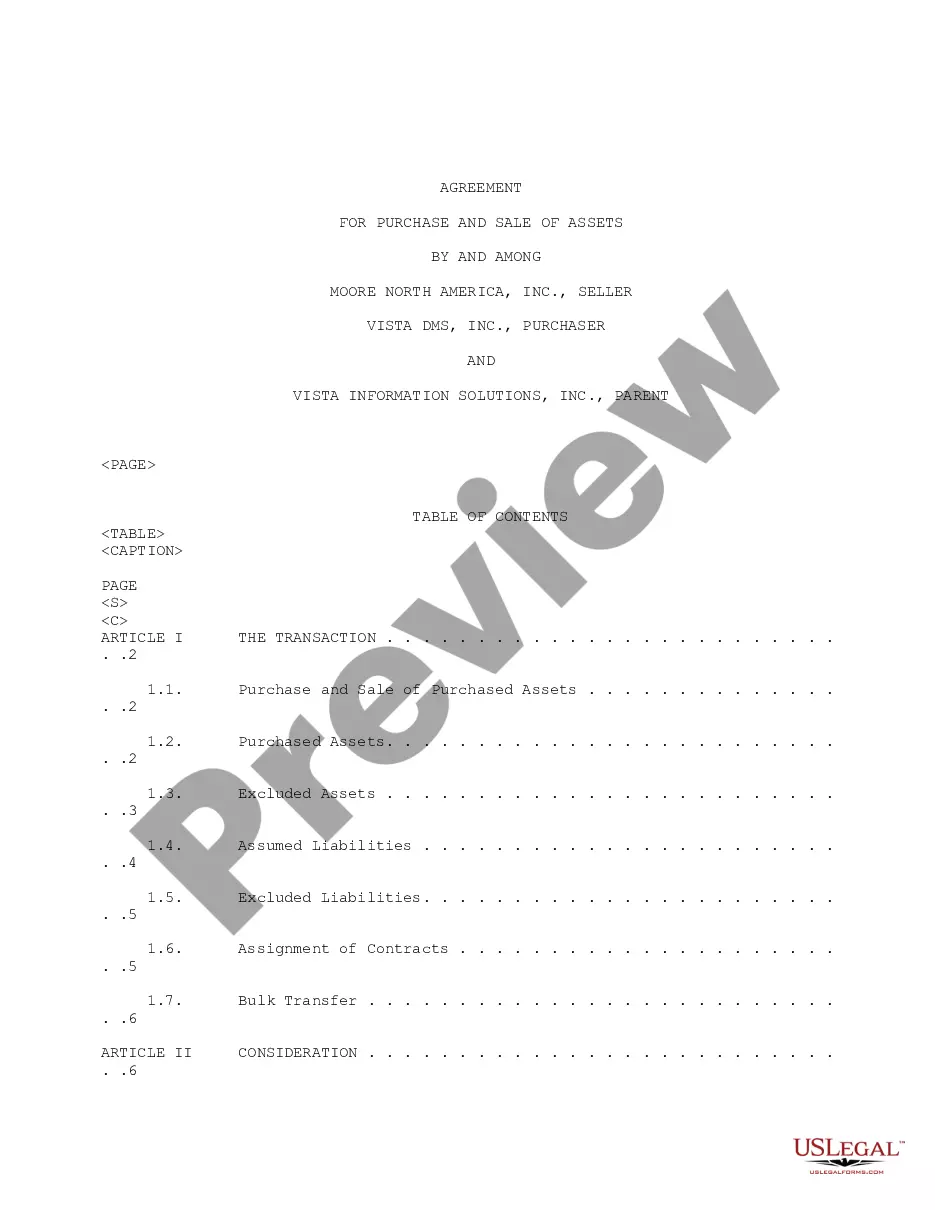

Uniquely packaged forms and information for Chapter 7 or 13 bankruptcies, including detailed instructions and other resources. Click and view the Free Preview for the latest revision dates and a complete overview of contents.

North Dakota Bankruptcy Guide and Forms Package for Chapters 7 or 13

Description

How to fill out North Dakota Bankruptcy Guide And Forms Package For Chapters 7 Or 13?

Avoid expensive lawyers and find the North Dakota Bankruptcy Guide and Forms Package for Chapters 7 or 13 you want at a reasonable price on the US Legal Forms website. Use our simple groups function to look for and obtain legal and tax documents. Read their descriptions and preview them just before downloading. Moreover, US Legal Forms enables customers with step-by-step instructions on how to obtain and complete each form.

US Legal Forms subscribers simply have to log in and obtain the specific document they need to their My Forms tab. Those, who haven’t obtained a subscription yet need to follow the tips below:

- Make sure the North Dakota Bankruptcy Guide and Forms Package for Chapters 7 or 13 is eligible for use in your state.

- If available, read the description and use the Preview option just before downloading the templates.

- If you are confident the template meets your needs, click Buy Now.

- If the template is incorrect, use the search engine to find the right one.

- Next, create your account and choose a subscription plan.

- Pay by card or PayPal.

- Select download the document in PDF or DOCX.

- Just click Download and find your template in the My Forms tab. Feel free to save the template to the gadget or print it out.

After downloading, you are able to complete the North Dakota Bankruptcy Guide and Forms Package for Chapters 7 or 13 manually or by using an editing software. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

The Overall Chapter 13 Average Payment. The average payment for a Chapter 13 case overall is probably about $500 to $600 per month. This information, however, may not be very helpful for your particular situation.

What Documents Do You Need to File for Bankruptcy? Tax Returns. Income Documentation. Vehicle Registration, Proof of Value & Insurance. Retirement And Bank Account Statements. Identification. What Information Do You Need to Complete the Bankruptcy Forms? Credit Counseling Requirement.

A completed Chapter 13 bankruptcy can stay on your credit reports for up to seven years from the date you file. But some creditors could view a Chapter 13 bankruptcy more favorably than a Chapter 7 bankruptcy. It could be an indication that you repaid more of your debt.

Chapter 7 is the most common type of bankruptcy and is often referred to as a straight bankruptcy. Under Chapter 7, you can eliminate most of your unsecured debts and some secured debts by surrendering your assets. Unsecured debts are debts not secured with collateral, including most personal loans and credit cards.

However, when you file for bankruptcy, you never really have to go to court. The only appearance you are required to make is attending the 341(a) Meeting of Creditors. The 341(a) Hearing is held around 30-35 days after your bankruptcy case is filed.

Generally, a debtor can convert a bankruptcy case one time with court approval.To convert a Chapter 7 case to Chapter 13, the debtor must meet the eligibility requirements for filing a Chapter 13 case. That includes having enough income to repay creditors under a payment plan.

Identifying Information. The Voluntary Petition for Individuals Filing for Bankruptcy form acts as the cover sheet for your paperwork. Your Property. Your Exempt Property. Your Collateralized Debt. Your Other Debt. Your Contracts and Leases. Your Codebtors. Your Income.

There is no minimum amount of debt you must have in order to file for bankruptcy relief. While the amount of your debt is an important factor to consider, there are other more important factors to take into account in determining if a bankruptcy filing is in your best interest.

Debts You Must Pay in Full Through Your Plan. Add up the following debts and divide by the number of months your plan will last. Secured Debt Payments on Property You Want to Keep. Unsecured Debts. Length of Your Repayment Plan.