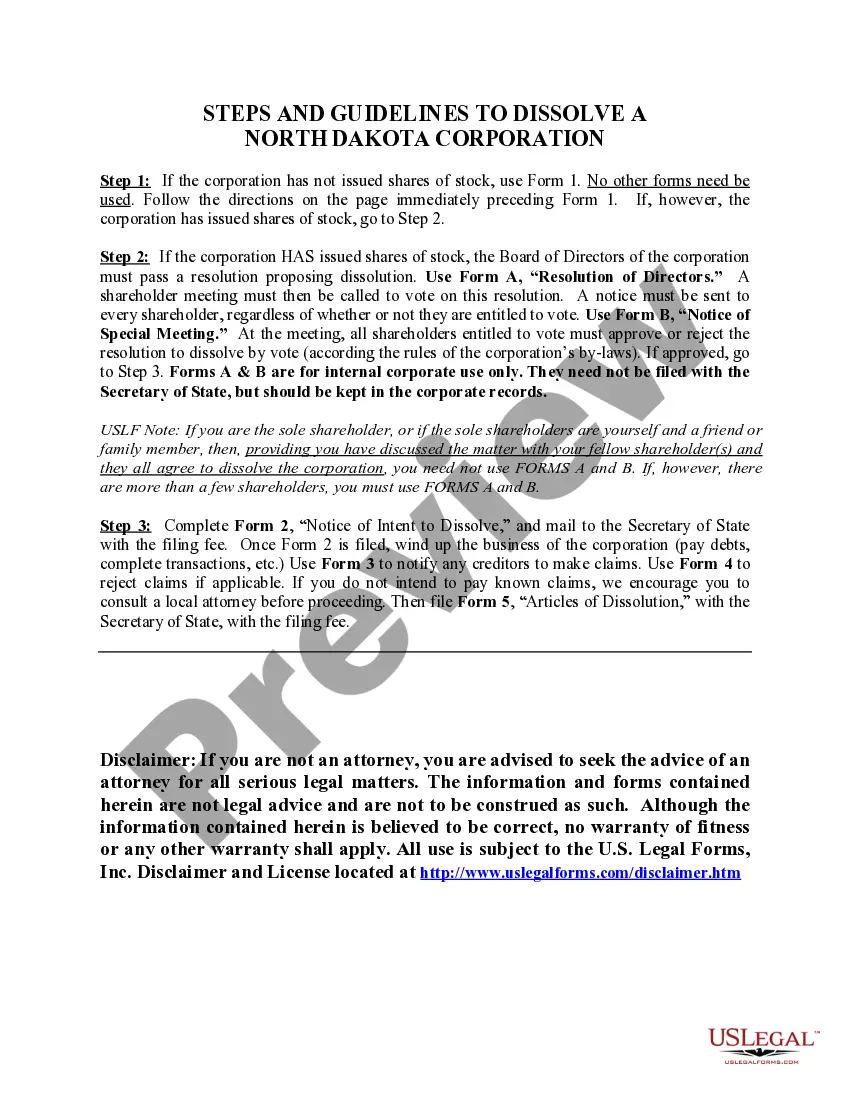

North Dakota Dissolution Package to Dissolve Corporation

Description Nd Dissolve Corporation

How to fill out North Dakota Dissolution Package To Dissolve Corporation?

