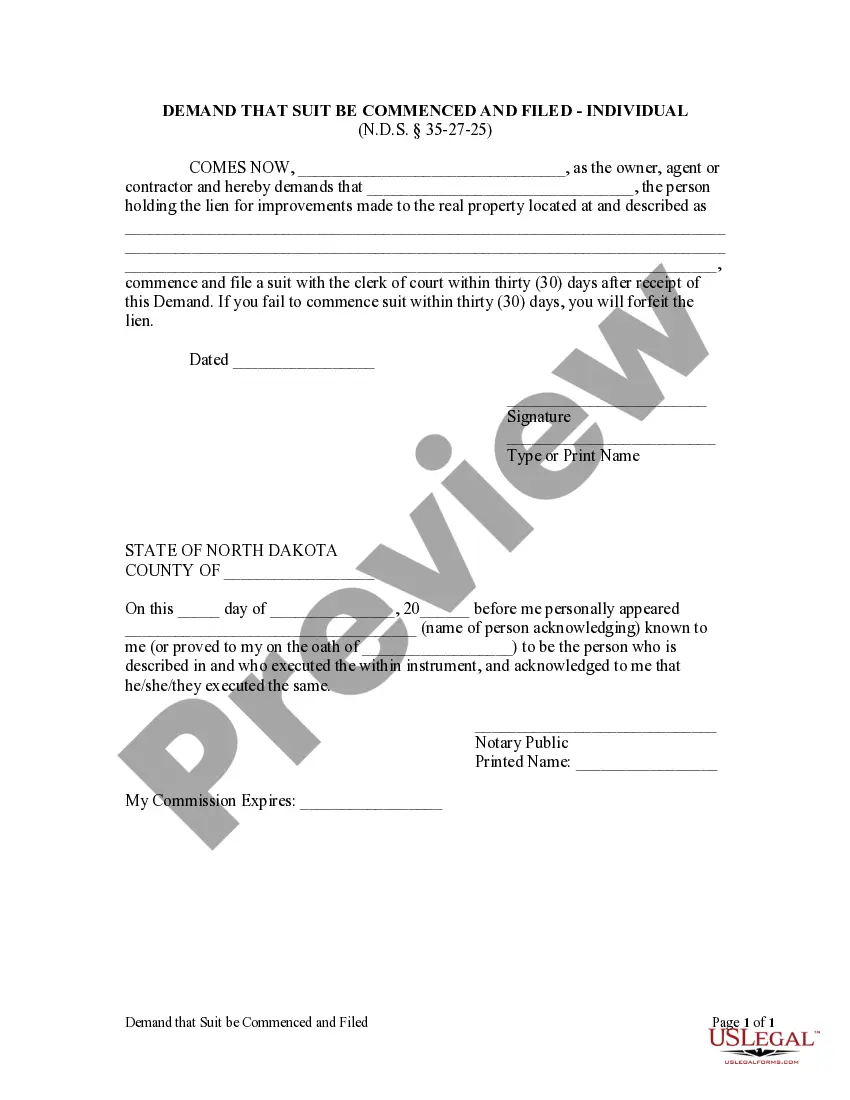

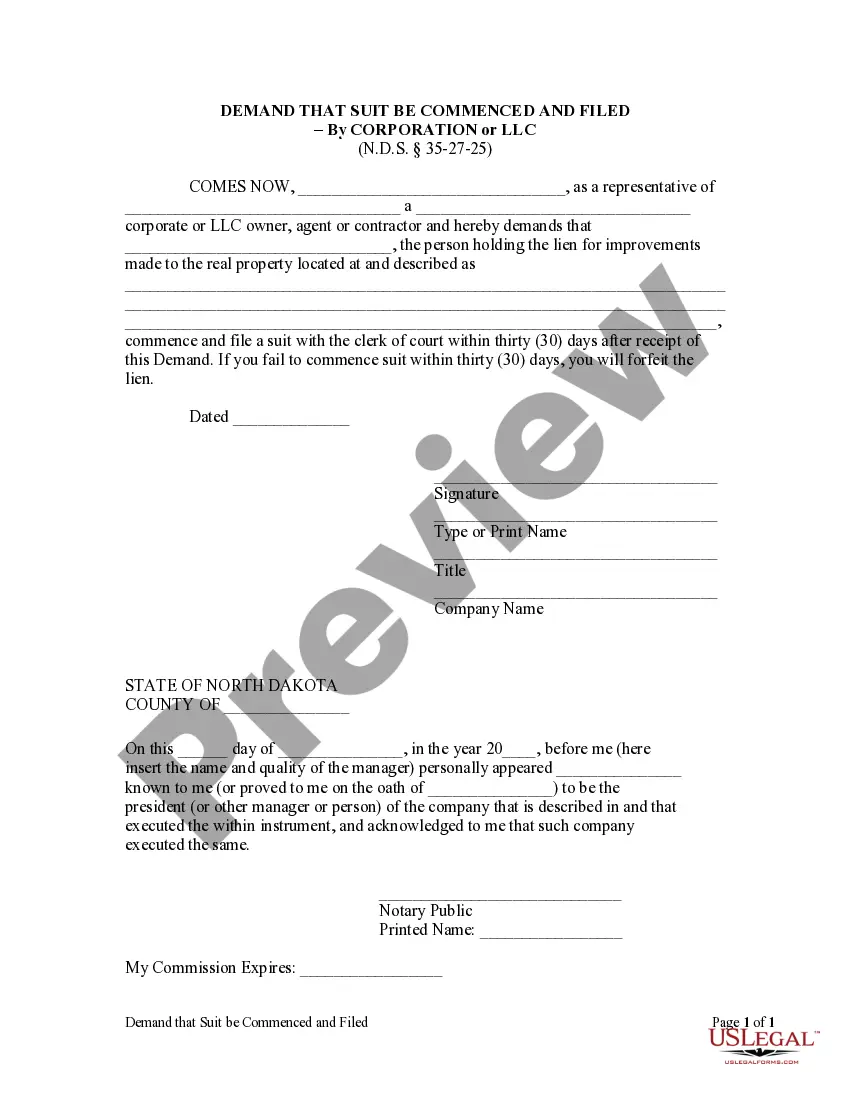

This Demand that Suit be Commenced and Filed form is for use by a corporate owner, agent or contractor to demand that a person holding a lien for improvements made to real property commence and file a suit with the clerk of court within 30 days after receipt of the demand or forefeit the lien.

North Dakota Demand that Suit be Commenced and Filed - Corporation

Description

How to fill out North Dakota Demand That Suit Be Commenced And Filed - Corporation?

Avoid expensive attorneys and find the North Dakota Demand that Suit be Commenced and Filed - Corporation or LLC you need at a affordable price on the US Legal Forms website. Use our simple categories function to find and download legal and tax files. Go through their descriptions and preview them prior to downloading. Additionally, US Legal Forms enables customers with step-by-step tips on how to obtain and complete each and every form.

US Legal Forms customers merely need to log in and get the particular document they need to their My Forms tab. Those, who have not obtained a subscription yet should stick to the tips below:

- Ensure the North Dakota Demand that Suit be Commenced and Filed - Corporation or LLC is eligible for use where you live.

- If available, read the description and use the Preview option before downloading the sample.

- If you’re confident the template suits you, click on Buy Now.

- If the form is wrong, use the search engine to find the right one.

- Next, create your account and choose a subscription plan.

- Pay out by credit card or PayPal.

- Select download the form in PDF or DOCX.

- Simply click Download and find your template in the My Forms tab. Feel free to save the template to the device or print it out.

Right after downloading, you can complete the North Dakota Demand that Suit be Commenced and Filed - Corporation or LLC manually or with the help of an editing software. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

In an LLC, individuals with an ownership share are called members. In a corporation, they are called shareholders. One of the advantages an LLC has over a corporation is that in many states, a creditor cannot collect a member's dividends, whereas in a corporation dividends can be collected from shareholders.

