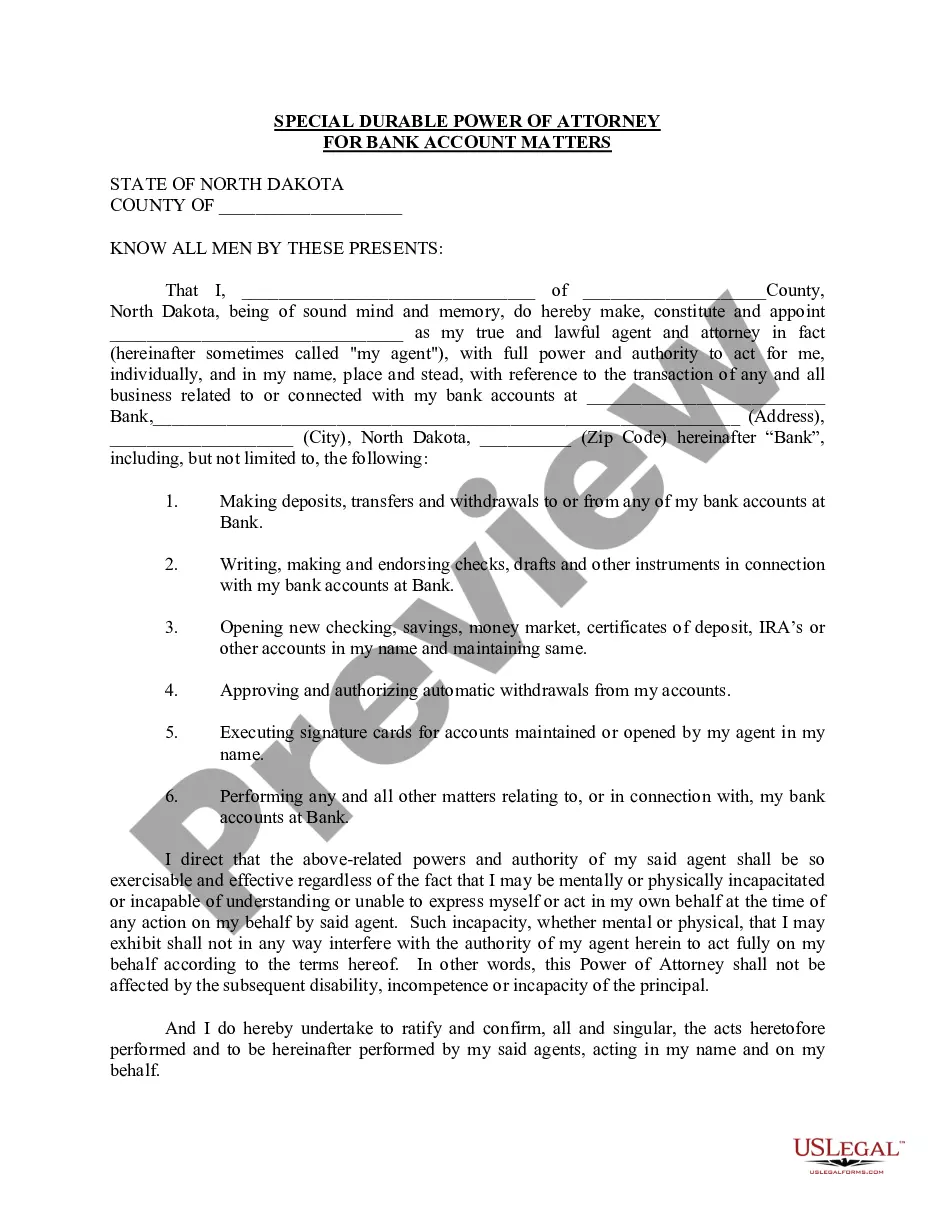

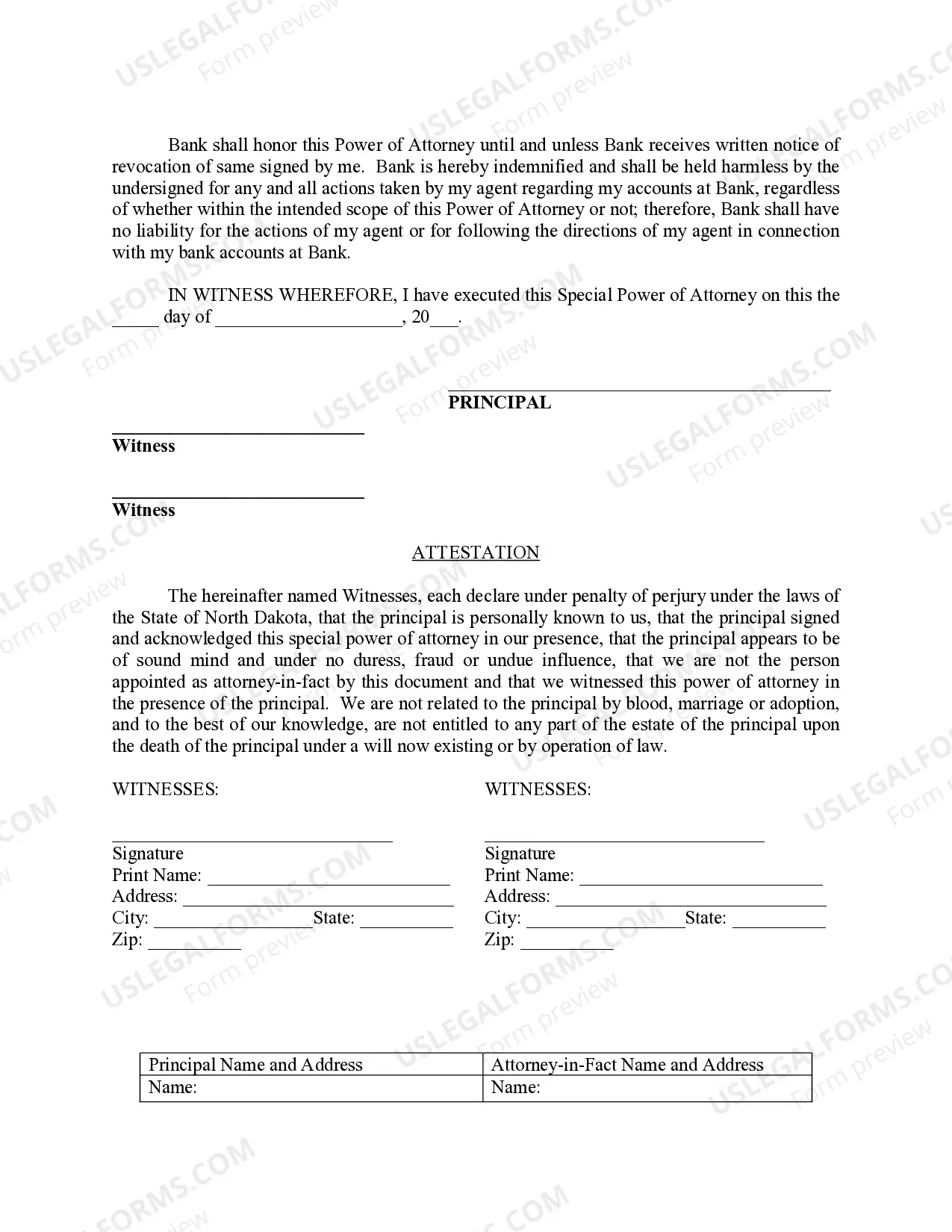

North Dakota Special Durable Power of Attorney for Bank Account Matters

Description

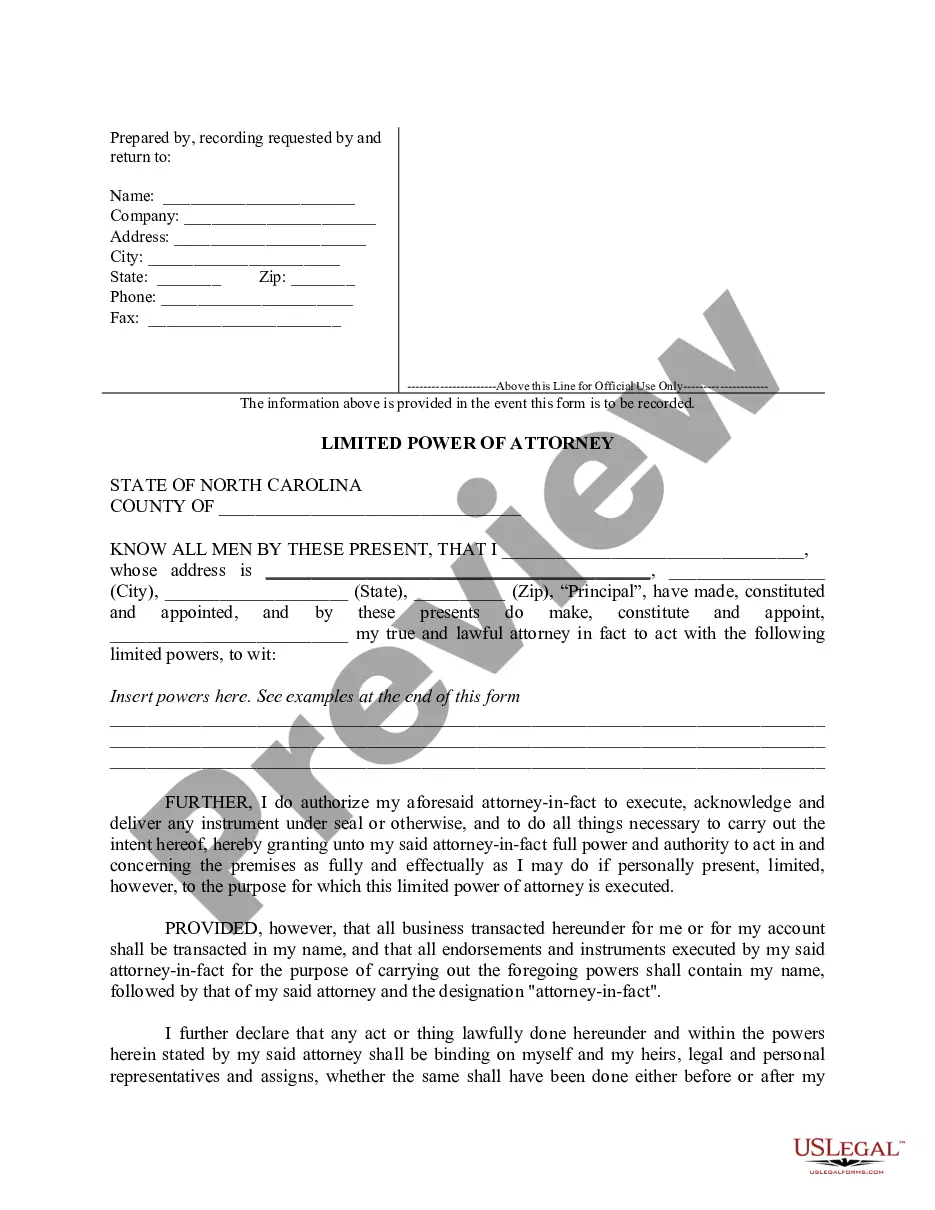

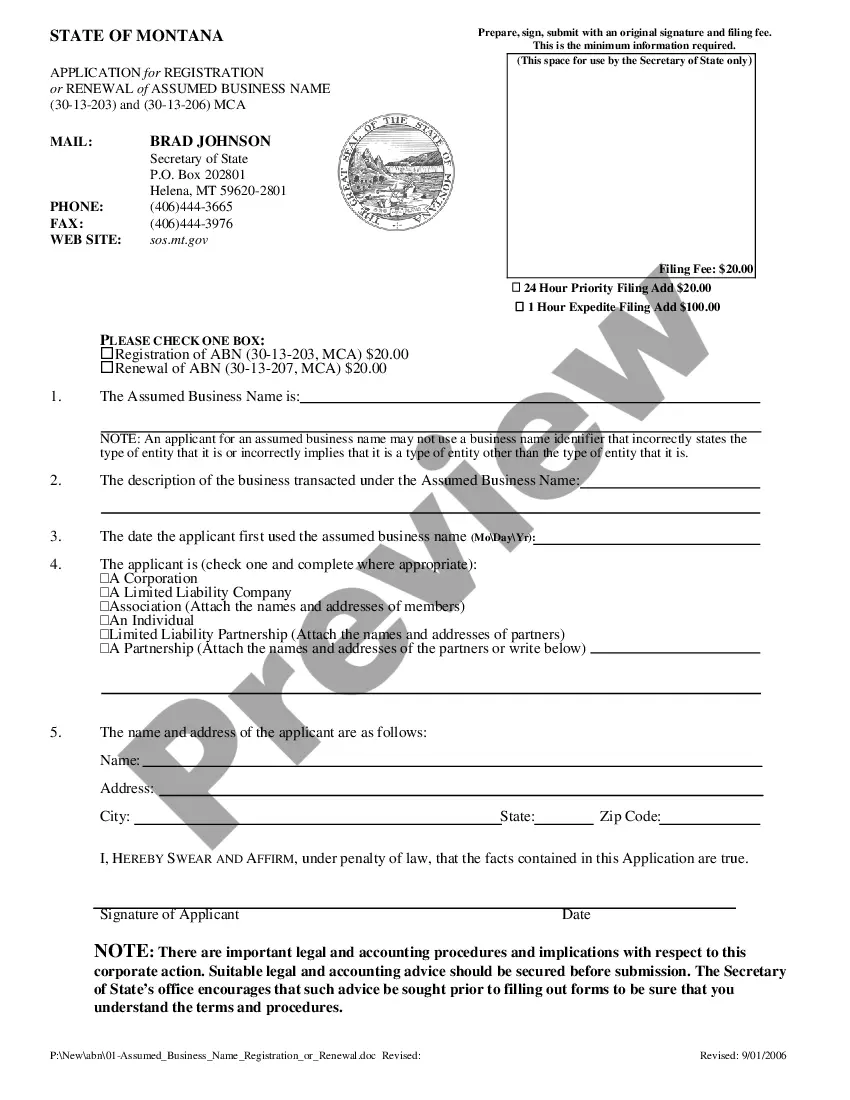

How to fill out North Dakota Special Durable Power Of Attorney For Bank Account Matters?

Avoid expensive attorneys and find the North Dakota Special Durable Power of Attorney for Bank Account Matters you want at a reasonable price on the US Legal Forms site. Use our simple categories functionality to look for and download legal and tax forms. Read their descriptions and preview them before downloading. Moreover, US Legal Forms enables users with step-by-step tips on how to obtain and complete each template.

US Legal Forms clients basically need to log in and download the particular document they need to their My Forms tab. Those, who have not got a subscription yet need to stick to the guidelines below:

- Ensure the North Dakota Special Durable Power of Attorney for Bank Account Matters is eligible for use where you live.

- If available, look through the description and use the Preview option well before downloading the templates.

- If you are sure the document meets your needs, click Buy Now.

- In case the form is wrong, use the search field to find the right one.

- Next, create your account and choose a subscription plan.

- Pay out by credit card or PayPal.

- Select download the document in PDF or DOCX.

- Simply click Download and find your template in the My Forms tab. Feel free to save the form to the gadget or print it out.

After downloading, it is possible to complete the North Dakota Special Durable Power of Attorney for Bank Account Matters manually or by using an editing software program. Print it out and reuse the form many times. Do more for less with US Legal Forms!

