Grantor assigns all of his/her rights in a real estate purchase contract to a certain trust department. Grantor also directs the trust department to apply escrowed funds held under the exchange agreement to the purchase of property covered by the assigned contract.

North Dakota Assignment and Instruction to Apply Escrowed Funds

Description

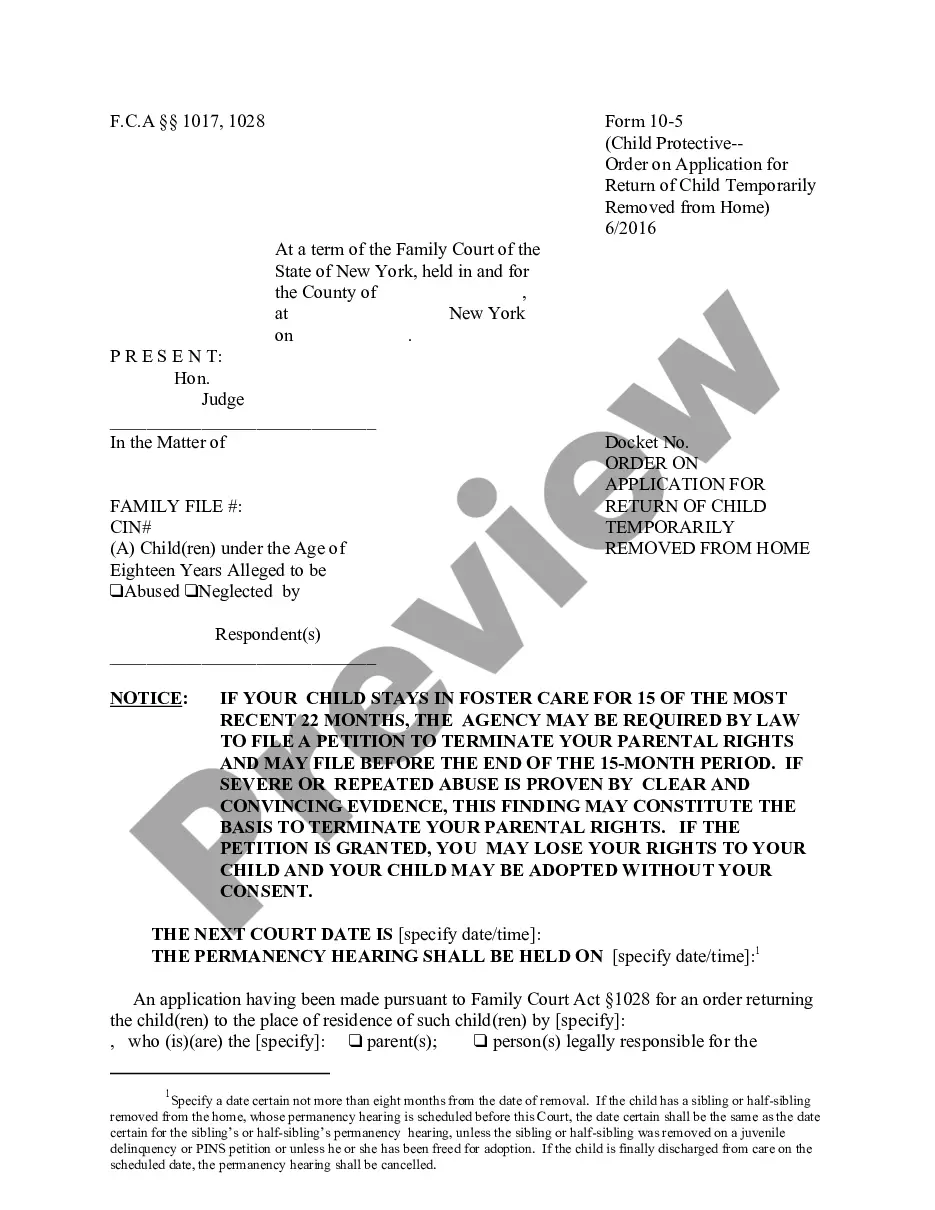

How to fill out Assignment And Instruction To Apply Escrowed Funds?

If you desire to conclude, obtain, or create legal document templates, utilize US Legal Forms, the top selection of legal forms, available online.

Utilize the site’s user-friendly and accessible search to find the documents you need.

Numerous templates for business and personal purposes are sorted by categories and states, or keywords.

Every legal document template you purchase is yours indefinitely. You can access all forms you saved within your account.

Click on the My documents section and select a form to print or download again. Compete and obtain, and print the North Dakota Assignment and Instruction to Apply Escrowed Funds with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- Step 1: Ensure you have selected the form for your correct city/state.

- Step 2: Use the Preview option to review the form’s content. Do not forget to read the summary.

- Step 3: If the form does not meet your expectations, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4: After locating the form you need, click on the Get now option. Choose the payment plan you prefer and provide your details to register for an account.

- Step 5: Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6: Choose the format of your legal form and download it to your device.

- Step 7: Complete, modify and print or sign the North Dakota Assignment and Instruction to Apply Escrowed Funds.

Form popularity

FAQ

To sell your car in North Dakota, you need to complete a Seller's Assignment and Warranty of Title and, if the car is less than nine years old, a Damage Disclosure Statement (SFN 18609). You must also remove the license plates. The state does not require sellers to complete a bill of sale.

To transfer your vehicle's title as a new resident of North Dakota, you need to visit your local ND Department of Transportation (DOT) office and:Submit a completed Application for Certificate of Title and Registration of a Motor Vehicle (Form SFN 2872)Submit your out-of-state vehicle registration.More items...?

To gift a car in North Dakota, you'll need to complete a handful of forms, transfer the car's title to the recipient, and pay nominal fees. There are few gestures of generosity more powerful than gifting a car.

How to Sell a Car in North DakotaStep 1: Allow the buyer to have the car inspected by a third party.Step 2: Organize and gather all related vehicle documentation.Step 3: Bill of Sale (optional)Step 4: Damage disclosure statement.Step 5: Transfer the title.Step 6: Remove your plates and cancel your insurance.

Required Documents For North Dakota Title TransferYou will need the title from the seller, signed by both the seller and the buyer.You will need a completed DMV title transfer form.You will also need to pay any required fees.Disclosure of odometer if the car is less than 10 years old.

You will need the title from the seller, signed by both the seller and the buyer. You will need a completed DMV title transfer form. You will also need to pay any required fees. Disclosure of odometer if the car is less than 10 years old.

To sell your car in North Dakota, you need to complete a Seller's Assignment and Warranty of Title and, if the car is less than nine years old, a Damage Disclosure Statement (SFN 18609). You must also remove the license plates. The state does not require sellers to complete a bill of sale.

Required Documents For North Dakota Title TransferYou will need the title from the seller, signed by both the seller and the buyer.You will need a completed DMV title transfer form.You will also need to pay any required fees.Disclosure of odometer if the car is less than 10 years old.