The North Dakota Direct Deposit Form for the Stimulus Check is a document that allows residents of North Dakota to receive their stimulus payments directly into their bank accounts. This form is particularly relevant for individuals who prefer to have their funds deposited electronically, providing a secure and efficient method of receiving the stimulus funds. By utilizing the North Dakota Direct Deposit Form for the Stimulus Check, residents can avoid the inconvenience of receiving a physical check in the mail and reduce the risk of potential delays associated with traditional mailing services. The form requires the individual to provide their personal information, including their name, address, social security number, and their banking details, such as the routing number and account number. There are no specific variations of the North Dakota Direct Deposit Form for the Stimulus Check. However, it is essential to ensure that individuals use the correct form designated by the North Dakota state government. It is advisable for residents to visit the official website of the North Dakota Department of Revenue or the Internal Revenue Service (IRS) to obtain the most up-to-date and accurate version of the form. Completing the North Dakota Direct Deposit Form for the Stimulus Check requires attention to detail, as any errors or missing information may result in payment delays. Once the form is completed, individuals should submit it electronically or via mail to the relevant authorities as directed on the form. By providing accurate and complete information on the form, individuals can ensure that their stimulus payment is promptly deposited into their designated bank account. In summary, the North Dakota Direct Deposit Form for the Stimulus Check is a crucial tool for North Dakota residents seeking a convenient and efficient means of receiving their stimulus payments. By using this form, individuals can securely and expeditiously receive their funds directly into their bank account, avoiding potential delays associated with traditional mailing services. It is important to stay updated on the latest version of the form by visiting the official websites of the North Dakota Department of Revenue or the IRS.

North Dakota Direct Deposit Form for Stimulus Check

Description

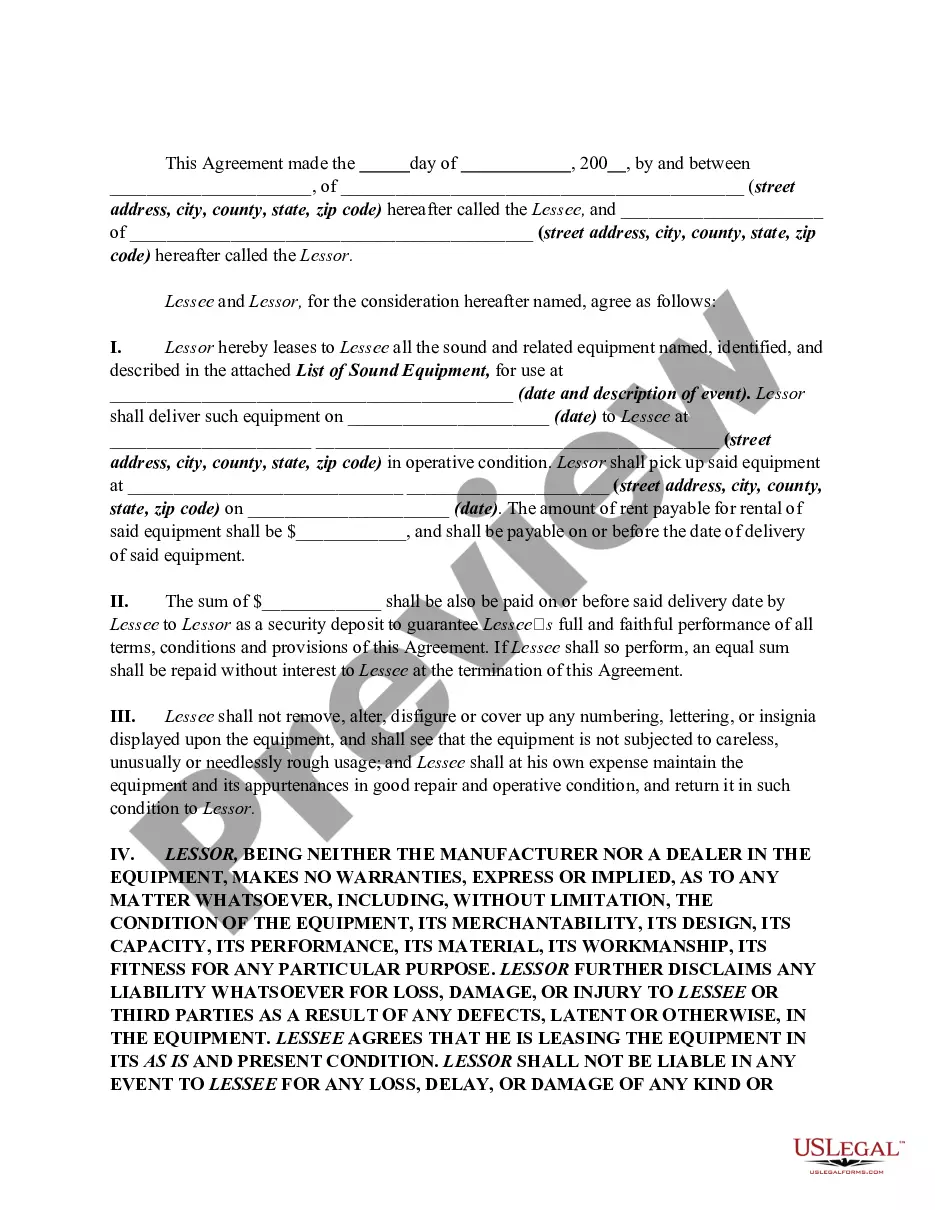

How to fill out North Dakota Direct Deposit Form For Stimulus Check?

Are you presently within a place the place you need to have papers for both organization or personal uses virtually every day? There are tons of legal file templates available online, but finding versions you can depend on is not effortless. US Legal Forms gives a large number of develop templates, much like the North Dakota Direct Deposit Form for Stimulus Check, which are created to meet federal and state needs.

When you are currently acquainted with US Legal Forms web site and also have a merchant account, basically log in. Next, you can acquire the North Dakota Direct Deposit Form for Stimulus Check design.

If you do not provide an bank account and would like to begin using US Legal Forms, abide by these steps:

- Obtain the develop you want and make sure it is to the right area/area.

- Utilize the Preview key to check the shape.

- Read the outline to actually have selected the appropriate develop.

- In the event the develop is not what you`re searching for, make use of the Look for discipline to discover the develop that meets your needs and needs.

- Once you discover the right develop, click Buy now.

- Choose the pricing program you desire, fill in the necessary information and facts to create your money, and purchase the transaction utilizing your PayPal or Visa or Mastercard.

- Choose a convenient file format and acquire your backup.

Get all of the file templates you might have bought in the My Forms menus. You can obtain a extra backup of North Dakota Direct Deposit Form for Stimulus Check anytime, if possible. Just click on the necessary develop to acquire or print out the file design.

Use US Legal Forms, one of the most considerable assortment of legal forms, to save time as well as avoid faults. The assistance gives appropriately made legal file templates which can be used for a variety of uses. Create a merchant account on US Legal Forms and commence creating your way of life easier.