North Dakota Business/Farm/Professional Corp Articles of Amendment is a document filed with the Secretary of State of North Dakota by a business, farm, or professional corporation to make changes to the articles of incorporation. This document can be used to make amendments to the corporation's name, purpose, or the number of shares of stock authorized. It can also be used to change the corporation's registered agent or address. There are three types of North Dakota Business/Farm/Professional Corp Articles of Amendment: Regular Articles of Amendment, Restated Articles of Amendment, and Merger Articles of Amendment. Regular Articles of Amendment are used to make minor changes to the existing articles of incorporation, such as changing the name or address of the corporation. Restated Articles of Amendment are used to make more significant changes to the articles of incorporation, such as changing the corporation's purpose, increasing or decreasing the number of authorized shares of stock, or changing the corporation's registered agent. Merger Articles of Amendment are used to merge two or more corporations into a single entity.

North Dakota BUSINESS/FARM/PROFESSIONAL CORP ARTICLES of AMENDMENT

Description

How to fill out North Dakota BUSINESS/FARM/PROFESSIONAL CORP ARTICLES Of AMENDMENT?

If you’re searching for a way to properly complete the North Dakota BUSINESS/FARM/PROFESSIONAL CORP ARTICLES of AMENDMENT without hiring a lawyer, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of official templates for every personal and business scenario. Every piece of documentation you find on our online service is designed in accordance with federal and state regulations, so you can be sure that your documents are in order.

Follow these simple guidelines on how to get the ready-to-use North Dakota BUSINESS/FARM/PROFESSIONAL CORP ARTICLES of AMENDMENT:

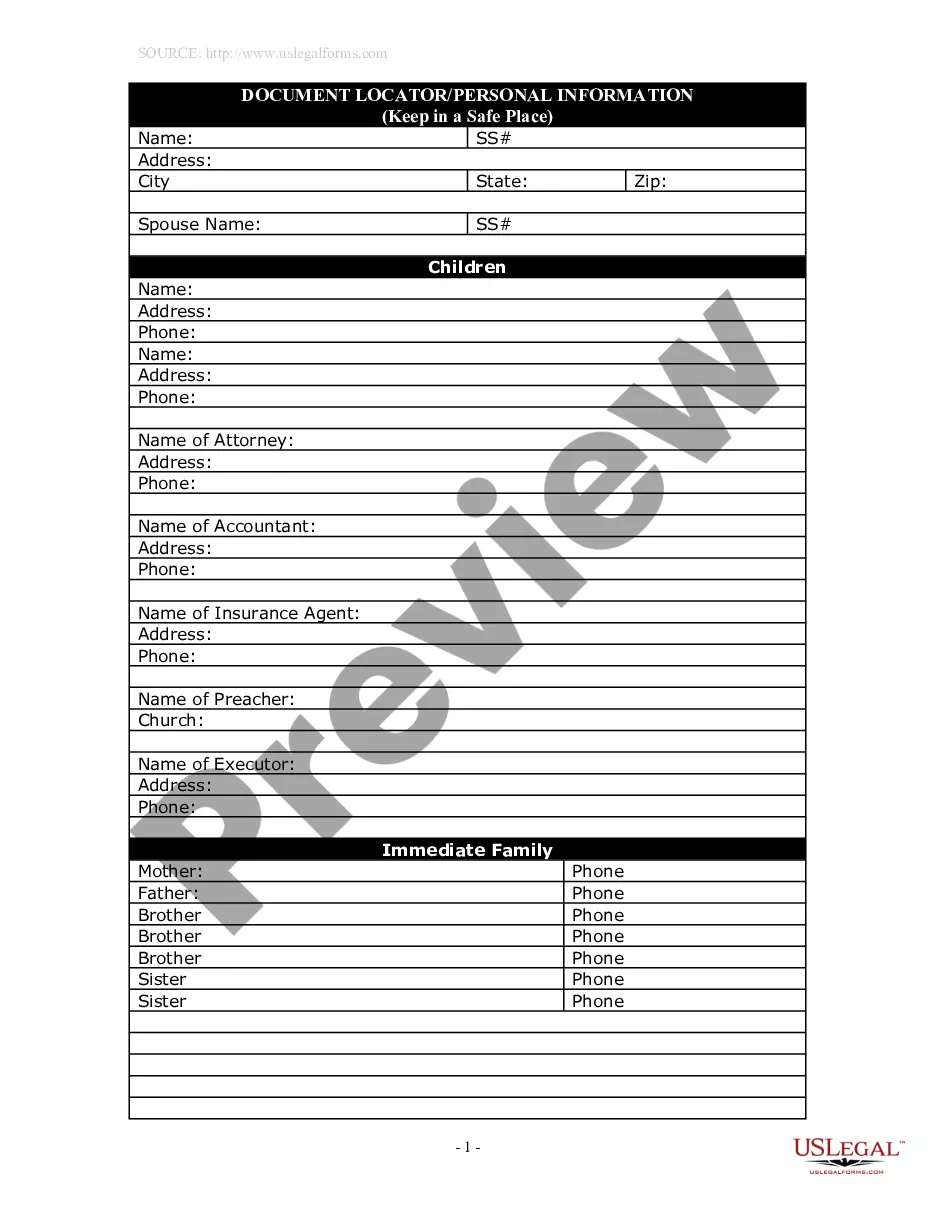

- Ensure the document you see on the page meets your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Enter the form title in the Search tab on the top of the page and choose your state from the dropdown to locate another template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Create an account with the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be available to download right after.

- Choose in what format you want to get your North Dakota BUSINESS/FARM/PROFESSIONAL CORP ARTICLES of AMENDMENT and download it by clicking the appropriate button.

- Add your template to an online editor to complete and sign it rapidly or print it out to prepare your paper copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you purchased - you can pick any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

To form a corporation in North Dakota, you must file articles of incorporation with the Secretary of State and pay a fee. Upon filing, the Secretary of State issues a certificate of incorporation. The corporation's existence begins when the certificate is issued, unless the articles specify a later date.

There are two filing options when you dissolve your North Dakota LLC. You can file either the Articles of Dissolution by Organizers or the Articles of Dissolution by Members. The Articles of Dissolution by Organizers does not require the filing of a Notice of Dissolution with the North Dakota Secretary of State (SOS).

Liquidation of Assets After a company is dissolved, it must liquidate its assets. Liquidation refers to the process of sale or auction of the company's non-cash assets. Note that only those assets your company owns can be liquidated. Thus, you can't liquidate assets that are used as collateral for loans.

Shareholders must authorize the liquidation and dissolution of the corporation by special resolution. If there is more than one class or group of shareholders, each class or group must pass a special resolution to authorize the dissolution even if these shareholders are not otherwise entitled to vote.

Dissolving a corporation successfully takes several key steps. Such requirements may vary across the fifty states. Generally, it is recommended that business owners get legal assistance to file the necessary documents with the proper state agencies.

There are two filing options when you dissolve your North Dakota LLC. You can file either the Articles of Dissolution by Organizers or the Articles of Dissolution by Members. The Articles of Dissolution by Organizers does not require the filing of a Notice of Dissolution with the North Dakota Secretary of State (SOS).

You amend the articles of your South Dakota Corporation by submitting the completed Amendment to Articles of Incorporation form in duplicate by mail or in person, along with the filing fee to the South Dakota Secretary of State.