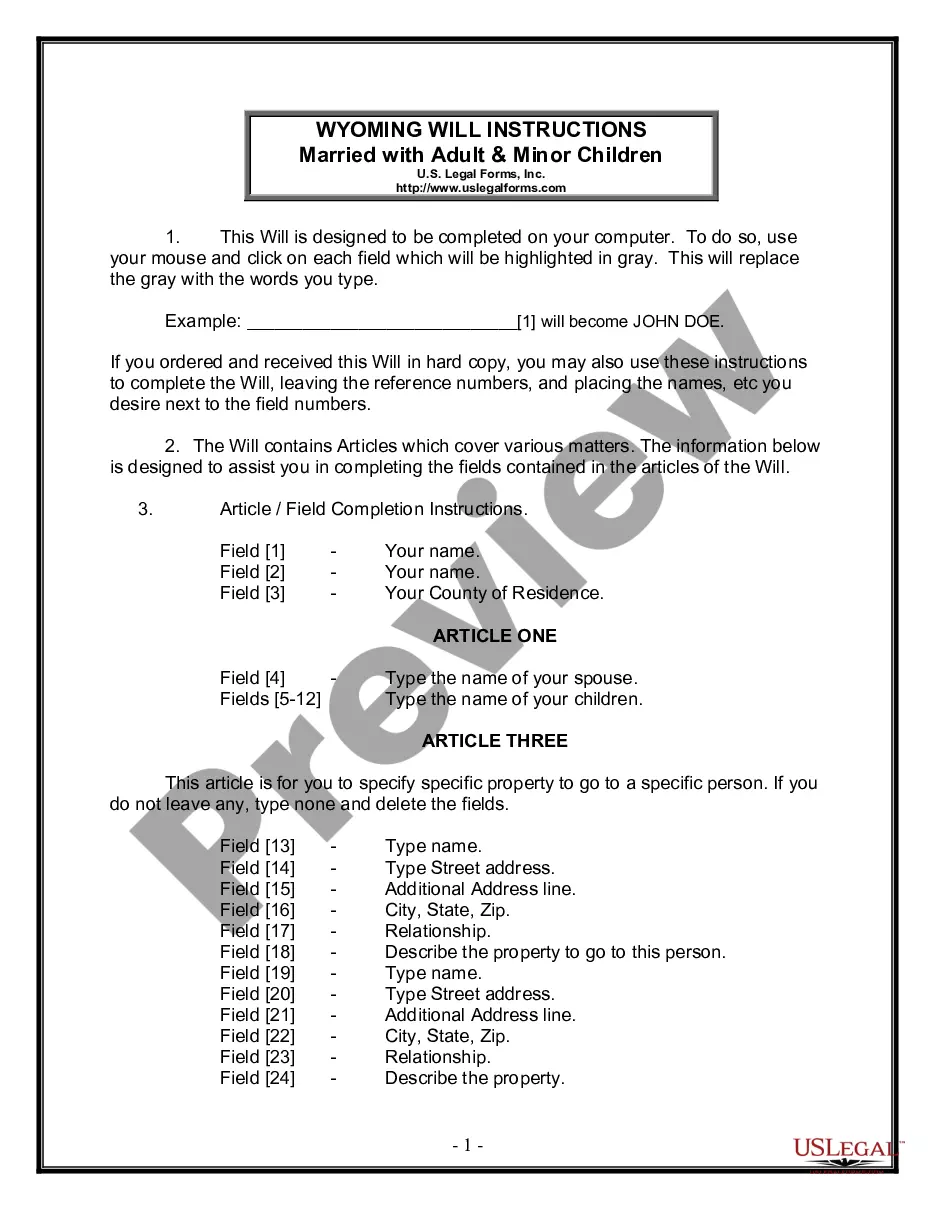

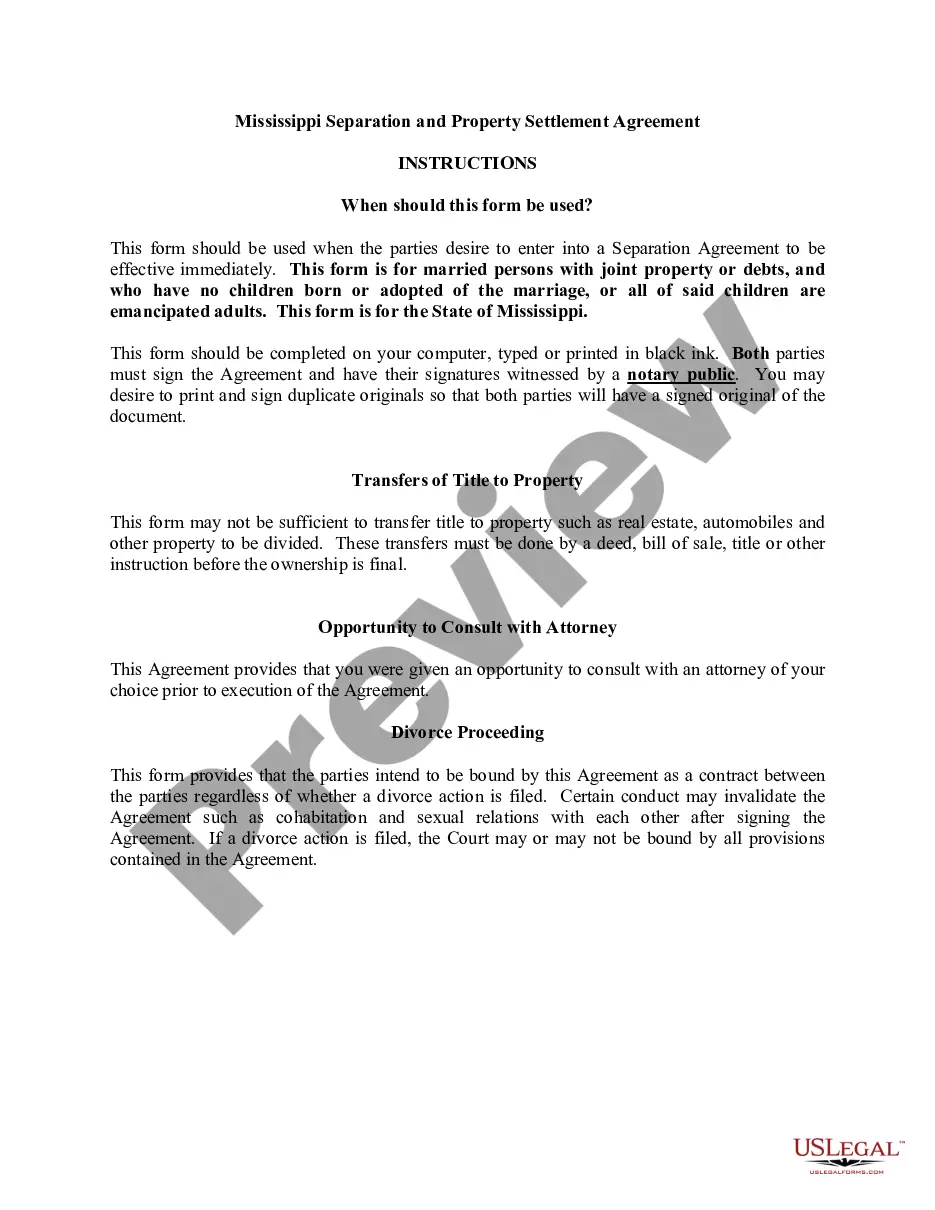

Avoid expensive attorneys and find the North Dakota Dissolution Package to Dissolve Corporation you need at a affordable price on the US Legal Forms site. Use our simple categories function to search for and download legal and tax documents. Read their descriptions and preview them well before downloading. In addition, US Legal Forms provides users with step-by-step tips on how to download and fill out each form.

US Legal Forms clients basically have to log in and get the particular form they need to their My Forms tab. Those, who haven’t got a subscription yet need to stick to the guidelines below:

- Ensure the North Dakota Dissolution Package to Dissolve Corporation is eligible for use where you live.

- If available, read the description and use the Preview option well before downloading the sample.

- If you are sure the template is right for you, click Buy Now.

- In case the template is wrong, use the search field to get the right one.

- Next, create your account and select a subscription plan.

- Pay by credit card or PayPal.

- Choose to download the form in PDF or DOCX.

- Just click Download and find your form in the My Forms tab. Feel free to save the template to your gadget or print it out.

Right after downloading, you are able to complete the North Dakota Dissolution Package to Dissolve Corporation manually or an editing software. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Form popularity

FAQ

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.

