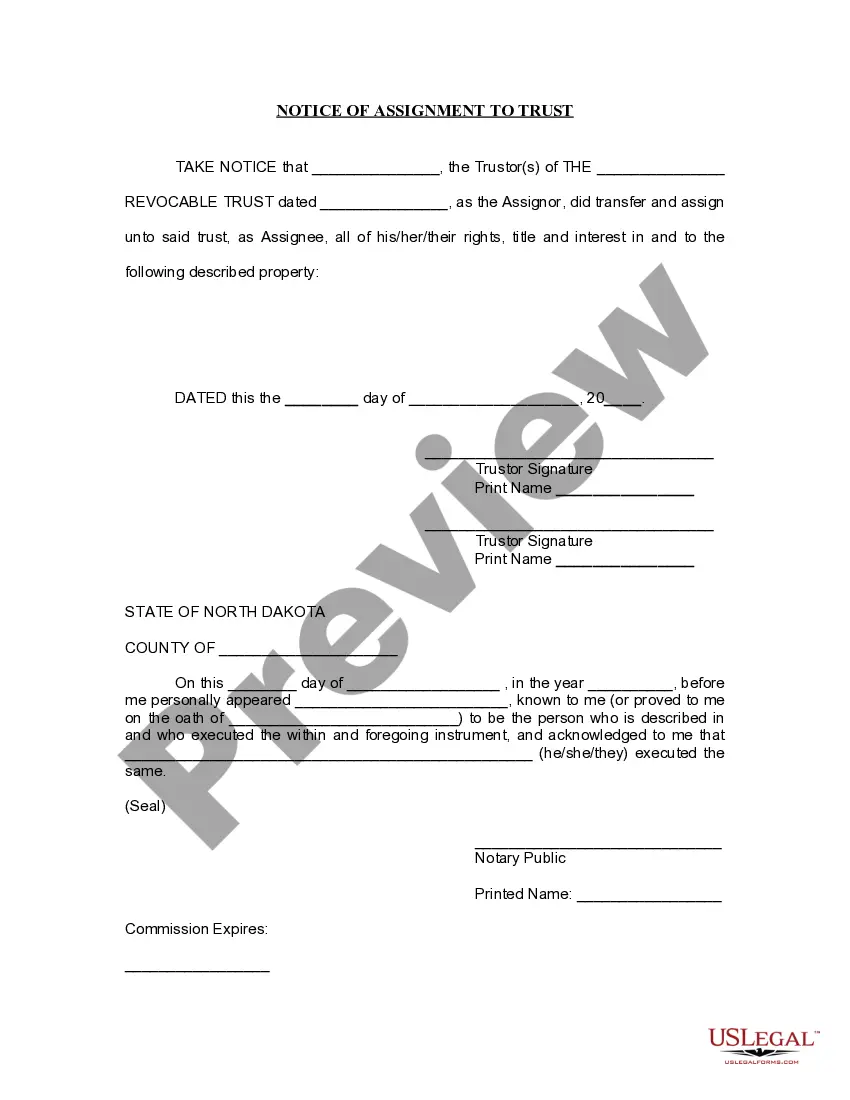

North Dakota Notice of Assignment to Living Trust

Description

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

How to fill out North Dakota Notice Of Assignment To Living Trust?

Avoid pricey attorneys and find the North Dakota Notice of Assignment to Living Trust you need at a reasonable price on the US Legal Forms site. Use our simple categories functionality to find and obtain legal and tax files. Read their descriptions and preview them just before downloading. Additionally, US Legal Forms enables users with step-by-step instructions on how to obtain and fill out each template.

US Legal Forms customers just have to log in and get the particular document they need to their My Forms tab. Those, who haven’t got a subscription yet should follow the tips below:

- Make sure the North Dakota Notice of Assignment to Living Trust is eligible for use where you live.

- If available, read the description and use the Preview option just before downloading the templates.

- If you are confident the template suits you, click on Buy Now.

- If the template is incorrect, use the search engine to find the right one.

- Next, create your account and select a subscription plan.

- Pay out by card or PayPal.

- Choose to obtain the form in PDF or DOCX.

- Simply click Download and find your template in the My Forms tab. Feel free to save the template to your device or print it out.

After downloading, you can fill out the North Dakota Notice of Assignment to Living Trust manually or by using an editing software program. Print it out and reuse the form many times. Do more for less with US Legal Forms!

Form popularity

FAQ

A living trust, specifically a revocable living trust, is a legal document that places your assetsinvestments, bank accounts, real estate, vehicles and valuable personal propertyin trust for your benefit during your lifetime, and spells out where you'd like these things to go upon your death.

Although there is no hard and fast rule on how often you should update your trust, conducting an annual review of the trust and asset schedule is recommended. In most situations, updates are typically needed every 3-5 years. Circumstances change. There will always be changes in the law especially the tax laws.

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them.You'll also need to choose your beneficiary or beneficiaries, the person or people who will receive the assets in your trust.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

A trust is a legal entity that you transfer ownership of your assets to, perhaps in order to decrease the value of your estate or to simplify passing on assets to your intended beneficiaries after you die. An estate planning attorney may charge at least $1,000 to create a trust for you.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

A living trust is an important part of your estate plan. Most people can create a living trust without an attorney using software or an online service.

Sure you can write your own revocable living trust. In fact, you can do it better than a lot of the attorneys. First you have to ascertain that you really want a trust.This is true whether you are preparing a revocable living trust, corporate bylaws, LLC documents, or any other legal documents.