Form popularity

FAQ

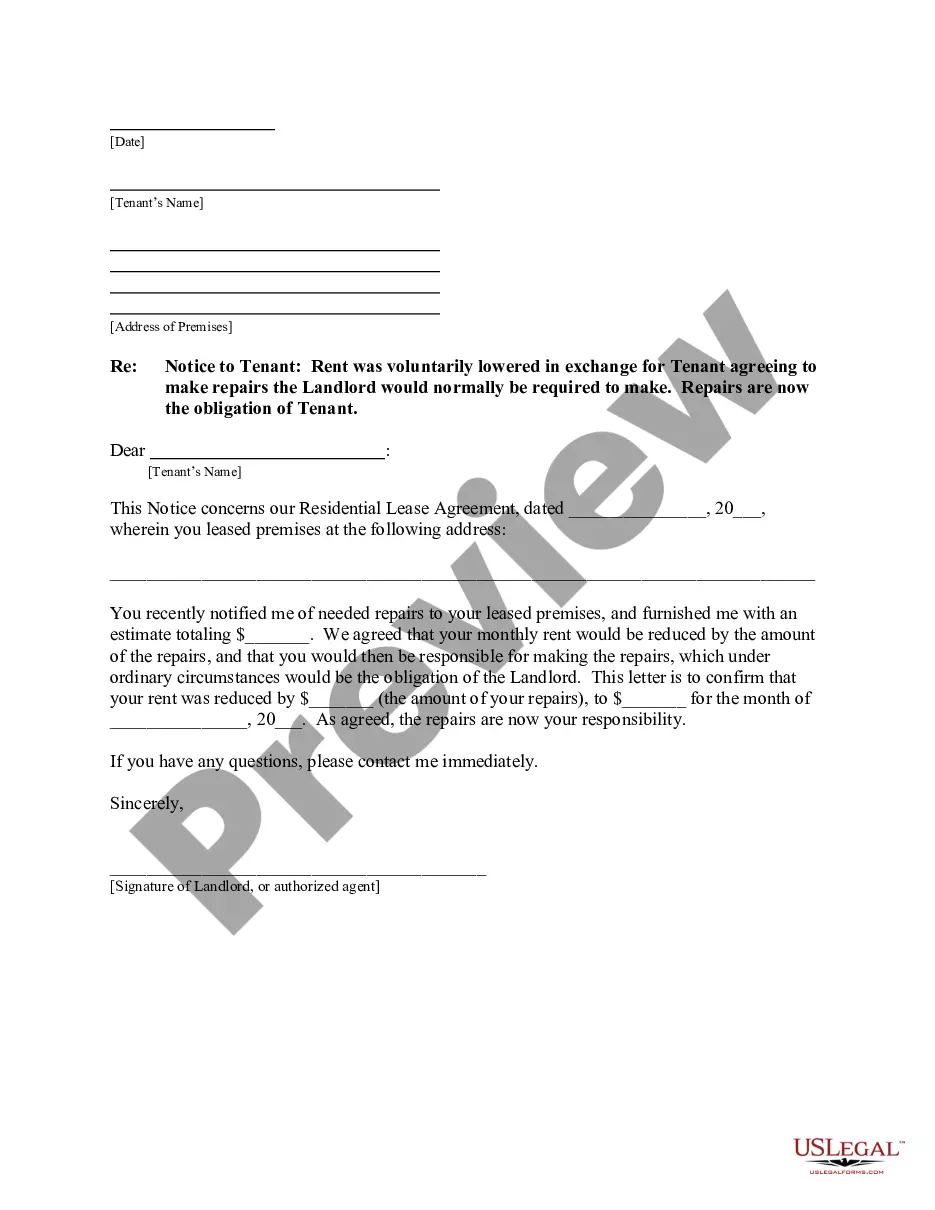

A power of attorney allows an agent to access the principal's bank accounts, either as a general power or a specific power. If the document grants an agent power over that account, they must provide a copy of the document along with appropriate identification to access the bank account.

Power of Attorney broadly refers to one's authority to act and make decisions on behalf of another person in all or specified financial or legal matters.Durable POA is a specific kind of power of attorney that remains in effect even after the represented party becomes mentally incapacitated.

But because of the risk of abuse, many banks will scrutinize a POA carefully before allowing the agent to act on the principal's behalf, and often a bank will refuse to honor a POA.The agent fought back in court and won a $64,000 judgment against the bank.

A power of attorney allows an agent to access the principal's bank accounts, either as a general power or a specific power. If the document grants an agent power over that account, they must provide a copy of the document along with appropriate identification to access the bank account.

A Power of Attorney might be used to allow another person to sign a contract for the Principal. It can be used to give another person the authority to make health care decisions, do financial transactions, or sign legal documents that the Principal cannot do for one reason or another.

Depending on the language of the power of attorney, your agent may be able to change the ownership of your bank accounts or change your beneficiary designations.

What's the difference between durable and general power of attorney? A general power of attorney ends the moment you become incapacitated.A durable power of attorney stays effective until the principle dies or until they act to revoke the power they've granted to their agent.

Although third parties do sometimes refuse to honor an Agent's authority under a POA agreement, in most cases that refusal is not legal.In that case, the law allows you to collect attorney's fees if the third party unreasonably refused to accept the POA.

A POA can change beneficiaries if the POA instrument allows it. Make sure you're changing a beneficiary or adding one for a legitimate reason. Once you have a POA that allows you to change beneficiaries, changing beneficiaries is relatively simple and something you can do yourself.