Profits subject to social security and medicare taxes. In some circumstances, owners of an LLC may end up paying more taxes than owners of a corporation. Salaries and profits of an LLC are subject to self-employment taxes, currently equal to a combined 15.3%.

Businesses that have or expect to have employees should incorporate before hiring them.If you run your business as a sole proprietorship, you as an individual are liable and your personal assets are at risk. However, if you have incorporated, the corporation or LLC is the employer and takes on this liability risk.

The advantages of incorporating a small business include: No.In a properly structured and managed corporation or LLC, owners should have limited liability for business debts and obligations. Corporations generally have more corporate formalities than an LLC that must be observed to obtain personal asset protection.

Both types of entities have the significant legal advantage of helping to protect assets from creditors and providing an extra layer of protection against legal liability. In general, the creation and management of an LLC are much easier and more flexible than that of a corporation.

Corporations offer more flexibility when it comes to their excess profits. Whereas all income in an LLC flows through to the members, an S corporation is allowed to pass income and losses to its shareholders, who report taxes on an individual tax return at ordinary levels.

Forming an LLC or a corporation will allow you to take advantage of limited personal liability for business obligations. LLCs are favored by small, owner-managed businesses that want flexibility without a lot of corporate formality. Corporations are a good choice for a business that plans to seek outside investment.

Because distributions are taxed at both the corporate and the shareholder level, C corporations and their shareholders often end up paying more in taxes than S corporations or LLCs.

You'll need your LLC's name, the name and address of its registered agent, and other basic information, like how it will be managed or the names of the LLC owners. You'll have to pay a filing fee when you submit the articles. In most states, the fees are modest - typically around $100.