The North Dakota Nonprofit Organization Claim of Exemption is an exemption from North Dakota sales and use tax granted to qualified nonprofit organizations. Nonprofit organizations must complete Form ND-1NP, the North Dakota Nonprofit Organization Claim of Exemption, in order to receive the exemption. This form must be completed and submitted to the North Dakota Tax Commissioner for approval. There are two types of North Dakota Nonprofit Organization Claim of Exemption: the Exempt Use Certificate and the Exempt Purchase Certificate. The Exempt Use Certificate allows eligible organizations to make purchases of goods and services without paying sales tax. The Exempt Purchase Certificate allows eligible organizations to purchase goods and services for their own use without paying sales tax. In order to qualify for either of these exemptions, organizations must meet certain criteria set forth by the North Dakota Department of Revenue.

North Dakota Nonprofit Organization Claim of Exemption

Description

How to fill out North Dakota Nonprofit Organization Claim Of Exemption?

How much time and resources do you often spend on drafting formal paperwork? There’s a better way to get such forms than hiring legal experts or wasting hours browsing the web for an appropriate blank. US Legal Forms is the premier online library that provides professionally drafted and verified state-specific legal documents for any purpose, including the North Dakota Nonprofit Organization Claim of Exemption.

To acquire and complete a suitable North Dakota Nonprofit Organization Claim of Exemption blank, follow these simple instructions:

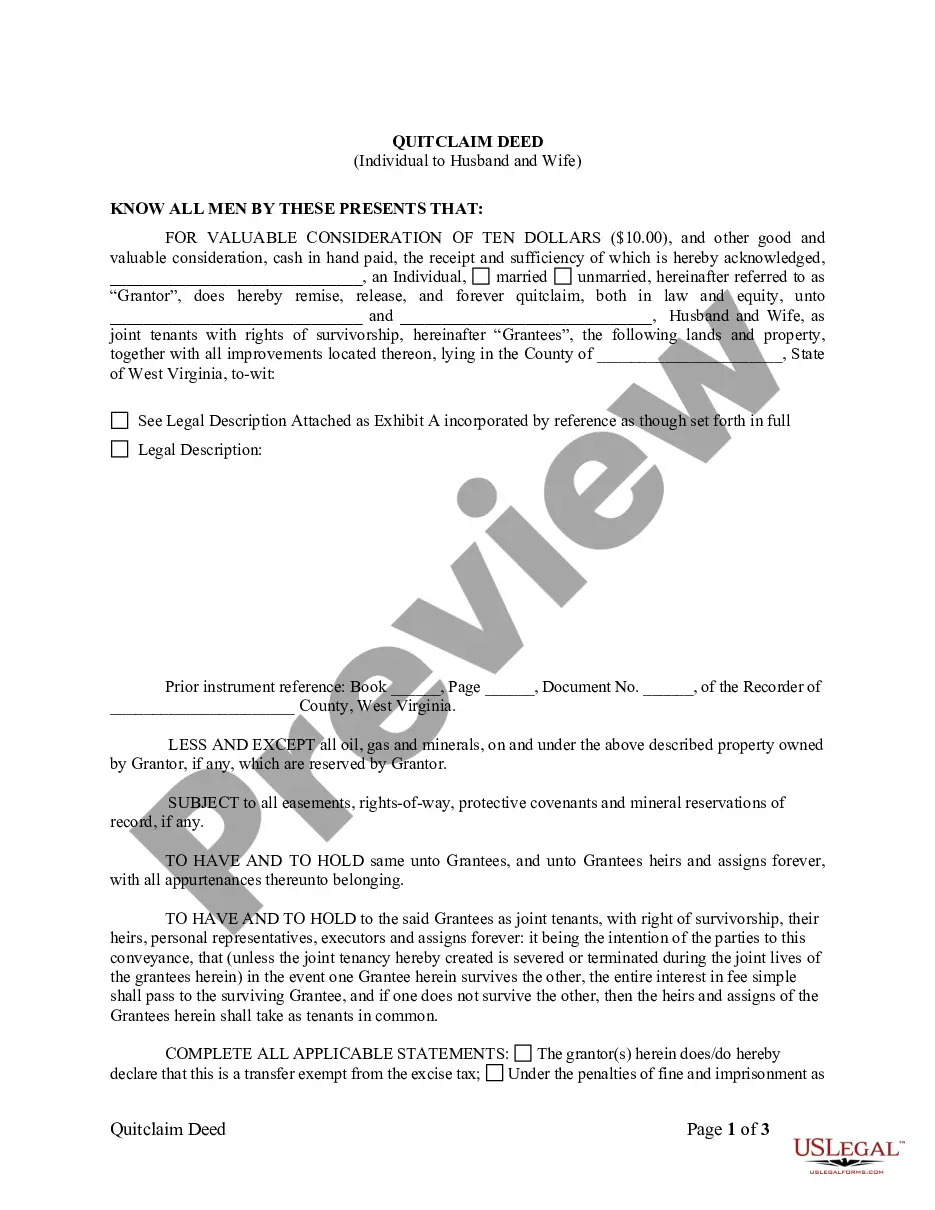

- Examine the form content to ensure it meets your state requirements. To do so, check the form description or utilize the Preview option.

- In case your legal template doesn’t meet your needs, locate a different one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the North Dakota Nonprofit Organization Claim of Exemption. If not, proceed to the next steps.

- Click Buy now once you find the right blank. Choose the subscription plan that suits you best to access our library’s full service.

- Sign up for an account and pay for your subscription. You can make a transaction with your credit card or through PayPal - our service is totally safe for that.

- Download your North Dakota Nonprofit Organization Claim of Exemption on your device and complete it on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously purchased documents that you safely store in your profile in the My Forms tab. Get them at any moment and re-complete your paperwork as frequently as you need.

Save time and effort completing formal paperwork with US Legal Forms, one of the most reliable web services. Sign up for us now!

Form popularity

FAQ

North Dakota law specifically exempts government entities and certain organizations from sales tax on purchases they make. North Dakota law does not exempt religious, charitable, or non-profit organizations.

The Constitution of North Dakota provides in Article X, Section 5, that ". . . property used exclusively for schools, religious, cemetery, charitable or other public purposes shall be exempt from taxation."

Who is Exempt from Sales Tax? North Dakota law specifically exempts government entities and certain organizations from sales tax on purchases they make. North Dakota law does not exempt religious, charitable, or non-profit organizations.

Certain gross receipts resulting from the sale of tangible personal property by civic and nonprofit associations are exempt from the state and local sales taxes. Sales to these associations are generally subject to the state and municipal sales tax.

How to Start a Nonprofit in North Dakota Name Your Organization.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.Establish Initial Governing Documents and Policies.

Tax-exempt status allows a taxpayer to file a return with the IRS that exempts them from paying taxes on any net income or profit. A taxpayer can offset capital gains and avoid taxes on disposed assets, though this often allows a taxpayer to be exempt up to their current or prior losses.

Tax-exempt goods Some goods are exempt from sales tax under North Dakota law. Examples include most non-prepared food items, food stamps, prescription medications, and medical supplies.

How to Start a Nonprofit in North Dakota Name Your Organization.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.Establish Initial Governing Documents and Policies.