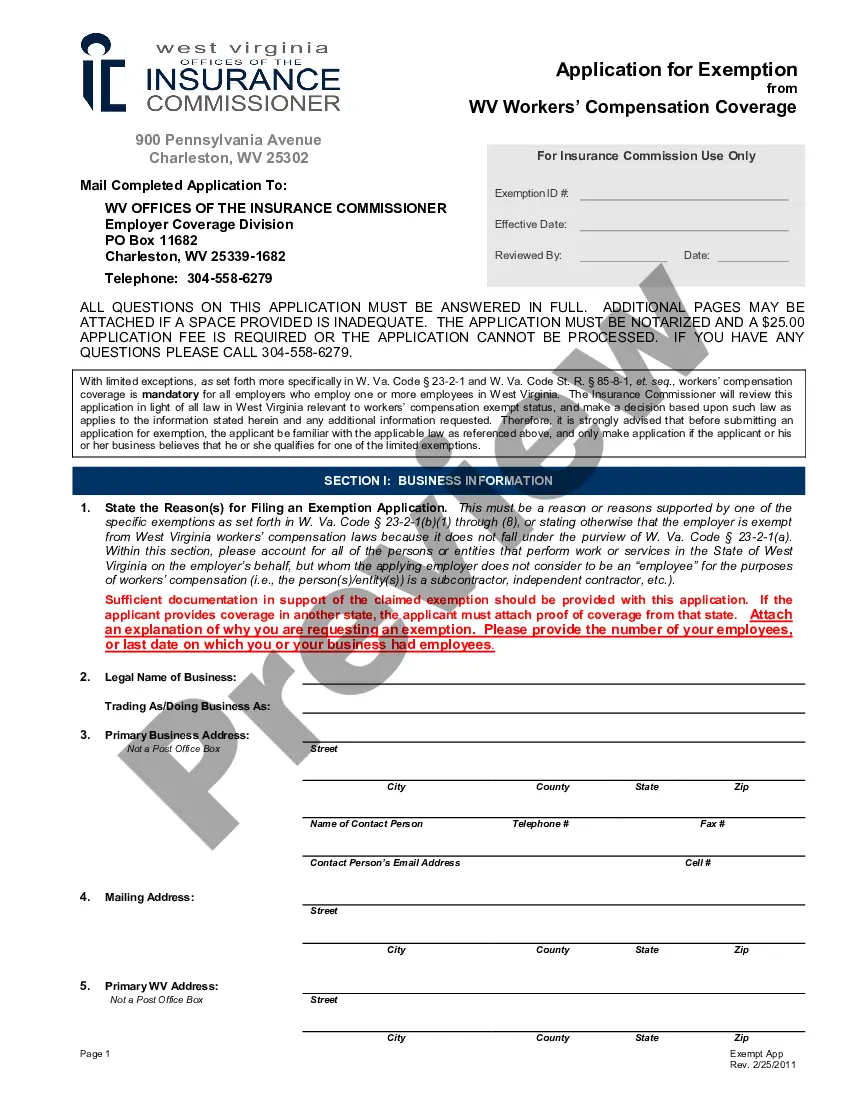

North Dakota CERT of WITHDRAWAL FOREIGN CORPORATION APPLICATION is a document required by the North Dakota Secretary of State for a foreign corporation to withdraw its registration in the state. The application must be filed by the foreign corporation in order to dissolve its registration in North Dakota. There are two types of North Dakota CERT of WITHDRAWAL FOREIGN CORPORATION APPLICATION: Certificate of Withdrawal of Foreign Corporation Application and Certificate of Withdrawal of Foreign Profit Corporation Application. The Certificate of Withdrawal of Foreign Corporation Application must be completed by the foreign corporation and filed with the North Dakota Secretary of State. The Certificate of Withdrawal of Foreign Profit Corporation Application must be completed by the foreign profit corporation and filed with the North Dakota Secretary of State. Both applications must include the name of the corporation, its address and the date of filing.

North Dakota CERT of WITHDRAWAL FOREIGN CORPORATION APPLICATION

Description

How to fill out North Dakota CERT Of WITHDRAWAL FOREIGN CORPORATION APPLICATION?

US Legal Forms is the most easy and cost-effective way to locate suitable legal templates. It’s the most extensive web-based library of business and personal legal documentation drafted and checked by legal professionals. Here, you can find printable and fillable templates that comply with federal and local regulations - just like your North Dakota CERT of WITHDRAWAL FOREIGN CORPORATION APPLICATION.

Getting your template takes only a few simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the document on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can get a professionally drafted North Dakota CERT of WITHDRAWAL FOREIGN CORPORATION APPLICATION if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to ensure you’ve found the one meeting your requirements, or find another one using the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and choose the subscription plan you like most.

- Create an account with our service, log in, and purchase your subscription using PayPal or you credit card.

- Decide on the preferred file format for your North Dakota CERT of WITHDRAWAL FOREIGN CORPORATION APPLICATION and save it on your device with the appropriate button.

Once you save a template, you can reaccess it whenever you want - just find it in your profile, re-download it for printing and manual fill-out or import it to an online editor to fill it out and sign more effectively.

Benefit from US Legal Forms, your reputable assistant in obtaining the required formal paperwork. Try it out!

Form popularity

FAQ

Submit Your Trade Name Registration ND Form Mail. Secretary of State.Fax. 701-328-2992. Fees. $25 Filing Fee.DBA Questions. Call the North Dakota Secretary of State: 701-328-2904. Renew Your DBA with the State. Your North Dakota trade name expires five years from the date of registration.Change Your DBA.Withdraw Your DBA.

To form a corporation in North Dakota, you must file articles of incorporation with the Secretary of State and pay a fee. Upon filing, the Secretary of State issues a certificate of incorporation. The corporation's existence begins when the certificate is issued, unless the articles specify a later date.

North Dakota doesn't have a general business license requirement. However, construction contractors must register with the North Dakota Secretary of State. Contractors need to get a general contractor's license through the Secretary of State's Office as well.

Dissolving a corporation successfully takes several key steps. Such requirements may vary across the fifty states. Generally, it is recommended that business owners get legal assistance to file the necessary documents with the proper state agencies.

Foreign LLCs that intend to do business in North Dakota need file a Certificate of Authority Foreign Limited Liability Company Application with North Dakota's Secretary of State and pay a $135 state filing fee.

To form a corporation in North Dakota, you must file articles of incorporation with the Secretary of State and pay a fee. Upon filing, the Secretary of State issues a certificate of incorporation. The corporation's existence begins when the certificate is issued, unless the articles specify a later date.

There are two filing options when you dissolve your North Dakota LLC. You can file either the Articles of Dissolution by Organizers or the Articles of Dissolution by Members. The Articles of Dissolution by Organizers does not require the filing of a Notice of Dissolution with the North Dakota Secretary of State (SOS).

There are two filing options when you dissolve your North Dakota LLC. You can file either the Articles of Dissolution by Organizers or the Articles of Dissolution by Members. The Articles of Dissolution by Organizers does not require the filing of a Notice of Dissolution with the North Dakota Secretary of State (SOS).

Shareholders must authorize the liquidation and dissolution of the corporation by special resolution. If there is more than one class or group of shareholders, each class or group must pass a special resolution to authorize the dissolution even if these shareholders are not otherwise entitled to vote.