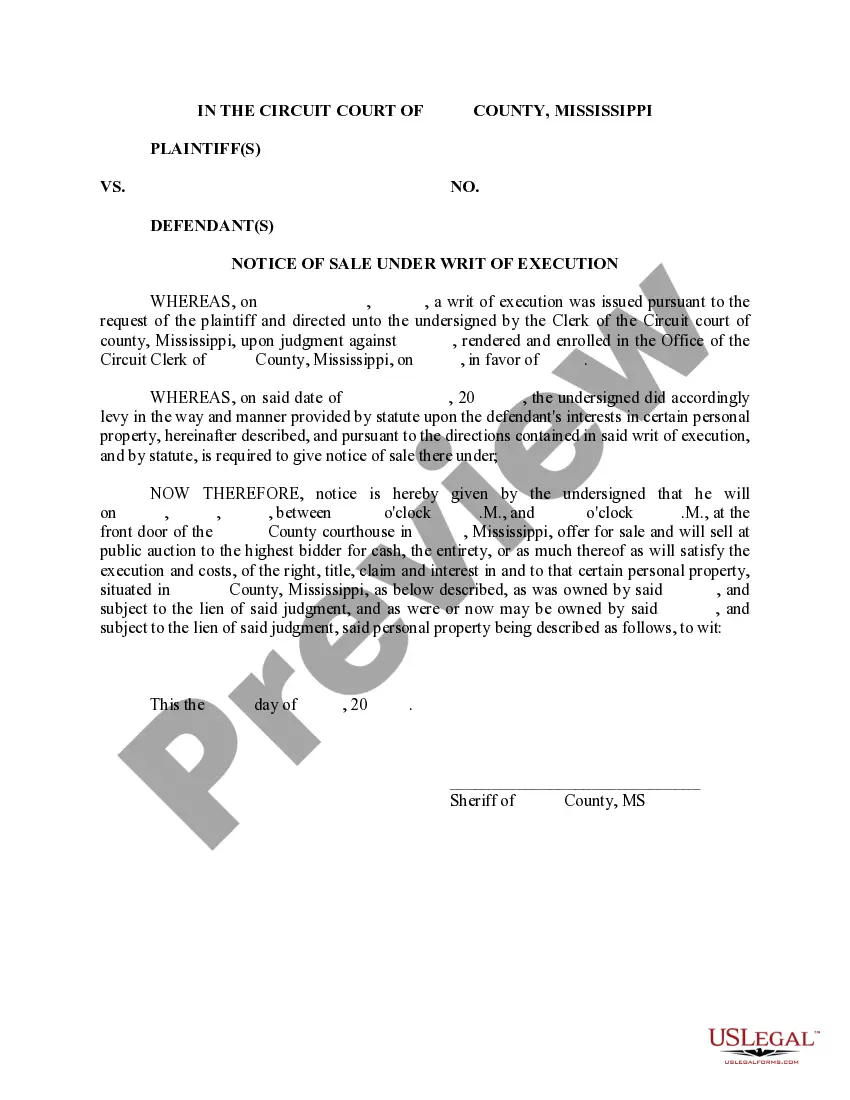

North Dakota Chapter 13 Plan is a type of bankruptcy filing available to individuals in North Dakota. It is designed to help debtors reorganize their debts and repay them over a period of three to five years. Under this plan, debtors must develop a repayment plan and submit it to the court for approval. The plan must include all the debtor's debts, income, and expenses. The plan must also specify how much of the debt will be paid back, and how long it will take. Once the court approves the plan, the debtor must make payments according to the plan's terms. The two types of North Dakota Chapter 13 Plan are: 1) Wage Earner Plan and 2) Self-Employed Plan. A Wage Earner Plan is available to individuals who have a regular source of income, such as a job or Social Security benefits. A Self-Employed Plan is available to individuals who are self-employed, such as a business owner or freelancer. The court will consider the debtor’s income, expenses, and other factors when determining which type of plan is best for the debtor.

North Dakota Chapter 13 Plan

Description

How to fill out North Dakota Chapter 13 Plan?

Preparing legal paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them correspond with federal and state laws and are examined by our specialists. So if you need to complete North Dakota Chapter 13 Plan, our service is the best place to download it.

Getting your North Dakota Chapter 13 Plan from our service is as easy as ABC. Previously registered users with a valid subscription need only sign in and click the Download button once they find the correct template. Afterwards, if they need to, users can take the same blank from the My Forms tab of their profile. However, even if you are new to our service, registering with a valid subscription will take only a few moments. Here’s a brief instruction for you:

- Document compliance verification. You should carefully review the content of the form you want and make sure whether it suits your needs and fulfills your state law regulations. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library using the Search tab above until you find a suitable template, and click Buy Now once you see the one you need.

- Account registration and form purchase. Create an account with US Legal Forms. After account verification, log in and select your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your North Dakota Chapter 13 Plan and click Download to save it on your device. Print it to fill out your papers manually, or take advantage of a multi-featured online editor to prepare an electronic version faster and more effectively.

Haven’t you tried US Legal Forms yet? Subscribe to our service today to get any formal document quickly and easily any time you need to, and keep your paperwork in order!