Failing to dissolve the corporation allows third parties to continue to sue the corporation as if it is still in operation. A judgment might mean that shareholders use the money received from distributed assets when the corporation closed down to satisfy judgments against the corporation.

North Dakota requires business owners to submit their Articles of Dissolution and Termination online. You can also have a professional service provider file your Articles of Dissolution for you. Incfile prepares the Articles of Dissolution for you, and files them to the state for $149 + State Fees.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

Unless dissolved, your California LLC will continue to be liable for state fees, it will continue to be open to incurring more debts, it will continue to own the assets under its name, and you won't be able to sell those assets as your own.

Hold a Members meeting and record a resolution to Dissolve the North Dakota LLC. File a Notice of Dissolution with the ND Secretary of State. File all required Annual Reports with the North Dakota Secretary of State. Clear up any business debts. Pay all taxes and administrative fees owed by the North Dakota LLC.

When a corporation is dissolved, it no longer legally exists and, in most cases, its debts disappear as well. State laws usually give additional time beyond the dissolution for creditors to file suits for failure to pay any corporate debts or for the wrongful distribution of corporate assets.

Call a Board Meeting. File a Certificate of Dissolution With the Secretary of State. Notify the Internal Revenue Service (IRS) Close Accounts and Credit Lines, Cancel Licenses, Etc.