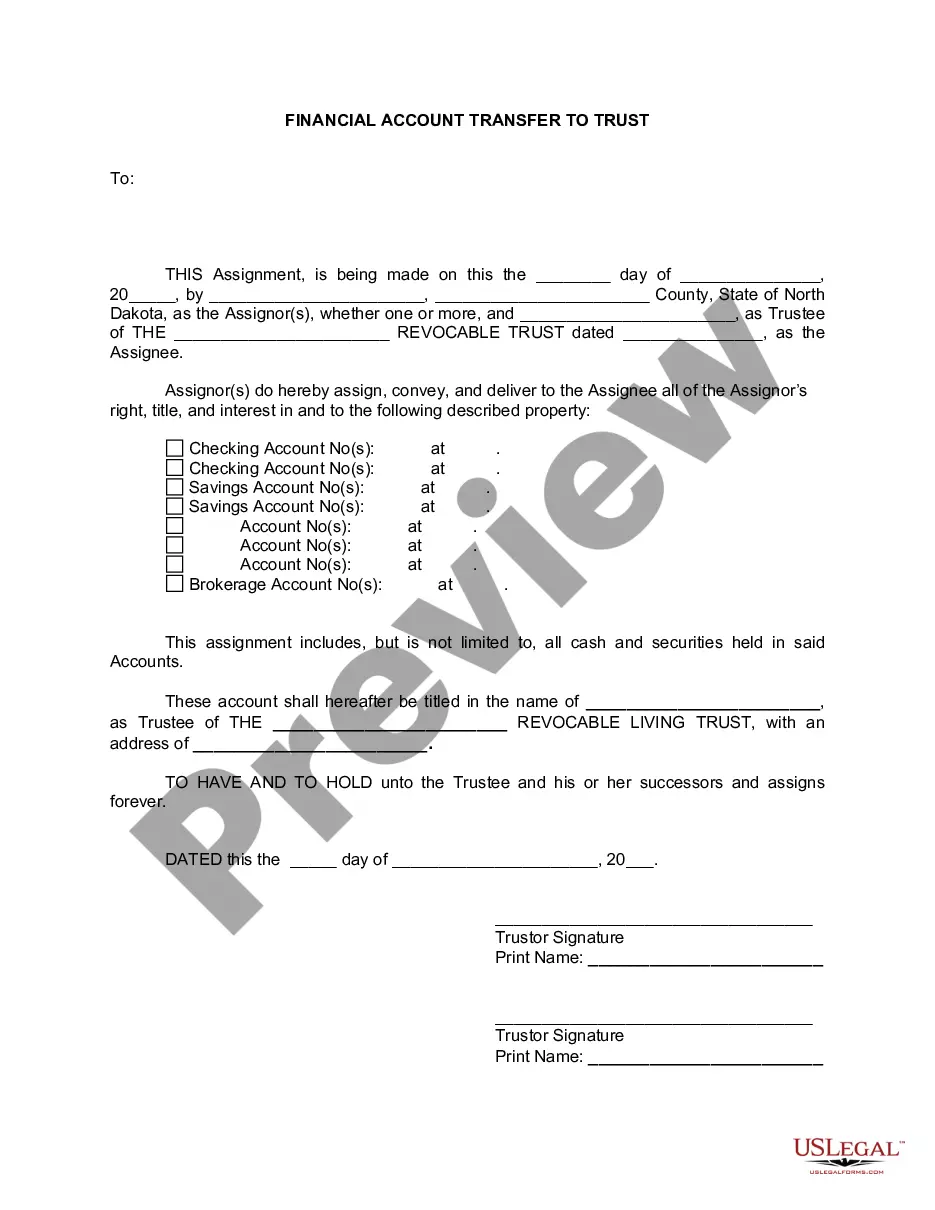

North Dakota Financial Account Transfer to Living Trust

Description

How to fill out North Dakota Financial Account Transfer To Living Trust?

Avoid expensive lawyers and find the North Dakota Financial Account Transfer to Living Trust you want at a reasonable price on the US Legal Forms site. Use our simple groups function to look for and download legal and tax forms. Go through their descriptions and preview them well before downloading. In addition, US Legal Forms enables users with step-by-step instructions on how to obtain and complete every single template.

US Legal Forms clients merely must log in and download the particular form they need to their My Forms tab. Those, who have not obtained a subscription yet should stick to the guidelines listed below:

- Ensure the North Dakota Financial Account Transfer to Living Trust is eligible for use where you live.

- If available, read the description and make use of the Preview option before downloading the sample.

- If you’re confident the template is right for you, click on Buy Now.

- If the template is wrong, use the search engine to find the right one.

- Next, create your account and choose a subscription plan.

- Pay out by credit card or PayPal.

- Select obtain the document in PDF or DOCX.

- Click on Download and find your form in the My Forms tab. Feel free to save the form to the device or print it out.

Right after downloading, it is possible to complete the North Dakota Financial Account Transfer to Living Trust manually or by using an editing software program. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.

Ownership in a business can also be transferred through a living trust. To do this, the business owner must first transfer the business to the trust, then name the intended successor as successor trustee to the trust. The business owner, while living, would serve as both trustee and beneficiary of the trust.

As of 2019, attorney fees can range from $1,000 to $2,500 to set up a trust, depending upon the complexity of the document and where you live. You can also hire an online service provider to set up your trust. As of 2019, you can expect to pay about $300 for an online trust.

Transferring Real Property to a Trust You can transfer your home (or any real property) to the trust with a deed, a document that transfers ownership to the trust. A quitclaim deed is the most common and simplest method (and one you can do yourself).

Houses and other real estate (even if they're mortgaged) stock, bond, and other security accounts held by brokerages (but think about naming a TOD beneficiary instead) small business interests (stock in a closely held corporation, partnership interests, or limited liability company shares)

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

Property you put in a living trust doesn't have to go through probate, which means that the assets won't get tied up in court for months and maybe years. However, you don't have to put bank accounts in a living trust, and sometimes it's not a good idea.

Visit your local bank branch and let the branch manager or representative know you want to transfer your bank account into the trust. Give the bank representative a signed and notarized copy of your trust document. The bank will need to confirm that you're the owner and verify the name of the trust.